Spotlight on $pending Report

/in Budget and Spending, Featured, Taxes/by RI Center for FreedomOVER $220 MILLION IN WASTEFUL SPENDING detailed.

When the political class says it can’t be done … this is how to pay for tax and other reforms!

The Economic Impact of the Above-Market Deepwater Contract

/in Blog, Energy, Recent Posts/by Justin KatzPublished in Cooperation with the Beacon Hill Institute

Deepwater Impact

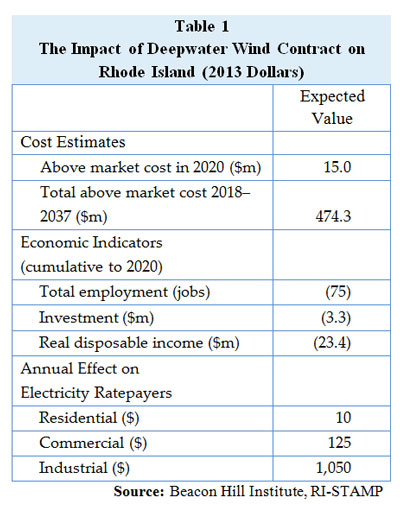

On December 13th, National Grid supplied new details about its contract with Deepwater Wind to purchase power produced by its proposed offshore wind farm. The contract calls for above-market rates, with the total cost estimated in the response along with other details.[1] Based on the underlying assumptions that the project will produce 125,000 MWh of electricity, requiring an annual capacity of 47.8%, the paper predicts a total of $474.3 million above market costs over the expected 20-year lifetime of the project.

We simulated the annual “Above Market Cost” predicted by National Grid in the Rhode Island STAMP® model as a percentage price increase on electricity to measure the dynamic effects on the state economy. The model provided estimates of the project’s impact on employment, wages, and income. Each estimate represents the change that would take place in the indicated variable against a “baseline” assumption of what it would have been in the absence of the Deepwater contract.

The agreement to pay above-market prices for the power produced by Deepwater will have negative economic effects on the state of Rhode Island. The touted job effect of a wind farm is true to a degree; some jobs will be created, such as those that maintain the turbines. But the model shows that the net effect is negative. Individuals and companies forced to pay more for electricity will consume less in other areas, leading to job losses across all sectors. There will be a net job loss of 75 jobs in 2020. Job losses and price increases, due to higher costs for commercial and industrial electricity consumers, will reduce real incomes as firms, households, and governments spend more of their budgets on electricity and less on other items.

In 2020, real disposable income will fall by an expected $23.4 million. Net investment will fall by $2.3 million, compared to a baseline of no Deepwater contract. In 2020, the “higher than market” electricity contract is expected to cost families $10 per year; commercial businesses $125 per year; and industrial businesses $1,050 per year.

Renewable Energy Standard Impact

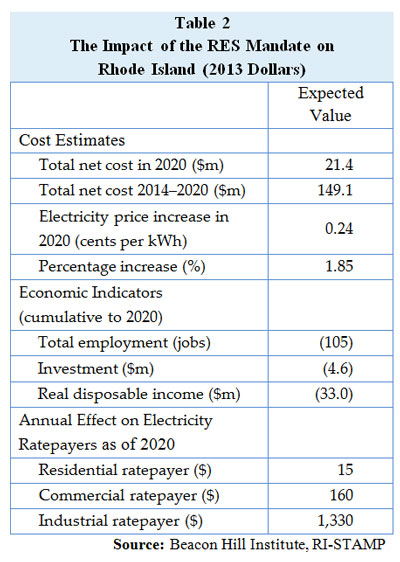

Last month, Beacon Hill and the RI Center for Freedom & Prosperity released a similar analysis of Rhode Island’s Clean Energy Act Renewable Energy Standards (RES).2 These effects would be in addition to the Deepwater contract.

Rhode Island’s renewable energy standard mandate and Deepwater Wind cost $36.4 million annually by 2020.

[1] Docket 4371: National Grid’s Responses the Division’s Second Set of Post Hearing Data Requests. Rhode Island Public Utilities Commission. Available at: www.ripuc.org/eventsactions/docket/4371-NGrid-PHDR-DPU2_12-13-13.pdf (Accessed March 26, 2014.)

