Protecting Citizens from Unjust Prosecution

/in Blog, Recent Posts, Regulatory Environment/by RI Center for FreedomWhy Rhode Island needs a Default Mens Rea Provision

Download a PDF of the 2013 policy brief here ; related Senate Bill No. 414; related 2012 policy brief

2014 GoLocalProv Article – on “Dumb” Providence ordinances

2013 GoLocalProv article – on “50 Dumbest” RI Laws

Background

The rapid expansion of criminal laws in modern day jurisprudence requires a default mens rea (criminal intent) provision to ensure innocent citizens are not given serious criminal penalties for conduct outside the realm of traditional criminal laws.

Every state should be careful when seeking to convict its citizens of crimes without the government proving that he or she intended to violate a law or knew that his or her conduct was unlawful. Many states are moving to protect its citizens from unjust punishment because of ambiguous and poorly-drafted criminal offense statutes.

Nationally, there are fourteen states that have a default mens rea provision similar or identical to that found in §2.02(3) of the Model Penal Code: Alaska, Arkansas, Delaware, Hawaii, Illinois, Kansas, Missouri, North Dakota, Ohio, Oregon, Pennsylvania, Tennessee, Texas, and Utah. Four other states facially require a mental state without a default mens rea.

Close to Home: Examples in Rhode Island Statutes

1) It is a fineable offense, with no requisite mental state, to use the terms “fresh eggs,” “strictly fresh eggs,” “new-laid eggs,” or similar words or descriptions when selling eggs, unless the eggs are consumer grade A or better. R.I. GEN. LAWS §21-17-10, §21-17-6.

What about a farm stand owner who sells “fresh eggs” but doesn’t know to check if they are consumer grade A or better?

2) It is an offense to own a billiard table without a license, and no intent requirement is included. The fine is either $20 or three months of imprisonment. R.I. GEN. LAWS §5-2-12.

What if a bar owner puts a pool table in his facility without knowing of this requirement?

3) It is an offense to sell footwear which has been imported from a foreign country without notifying each person purchasing or intending to purchase that footwear that it has been imported, by displaying in a conspicuous place, in letters at least as large as the figures indicating the price of the goods sold, a sign marked “Imported goods.” If the goods have an individual price marking, they shall also be marked with the words “Imported goods” or the country of origin. This offense carries penalties up to $500 or three months imprisonment, or both. R.I. GEN. LAWS §5.41.1, §5.41.2, §5.41.3.

What about garage or yard sales?

4) It is an offense to own a snowmobile or ATV without “a muffler in good working order which blends the exhaust noise into the overall snowmobile or recreational vehicle noise and is in constant operation to prevent excessive or unusual noise. The exhaust system shall not emit or produce a sharp popping or crackling sound.” The penalty is $100 or 90 days imprisonment, or both, for a first offense. R.I. GEN. LAWS §31-3.2-8, §31-3.2.10.

Does one single pop or crack create criminal liability? What if someone isn’t aware the muffler is required to “blend the exhaust noise” adequately?

Nationally: A Real Life Example of Over-Criminalization

George Norris, a resident of Houston, Texas, imported orchids as a part-time business. In 2003, federal agents raided his home and seized his belongings. Norris was prosecuted and imprisoned because he imported a few legal orchids into the United States with improper paperwork. Because Norris unknowingly committed this “crime,” he not only spent 17 months in prison, but he lost his business, retirement savings, and trust in the legal system.

Recommendations

Enact a Default Mental State in Rhode Island

Criminal laws in Rhode Island today cover a wide range of otherwise innocent behavior, from trading workout tips to transporting poultry, in statutes and administrative regulations.

Such criminal sanctions to regulate behavior sometimes do not include a requisite culpable mental state, opening up innocent actors to serious criminal sanctions for behavior that is not inherently wrong.

Enacting a default mental state provision would ensure that criminal sanctions are levied against the guilty while protecting citizens from unduly burdensome regulations and criminal laws. It would not alter any Legislative pronouncement of a requisite mental state, but merely supply the answer when the Legislature has not already specifically addressed it in codification in a particular criminal law.

This policy recommendation is not about letting violent, career criminals off the hook – this model is about reining in government’s zealous regulation and protecting innocent, hardworking Americans from the destruction of their businesses and livelihoods.

