The Excessive Costs Of Public Collective Bargaining Means: Younger generations are paying more and more to keep the unsustainable terms negotiated for prior generations of former government workers who are no longer providing public services. The money that could have been spent on maintaining school buildings, bridges, and roads has been spent instead on overly-generous government worker pensions. Greedy union bosses have corrupted state government, restricting municipal policymakers from governing their own affairs at the local level closer to the people.

per year, the “excess” total compensation range

The Excessive Costs Of Government Unions

With the eighth highest property taxes in the country, a major encumbrance within an overall anti-taxpayer and anti-business climate that has dropped Rhode Island into bottom-10 rankings in a number of critical national indexes, the excessive costs of collectively bargained government services can be directly linked to this statewide problem.

According to its May 2019 report, the Rhode Island Center for Freedom & Prosperity calculates that Ocean State taxpayers are dishing out an extra $888 million per year, providing up to a 27% total compensation premium for government workers; conclusions that are consistent with previous national studies.

Click here to read more.

At a cost of approximately $888 per year for each of Rhode Island’s one-million or so residents, a typical family of four is paying over $3500 annually to support extravagant compensation programs for government workers, while the basic needs of their own families are being ignored by politicians.

With almost two-thirds of these excessive costs being heaped upon municipal taxpayers, the report further estimates that property taxes could be reduced by as much as 25% … if more reasonable, market-based collective bargaining terms were to be negotiated.

[Applying these estimates to the town of Cumberland for example, annual property tax levies are $15.6 million higher than they need be. In Lincoln, the total excess is $12.4 million, and $11.2 million for Smithfield.]

These dramatic figures do not even include other costs of unionization, such as public-works projects that become unaffordably expensive because of state prevailing wage laws; excessive costs of non-unionized public employees; or special perks such as free college tuition like Frank Montanaro fraudulently claimed.

Add in the massive unfunded pension and healthcare benefits promised to former government workers, and the financial picture becomes even darker. Unfortunately for younger generations and those just starting families, all tolled, they will be asked to pay more and more for the unsustainable terms negotiated by prior generations, often for people who are no longer providing any public service.

Another way to look at this situation is the significant lost ‘opportunity cost’. Taxpayer money that could have been spent on maintaining school buildings, recreational spaces, or bridges and roads, was instead collectively bargained for the form overly generous compensation and a wide array of other cash-back schemes. For example, with cumulative potential savings of almost $600 million per year, in just three to four years, localities across the state would be able to pay for necessary repairs and upgrades to their crumbling school buildings, estimated to total over $2 billion … if they did not exorbitantly pay for collectively bargained, union-provided services.

With the 9th most favorable pro-union laws, and despite these entrenched institutional benefits, Rhode Island regularly sees its public employee unions seek even further unfair advantage by demanding greater legislative protections and by encouraging their union executives to seek state and local elected office.

Two current issues in Rhode Island provide provide evidence of what many believe is a rigged system. When local elected officials seek cost-saving measures as part of the collective bargaining process, union bosses immediately turn to their allies in the state legislature to forcefully prohibit any such measure. There can be little doubt that greedy union officials have corrupted government at both the state and local level, restricting elected officials from making decisions that might benefit their taxpaying constituents.

The “firefighter overtime” mandate bill that passed the House in April and the “evergreen contract” legislation that passed a House committee would each create state laws that would grant additional leverage to local union negotiators.

Beyond these extreme financial costs, there may be an even more corrosive impact from this kind of political cronyism. People have lost trust in their government and are fed up with betrayals from lawmakers who have forgotten them, who cater to special interest groups, and who make it harder to live and take care of their families – and to continue to reside in Rhode Island.

For these reasons, Rhode Island is not keeping pace with the rest of the nation when it comes to jobs and population growth. After 10 years of perhaps the slowest economic recovery among all states, Rhode Island’s political leaders are not fulfilling their promise to help the average family.

Instead, by heaping more and more favors upon those who help get them elected, politicians will continue to lose the trust of the people who are also losing hope for their state. These tragic circumstances have conspired to make it a virtual certainty that the Ocean State will lose a prized US Congressional seat after the 2020 national census because of its stagnant population growth.

This massive and excessive cost of government unions, which taxpayers completely pay for, is the biggest problem facing our state. While also being the 800 pound gorilla in the room … that everyone knows is there, but that no one dares to acknowledge … hopefully this Public Union Excesses report will change that dynamic and bring this important cost-of-unionization issue to the forefront.

Among all workers in the state, treating the 10% of unionized government employees more like the 90% of the rest of us are treated … is not only more fair but also builds trust that government is looking out after everyone the same, as opposed to special privileges and favorable laws for special interest groups.

show less

Images

Exploiting Taxpayers

Crumbling Schools

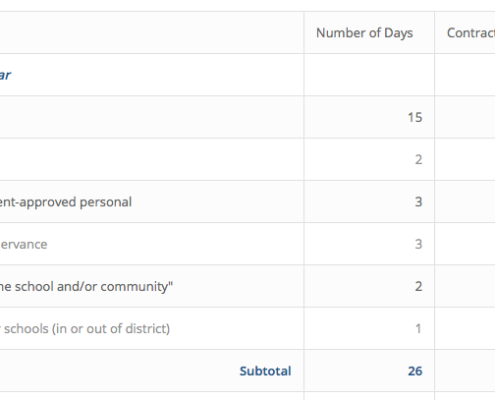

Special Privileges

You’re Overpaying

Political Favors

Greedy Union Bosses

Younger Generations

Time Is Running Out

In The Media:

5/1/19 The Providence Journal: R.I. conservative group: Unions are driving up costs for taxpayers

5/1/19 NBC 10: Expert wary after RI Senate passes union-backed bills

5/1/19 GoLocal Prov: Public Union “Excesses” Cost RI $888M a Year, Says Center for Freedom and Prosperity in New Report

5/1/19 WPRO The Dan Yorke Show: Mike Stenhouse Joins Dan Yorke In Studio

5/2/19 The Providence Journal: My Turn- Mike Stenhouse: Government unions cost us dearly

5/2/19 The John Depetro Show: CEO Stenhouse Talks New Report

5/2/19 NBC 10 I-Team: Injured on duty for years, decades

5/3/19 The Public’s Radio: TGIF- Ian Donnis’ Politics & Media Roudup For May 3

5/4/19 WPRI 12: Nesi’s Notes – May 4 number 6