UnleashRI Debate Series: Debate Panelists

/in Debate Series/by RI Center for Freedom

As part of its UnleashRI debate series, the RI Center for Freedom & Prosperity is pleased that the following policy experts and advocates have agreed to participate as debate panelists in our April 26, 2014 debate on the University of Rhode Island Campus, entitled: “What’s Really In Our Best Interests?”

Debate Segment 1: Policy and Economic Philosophy

STEPHEN MOORE recently joined The Heritage Foundation as Heritage’s chief economist. Prior to taking a position at Heritage, Moore served for nine years as the senior economics writer for the Wall Street Journal editorial page and a member of the Journal’s editorial board. He is the founder and President of the Club for Growth and served as a Senior Economist for the Joint Economic Committee. Moore worked for two presidential commissions under the Reagan Administration. He has authored 6 books and appears daily on Fox News Channel and is seen frequently on CNN and CNBC. Moore was a graduate from the University of Illinois and holds an MA in Economics from George Mason University.

STEPHEN MOORE recently joined The Heritage Foundation as Heritage’s chief economist. Prior to taking a position at Heritage, Moore served for nine years as the senior economics writer for the Wall Street Journal editorial page and a member of the Journal’s editorial board. He is the founder and President of the Club for Growth and served as a Senior Economist for the Joint Economic Committee. Moore worked for two presidential commissions under the Reagan Administration. He has authored 6 books and appears daily on Fox News Channel and is seen frequently on CNN and CNBC. Moore was a graduate from the University of Illinois and holds an MA in Economics from George Mason University.

TOM SGOUROS is a freelance public policy researcher, engineer, and writer in Rhode Island. His policy work spans a range of topics, including economics, health care, public finance, and budgeting. Over a 26-year career, he has consulted with dozens of campaigns, elected officials, and activist groups, offering legislation, testimony, and technical reports. He has had clients in many states, but still treasures most his work here and his complete set of Rhode Island state budget documents, dating back to 1990. He also works as a software engineer and statistician, and is a frequent contributor to rifuture.org. He has just completed a book about banking: “Checking the Banks: The Nuts and Bolts of Banking for People Who Want to Fix It” see checkingthebanks.com.

Debate Segment 2: Moral Aspects to Public Policy

RICH BENJAMIN is Senior Fellow with Demos, bringing an astute, original voice to politics and social issues, in the US and abroad. He is the author of Searching for Whitopia: An Improbable Journey to the Heart of White America, winner of an Editor’s Choice Award from Booklist and the American Library Association (2009).

RICH BENJAMIN is Senior Fellow with Demos, bringing an astute, original voice to politics and social issues, in the US and abroad. He is the author of Searching for Whitopia: An Improbable Journey to the Heart of White America, winner of an Editor’s Choice Award from Booklist and the American Library Association (2009).

Rich’s commentary appears regularly in the media, including on NPR, MSNBC, CSPAN,The New York Times, USA Today, and CNN.com. Rich is a contributor forTime/Time.com in partnership with CNN. He also sits on the Board of Contributors for USA Today. As an expert on politics and culture, Rich has held teaching and research positions at Stanford University, Brown University, and the Columbia University School of Law.

Rich earned a BA in English and political science from Wesleyan University and his PhD in Modern Thought and Literature from Stanford University. ?He is a member of the Authors Guild, PEN American Center, and the National Book Critics Circle. Please visit him at www.richbenjamin.com.

DON WATKINS is coauthor, with Yaron Brook, of the national best-sellerFree Market Revolution: How Ayn Rand’s Ideas Can End Big Government,and a fellow of the Ayn Rand Institute, where he studies Social Security reform, poverty and the moral foundations of capitalism.

As one of today’s most vocal champions of laissez-faire capitalism, Mr. Watkins has been interviewed on hundreds of radio and TV programs, and speaks regularly at conferences and university campuses, including Stanford, Brown, the University of Virginia, and the University of Chicago. He has briefed congressional staffers on Capitol Hill. His writings have appeared in The Guardian, USA Today, Forbes, Christian Science Monitor, Investor’s Business Daily, Daily Caller and Foxnews.com, among many others. He is coauthor of a regular column at Forbes.com, along with Yaron Brook.