The Criminal Intent Protection will:

- Protect citizens from unjust charges or conviction

- Protect freedom and liberty for individuals and small business

- Strengthen our criminal justice system

How will a default mental state achieve these goals?

1) By protecting citizens from unjust charges or conviction:

- It will ensure that criminal offense statutes and rules include a criminal intent requirement.

- It will focus the criminal law on putting dangerous offenders in prison (murder, arson, rape, theft, and robbery)–-not putting hardworking Americans in prison who are unaware of vague and ambiguous law.

- Many non-violent criminal offenses, such as failing to comply with specific regulatory or reporting requirements, criminalize conduct that is not inherently wrongful.

- It will protect citizens from being criminally charged for an accidental mistake.

- Many of the offenses that do not include criminal intent requirements are paperwork violations and are created by un-elected, regulatory bureaucrats.

2) Protect freedom and liberty for individuals and small business:

- The average American, worker, and business have no hope of knowing the thousands of criminal-law statutes. They can find themselves facing expensive prosecutions and lengthy prison sentences for making honest mistakes.

- Will reserve criminal law for those who intended to commit a wrongful act – those who deserve the consequences.

- Will help to protect citizens’ businesses, livelihoods and reputations so they may contribute to, and strengthen, our economy.

- Any time lawmakers pass a criminal law that does not take into account criminal intent, honest hardworking citizens can find themselves facing prison time.

3) Strengthen our criminal justice system:

- When conduct that is not inherently wrongful is criminalized, it threatens and endangers the integrity of our criminal justice system.

- Criminal law should safeguard both liberty and security.

- Prosecuting and imprisoning one individual is costly to taxpayers and should be reserved for offenders who knowingly and willfully violated the law.

Conclusion

A default mental state would prevent unjust criminal sanctions for innocent behavior. It would protect citizens from oversights in legislative drafting and provide peace of mind for those taking part in wholly innocent and blameless behavior. It would not restrict the Legislature, but instead encourage it to speak clearly as to the guilty mind it thinks must be proven to obtain a guilty verdict.

Rhode Island citizens are currently without recourse if charged with a crime that should have a mental state included in its language but does not. A default criminal intent provision would restore the protection afforded to Americans for centuries.

Minimum Wage’s Cost in Jobs: 432 at $8.25 and 3,466 at $10.10

/in Blog, Jobs, Minimum Wage, Recent Posts, Youth Issues/by RI Center for FreedomProfile of minimum wage worker is NOT of a low-income, family bread-winner.

Related Links: WJAR-10 TV Story; GoLocalProv Story; Pew Research Center: national data backs up our findings; CBO – nonpartisan federal agency echos job loss projections (2014)

2014 Wall Street Journal story confirms Center’s position

Video by FEE: The Truth about the minimum wage …

As an update to prior studies of the effect of increasing the minimum wage on Rhode Island’s employment situation, the RI Center for Freedom & Prosperity estimates that proposed increases could cost the state hundreds or even thousands of jobs.

Legislation passed the General Assembly in 2014 that will increase the minimum wage in 2015 to $9.00 per hour, from its current $8.00, which was itself a new increase from $7.40 2 years ago. When all is said and done, this jump from $7.40 to $9.00 will wind up costing the state hundreds or thousands of jobs, the lion’s share affecting teenagers.

Additionally, legislators in the U.S. Congress are advocating for an increase to $10.10 per hour or higher. That change, we estimate, would destroy 3,466 Rhode Islanders’ jobs.

Minimum Wage Changes in Rhode Island

The very next session after the Rhode Island General Assembly voted to increase the minimum wage from $7.40 to $7.75, the legislature will consider bills moving it up again, to $8.25. The elected officials who made H5079 and S0256 among the earliest legislation to hit the State House, this year, surely see the move as a campaign to help struggling families. But the RI Center for Freedom & Prosperity sees it as a continuing assault on the state’s economy and especially those most in need of upward mobility.

Last July, the Center found that Rhode Island’s move from $6.75 to $7.40, from 2005 to 2011, likely cost teenagers in the state 397 jobs. The increase to $7.75 destroyed an estimated 200 more.

Based on the work of the economists who performed that study, David Macpherson (Trinity University) and William Even (Miami University), with a review of the Census Bureau’s Current Population Survey for 2011 and 2012, the Center estimates that, overall, the move from $7.40 to $8.25 will eliminate 432 jobs, 204 of them among teenagers.*

Who Is Affected?

