By Mike Stenhouse, CEO

The 2015 state budget is now public. Corporate tax and estate tax cuts are in. Help for the middle class is out. In fact, the average worker is being asked to pay for reforms that benefit more well-off constituencies. Why? It’s not just a matter of fairness; it’s a question of economic stability.

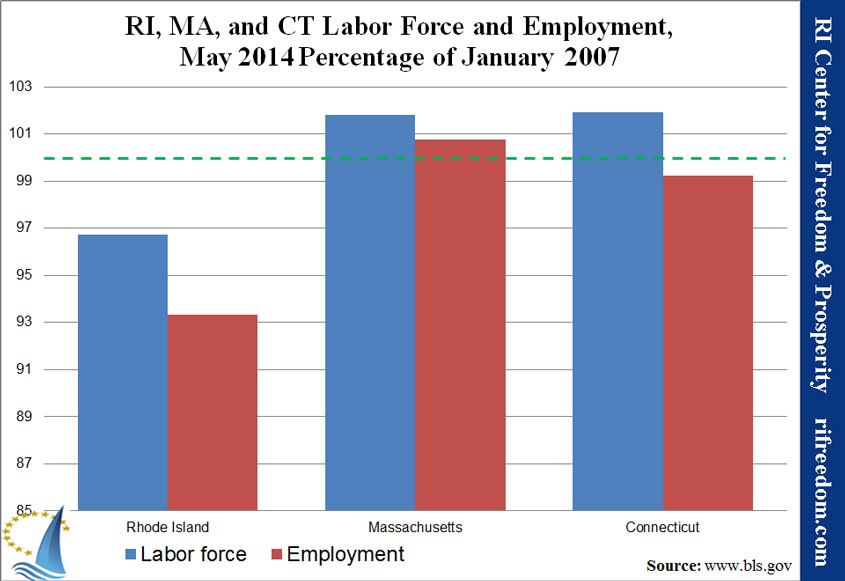

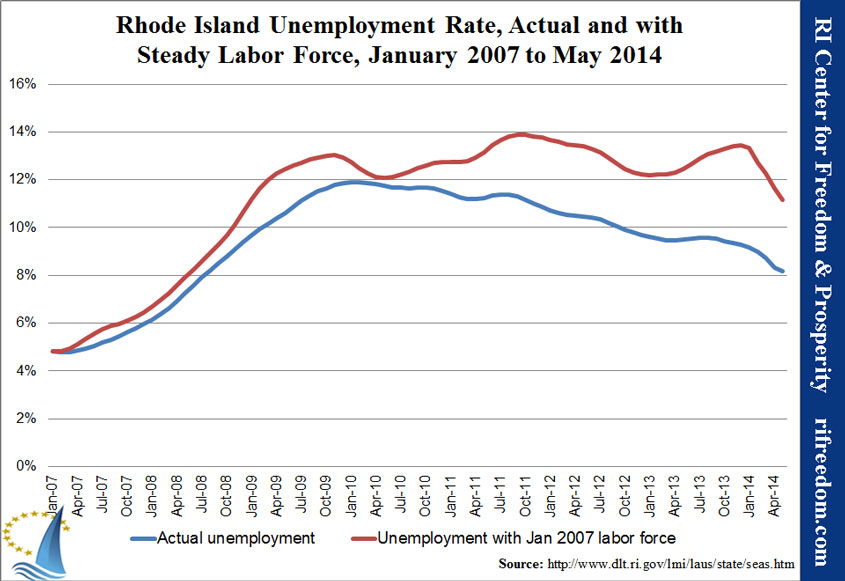

Rhode Island’s poor economic performance and dismal jobs outlook can largely be attributed to high levels of taxation and regulation across all points of Rhode Island’s economic lifestyle.

An analogy can be made between a prosperous state economy and a three-legged stool, where each leg plays an equally important role in keeping balance and maintaining strength, as part of the normal economic cycle through which most individuals progress:

- First leg – workers – where individuals produce the products and services essential for a growth economy; where valuable professional experience can gained; and where individual wealth can accumulated and spent in the local economy;

- Second leg – business sector – corporations and entrepreneurs who, as managers or small business owners, guide the free-market to generate profits that further fuel the overall economy; and where, simultaneously, further personal wealth and experience can be accrued and spent;

- Third leg – investors – where wealth is put at risk via equity investment back into the business sector, further boosting the economy and creating jobs, and which provides additional opportunity to grow individual wealth; where philanthropy funds local charities; where wealth is spent on a large scale, often in retirement, and, finally; where wealth is passed down to family heirs in the hope of maintaining ongoing investment and philanthropy in the state.

All three economic roles, or legs of the stool, are equally important and are inter-dependent on each other. The free-enterprise system allows individuals move from role one to another as they choose, as they acquire capacity, or as other circumstances dictate.

A balanced, growth economy must have strength in each of its three legs: a partnership of sorts. If any one leg is out of balance or weak, likewise, the other legs – and the overall economy – will also suffer. It is this tri-lateral partnership that creates a vibrant free-market economy and a stable tax “base”, strong enough to support public assistance programs and foundational services such as education and infrastructure.

However, in recent decades in Rhode Island, excessive government interference has systematically weakened all three legs of our economic stool, limiting the capacity of individuals to move from one role to another; and at all three roles, driving many out of our state.

With high sales and property taxes in a high cost of living state, and with limited opportunity for upward mobility because of a weak jobs market, Rhode Island is a barely affordable home for many workers in low and middle income families, who have little chance of saving money and accumulating initial wealth. Yet no relief is planned in 2015 for the average worker.

With the highest corporate tax in New England and one of the worst business environments among all states, along with a dwindling consumer base, it has become very difficult for businesses and entrepreneurs to prosper in the Ocean state. Limited corporate tax relief is designated in the 2015 budget for the business sector.

For wealth that is accumulated despite these roadblocks, our state has further imposed a dis-incentive for many families to keep that wealth in Rhode Island, by charging one of the nation’s most punitive estate, or death, taxes … tending to drive high-income individuals out of our state. Some relief is also planned for wealthy investors in 2015.

Yet, while it is a positive sign that some reform is planned to fortify the two roles that generally involve higher income individuals, why are we ignoring relief for the middle class? To make matters even worse, the new gas taxes and fees on real estate transactions, vehicle inspections, and traffic court appearances, along with the new the ‘use tax’ on income, will be a direct hit on middle and low income families.

This puts the proposed 2015 budget completely out of balance.

There is, however, a policy idea on the table that would restore that balance by aiding those with lower incomes. Our Center’s sales tax reform idea, that cuts the rate to 3%, can also fortify the worker leg, leading to more family savings and creating thousands of vital, new job opportunities. If we also implement a major sales tax cut, strengthening this leg as well, this would spur consumer demand, increasing corporate profits and wealth creation in the other two legs. This is a balanced, win-win solution. Instead, Rhode Islanders are yet again looking at an unbalanced, win-lose approach.

Rhode Islanders want a government that works for everyone, not just for the well-off. We can do this by cutting corporate, estate, AND sales taxes.

The former rock star, Meatloaf, may have crooned that “two-out-of-three ain’t bad”. But when it comes to fortifying all three economic roles that are equally essential in turning around a struggling state like Rhode Island … two-out-of-three ain’t good enough!

Mike Stenhouse holds an economics degree from Harvard University.