Student Panelists:

One of the unique features of this debate, is that paired with each policy expert in Segment-1 will be an area college student or recent graduate to give the debate a more local and youthful flavor. Our Center would like to introduce you to:

Justin Braga: paired with Steve Moore in Segment 1, Justin is currently the Chairman of the College Republican Federation of RI and also serves as President of the Alexander Hamilton society at Brown University, where he is a student, studying political science.

Samuel Bell: paired with Tom Sgouros in Segment 1, Samuel is the RI state coordinator for Progressive Democrats of America and also serves as VP of Young Democrats of RI. He is a recent Amherst College graduate and Brown Univ. graduate student.

Rhode Island Employment Snapshot, January 2014: Dead Last

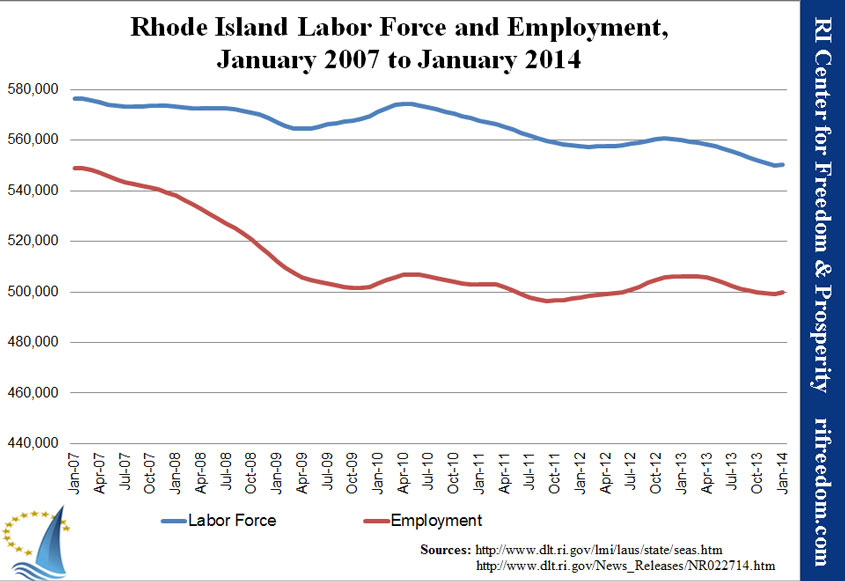

/in Blog, Jobs, Recent Posts/by Justin KatzRhode Island’s 9.2% unemployment rate is worst in the nation by a half-percentage-point margin. No other state really comes close. Worse yet, for the first time since we started tracking these numbers, the Ocean State is the farthest in the union from its pre-recession employment peak.