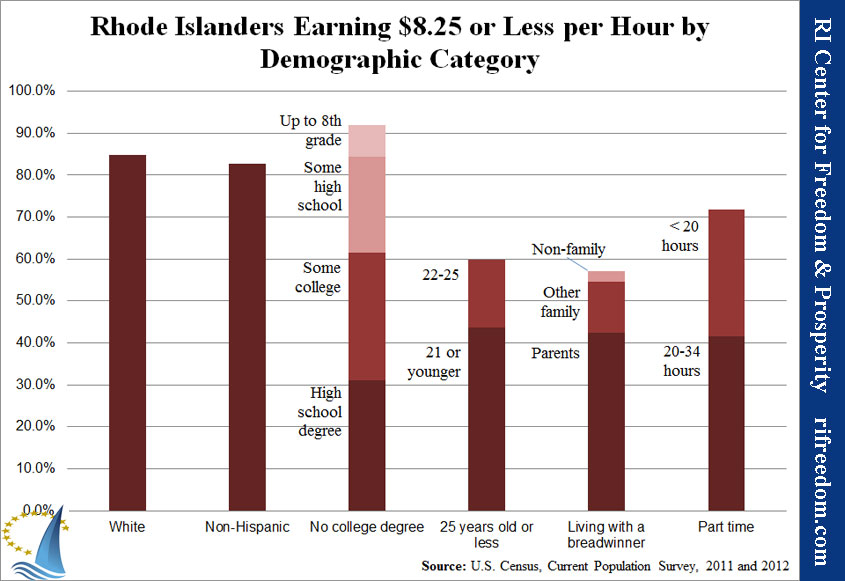

According to the study, 24,846 Rhode Islanders currently have jobs that pay them at a rate of $8.25 per hour or less. The “typical” profile — using the highest percentage by each demographic quality — is of a white non-Hispanic high-school graduate, 21-years-old or younger and with no college experience, who lives with his or her parents and works 20-34 hours per week. The following chart shows how dominant each of these qualities is in the under-$8.25 population.

Simply put, the image of low-income families struggling along at minimum wage is mostly false. The average family income of Rhode Islanders who make $8.25 per hour or less is $61,299. For these families, the minimum-wage job provides only supplemental income. As the following table shows, even two full-time minimum-wage incomes would barely amount to half of this average.

|

Annual Income Earned for Different Minimum Wages by Hours Worked per Week ($) |

|||

|

$7.40 |

$7.75 |

$8.25 |

|

| 20 hours |

7,696 |

8,060 |

8,580 |

| 34 hours |

13,083 |

13,702 |

14,586 |

| 40 hours |

15,392 |

16,120 |

17,160 |

Notes: The percentages of minimum-wage-earning Rhode Islanders in each hours category is as follows:

Results assume 52 weeks of work per year. Source: U.S. Census, Current Population Survey, 2011 and 2012 |

|||

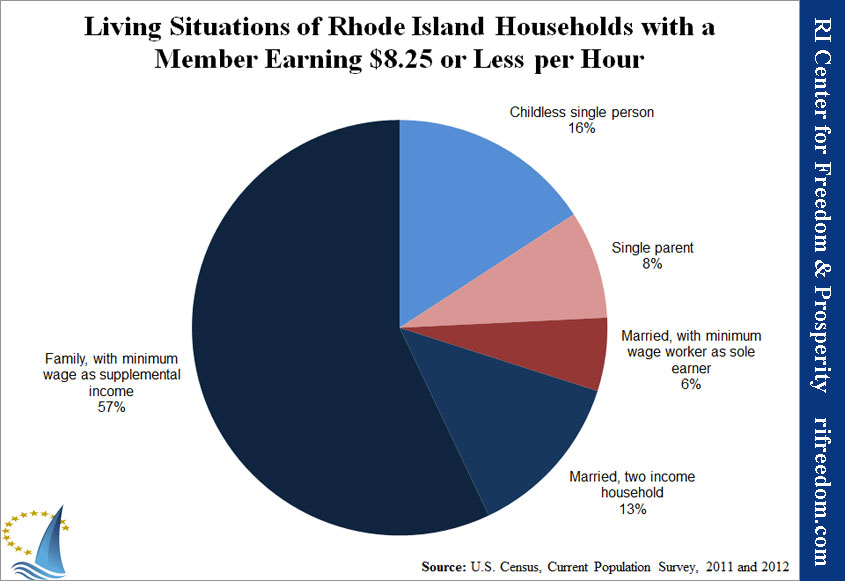

The following chart illustrates that only a small minority of families rely entirely on a minimum wage income for support, even among households with some minimum-wage income.

