Open-Eyed Medicaid Reform: Review of Working Group Proposals

Click here for a printable PDF of this analysis.

Josh Archambault with Buddy on Medicaid

As part of her 2016 budget proposal, Rhode Island Governor Gina Raimondo convened a Working Group to Reinvent Medicaid. Although its theme is reform of the way the public healthcare program operates, the selling point has been budgetary savings — specifically in the next fiscal year, when the group expects its suggestions to save or raise $91.1 million, just shy of 10% of state spending.

While there can be no doubt that Rhode Island’s Medicaid system is in need of reform, analysis of the proposals suggests that policymakers should be reluctant to hinge their budget decisions on the savings’ actually being realized. They should also go into the reforms with eyes wide open. Substantial portions are likely to shift costs to their constituents as healthcare consumers and federal taxpayers.

The group divides its proposals into three categories:

- Payment and delivery system reform

- Targeting waste, fraud, and abuse

- Administrative and operational efficiency

Although waste, fraud, and abuse is often a go-to source when government officials promise to pay for new spending without raising taxes, it makes up a very small portion of the working group’s list, at $4.0 million (4% of the expected savings). About two-thirds of the savings come via payment and delivery system reform, with the remainder in administrative and operational efficiency.

These categories are of limited use in understanding how the state is actually supposed to save money. Working with health policy expert Josh Archambault, of the Foundation for Government Accountability, the RI Center for Freedom & Prosperity sorted the proposals into five new categories that are more descriptive of the likely effects of the policies:

- Shifting costs to private insurance and employers

- Shifting costs to federal taxpayers

- Potentially saving or costing money, depending how the market reacts

- Cutting payments, with uncertain effects

- Implementing good (if limited) ideas

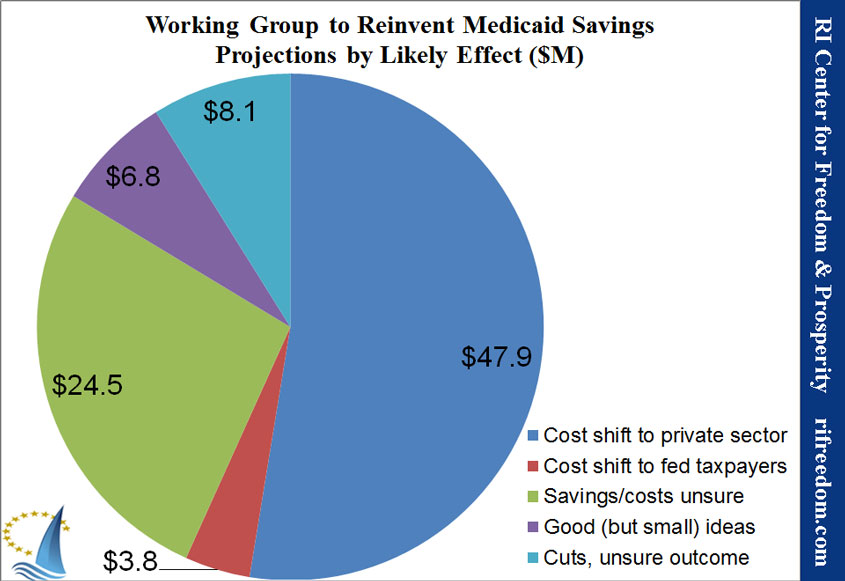

More than half of the savings (53%) will likely shift costs to the private sector, with another 4% shifting to the federal government. Despite the working group’s projections, 27% of the reforms should be considered speculative and might even cost the state money. Another 8% are simply cuts that may have adverse outcomes or fiscal effects. That leaves just 7% of reforms that we would count as plainly good ideas.

The largest example of cost-shifting to the private sector ($15.7 million) is a 5% reduction in hospital payment rates, which hospitals will seek to transfer to others. The policy would give hospitals an opportunity to receive bonuses, but to the extent that they do so, the “savings” will be consumed. The largest proposal to transfer costs to federal taxpayers, at $1.5 million, would “streamlin[e] the application process” to ensure that beneficiaries are counted in the way that will bring the most federal dollars for their care.

With respect to unknowable outcomes, the largest projected savings ($3.3 million each) come from proposals to change the methods and locations of treatment for people who are seriously mentally ill or have complicated cases. Such proposals may or may not save money, and if the providers losing revenue find ways to bring their customer bases back up, the costs could actually increase. The largest outright cut is $6.1 million in increased risk and other agreements the state would force on providers. Meanwhile, the most significant good, if limited, idea is $2.6 million in projected savings from new methods of tracking waste, fraud, and abuse.

In short, the working group’s proposals are a mixed bag. In some cases, it may in fact be more appropriate for costs to be borne by insurance customers and the federal government, and some reforms might be worthwhile despite uncertain outcomes. Hopes for short-term savings, however, should not become an excuse for jumping into reforms, and costs shifted off of the state’s books should not be an excuse for increasing or maintaining other government spending.

Leave a Reply

Want to join the discussion?Feel free to contribute!