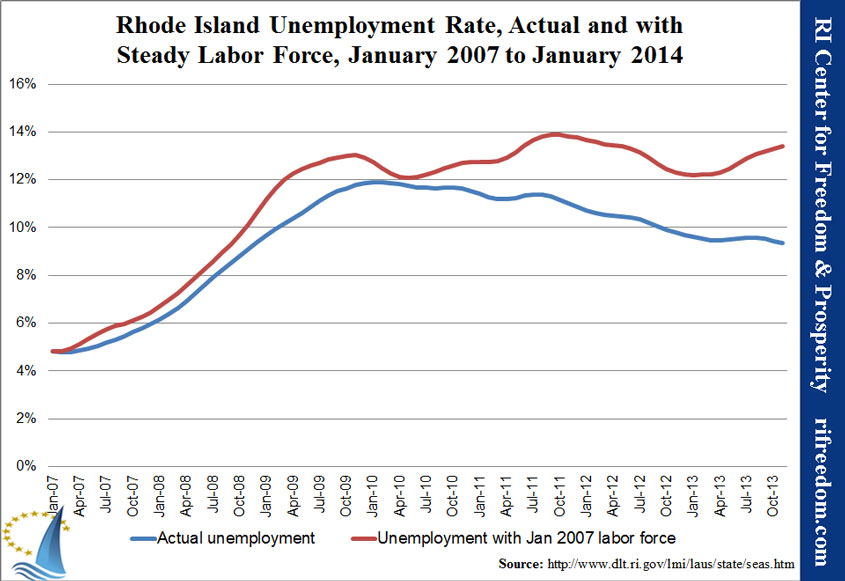

The first chart below illustrates the story pretty well. After two years of employment free-fall, Rhode Island experience a little bit of a rebound. Within six months, however, there began to be no fuel in the recovery, and the labor force responded by beginning its long trend of giving up. All reduction in the state’s unemployment rate during this period is attributable to people exiting Rhode Island’s economy as workers.

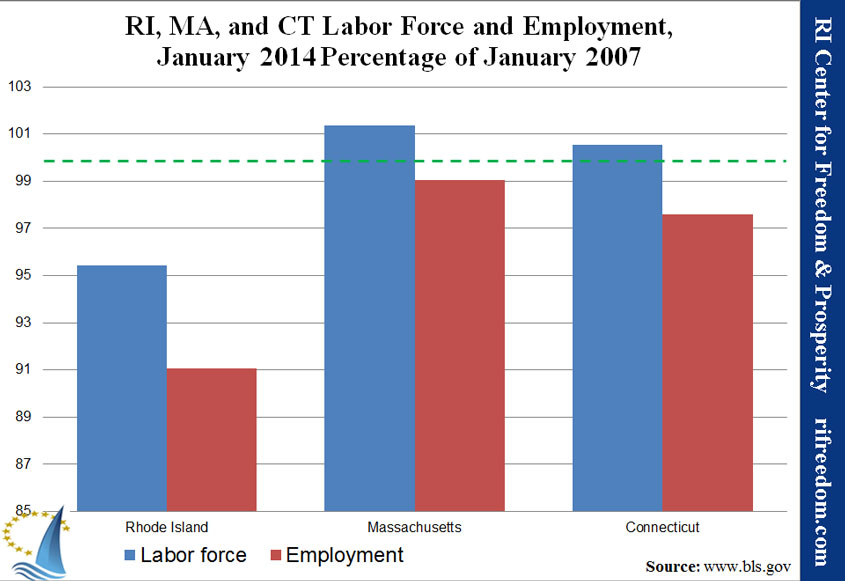

The second chart gives a view of the state’s great distance from peak employment. Both of our neighbors, Massachusetts and Connecticut have seen labor force increases since the beginning of the jobs recession, and both have maintained significantly higher employment

The third chart compares Rhode Island’s unemployment rate with what it would have been if the state’s labor force had held steady. The Bureau of Labor Statistics (BLS) has revised its numbers since the last time we published this chart, but the main differences are that unemployment never got as low as Rhode Island officials had claimed, and the growth in the gap between the two lines is steadier and more dramatic.

The chart makes clear that the Ocean State’s unemployment rate would have been much higher, over the past few years, had people not given up looking for work… almost reaching 14% in 2011. It also emphasizes the disturbing trend that the only reason the unemployment rate seems to have been stagnant, rather than increasing, throughout 2013 is that fewer Rhode Islanders are counted at all.

RI Health Benefits Exchange Costs Exceeding Even Center’s Projections

/in Blog, Health Care, Recent Posts/by Justin KatzImplementation of the Affordable Care Act (ACA) in Rhode Island, with both the health benefits exchange (called HealthSource RI) and the expansion of Medicaid to cover able-bodied low-income adults, has been a lesson in government operation. The policies were put into place — and over $100 million in federal tax dollars were spent — without significant public discussion and with no plan to cover the costs, and we’re now learning that projections of costs were wrong in several critical aspects.

The total cost to the state in fiscal year 2015 (FY15) could be as much as $100 million.

Enrollment

When the General Assembly declined to create a health benefits exchange through legislation, now-Democrat Governor Lincoln Chafee did so by executive order. In the text of that order, issued September 2011, the governor explicitly decreed that “No state general revenues shall be used for purposes of the [exchange], and no liability incurred by the [exchange] or any of its employees may be satisfied using state general revenues.”

