October 11, 2012 Press Conference: Mike Stenhouse, Revised & Extended Remarks

“Get Government Out of the Way” Solution

Good morning. Today, the RI Center for Freedom & Prosperity recommends a free-market, get-government-out-of-the-way approach to restore Rhode Island’s struggling economy.

Rhode Islanders want to be in control of their own lives. They want to know that if they educate themselves and work hard that they can be in charge of their own futures. They don’t want someone else telling what they need to do.

The Secretary of States publishes the RI Government Owner’s Manual, under the premise that we the people “own” our government. But who’s really in charge? Many Ocean Staters feel like the government is running THEIR lives, both personally and professionally.

The Secretary of States publishes the RI Government Owner’s Manual, under the premise that we the people “own” our government. But who’s really in charge? Many Ocean Staters feel like the government is running THEIR lives, both personally and professionally.

Rhode Island has the worst business climate in the nation because we have one of the most burdensome tax and regulatory environments, leaving families with fewer opportunities and options to pursue a productive life of their own choosing.

More and more it seems that restrictive laws and government programs are running our lives and creating obstacles to prosperity.

Bad laws created this bad environment. So … it should not be all difficult to determine what approach we should take: If we want a good economy, bad laws must be repealed.

Our Center’s Report Card on RI Competitiveness documents dozens of areas where our state receives failing or poor grades because of laws that restrict opportunity or economic activity. Each of these poor grades represents a barrier to success. If we want a more competitive economy, we must tear down those intrusive barriers.

Our Center’s General Assembly Freedom Index for 2012 demonstrates how this past legislative session – only made matters worse. If we want an improving economy, we must roll back destructive legislation.

