38 Studios–Type Cronyism Is Not Capitalism

Introduction

Put simply, crony capitalism is the transfer of public money to businesses and organizations through the peddling of influence. Cronyism gives free markets a bad name, since it can be difficult to determine whether true competition exists or the game has been rigged.

A more appropriate term might be “venture socialism” or the more familiar “corporate welfare.” Whatever its name, the concept involves a less efficient economy — making us all poorer and reducing economic opportunity for our citizens.

Download a PDF of the Policy Brief here.

Unfortunately, cronyism has defenders on both sides of the political aisle because its proponents are on the receiving end of the short-term benefits. Politicians reward their “friends” with all kinds of publicly provided treasures, from subsidies to exemptions from regulations to loopholes in the tax code. In 2008, we witnessed hundreds of billions of dollars spent on the bailout of major Wall Street firms. A more-recent example of a half-billion dollar investment gone bad has given a name to politically correct green industry schemes: Solyndra.

Given its insulated political culture, Rhode Island is certainly not exempt from cronyist deals and boondoggles. Beginning in the 1990s, corporate giants CVS Caremark and Fidelity Investments have received a bevy of tax breaks and subsidies to build or expand national or regional headquarters.

During the last decade, debates raged about the $300-million-plus ratepayer-funded Deepwater Wind project, a Twin River casino bailout, and the $75 million loan guarantee to Curt Schilling’s 38 Studios. In the past week, Schilling’s video game company has offered a uniquely clear example of the risk that targeted public investments will never produce a positive return on investment for taxpayers.

Taxpayer or ratepayer dollars should not be randomly put at risk to finance politically connected corporate interests. It’s time to replace corporate welfare programs with a broad-based growth program. It’s time to end the handouts and create a pro-job, pro-business structural environment for economic growth in Rhode Island.

Policy Recommendations

As just one step in reducing the size and scope of government in the Ocean State, the RI Center for Freedom & Prosperity recommends that the State of Rhode Island:

- End the practice of corporate welfare in the General Assembly

- Defund the Economic Development Corp. (EDC), preventing it from spending or putting at risk any taxpayer dollars

One of the great mistakes to which policymakers often fall victim is judging public policy programs by their intent rather than their results. Such an approach minimizes the consideration that serious unintended consequences ought to carry in subsequent policy decisions.

Rhode Island should roll back many of its so-called economic development incentive programs, whether in the form of subsidies on the expenditures side of the ledger or loopholes on the tax side. Any economic development program that cannot be objectively shown to create jobs that generate more in-state revenue than they cost should be repealed.

The savings from the ended programs should be used to enact across-the-board improvements of state competitiveness by reducing the Rhode Island’s stratospheric tax rates to more-competitive figures. For instance, Rhode Island’s corporate income tax rate and sales tax rate are the highest in New England, putting the state at a serious economic disadvantage.

Furthermore, ending the practice of cronyism will reduce the special interest and corporate lobbying that pervades Smith Hill and will send a message that taxpayer dollars can no longer be traded for political support and campaign contributions.

Background/Overview

A key critique of market capitalism often revolves around the undue relationship between powerful corporations and the government, resulting in policies, legislation, and regulations that appear to benefit the well-connected at the expense of the public. This critique — though often labeled an inherent failure of capitalism — is a function of an outsized government.

The relationship is intuitive: A government with more power over the economy creates more opportunities and greater rewards for lobbying. In turn, influence over an entity with the power to regulate, tax, and police brings access to competitive weapons not available in a free market.

Indeed, the lion’s share of blame for the current economic crisis can be laid at the feet of connected business interests’ feeding on the fruits of the public commons while pushing the risk onto the public. National examples are most prominent in our minds.

When the housing bubble popped in 2008, Washington-connected Wall Street firms won taxpayer bailouts and bonus checks while the working Americans who paid the bill received pink slips and empty promises. And by most measures, those same firms are now more profitable than ever; industry data shows that President Barack Obama’s first two and a half years in office have been more profitable for Wall Street than George W. Bush’s entire eight years in office.