The order mentions the possibility that funds would come from “insurers or other entities,” so it’s probable that the governor’s office expected the exchange to be self-sustaining, as a government-run start-up company.

A grant application to the federal government in March 2011, by Deb Faulkner, the state’s Exchange Project Coordinator, projects that 2014 would find 127,000 Rhode Islanders enrolled in private health plans through the exchange, with 32,000 of them paying the full cost of their coverage, with no state or federal subsidies. Another 77,000 people were expected to be enrolled through the business-focused component of the exchange, called the Small Business Health Options Program (SHOP).

Under those circumstances, the governor may have expected small transaction fees to be sufficient to cover the cost of the exchange.

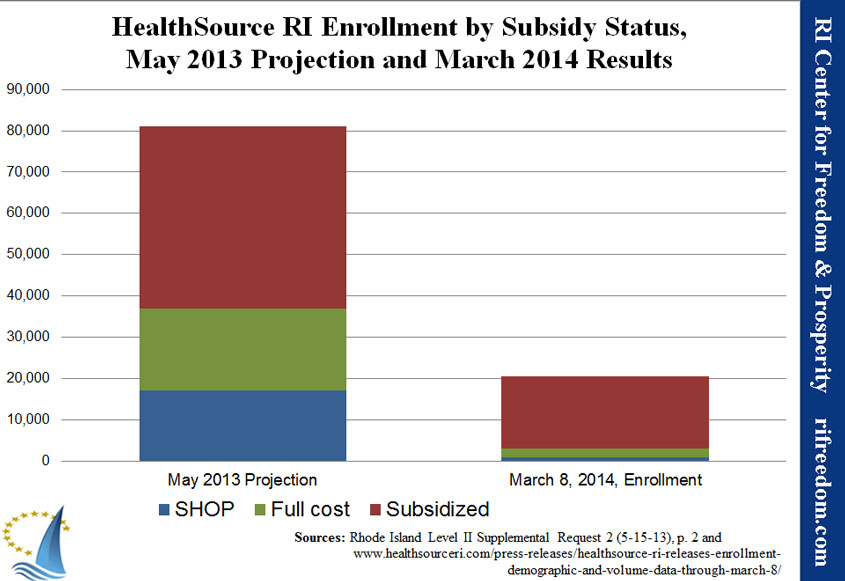

In May 2013, another grant application, this one from HealthSource RI director Christine Ferguson, cites a projection developed in cooperation with MIT economics professor Jonathan Gruber. Five months before the launch of the exchange, the state was still expecting 64,000 private enrollees, with 20,000 of them paying the full cost, plus 17,000 in SHOP.

Local news reports cite an “unofficial” memo from the U.S. Centers for Medicaid and Medicare to say that actual enrollment is “far above federal targets.” However, the results are well below the more-official expectations in the applications. As of March 8 of this year, the exchange had enrolled 19,690 people (17% of whom had not yet paid and arguably should not be included until they do), with only 2,284 paying the full cost, plus 795 in SHOP.

The following chart compares the May 2013 projections with HealthSource RI’s results thus far.

In total, the projection was almost four times higher than the results that the exchange had achieved by March 8. Looking at just the full-cost individual plans, the projections were overly optimistic almost by a factor of nine times. This leaves the exchange’s annual budget of nearly $25 million up in the air.

Medicaid

As if the failure of the exchange’s cost structure weren’t bad news enough, the results from the Medicaid portion of the ACA make matters worse.