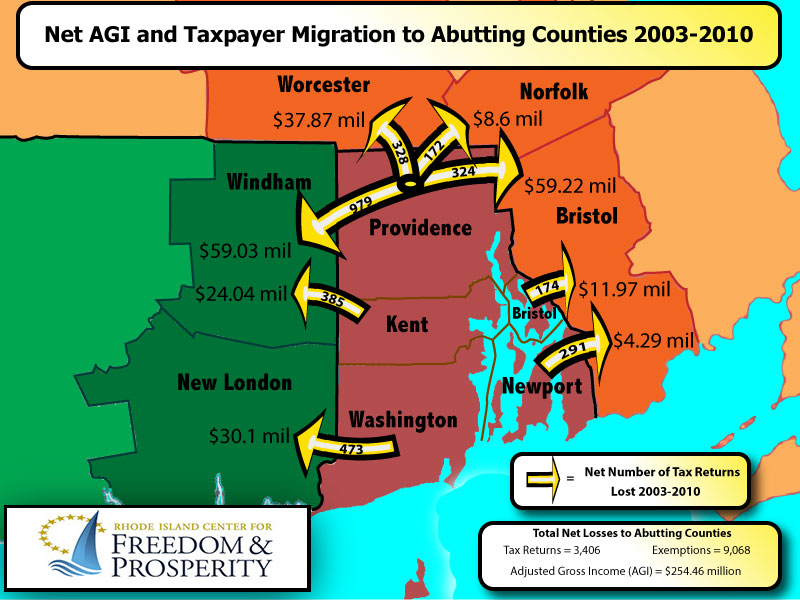

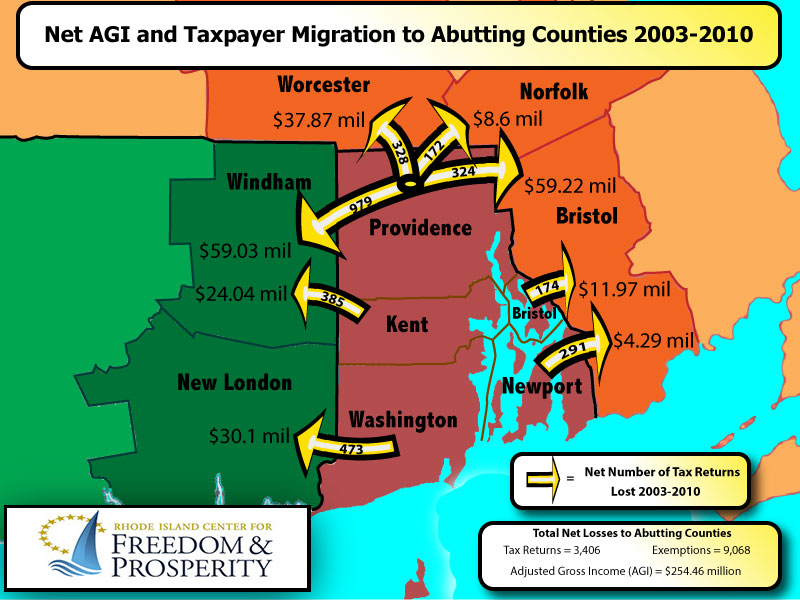

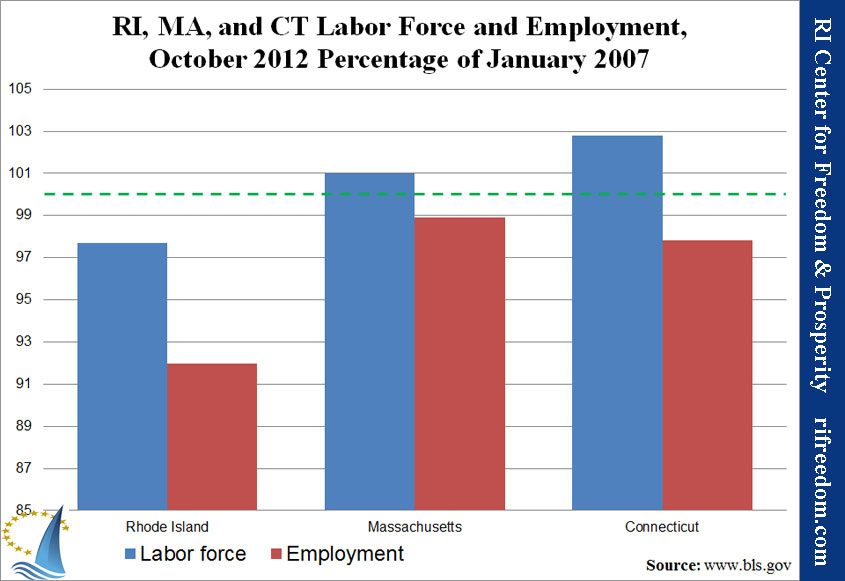

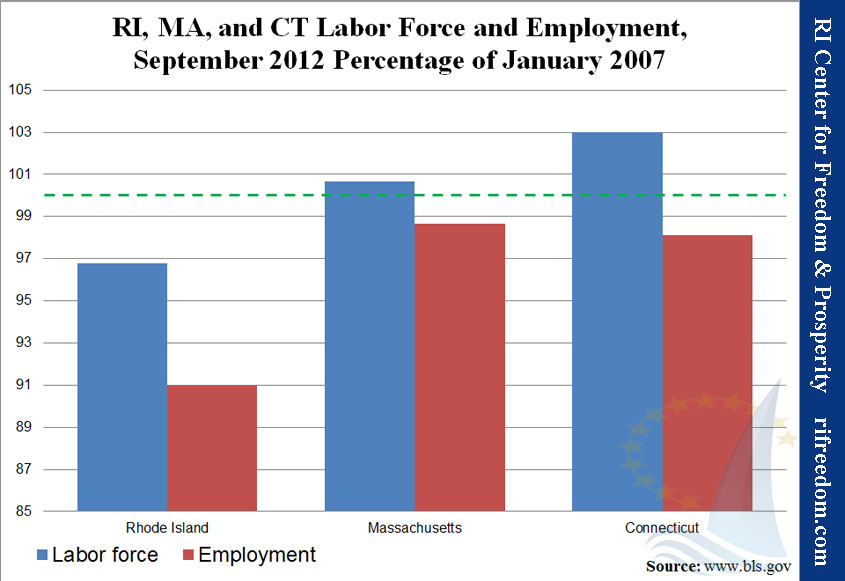

Our recent study on out-migration to bordering counties in MA and CT, are evidence that the onerous state and local tax burden in RI is driving taxpayers out of state.

High Taxes in RI are forcing taxpayers to flee to MA and CT

The Chart above shows that Rhode Islanders who want to work and stay close to their families in Rhode Island, but who can’t afford to pay the taxes we impose on them, simply have to move a few miles over the border. And they are moving … in droves … taking their wealth and their kids with them. Taking our state’s future with them.

If we want an economy that attracts people to our state, we must stop over-taxing them.

Most Rhode Islanders want job security, more disposable income, and more quality time with their families.