This is not simply a crisis of bad banks run amok, but an unsettling symptom of cronyism. Cronyism, by its very definition, implies a situation in which the system (i.e., the government and the institutions it establishes), rather than the choices of consumers, picks the winners and losers.

While Rhode Island’s economic climate is demonstrably bad for business (Rhode Island ranks 45th in the Fraser Institute’s Economic Freedom of North America 2011 index), a number of tax credits, incentive packages, and corporate welfare programs benefit a few chosen firms while the rest are forced to languish within a suffocating structural environment.

Targeted incentives are sometimes viewed as legitimate instruments for economic development, but a genuine program for broader growth would allow the state to close many of these loopholes in favor of broader reforms that ease the economic burden across the board.

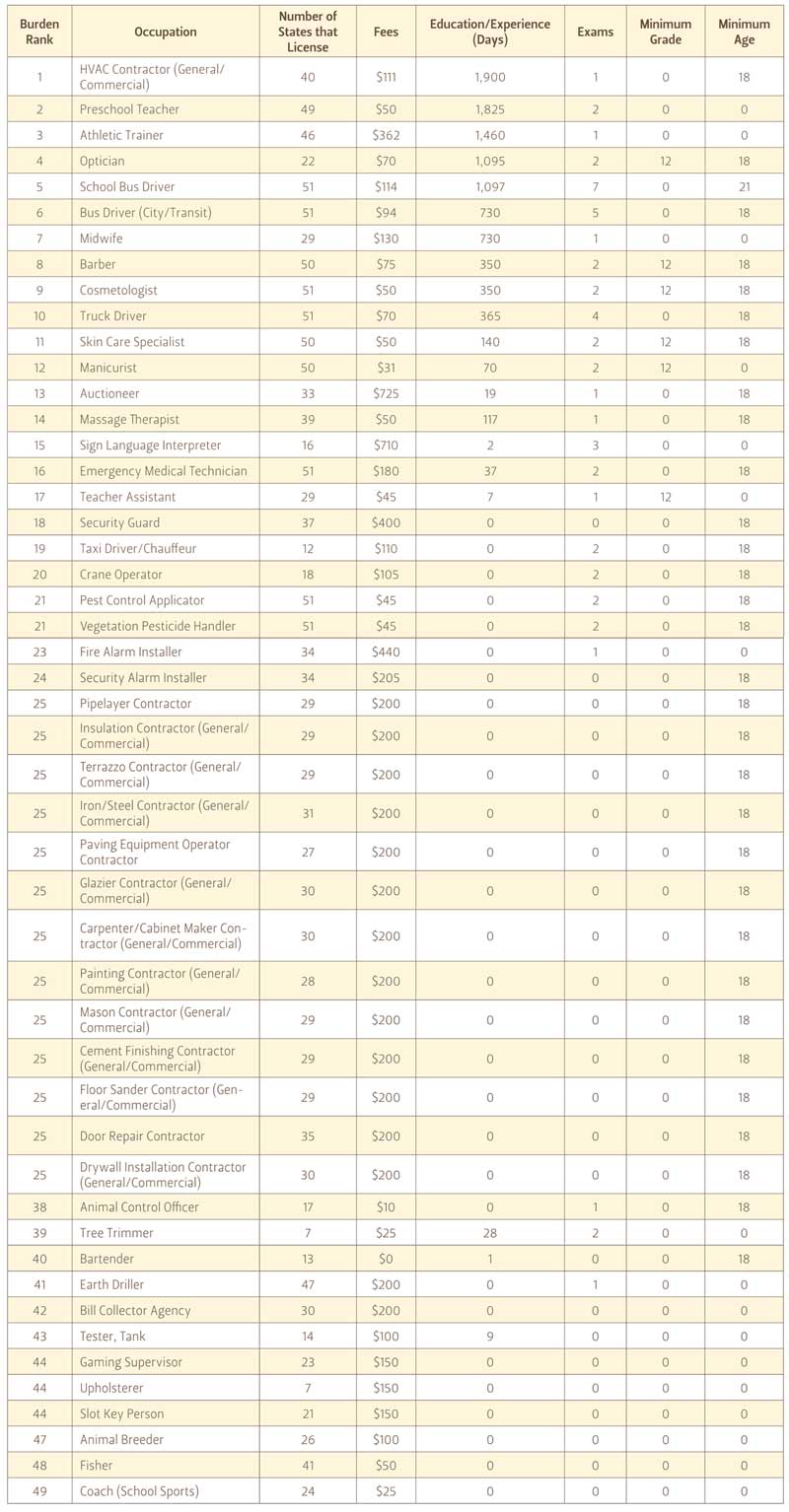

The Research

Every day, taxpayer money is being funneled to organizations and enterprises that someone in government has decided are worthy of patronage, whether they need it or not. Worse, this kind of cronyism is not merely limited to a series of one-off deals, but is systematized on every level in the form of grants, tax credits, sweetheart loans, loan guarantees, and other preferential treatment.

According to GoodJobsFirst.org, a left-leaning economic development accountability resource, Rhode Island taxpayers paid out almost $50 million in related costs for fiscal year 2010, including:

- Corporate income tax rate reduction for job creation

- Enterprise zone tax credits

- Job training tax credit

- Manufacturing and high-performance manufacturing investment tax credit

- Motion picture production tax credit

Worse, disclosure and reporting on these programs are well below what anyone would expect in return for $50 million. In a series of transparency benchmarks measuring program outcomes, data availability, and accessibility, the average Rhode Island program produced a woeful score of only 36 out of a possible 100 points.

