POLICY BRIEF: Catch-UP ESAs Give Students Immediate Support

/in Featured, Recent Posts/by RI Center for FreedomInnovative Program Would Fill Major Gaps in the Providence Plan

Providence, RI – With the goal of obtaining immediate educational support for students who may have fallen behind after schools were shut down this past spring, an innovative policy idea would tap unspent federal funds to empower parents to customize supplemental programs for their children.

Called Catch-up ESAs in Rhode Island, and described in a policy brief published today by the RI Center for Freedom & Prosperity, this policy idea has been formally submitted as legislation in Pennsylvania and is being considered in other states as well.

The Catch-up ESA concept was publicly supported by Ray Rickman on a recently taped episode of In The Dugout with Mike Stenhouse, a new video interview series by the Center, especially if it can be targeted to low and moderate income families. Rickman heads Stages of Freedom, a nonprofit that works with hundreds of minority families.

“Instead of families being forced to consider spending their own money to augment their children’s schooling, or not being able to afford at anything at all, programs like after-school enrichment classes, online classes, or private-tutoring could become immediately within reach and would greatly benefit students who may have lost ground by not being able to attend in-person classes this past spring,” said Stenhouse, the Center’s CEO.

These one-time Catch-Up ESAs, available to all qualified students in the state, would also immediately fill major gaps in the five-year Providence schools reform plan, by addressing current student needs. The program would be funded by unspent federal CARES Act funds. The full policy brief can be viewed here.

All In The Dugout interviews can be found on the Center’s website, RIFreedom.org/in-the-dugout/ .

IN THE DUGOUT: John Cianci, Veterans Advocate Raises Alarm Bells About RIDOH

/in In The Dugout, Recent Posts/by RI Center for FreedomIN THE DUGOUT: JONATHAN WILLIAMS AND THE BUDGET DECISION OF THE CENTURY

/in In The Dugout, Recent Posts/by RI Center for FreedomJobs & Opportunity Index (JOI), April 2020: A First Glimpse of the Chasm