I think of Marshall D’Ambrosio, owner of Legion Bowl and Billiards, our gracious host here today. Because of Rhode Island’s poor economy, and in order to survive, he has had to continually invest and risk his time and money in order re-invent his longtime family business here in Cranston.

How many ballgames and other family activities has he had to miss over the years, working into the wee hours because of the bad business climate in this state?

That bad business climate means other families and businesses have less disposable income … less income to go on a family vacation, to organize a business event, or even for a family outing at the local bowling alley.

It’s time to get real. It’s time to understand that the recent high-profile forums and reports, seeking solutions for our economy, are just window dressings that forestall action on the critical problems we must face head on as a state … that they seriously miss the mark.

The bad news is that no-one in the political class seems to want to address this problem. Think about what has transpired this year: the two most powerful officials in our state, the Governor and the Speaker of the House, have both indicated that there’s not much to do but to wait until the national economy picks up … this is not an economic strategy. And, unfortunately, they followed their own advice … they did nothing.

The General Assembly seems concerned only with balancing a budget … a budget is not economic policy.

More recently, highly publicized forums and special reports have generated much debate about how to boost the state’s failing economy: from commerce czars, to public-private partnerships, to what the private sector can do, to more creative marketing of the state, to reorganizing government departments, to grappling with questions like “who’s in charge”. Yet all of these approaches miss the critical mark. The political class does not get it.

But the good news is that citizens seem to get it … In fact, at one of those recent forums, 83% of the participants surveyed believe government to be the obstacle to economic development. Let me repeat … 83% believe government is the obstacle!

The solution must be to get government out of the way … to tear down the barriers to success … this solution is called the free-enterprise system. In the national debate last week, even President Obama call free-enterprise the ‘genius of America’; yet Rhode Island has severely departed from its principles.

Free-enterprise works, and has always worked; but Rhode Island’s economy is anything but free.

Free-markets are about individuals trying to better their own lives by working, innovating, and investing in business enterprises. Unlike the approaches currently under debate in our state, there should be no central authority dictating how or what workers and entrepreneurs need to do. There need be no over-arching strategy that restricts people’s choices. Laborers, investors, and business leaders should be largely free to work and prosper as they deem best.

This is what stimulates growth. This is what increases jobs. This is what creates wealth and grows the economic pie.

If we want a prosperous economy we must re-embrace the free-enterprise system.

Prosperity means that barriers to success must systematically be torn down.

Prosperity means that tax rates must be lowered.

Prosperity means that regulations on workers and businesses must be rolled back.

Prosperity means that we must trust more in each individual’s capacity to thrive and become self-sufficient.

Prosperity means that our state government must do less, and it must spend less.

Prosperity means that government must get out of the way. Adherence to a philosophy that seeks to subsidize politically sensitive constituencies – perceived to be in need – must be reversed.

If we want a productive economy we must build an opportunity environment that encourages people to be self-sufficient.

Similarly, revenue neutral approaches will not be enough to stimulate the rapid growth we need. Taxes and spending must be cut.