These are only a few of the higher-priced programs. At present, a startling number of programs are on the books to divert taxpayer money to targeted businesses and industries, accounting for tens of millions in additional handouts with little or no objective standards or accountability. Some of the others include:

- Distressed Areas Economic Revitalization Act and Enterprise Zone Program

- Jobs Development Act

- Rhode Island Public Rail Corporation

- Child Day Care Facilities in Industrial Parks Grant Program

- Jobs Training Tax Credit Act

- Urban Infrastructure Commission

- Mill Building and Economic Revitalization Program and Tax Credits

- Jobs Growth Act

- Petroleum stockpiling program

- Small Business Advocacy Council

- and many, many more.

While each carries a plausible justification and positive intended outcome (who could be against child care?), they are all simply variations on the crony-capitalism theme.

Discussion

John Stossel, the libertarian journalist of 20/20 fame and program host on Fox Business News, penned a provocative and compelling piece for Reason magazine in March 2004 titled “Confessions of a Welfare Queen.” Rather than documenting now-familiar stories of individual welfare abuse, as the allusion to Ronald Reagan’s famous “welfare queen” quip suggests, Stossel turned his sights on the multilayered fabric of lavish subsidies for the rich and cronyism.

From bizarre payouts to beachfront homeowners to abuses of eminent domain to unfair subsidies for agro-corporations, Stossel explains how these programs are not examples of market failure, but simply the symptoms of the increasing investiture of power into government, especially over ever-greater swaths of the economy.

Americans who decry cronyism as a betrayal of the social contract are correct: The iron triangle linking lobbyist-rich companies and organizations, campaign contributions, and government policy is a burden on our economy and a drag on our democracy. Too often missed, however, is that regulatory solutions just hand over new car keys and more drinkable money to the hooligans who repeatedly steer the economy into a ditch.

