Loss of US Congressional Seat Underscores Need for Reform “Freedom Agenda”

The Rhode Island Center for Freedom & Prosperity, in seeking to advance a more prosperous society, finds it unacceptable that our Ocean State ranks so poorly in so many critical national indexes. A pro-family, pro-business agenda that advances cultural and an economic well-being, both from a both public policy and civil society advocacy perspective, is the goal. Rhode Island must adopt stronger policy positions on the issues that relate to our families well-being.

The state of the State of Rhode Island is not competitive. Even as the rising national economic tide has lifted ships in all states, when compared with the rest of the nation, our Ocean State is severely lagging, and is in danger of sinking further behind if progressive policies continue to be implemented.

Perhaps no indicator more appropriately demonstrates the failure of the leftist status quo, than does the near-certainty that Rhode Island will lose one of its precious House seats in the U.S. Congress after the 2020 census. The persistent jokes of family and friends “moving out of state” have now tragically manifested themselves into the harsh reality that our state is not competitive enough to see population growth on par with the rest of the country.

With a bottom-5 rankings on three important measures – overall business climate, Jobs & Opportunity Index, and (best/worst) states to retire in – it is no wonder that Rhode Island is an unattractive destination of choice for many Americans.

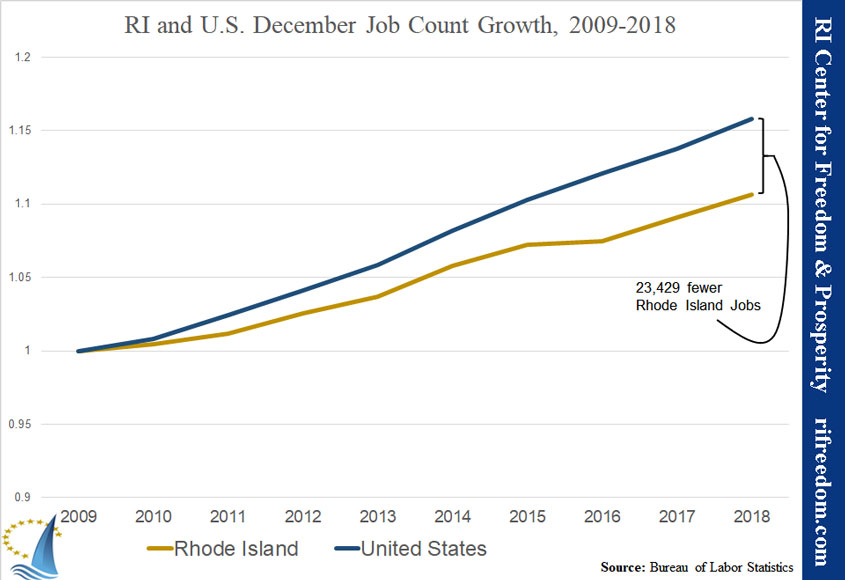

Despite false claims by political leaders, when compared with the nation as a whole, our Ocean State has would have gained 23,429 more jobs if our excessively liberal policies had not caused a significant lag behind the average national rate of recovery from the 2008 recession.

The top economist at JP Morgan Chase, when visiting Rhode Island, stressed that economic growth is the best solution to alleviate budget pressures.

However, the Governor’s proposed budget is an anti-growth agenda that would further deteriorate our state’s dismal business climate; further infringe on individual and constitutional rights; and hasten erosion of our society’s moral compass – and would do nothing to improve educational outcomes. Even the Wall Street Journal said that the Governor’s budget is “now driving off businesses like Democrats in Connecticut and Illinois.”

Combined with a General Assembly that is torn between advancing progressive-left political agendas and catering to special interest cronies … rather than advancing prosperity and freedom for its residents … our state government is seizing more and more control over our lives, and leaving us with fewer freedoms and less opportunity for upward mobility.

In order for Rhode Island to become a more welcoming place to raise a family and build a career, the RI Center for Freedom & Prosperitytoday puts forth its 2019 legislative priorities.