What’s the Effect?

We estimate that the increase of the minimum wage from $7.40 to $8.25 per hour will result in a loss of 432 minimum wage jobs in Rhode Island. This total assumes a lower effect on better educated and older workers. That’s a 1.74% reduction of employment available to people currently earning less than $8.25. Of those losing jobs, 204 will be teenagers.

The focus of advocates for higher minimum wages is very often on the plight of people striving to live on such low salaries, but most workers at that pay rate do not fit the profile. Most of them are bringing in relatively small amounts of supplemental income — many as discretionary spending cash for teens and young adults who are still largely supported by their parents.

In the view of the RI Center for Freedom & Prosperity, the loss of employment opportunities for Rhode Islanders in this group outweighs the relatively small increases in take-home pay. At young adults’ formative age, the connections, habits, and general experience that come from working at any pay scale are vastly more valuable than the small increases that legislators are able to mandate through minimum wage laws.

At the National Level, a Bigger Hammer

This morning, Rhode Island’s two representatives in the U.S. Congress, Jim Langevin (D) and David Cicilline (D), jointly announced their support for the “Fair Minimum Wage Act.” The act would increase the federal minimum wage — and, therefore, Rhode Island’s minimum wage — to $10.10 per hour.

The RI Center for Freedom & Prosperity estimates that this move would result in a loss of 3,466 jobs for Rhode Islanders, or 4.1% of the total number who currently work at or below that rate of pay. Moreover, even with this broader net, the number of affected families that are subsisting on minimum wage income alone would still be just 17% of all households with at least one member earning that amount.

* Going back to the prior minimum wage rate of $7.40 was necessary because measuring the change from the current rate of $7.75 to $8.25 produced insufficient sample sizes.

Rhode Island Employment Snapshot, February 2013: Mixed, Stagnant Picture

/in Blog, Recent Posts/by Justin KatzFor the first time in years, Rhode Island’s unemployment rate is out of the bottom three for the nation, down to 9.4%. Once again, however, the Ocean State’s “improvement” hinges on a loss of people in the labor force.