The only solution that can work is to limit the government’s ability to mismanage taxpayer funds; that means cutting back on the size, scope, and domain of government. The most vocal opponents of ending cronyism are, predictably, those who benefit most from the system. They, along with well-meaning but misguided allies, will generally contend that targeted systems of tax breaks and incentive programs are useful for directing policy mechanisms toward specific, concerted ends and that Rhode Island needs these incentive programs to be nationally competitive.

Two fallacious premises support these arguments: first, that public policy instruments are the best available means of achieving common ends and, second, that a labyrinth of programs is a suitable way to attract and develop economic activity. These fallacies, in tandem with the frenetic and sound-bite oriented nature of contemporary media, contribute to the idea that most problems have public sector solutions. This is particularly common in the realm of economics, precisely the area over which a market capitalist system would give the government the least control.

Again and again purported plans for “economic development” have been used to justify programs and incentives that ultimately do little to boost economic growth. But because spending and special-project support create the illusion of forward movement, beneficiaries can brand the efforts as “doing something.” What corporate welfare actually does, however, is to tip the scales toward the already rich at the direct expense of the poor and middle class.

Ultimately, government remains wedded to the language and practice of inputs — what it gives and does — because it has very little competence generating or measuring outcomes. Advocates tend to point to inputs as measures of success — the dollars spent, the teachers hired, the police stations built. Then they trumpet or downplay economic trends, educational accomplishment, and as suits their needs.

Tax breaks and incentives may seem like positives from the input side, but their non-anecdotal outcomes show them to be generally a waste of money.

Conclusion

It’s hard to argue against economic development. Who doesn’t want the economy to “develop”? But the sad truth is that sending public money to politically-connected organizations, interest groups, and companies on the basis of poorly measured and ill-defined goals is more of a handout than a strategy. If Rhode Island is serious about promoting economic growth, this kind of piecemeal approach should be seen as expensive and insufficient.

Instead of using targeted tax breaks, incentive grants, and other wizards’ tools to trade away taxpayer funds, Rhode Island should focus on creating a growth-oriented structural environment. That means replacing isolated pockets of preferential treatment with an across-the-board slate of policies to support growth:

- Reduced tax rates

- A more nimble and versatile education system to produce a highly trained workforce

- Eliminated regulations, streamlined when they are absolutely necessary

Any economic development program that cannot be objectively shown to create jobs and generate more in-state revenue than they cost should be repealed. The savings should be allocated to more general improvements, especially lowering taxes.

Rhode Island’s corporate tax rate remains the highest in New England and is tied for third highest in the country, after Washington, D.C. and Illinois.

|

Rank in New England

|

Corporate Tax Rate (%)

|

| Rhode Island |

1

|

9.0

|

| Maine |

2

|

3.5–8.93

|

| New Hampshire |

3

|

8.5

|

| Vermont |

4

|

6.5–8.5

|

| Massachusetts |

5

|

8.25

|

| Connecticut |

6

|

7.5

|

Another area in which Rhode Island is uncompetitive is its state sales tax, which is the highest in the region and tied for second in the country. A study to be released shortly by the RI Center for Freedom & Prosperity will demonstrate that eliminating the sales tax would have the highest “bang for buck” of any reform, creating tens of thousands of jobs and paying for over half of its cost with the increased tax receipts of a larger economy.

|

Rank in New England

|

State Sales Tax Rate (%)

|

| Rhode Island |

1

|

7

|

| Connecticut |

2

|

6.35

|

| Massachusetts |

3

|

6.25

|

| Vermont |

4

|

6

|

| Maine |

5

|

5

|

| New Hampshire |

6

|

0

|

These are just a few of the low-threshold starting points for reform. If Rhode Island seeks to distinguish itself as a pro-growth state, it should depart from crony capitalism and unleash the true capitalistic forces in the state. Fortunately, much of the government cost of the necessary policy changes can be borne by elimination of the special deals and crony-capitalism style programs that infest our state with false promises of a better tomorrow.

To the population more broadly — to the people of Rhode Island — there will be no cost, but rather the benefits of a thriving economy.