Rhode Island COVID-19 Crisis: 30 Public Policy Solutions to Restore Financial and Health Security

In these trying times, with over one-hundred thousand Rhode Islanders recently laid-off, and unemployment rates that could soon reach 30%, common-sense public state-based policy can help mitigate the destructive economic impact of the Rhode Island Covid-19 crisis … and can help restore a sense of normalcy and financial security.

See the list below for the Center’s policy suggestions.

In response to this health crisis that is impacting our lives in so many ways, our state government’s actions to shut down commerce across many industries is inevitably having a crushing impact on small businesses, jobs, and family budgets… creating anxiety and fears among our populace.

On top of the major disruptions to our daily lives, our individual and societal peace of mind has deteriorated, with many Rhode Islanders concerned not just about their health, but also worried about their financial well-being.

However, leading national voices from across the political spectrum – The New York Times, the Wall Street Journal, the Governor of New York, and the President of the United States – have raised awareness about the need to restore economic activity as part of our nation’s recovery from the coronavirus crisis.

As the federal government considers various assistance programs, it is vital that Rhode Island’s political leaders also play a positive role in restoring prosperity. It is a historical fact that economic depressions kill people, too… we must not let our Ocean State’s circumstances come to that.

Governor Raimondo has asked the business community for more time and patience as our state’s health care system is strengthened, before the “temporary,” yet major, restrictions on the private sector are lifted.

The public policy solutions recommended in this paper include a number of smaller, “temporary” solutions that can be implemented – beginning now, while the larger state mandates remain in place – and that should remain in place until our state’s economy is fully recovered.

While the governor asks for the public’s trust, state leaders, likewise, must place trust in the power of the American people – business innovation and individual consumerism, guided by the free-market system – to be the driving force in lifting Rhode Island out of this severe economic crisis.

Specifically, the General Assembly must find a way to convene and govern – and to consider emergency rescue legislation that balances the need to address the state’s budget with the need to bolster the budgets of families and businesses.

Rhode Island COVID-19 Recovery by #GovernmentDistancing. To aid in Rhode Island’s economic survival and eventual recovery – and to restore confidence about our future among the populace – the Center suggests that there are many ways our state government can take important and symbolic actions in alleviating some of these concerns about our individual and overall financial security.

The common-sense ‘crisis recovery’ policy ideas recommended in this paper are designed to free-up individuals and employers in the private sector to be able to speed back to the peak employment and income-levels that we saw before the COVID-19 crisis. These solutions are especially beneficial to a state economy that is suffering catastrophic job losses as we have seen in Rhode Island.

Many states across America are aggressively taking or considering similar steps, and Rhode Island must not lag behind. By temporarily suspending certain taxes and regulations that hold back economic growth, by practicing what we call “government distancing,” political leaders can separate unnecessary government burdens from those suffering the most distress … and help clear the way for rapid economic recovery.

In late March, our Center published 10 initial pro-active policy recommendations. The Center continues to add to its list of policies, and we’re now up to 30. The newest suggestions are in bold, and policies that have been implemented are italicized. Explanations of the policies follow the list.

Business operations

- Eliminate any state or local inspections required before re-opening a business that was temporarily closed due to COVID-19.

- Allow businesses to fully expense capital investments in machinery and equipment.

- Extended deadlines for commerce-related licensing.

- Temporarily extending the deadlines for businesses to remit collected sales taxes to the state.

- Temporary suspension of the corporate minimum tax.

Consumer assistance

- Repeal bans on single-use plastic bags.

- Repeal the ban on flavored vaping products.

- Temporarily suspending Internet sales taxes.

- To allow alcoholic beverages to leave restaurants when sold with a food take-out order.

Regulatory reform & occupational licensing

- Relax all state and local regulations, including zoning, that would interfere with the ability to operate businesses out of the home.

- Institute temporary “reciprocal” occupational licensing.

- Eliminate sales and hotel taxes on people who offer short-term rentals.

Labor

- Implement a three-month moratorium on the deduction of government union dues, leaving more money in the pockets of state and local employees.

- Temporarily suspend prevailing wage laws.

- Temporarily reducing Rhode Island’s minimum wage to the federal level of $7.25 per hour (with a temporary increase in the Earned Income Tax Credit (EITC).

Civic

- Develop a forum for public education, debate, and study of the state and federal constitutions and the response of our state and local governments to the COVID-19 crisis, perhaps as a precursor to a state Constitutional Convention.