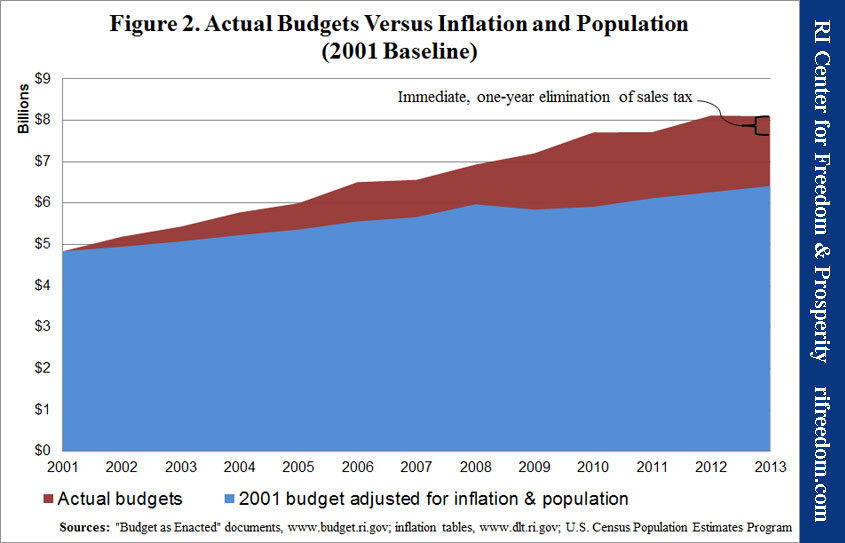

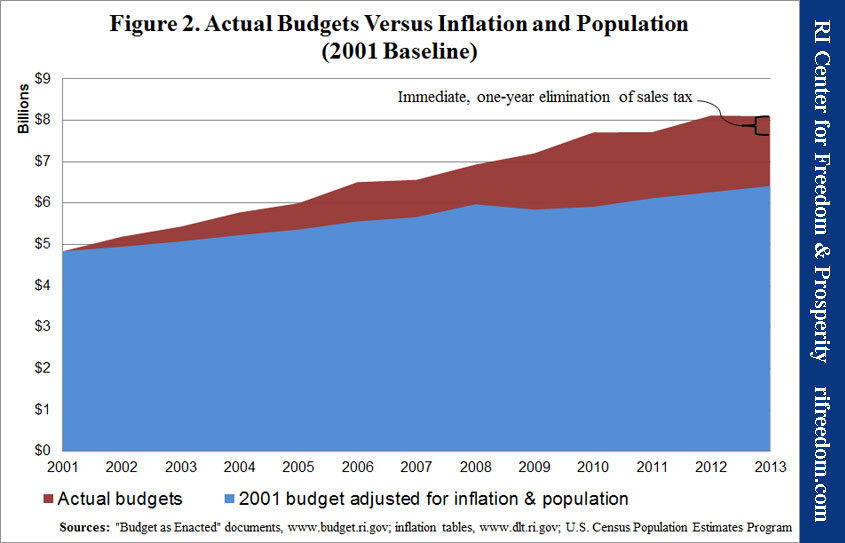

In fact, as we can see in the chart below, Rhode Island’s spending over the past 10 years has far outpaced inflation and its population growth … real spending cuts must be made, and can be made. Over this period, our state, in trying to be compassionate, has simply tried to help too many people … and it is slowly killing our economy.

RI spending has outpaced inflation and population rates

If we want to create new wealth, we must abandon the redistribution of wealth approach.

If we survived at the spending levels of ten years ago, we can survive on them today.

Rhode Island can learn from the experiences of other states; some states richer, some states poorer; some polices working, some policies failing. It was also part of the genius of America that states would serve as laboratories of freedom, so that policy concepts of all kinds could be tried and tested.

Regarding economic policy, many state tests have been studied. We have ample data and evidence; and it is now well-known what approaches have been successful in other states.

If we want a bigger economic pie in RI … we need a new recipe.

We don’t need hundreds of pages of reports, or days upon days of public meetings to figure out what we need to do. In fact, our Get Gov’t Out of the Way public policy approach comprises 3 basic steps, that fits on a single page (in your packets).

In this regard, last month, our Center released a Prosperity Agenda for Rhode Island, a set of initial policy recommendations that will indeed roll back bad laws; an agenda that will tear down some of the significant barriers to success in our state; a pro-worker, pro-business agenda that can begin to restore freedom and prosperity for our citizens.

An example of one of the more compelling reforms is our Zero.Zero Sales Tax recommendation. Which of these two sets of numbers is better: [75-38-400] or [68-0-5000]?

Well, let’s take a closer look … for less than the 75 million dollars the state thought was a good investment in 38 Studios chasing after just 400 jobs, Rhode Island could spend 68 million dollars in the first year of a phase out the sales tax towards 0.0%, which would create 5000 jobs each year for four years!

Yet, no one in the political class wants to debate this concept. Are we not in need of a game-changing solution?

We have evidence of a prosperous 0%-sales-tax state right up the road from us in New Hampshire; further, sales taxes reform is one of the handful of proven policies that states should consider, according to our guest speaker.

In fact, a national expert on state fiscal policy is here with us today, Jonathan Williams. In his book, Rich States, Poor States, he documents which states are doing well and which are not; which approaches to prosperity are succeeding and which approaches have failed.

To add his perspective is a man who has spoken to audiences across the country and has been quoted, seen or heard on numerous national media outlets. May I introduce to you the Director of the Center for State Fiscal Reform and the Tax and Fiscal Policy Task Force at the American Legislative Exchange Council, Mr. Jonathan Williams …

The Secretary of States publishes the

The Secretary of States publishes the