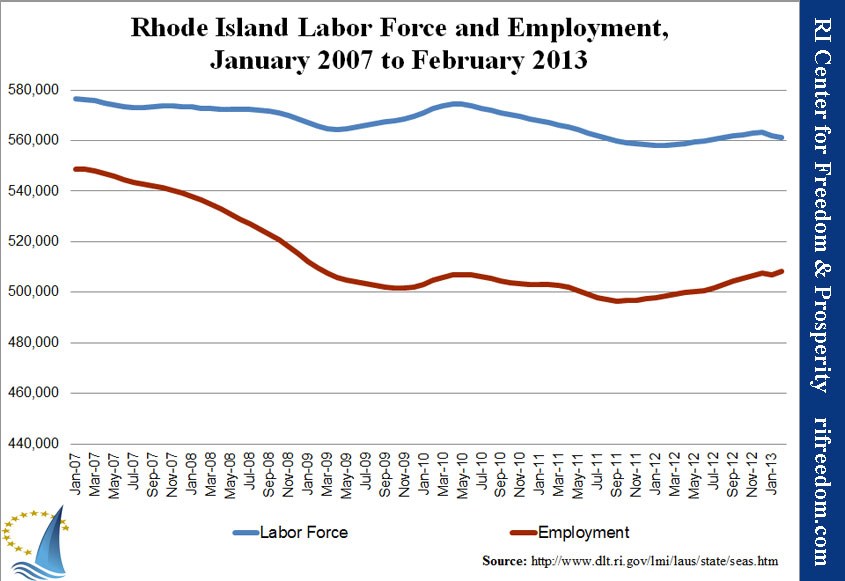

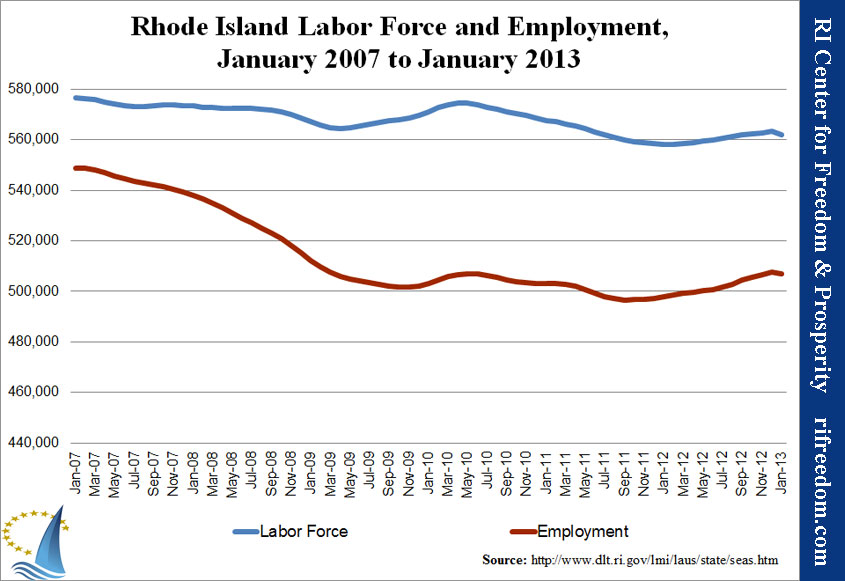

The first chart below shows that, while employment edged up in February, the total labor force (those either employed or looking for work) continued to fall. February’s number was down, and at the same time, January’s number was revised downward, as well. If the labor force had held steady from December, Rhode Island’s unemployment rate would still be a worst-in-the-country 9.8%.