- Temporarily limit legal liability for volunteers and charitable organizations.

Budget

- Implement a state Savings Reward Programs to reward state employees for saving taxpayer money through innovative or reengineered government processes.

- Freeze all government hiring, even in cases of retirement and resignation, reallocating employees where they are most needed.

- Eliminate all government positions that were vacant for at least six months prior to the COVID-19 shut-down.

- Freeze all taxes, state and municipal, at current levels.

Infrastructure (Legacy and Future-Ready)

- Adopt “dig once” and “one-touch make ready” policies. Implementing policies that increase cooperation between Internet service providers (ISPs) and state and local construction planners would enable the Ocean State to expand broadband communications more cheaply and quickly.

Education

- Begin the process of comparing and analyzing districts’ effectiveness in implementing remote learning in (in and out of Rhode Island) for the development of best practices and other lessons learned.

- Review state and local budgets to determine what money has been saved by closing school buildings and limiting services in order to create a fund to assist families with education-related expenditures.

Healthcare

- Expand access to telemedicine services.

- End surprise billing for patients.

- Expanded scope-of-practice allowances.

- Remove insurance laws that discourage the sale of short-term health insurance plans.

- Waive regulation to allow medical professionals licensed in other states to practice in RI.

- Repeal certificate of need laws.

Explanations

Already in Rhode Island, one of the Center’s early common-sense recommendations has been enacted:

- To allow alcoholic beverages to leave restaurants when sold with a food take-out order. This will help many restaurants to maintain cash flow and better serve their customers.

For small businesses and their employees, it will be important to get as many people back to work at their normal shifts as soon as possible. However, the ramp-up to normal business conditions, and the associated revenues, may not be as fast the shut-down was. Therefore, as a short-term measure, the Center suggests:

- Eliminate any state or local inspections required before re-opening a business that was temporarily closed due to COVID-19. Whether the inspection would have been due or overdue anyway or is related to the pandemic, Rhode Island needs its existing businesses to get up to speed, while adapting to new realities, as quickly as possible. Red tape does not make the cut.

- Allow businesses to fully expense capital investments in machinery and equipment as they seek to rebuild, providing them with potentially critical 2020 tax relief.

- Extended deadlines for commerce-related licensing by the Department of Business Regulation and other state agencies that have a hand in stringing red tape for businesses would help ensure existing small businesses remain legally operational.

- Temporarily extending the deadlines for businesses to remit collected sales taxes to the state. This option would give many businesses additional near-term cash flow when it comes to compensating their employees, paying their rent, or covering other vital overhead expenses.

- Temporary suspension of the corporate minimum tax, which imposes one more burden on individual looking to start a new business, or maintain their existing small business – for instance, as sole proprietors or limited partnerships – even if the businesses loses money.

Rhode Island consumers have been cooped up inside, often without their regular income. The state should help our families be as active as possible while giving businesses the benefit of their commerce:

- Repeal bans on single-use plastic bags and other items. The COVID-19 virus and other germs can live on re-usable bags for many days, Rhode Island should repeal all state and municipal bans on single-use plastic bags, straws, and other items. (Maine, New York, and New Hampshire have taken action to roll back similar laws.)

- Repeal the ban on flavored vaping products to restore choice to Rhode Island adults and to help this industry hire back the workers it was forced to lay-off in 2019.

- Temporarily suspending Internet Sales Taxes. In March of 2029, the Center published a policy brief with a policy idea that would provide a financial incentive for Ocean Staters to work, shop, and eat at home as much as possible, as the government has either mandated or recommended. To encourage online commerce as a form of social-distancing, the Center recommended this policy. Consideration should be given as to whether this suspension should only apply to in-state purchases and deliveries.

- To allow alcoholic beverages to leave restaurants when sold with a food take-out order. This will help many restaurants to maintain cash flow and better serve their customers.

Regulatory Reform & Occupational Licensing. For entrepreneurs or individuals looking to start a new career, or to engage in the “gig” economy, and to encourage them to re-enter the workforce as quickly as possible, it is vital that our Ocean State be a welcoming state in support of their desire to engage in meaningful work:

- Relax all state and local regulations, including zoning, that would interfere with the ability to operate businesses out of the home. Even in the best of times, we are skeptical about the justification for imposing restrictions on people who are trying to advance our economy, improve our society, and support their families. In a time of economic crisis, our tolerance for restrictions should go way down.

