Stating his rationale for eliminating the state’s car tax (as his campaign for reelection puffed toward the election day finish line), Rhode Island Speaker of the House Nicholas Mattiello (D, Cranston) told reporters that the tax is “regressive” and “unfair.” The same can be said of the sales tax, which the RI Center for Freedom & Prosperity believes should be reduced to a rate of 3.0%.

That the sales tax is regressive — meaning that it disproportionately affects poorer people — is so uncontroversial that the point needn’t be argued, so here are four reasons the sales tax is unfair, too.

The Sales Tax Was Implemented for Specific Purposes… and Failed

When the General Assembly imposed the sales tax on Rhode Islanders for the first time in 1947 and revised its rationale in 1956 and 1988, legislators emphasized an “obligation to grant pay increases for teachers” and a dire need to provide more state money to “the several cities and towns now confronted with financial crisis.”

As Rhode Islanders continue to face high levels of taxation with no reduction in teachers’ claim to deserve higher pay or municipalities’ insistence that their finances are threatened without help from the state (even with the looming pension calamity having gone dormant for the time being), nobody can plausibly claim that the sales tax solved the problem that it was implemented to solve.

Rhode Islanders need a credible alternative to the status quo and its destructive progressive ideas. You can help.

Click here to find out more >>>

The RI Center for Freedom & Prosperity is the Ocean State’s leading voice against the wreckage caused by our state’s progressive agenda.

As the state’s leading research organization, advancing family and business friendly values… the mission of our Center is to make Rhode Island a better place to call home – to raise a family and to build a career.

While progressives value government-centric, taxpayer-funded dependency… our Center believes in the value of hard work and the free-enterprise system.

We understand that in order for more Rhode Island families to have a better quality of life, that more and better businesses are needed to create more and better jobs.

Your donation will help us fight the union-progressive movement and, instead, advocate for pro-family, pro-business policies and values.

Please make a generous, tax-deductible gift to support our Center today!

show less

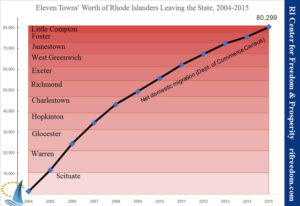

To the extent that the state’s tax burden drives Rhode Islanders out of the state to shop, to live, and to start businesses, thus harming the revenue of the state and its municipalities, the tax is actually undermining the very purpose for which it was implemented.

The 7% Rate Was Supposed to Be Temporary

Faced with a banking crisis in the early ’90s, the people of Rhode Island accepted a higher rate on the sales tax. As the New York Times reported in 1992, “To provide [the Rhode Island Depositors Economic Protection Corporation (Depco)] with money to repay the bonds, the state raised the sales tax to 7 percent from 6 percent, with six-tenths of 1 percent, or $31.8 million in 1992, earmarked for Depco.”

The expectation was that the increase was temporary, but that turned out to be yet another broken promise from the state government.

The Rate Is Supposed to Go Down with Internet Sales

Similarly, when legislators wanted to sell voters on the idea of taxing online sales, as through Amazon.com, they put a provision into the law to drop the 7% rate down to 6.5% “upon passage of any federal law that authorizes states to require remote sellers to collect and remit sales and use taxes.” Well, the federal government never passed such a law, but over the years, the state has cracked down on online retailers in a variety of ways.

Just this year, as part of her budget proposal, Democrat Governor Gina Raimondo has suggested a Remote Seller Sales Tax Collection program that would increase the reporting requirements on online retailers and pressure Rhode Islanders to pay the use tax. Her budget assumes $34,715,462 from the tightening of the taxation screws. Since the budget’s release, Amazon has stated that it will voluntarily begin collecting sales taxes for Rhode Island.

No elected officials have even hinted that the sales tax rate might go down accordingly.

Use Tax Crackdown Could Double-Tax Purchases

One of the measures the state recently implemented in order to impose a de facto online sales tax was, essentially, a minimum tax for purchases the government assumes people make online or out of state.

Under state law, Rhode Islanders are supposed to pay a “use tax” equaling the sales tax they avoided on any purchase from a non–Rhode Island retailer. As part of the fiscal 2015 budget, the state began requiring people filing their income tax returns to either catalog their out-of-state and online purchases and pay the appropriate use tax or to pay a minimum of $8 use tax for every $10,000 in income. In effect, that assumes that a household with income of $50,000 spent around $571 on purchases without paying a sales tax. (Naturally, the state set the minimum to go up with inflation every year.)

At the time this minimum use tax was implemented, the state budget experts estimated that the new requirement would raise about $2.2 million in revenue.