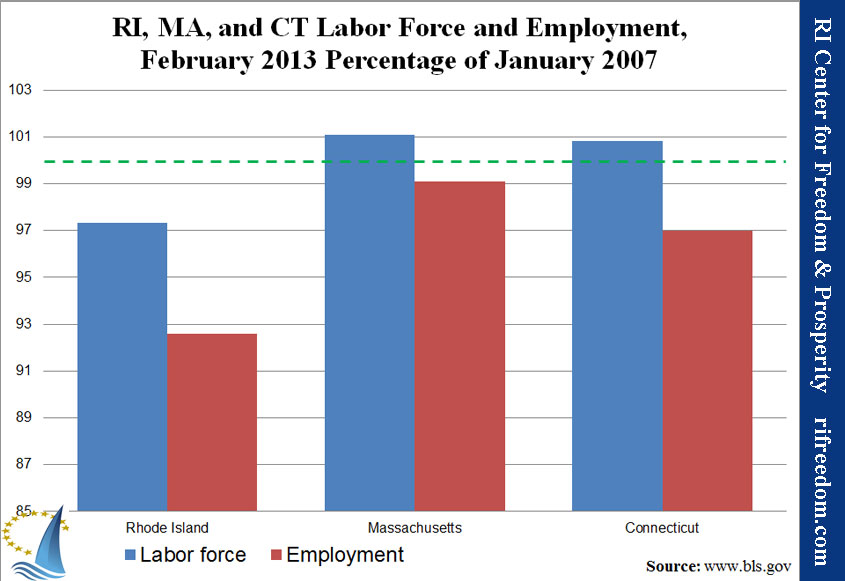

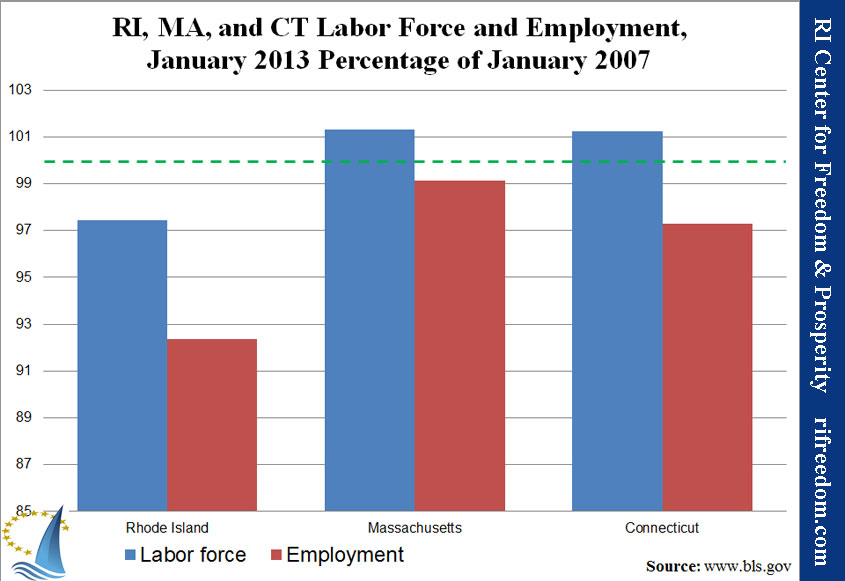

The second chart shows that the Ocean State still has a long way to go to reach its January 2007 level of employment, and once again remains well behind Massachusetts and Connecticut, although Connecticut has been closing the gap through its own downslide.

RI Medicaid Abuse Puts New Spin on “Laundering” Taxpayer Dollars

/in Blog, Featured, Labor, Recent Posts, Transparency/by RI Center for FreedomMEDIA: NBC- Channel 10, ABC Channel 6

The State of Rhode Island has developed a new spin on the idea of “laundering” money, as part of the cycle of taxpayer dollars that end up in the pockets of the special few, according to a follow-up post today on The Ocean State Current, the journalism wing of the RI Center for Freedom & Prosperity.

According to the post by Justin Katz, some unionized laundry workers at the Eleanor Slater Hospital, and throughout the Department of Behavioral Healthcare, Developmental Disabilities and Hospitals (BHDDH), routinely double or even triple their salaries to take home over $123,000 per year, due to suspiciously high overtime payments.

The post follows an investigative article published yesterday in The Ocean State Current about six-figure overtime payments to government employed nurses and psychiatrists.

These new laundry worker revelations depict the waste and abuse in the laundering scheme where local and national taxpayer dollars are recycled first through the government via collection of taxes, then, in the Eleanor Slater case, sent to state-run facilities in the form of excessive Medicaid payments, with the money then further cycled directly into the pockets of privileged union employees – in this case, to laundry workers via exorbitant overtime payments.

Result: our hard-earned taxpayer dollars legally recycled to lavishly benefit government workers.

The data for The Current’s article and post was collected by the Center, as part of its transparency effort.For more information about salary and overtime payments made to other state employees, please visit our popular transparency website, www.RIOpenGov.org.

High Overtime, Evasion Raise New Questions About Medicaid Fraud and Waste

/in Blog, Labor, Recent Posts, Transparency/by Mike StenhouseRelated Links: GoLocalProv, New Allegations Surface in RI Medicaid Fraud;

In the wake of an investigative article published this morning in The Ocean State Current about suspiciously high overtime payments to government employed nurses and psychiatrists, the Rhode Island Center for Freedom and Prosperity plans to publish additional related information in the coming week.

Considering that public dollars are being paid to government workers who, for years, have collected six-figures in overtime from a facility that was cited in a recent Medicaid fraud and waste report, “one really has to wonder if the State of Rhode Island is defrauding itself: at taxpayer expense”, commented Mike Stenhouse, CEO for the Center.

The recent Block Report cited the Eleanor Slater Hospital in Cranston, a state-run facility that charges abnormally high fees, as a potential source for abusive Medicaid spending. In her article, Suzanne Bates, a freelance journalist, details how nine employees at that same facility received over $100,000 in overtime compensation alone, pushing gross annual pay for some to over a quarter-of-a-million dollars.

The article also describes the difficulties Bates and the Center faced in getting an explanation and in obtaining the data. The investigative article raises questions that go to the heart of our state government’s inability to manage its budgets in a way that serves all Rhode Islanders:

- Why would the state-run Eleanor Slater Hospital, in Cranston, be so short-staffed that it must pay over one million dollars in overtime to just 9 employees year after year?

- Is our state truly being served well if union contracts make it more cost-effective for the Dept. of Behavioral Healthcare, Developmental Disabilities and Hospitals (BHDDH) to pay exorbitant overtime to some, rather than to hire more people during these hard economic times?

- If taxpayers are ultimately paying almost the entire bill for this expensive workforce through both state and federal Medicaid dollars, where is the oversight to keep these costs under control?

Later this week, the Center plans to publish a broader list of overtime payments made to other state employees. Next week, the Center plans to launch a new module – that lists regular and overtime compensation for all state employees – to its popular transparency website, www.RIOpenGov.org .

