STATEMENT on FY15 BUDGET: Middle Class to Pay for Corporate & Estate Tax Reforms

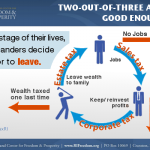

“While the modest corporate and estate tax reforms will be helpful over the long term for those constituencies, we then simultaneously turn-around and add to the plight of the average guy, asking them to pay for those reforms by imposing new vehicle fees and gas and use taxes,” said Mike Stenhouse, CEO for the Center. “Nor does this budget have any bold jobs creation plan. If we also cut the sales tax, we can put money back in the pocket of every Rhode Island family and business, and create thousands of new jobs right away.”

The proposed new gas taxes and fees on vehicle inspections and on good-drivers seeking to clear their traffic records, along with the $2+ million in new sales taxes, will be a direct hit on middle and low income families. The deceptively named “Safe Harbor” for the use tax would impose a new default of 0.08% of adjusted gross income tax on residents’ assumed purchases outside of the state.

The Center does note it as a positive step that the proposed budget did make some cuts that were recommended in its April Spotlight on $pending report, namely: suspension of the historic tax credit program and holding the line on state personnel costs.

The $48 million to pay for a reduction in the sales tax to 3%, that would produce about 13,000 jobs, can be made by eliminating the $12 million payment of the 38 Studio bond, by eliminating the $15 million to the HealthSourceRI UHIP project, by eliminating $11 million in General Assembly legislative and community service grants, and by cutting $19 million in excessive overtime payments, all were recommended cuts in the Center’s spending report.

OTHER NEW TAXES & FEES:

* Article 12 of the budget increases the real estate conveyance tax that a seller of a home or other real estate must pay at the time of transfer. The current tax is $4.00 per $1000 of the sale price; the FY2015 budget would increase this tax by 15% and would become $4.60 per $1000 in Rhode Island, higher than Massachusetts tax of $4.56 per $1,000.

Leave a Reply

Want to join the discussion?Feel free to contribute!