- Institute temporary “reciprocal” occupational licensing, so that licensed professionals in another state, who may be moving to our state to help with the crisis or to establish a new career, can immediately and legally work in their licensed field of expertise.

- Eliminate sales and hotel taxes on people who offer short-term rentals, independently or through online services like AirBnB. This will encourage home-owners to develop new revenue streams for their households and will make our Ocean State a less expensive tourism destination for many during the vitally important upcoming summer season.

Labor Reforms. To decrease pressure on municipal and state budgets and to lessen the urge to increase taxes on Covid-19 devastated families and businesses:

- Implement a three-month moratorium on the deduction of government union dues, leaving more money in the pockets of state and local employees. However important labor unions were in helping workers gain some of the benefit of economic booms in the last century, they represent another layer of bureaucracy in our economy. At the same time, the public sector has to share some of the burden of the oncoming recession. At a minimum, removing the government’s implicit subsidy of automatic dues deduction would allow state and local employees to make their own decisions about how their income can best be utilized during these unprecedented times.

- Temporarily suspend prevailing wage laws that artificially drive up the cost of contracted services by state and local governments by requiring open-shop vendors to pay labor rates significantly higher than they normally would.

- Temporarily reducing Rhode Island’s minimum wage to the federal level of $7.25 per hour. Our state’s hourly wage mandate of $10.50 is scheduled to rise to $11.50 on October 1st. By providing employers with more flexibility in hiring back their workforce, more Rhode Islanders can more quickly be put on the road to economic recovery. Consideration should be given to limiting this wage-suspension to apply only to newly created or revived positions.

- Additionally, with government assuming further responsibility for aiding low-income families as we recover from this crises, the state should temporarily increase the Earned Income Tax Credit (EITC).

The experience of the pandemic, and officials’ response to it, have put a spotlight on just how profound the decisions are that our society must make. Therefore, the state should encourage increased civic participation and development of voluntary civic organizations so neighbors can help their neighbors through these difficult times.

- Develop a forum for public education, debate, and study of the state and federal constitutions and the response of our state and local governments to the COVID-19 crisis, perhaps as a precursor to a state Constitutional Convention. An educated population with a direct line for debate that will actually make a difference in how our state is governed will give Rhode Islanders an opportunity to determine the direction of their own state, articulating the assumptions under which our government was set up and determining which may no longer apply or have fallen by the wayside.

- Temporarily limit legal liability for volunteers and charitable organizations that may wish to provide a helping hand during this crisis.

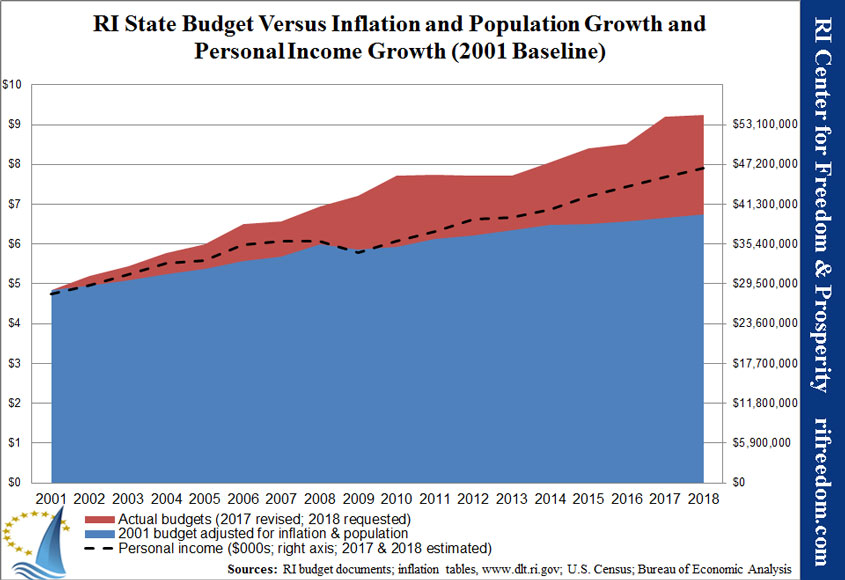

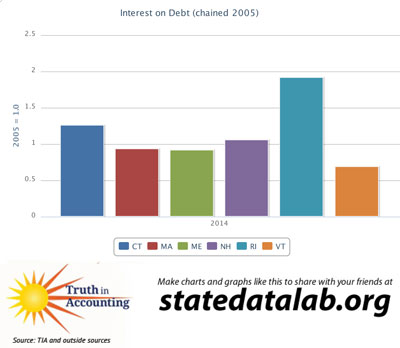

Regarding the 2021 budget process, and given the unpredictability of how quickly our state economy and government tax receipts will recover, it is vital that government live within its means, without placing additional burdens on an already distressed private sector. As New York Governor, Andrew Cuomo, recently stated … his state government is not going to be able to deliver all of the services and programs it did before the crisis, and can only begin to do as actual government “receipts” dictate.