The Ocean State Current is the journalism wing of the RI Center for Freedom & Prosperity. The data for The Current’s article was collected by the Center.

Zero.Zero 2013

/in Blog, Featured, Policy, Recent Posts, Sales Tax, Taxes/by Justin KatzELIMINATE THE STATE SALES TAX TO CREATE JOBS: The RI Center for Freedom & Prosperity proposes the elimination of Rhode Island’s sales tax as a means of high-impact economic development. Our RI-STAMP economic model suggests that the loss in state revenue would not be as large as static projections might suggest and would be well worth the boon to Rhode Islanders across the state.

Rhode Island Employment Snapshot, January 2013: RI Improves by Losing

/in Blog, Recent Posts/by Justin KatzWith the help of a revision in the way the U.S. Bureau of Labor Statistics (BLS) calculates its results, Rhode Island’s unemployment rate fell below the 10% barrier in December for the first time in years. And with the help of people giving up their quest for work, it notched down to 9.8% in January. That’s despite the fact that the state’s total employment fell for the first time since September 2011 (according to the revised numbers).

The first chart below shows that both labor force and employment turned downward in January, but since labor force fell even more than employment, the number of people who are technically “unemployed” went down as well. The second chart shows that the Ocean State still has a long way to go to reach its January 2007 level of employment, and once again remains well behind Massachusetts and Connecticut, although Connecticut has been closing the gap through its own downslide.

Nationwide, Rhode Island is still tied for the worst unemployment rate in the country, no longer with Nevada, however. The Ocean State’s last-place partner is now California, although the Golden State’s reason couldn’t be more different: California has been adding employment, but people are entering (or returning to) the workforce too quickly for the unemployment rate to go down.

Commentary: Zero out sales tax to change R.I. game

/in Blog, Recent Posts, Taxes/by Mike StenhouseFor perhaps the first time in recent memory, the Rhode Island General Assembly will consider legislation that could have a profound positive impact on the lives of virtually all residents and businesses in the state. Rhode Island families are being torn apart. Parents, children and siblings are being driven out of the state in search of good work or retirement at a more reasonable cost of living. Businesses struggle in our uncompetitive business climate. With some of the worst job outlooks and population trends in the entire nation, the Ocean State is in dire need of “out of the box” thinking to restore financial security and hope for a brighter future for our home state.

The recommendation by the Rhode Island Center for Freedom & Prosperity to eliminate the state’s 7 percent sales tax, which would bring shoppers and retail and construction jobs back, keeping our families and businesses intact and at home here in the Ocean State, has resulted in bipartisan legislation submitted last month in the Assembly.

Those who defend the status quo, though they themselves pledged that the economy would be their No.1priority for the 2013 legislative session, argue that we should be “boxed-in” by a demonstrably failed state budget.Think of the numbers 50-50-50-1. Depending on the index, Rhode Island ranks at or near: 50th in employment; 50th in population out-migration; and 50th in business climate — all because it ranks first in the category of redistribution-of-income policies. This makes the Ocean State the most anti-free-market, anti-family, anti-jobs state in the entire country. No wonder Rhode Island is in a death spiral, with fewer and fewer productive people to support an ever-increasing and burdensome budget.And it is this very budget that opponents of our sales-tax-repeal plan point to as reason not to create tens of thousands of new jobs, not to breathe new life into our economy and small-business sector, not to reduce the cost of living for every family (especially helpful at lower incomes), and not to provide local municipalities with $150 million in annual windfall revenue.But Rhode Island is not about numbers, or a budget, or government: It is about real people, with real lives, who suffer real consequences as a result of poor public policy. Dare to imagine a brighter future for Rhode Islanders, where public policy, for once, works in their favor.

Imagine the headlights on highways Route 95 and Route 195 jammed with traffic of shoppers and families coming into the Ocean State, instead of the tail-lights of those heading out.

Imagine the thousands of unemployed who will be able to earn a paycheck instead of a welfare check.

Imagine $900 million left in the pockets of area shoppers to reinvest in the local economy.

Imagine the new shoppers, higher revenues and profits, and lower compliance costs for local businesses.

Imagine Rhode Island businesses competing regionally and stepping to the plate without a proverbial 7 percent weight on their bats.