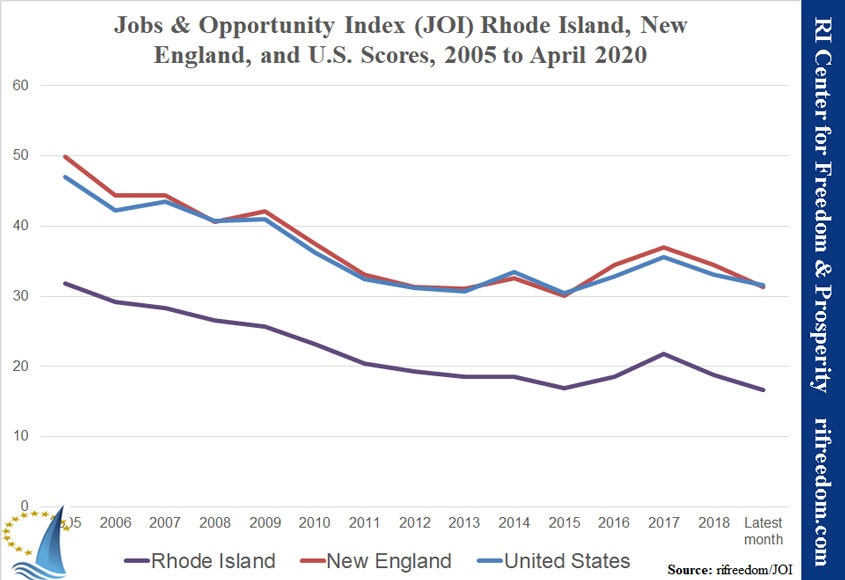

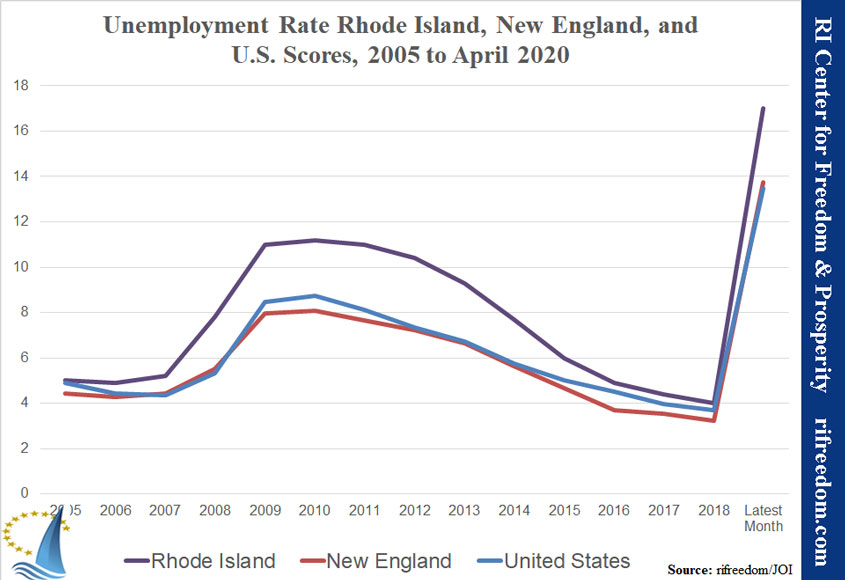

/in Blog, Featured, Jobs & Opportunity Index, JOI, Recent Posts/by Justin KatzThe unemployment chart from this snapshot gives a sense of the shock that April brought to the country’s economic system, but delays in the other data points that make up the RI Center for Freedom & Prosperity’s Jobs & Opportunity Index (JOI) make this just a taste of the full bitterness. Rhode Island dropped one spot in its overall ranking to 48th in the country, but that was arguably due to weakness at the end of pre-COVID 2019. Data for 10 of the 12 datapoints of the index except TANF and federal taxes were updated for this iteration.

Jobs based in RI fell a whopping 19% from the originally reported number for December, and employment fell 18%, nearly 100,000 in both cases, and the labor force fell 5%. Medicaid enrollment (as of January) increased about 0.7%, while SNAP (foodstamp) enrollment was down 1.8% (as of February). Because the COVID-19 hit came all of a sudden, the Ocean State managed to improve on long-term unemployment (as of March), but experienced a 4% increase in marginally attached workers and another 18% increase in those working only part time because more work was not available.

Perhaps of more concern, because it reflects data from December, personal income in the state fell 1.0% on an annualized basis (a little under $500 million). At the same time, state and local taxation increased 1.7%, or $63 million.

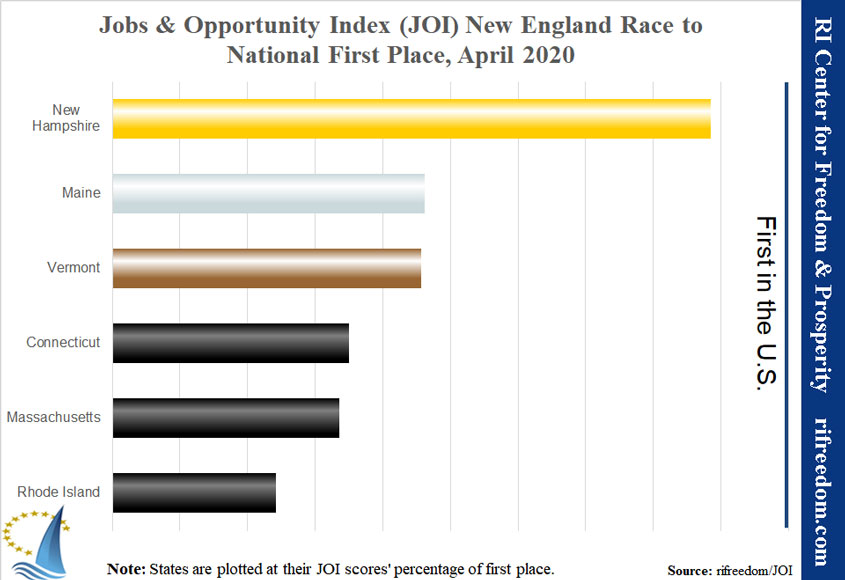

The first chart shows RI remaining last in New England on JOI, at 48th. New Hampshire slipped two spots, to 3rd nationally. Maine fell three, to 20th, while Vermont managed to hold at 21st. Connecticut overtook Massachusetts by maintaining its 37th place while the Bay State plummeted five spots, to 41st.

The second chart shows the gaps between RI and New England and the United States on JOI, and the third chart shows the gaps in the official unemployment rate.

Results for the three underlying JOI factors were:

- Job Outlook Factor (optimism that adequate work is available): RI fell nine spots, to 36th.

- Freedom Factor (the level of work against reliance on welfare programs): RI fell three spots, to 44th.

- Prosperity Factor (the financial motivation of income versus taxes): RI remained 47th.