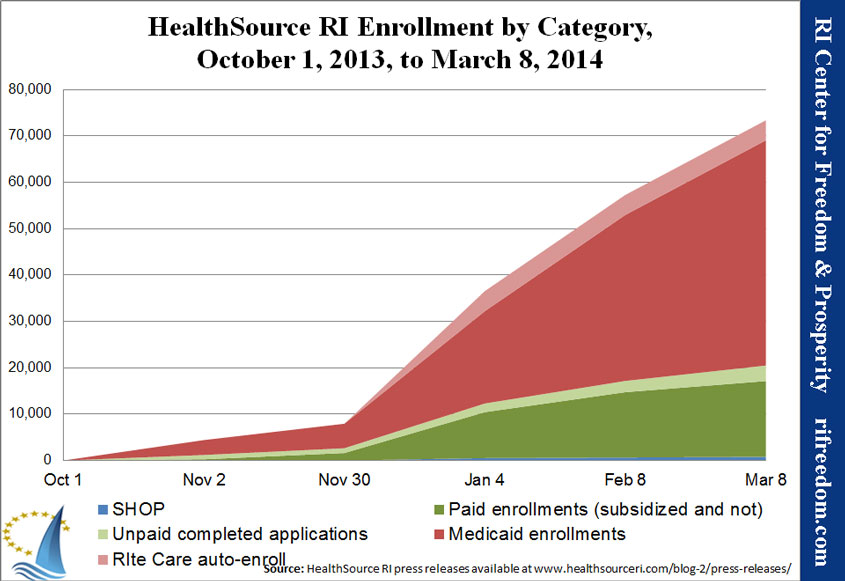

According to a report by Philip Marcelo, in today’s Providence Journal, the state had expected 51,000 people to enroll in Medicaid within the first 18 months after the introduction of the Medicaid expansion and the health benefits exchange. In actuality, six months into that period, Medicaid enrollment is already up by 48,602.

The following chart shows the trends in each category of enrollee, as HealthSource RI has reported them (roughly month to month). The dark red area represents Medicaid recipients.

After an initial surge leading up to the deadline to receive coverage starting January 1st, enrollment in paid programs has tapered off considerably, while growth in the Medicaid population has remained strong.

The number of people enrolling in paid insurance plans may experience another boost during this month, as the open-enrollment period comes to a close at the end of the month. The flip side of that possibility, however, is that there is no enrollment deadline for Medicaid, so costs may continue to balloon beyond what the RI House Fiscal staff projects.

Multiple calls and emails to various parties for clarification of House Fiscal’s findings have received no reply, as of this writing, but the circumstances may be more dire than is being reported.

According to Marcelo, the House Fiscal staff expects the cost of the Medicaid expansion — which the state government appears to have accepted as an administrative decision, with no public debate at all — to affect the state’s general fund budget for the first time in fiscal year FY17, with an expense of $14.2 million (on a total cost of the expansion of $570 million that year). That amount grows each year, as the state’s contribution phases up to 10% of the $719 million total, or $71.9 million, in 2021.

That isn’t the whole story, however.

Secretary of Health and Human Services Steven Costantino credits the state’s taxpayer-funded public awareness campaign with the high number of Medicaid enrollees. As individuals visit the HealthSource RI Web site, the system tells them whether or not they are eligible for Medicaid. Many of them would have been eligible without the expansion.

According to a HealthSource spokesperson, 33.3% of all Medicaid enrollments through the exchange as of February 8 (or 11,916) would already have been eligible for the public welfare program without the expansion. The federal government only picks up 50-55% of the cost for these Medicaid recipients.

It isn’t clear how (or whether) these enrollees factored into the House Fiscal staff’s analysis, but their cost in FY15 — the budget under consideration right now — could be around $74 million.

In a press conference announcing the Medicaid expansion on the day the Supreme Court ruled the ACA constitutional, in 2012, Costantino estimated that the expansion would only apply to 6,000 to 7,000 people. Even less optimistic estimates made by the RI Center for Freedom & Prosperity at the time put the total cost of the ACA much lower than now appears probable.

As Costantino acknowledges, although insisting it’s an outcome of which to be “proud,” as the state engages in an aggressive campaign to bring in new paying customer’s, it’s not attracting them, but rather new recipients of government handouts.

The people of Rhode Island were never given a chance to fully debate, much less vote on, these changes to government policy. Even now the layers of government spin and incomplete reportage leave them — even their elected representatives — with little understanding of how significant the costs are going to be, especially in comparison with the program they were sold.

Featured image: Stephen Costantino, Lt. Gov. Elizabeth Roberts, and Christine Ferguson at the June 28, 2012, press conference concerning the exchange and the Medicaid expansion.