The combination of this minimum use tax with the new online retail program and Amazon sales tax collections means that many Rhode Islanders will surely be double-taxed on their online purchases. The budget does not change the calculation of the minimum, meaning that it still assumes online purchases, so any taxpayers who do not begin keeping records of all purchases — online, in Rhode Island, and elsewhere — and sorting through their receipts while filling out their income tax forms will by default pay a use tax on Internet purchases that were already taxed.

Indeed, the state seems to be relying on this double-taxation, because the budget documents do not change the use tax law (to account for online sales tax collections). Moreover, use tax estimates for the upcoming year do not appear to have been reduced as they would have to be if Rhode Islanders were to begin itemizing online purchases.

Rage Against the Unfair Sales Tax

In summary, Rhode Island’s sales tax — the highest in New England and 30th out of 50 in the country — was first implemented to solve a problem that it did not solve, has been increased with the promise of reductions that never happened, and is leading to a stealth double tax.

Not only is it unfair and regressive, but the Ocean State’s high sales tax confiscates resources Rhode Islanders could better spend elsewhere and acts as a drag on the economy and a job killer. The least the state can do is to drop the rate to 3.0%, which ultimately wouldn’t lose the government much more revenue than it expects to gain from online sales and would cost much less than the car tax elimination.

Click HERE To Expand To See The Press Release

FOR IMMEDIATE RELEASE: March 29, 2017

Rep. Nardolillo Submits Bill to Reduce Sales Tax to 3.0%

As a Matter of Fairness, Rate Reductions Owed to Rhode Islanders

Providence, RI – The State of Rhode Island has broken its promises and unfairly has denied its residents a cut to its nationally high state sales tax rate. Representative Robert Nardolillo III (R, D28, Coventry) is attempting to exceed those promises by submitting legislation (H6105) that would reduce the rate to 3.0%, from its current 7.0% level.

In a new policy brief published today, the nonpartisan RI Center for Freedom & Prosperity discusses a “stealth triple sales tax burden” currently imposed on Rhode Islanders:

-Rhode Island’s state sales tax, among the highest rates in the nation, was originally implemented for a specific municipal purpose, while subsequent increases were supposed to be temporary. In both cases, the regressive tax has remained a costly burden on Ocean State families and businesses.

-The sales tax rate was supposed to be reduced following the implementation of a national Internet sales tax. New Internet taxes are now being collected in the state, yet there is no discussion of rate reductions.

-A minimum “use tax” was recently imposed on Rhode Islanders who file a state an income tax return. This estimated tax was designed to account for purchases made online or out of state. Again, with Internet taxes now being directly collected, there is no discussion to reduce or eliminate this “use tax.”

In summary, the sales tax is being used by lawmakers to stealthily take more money out of the pockets of Rhode Islanders in three unfair way ways … and breaking promises made to the people.

Last week the Center published detailed economic modeling projections and analysis, demonstrating that a cut in the state sales tax to 3.0% would produce far more statewide and municipal economic benefit than would repeal of the car tax, as proposed by the Speaker of the House, or would free college tuition, as proposed by the Governor.

The complete analysis, which can be found on the Center’s website, includes discussion of:

-Why bold tax reform is needed

-Budget reconciliation options

-State spending chart

-General findings

-Two tables with multiple and detailed projections of private employment impact and of various “state” and “municipal” revenues

In 2012 and 2013, the Center proposed two major options for sales tax reform, as the most effective and highest value method for creating jobs and boosting the state’s stagnant economy: full repeal of the sales tax; or cutting the sales tax to 3.0%. Links to this expansive past research can be found at RIFreedom.org/SalesTax.

show less

The RI Center for Freedom & Prosperity is the Ocean State’s leading voice against the wreckage caused by our state’s progressive agenda.

As the state’s leading research organization, advancing family and business friendly values… the mission of our Center is to make Rhode Island a better place to call home – to raise a family and to build a career.

While progressives value government-centric, taxpayer-funded dependency… our Center believes in the value of hard work and the free-enterprise system.

We understand that in order for more Rhode Island families to have a better quality of life, that more and better businesses are needed to create more and better jobs.

Your donation will help us fight the union-progressive movement and, instead, advocate for pro-family, pro-business policies and values.

Please make a generous, tax-deductible gift to support our Center today!

measure paints a more realistic picture of whether or not a particular state is an ideal place to raise a family or build a career than how people “vote with their feet.”

measure paints a more realistic picture of whether or not a particular state is an ideal place to raise a family or build a career than how people “vote with their feet.”