Report: Government Data Proof of Retail Boom for 3.0% Sales Tax Concept

Wine & Spirits Increased 21.4% After Sales Tax Cut

Providence, RI – Imagine the parking lots of Rhode Island retailers filled with cars with Massachusetts license plates. Actual data from the State demonstrates that this is possible. The same level of economic stimulus – as projected by the Center by cutting the state’s overall sales tax – actually occurred when the same tax was cut on liquor and wine. This, according to a report issued today by the nonpartisan Rhode Island Center for Freedom & Prosperity, based on RI Department of Revenue data.

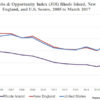

Among the report’s findings, in the years after the 7% retail sales tax on wine and spirits was repealed (to 0.0%) in 2013:

- Wine and spirits sales saw a boost of 21.4% over the first two years (during the same time period, all statewide retail sales increased by just 8.3%).

- The Center’s economic modeling tool projected a comparable 21.2% positive statewide retail impact if the sales tax were to be cut to 3.0%.

- Current corporate-subsidy schemes claim just dozens or hundreds of new jobs at a budget cost averaging about $80,000/job;

- Conversely, a 3.0% sales tax would create thousands of good new jobs at a 10X lower rate, or only $7,000/job per job.

- Over $3,100,000,000 in retail sales growth would result from a statewide sales tax cut to 3%.

“After the wine and spirits sales tax was cut, my store’s overall sales have increased dramatically, in part fueled by more Rhode Island shoppers staying home, instead of crossing into Massachusetts,” said Jan Malik, former state Representative from Warren and current liquor store owner.

“As opposed to the anti-business, job-killing legislation being advanced by the progressive-left, our Center’s pro-jobs, pro-family sales tax plan would keep more money in the pockets of businesses and families and would create new opportunities for Rhode Islanders to improve their quality of life,” explained Mike Stenhouse, CEO for the Center.

Rhode Islanders need a credible alternative to the status quo and its destructive progressive ideas. You can help.

Click here to find out more >>>

The RI Center for Freedom & Prosperity is the Ocean State’s leading voice against the wreckage caused by our state’s progressive agenda.

As the state’s leading research organization, advancing family and business friendly values… the mission of our Center is to make Rhode Island a better place to call home – to raise a family and to build a career.

While progressives value government-centric, taxpayer-funded dependency… our Center believes in the value of hard work and the free-enterprise system.

We understand that in order for more Rhode Island families to have a better quality of life, that more and better businesses are needed to create more and better jobs.

Your donation will help us fight the union-progressive movement and, instead, advocate for pro-family, pro-business policies and values.

Please make a generous, tax-deductible gift to support our Center today!

show less

Representative Robert Nardolillo III (R, D28, Coventry) has submitted legislation (H6105) that would reduce the state’s sales tax rate to 3.0%, from its current 7.0% level.

Representative Jared Nunes (D, D25, Coventry/W.Warwick). with support of Majority Leader, Joseph Shekarchi, has introduced legislation (H6127) for a special commission to study how the state can responsibly reduce the sales tax to 3.0%

Also, as the Center documented in a prior policy brief, a “stealth triple sales tax burden” currently imposed on Rhode Islanders and how the sales tax is being used by lawmakers to stealthily take more money out of the pockets of Rhode Islanders in three unfair way ways.

In March, the Center published detailed economic modeling projections and analysis, demonstrating that a cut in the state sales tax to 3.0% would produce far more statewide and municipal economic benefit than would repeal of the car tax, as proposed by the Speaker of the House, or would free college tuition, as proposed by the Governor.

In 2012 and 2013, the Center proposed two major options for sales tax reform, as the most effective and highest value method for creating jobs and boosting the state’s stagnant economy: full repeal of the sales tax or cutting the sales tax to 3.0%. Links to this expansive past research can be found at RIFreedom.org/SalesTax.

The RI Center for Freedom & Prosperity is the Ocean State’s leading voice against the wreckage caused by our state’s progressive agenda.

As the state’s leading research organization, advancing family and business friendly values… the mission of our Center is to make Rhode Island a better place to call home – to raise a family and to build a career.

While progressives value government-centric, taxpayer-funded dependency… our Center believes in the value of hard work and the free-enterprise system.

We understand that in order for more Rhode Island families to have a better quality of life, that more and better businesses are needed to create more and better jobs.

Your donation will help us fight the union-progressive movement and, instead, advocate for pro-family, pro-business policies and values.

Please make a generous, tax-deductible gift to support our Center today!

Leave a Reply

Want to join the discussion?Feel free to contribute!