But the ruling class in Rhode Island has no such imagination. All its members can see is the $900 million in sales-tax revenue that might be lost from their prized budget; $900 million less that they can hand out to preferred insiders. This is not leadership but fear of upsetting the apple-cart by hiding behind the limitations of a failed, job-killing budget.

But lo, the Center for Freedom & Prosperity has crunched the numbers and found that the ruling class’s sacred $900 million obstacle is imaginary. In reality, our estimates suggest that it would take only $105 million in budget savings in fiscal year 2014 to implement this game-changing reform. The legislation on the table would eliminate the sales tax as of Oct. 1 of this year. That means the state would still cash in on the busy summer tourism months, even as the people and stores of Rhode Island see their holiday shopping dollars go further.

Then, if political leaders were serious about making the economy their No. 1 priority, they would apply last year’s budget surplus to help pay for repeal of the sales tax. And if the political class was serious about making jobs its number one priority, it would likewise freeze the 2014 budget at 2013 levels.

And finally, by realizing the huge projected increases in other taxes and fees because of the massive economic boom the state would see, just under $105 million in savings would remain to be found in the budget to put Rhode Island on a fast path to growth and renewed vitality.

Repeal of the sales tax is not a budget-busting reform policy by any stretch of the imagination. This is a win-win solution for the state of Rhode Island. Imagine that.

Mike Stenhouse is CEO for the Rhode Island Center for Freedom & Prosperity, a free-market public-policy think tank.

Center Estimates Waste & Fraud in Rhode Island be as High as $185 Million

/in Blog, Health Care, Policy, Recent Posts/by RI Center for FreedomThe release by the Chafee Administration of a redacted report on waste and fraud in Rhode Island’s human services programs failed to provide the total taxpayer dollars discovered by Ken Block’s Simpatico software firm that were spent on illegal or other inappropriate activity; instead the report was limited to examples of impropriety and generalities of findings within the state’s Medicaid and food-stamp program.

Based on a brief analysis of related national findings and anticipated state budgets, the RI Center for Freedom & Prosperity estimates that up to $185 million dollars may be currently wasted in the Ocean State. With planned Medicaid expansion, this total could approach a whopping $221 million in future years, almost three times the amount of the 38-Studios debacle … every year.

The biggest portion of the fraud likely comes from Medicaid abuse. Common estimates of such waste and fraud nationally assume that 10% of related spending applies. In our updated report on the Zero.Zero sales tax initiative, the RI Center for Freedom & Prosperity referred to a U.S. House of Representatives Committee on Oversight and Government Reform document that uses that number.

Estimates from the federal Department of Health and Human Services, however, put current “improper payments” at 7.1%, with 6.4% as the target.

The governor’s budget document for fiscal year 2014 revises the current estimate of what the state will spend this year on “medical assistance” (i.e., Medicaid) to $1.616 billion, going up to $1.743 billion next year. Using the 2013 estimate puts the range for waste, fraud, and abuse for Medicaid alone at between $114.7 million and $161.6 million.

The other large portion of wasteful government spending in the report pertains to the food stamp program – also known as the “Supplemental Nutrition Assistance Program” (SNAP) – which uses electronic benefit transfer (EBT) cards to distribute the funds.

As predicted by a post in The Ocean State Current prior to the report’s release by the Chafee administration, and based on report on government waste that U.S. Senator Tom Coburn (R, OK) published in October, dead people in Rhode Island often receive food-stamp benefits.

Coburn’s report actually provides a low-end, for our purposes, estimating around 3% in “improper payments” nationwide. The more official number from the Department of Agriculture is 3.8%, however the Associated Press reported that Rhode Island’s “error rate” for the food stamp program in 2012 was 7.69%.

Governor Chafee’s revised expenditure for SNAP in 2013 is $298.2 million, recommended to hold steady through 2014. That puts the range for food stamp waste, fraud, and abuse between $11.3 million and $22.9 million.

In summary, our Center estimates that the total amount of criminal and abusive activity in Rhode Island’s current human services programs is in the range of $126 million to $184.5 million.

However the story does not end with today’s figures. With the Governor, Lieutenant Governor, and the Secretary of Health and Human Services opting to support expansion of Medicaid, as provided under the Affordable Care Act, the RI Center for Freedom & Prosperity expects that an additional $36.5 million of taxpayer money will be abused as part of the anticipated $365 million in new Medicaid spending in future years.

This could bring the total amount of waste and fraud up to $221 million per year.