- Implement a state Savings Reward Programs to reward state employees for saving taxpayer money through innovative or reengineered government processes. We know our state government is filled with smart, dedicated people, and they are in the best position to see how things can be changed for the better. Unfortunately, our system as it stands creates incentive to resist change, not advocate for it. This incentive structure must be reversed.

- Freeze all government hiring, even in cases of retirement and resignation, reallocating employees where they are most needed. The governor has already prepared Rhode Islanders for difficult decisions in the coming months and years. One broad decision that can be made now is to reduce the size of the government that taxpayers must support.

- Eliminate all government positions that were vacant for at least six months prior to the COVID-19 shut-down. If Rhode Island was getting along without certain government positions in good times, we cannot afford them during bad times. For those tasks that are more necessary in a crisis than they were before, existing personnel should be repurposed.

- Freeze all taxes, state and municipal, at current levels to ensure that families and businesses, who have faced major income cut-backs of their own, are not forced to shoulder the burden of non-essential government spending.

For people to be able to get back to work and to create an economy that will be more resilient the next time there is a crisis, Rhode Island needs to improve its infrastructure, both in the old sense of roads and bridges and in the emerging sense of digital connectivity.

- Adopt “dig once” and “one-touch make ready” policies. Implementing policies that increase cooperation between Internet service providers (ISPs) and state and local construction planners would enable the Ocean State to expand broadband communications more cheaply and quickly. The Ocean State has no resources to spare. As we spend money repairing and modernizing our roads, we cannot afford to miss the opportunity to advance the infrastructure of the future in a way that can adapt to changing technology.

With families’ learning the ins and outs of “distance learning,” our community has a new level of hands-on experience with education. We must take this opportunity to ensure that our struggling education system reforms to create an informed, job-ready, and resilient population.

- Begin the process of comparing and analyzing districts’ effectiveness in implementing remote learning in (in and out of Rhode Island) for the development of best practices and other lessons learned. It is not to early to start gathering information from the districts and analyzing it to understand what has worked and what hasn’t.

- Review state and local budgets to determine what money has been saved by closing school buildings and limiting services in order to create a fund to assist families with education-related expenditures. Our emergency response in education has, on the one hand, created a large network of school and administrative buildings that are not being operated for use and, on the other hand, shifted a substantial amount of the burden for education onto families, themselves. Our state should work to move resources from where they are not being used to where they can make the difference between keeping up and falling behind.

On the health insurance front, many people who have lost their jobs may also have lost their private health care coverage. Currently, Rhode Island’s onerous insurance regulations makes it impossible for provider to offer “short term” insurance plans, either forcing newly uninsured people into much more expensive government-improved plans, onto Medicaid, or to risk living without insurance (and subsequently being penalizing with a fee.)

To help individuals who may be in employment transition during this crisis, Rhode Island should:

- Expand access to tele-medicine services by having RI file an 1135 waiver with the federal Center for Medicaid & Medicare Services (CMS) to allow Medicaid patients the same access to tele-health services as Medicare recipients

- Repeal any existing regulations restricting access to tele-health services

- End surprise billing for patients by enacting a Georgia-type reform that prohibits medical providers from using third-party collection agencies to collect medical debt that was not informed up-front to patients

- Expand scope-of-practice allowances for nurses, pharmacists, medical technicians, medical students, and childcare providers … such that they can perform necessary medical testing or care in their field of expertise or for which they may have received training [FL]

- Remove insurance laws that discourage the sale of short-term health insurance plans, so that patients can be offered lower-cost insurance options from a broader array of providers.

Other health related policy ideas include:

- Waive regulation to allow medical professionals licensed in other states to be licensed to practice or conduct tele-health services in Rhode Island as was done in Missouri.

- Repeal Certificate of Need laws that restrict healthcare providers from acquiring advanced technologies, such as medical imaging devices. Such protectionist-driven laws must not become a barrier to Rhode Islanders receiving the the quality care they deserve.