Center’s “Freedom Agenda” policy objectives for 2019: RI should emulate successful federal policies by cutting taxes and regulations and opposing policies that would place further tax, fee, or regulatory burdens on businesses and families.

Advance Pro-business, pro-taxpayer policies; many of which, the Center has researched and written extensively about (click on a link for expanded text):

• Statutory Sales Tax reduction.

• Statutory Sales Tax reduction.

Recent expansions of RI’s sales tax to include internet transactions, as well as a host of other services and products never-before taxed, should trigger an existing state statute that calls for a reduction in the sales tax rate to 6.5% from its current 7.0% level when the state starts collecting internet sales taxes.

show less

• Estate Tax Reform – repeal this anti-jobs “death tax”, or significantly increase the threshold so as to keep wealthy investors from fleeing our Ocean State. H5310 and H5312 have already been submitted.

• Estate Tax Reform – repeal this anti-jobs “death tax”, or significantly increase the threshold so as to keep wealthy investors from fleeing our Ocean State. H5310 and H5312 have already been submitted.

The Ocean State should be the ideal location to raise a family, run a business, and build an estate that endures for generations. Our state benefits when wealthy people live within our borders, expanding our tax base, paying more taxes, increasing potential investment in businesses, and making greater contributions to local charities.

show less

• Asset Forfeiture Reform – preserves civil liberties and property rights against unjust governmental seizures, will protecting the State against constitutional legal challenges. House and Senate (S0229) bills already submitted.

• Asset Forfeiture Reform – preserves civil liberties and property rights against unjust governmental seizures, will protecting the State against constitutional legal challenges. House and Senate (S0229) bills already submitted.

Civil forfeiture laws represent one of the most serious assaults on cars, cash, and other private property by government today. According to the Institute for Justice, which produces a state-by-state report card, the Ocean State received a D- for its asset forfeiture laws.

show less

• Occupational & Regulatory Reforms:

• Occupational & Regulatory Reforms:

-Comprehensive regulatory “sunrise” provision – to ensure proposed new regulations or licensing requirements must first include a statement of need and a cost-benefit analysis. Oppressive licensing mandates (RI ranks in the bottom-10, nationally) has an especially harmful impact on jobs for low-income workers.

-Waiver or lower licensing fees for low-income workers – removes one potential barrier to work for the most needy families in our state.

show less

• Statutory Sales Tax reduction

• Statutory Sales Tax reduction

Recent expansions of the sales tax to include internet transactions, as well as a host of other services and products never-before taxed, should trigger an actual statute that calls for a reduction in the sales tax rate 6.5% if the sales tax were expanded to include Internet sales.

show less

• Repeal ban of Short Term Limited Duration health insurance policies.

• Repeal ban of Short Term Limited Duration health insurance policies.

Take advantage of recent federal rules changes to give ‘people in transition’ more options at significantly lower price points, up to 70% lower. One of the reasons that at least three million people have dropped out of the individual health insurance market is because they cannot afford the fully-mandated plans and are relieved to have other options.

show less

• Repeal renewable energy mandates.

• Repeal renewable energy mandates.

In order to reduce energy costs on RI families and businesses, unrealistic and ineffective green energy mandates should be repealed. Don’t blame National Grid – your high electricity rates are mandated by progressive-left green energy policies!

show less

Defeat the progressive-left’s agenda and oppressive provisions in the Governor’s budget (click on a link for expanded text):

• Carbon Tax – RI already suffers from the highest utility costs in continental US and cannot absorb another costly tax. Compliance with existing mandates will cost thousands of jobs in the private sector.

• Carbon Tax – RI already suffers from the highest utility costs in continental US and cannot absorb another costly tax. Compliance with existing mandates will cost thousands of jobs in the private sector.

Already paying some of the highest energy and gasoline rates in the country, Rhode Island families and businesses could see an increase of up to 15 cents per gallon if proposed legislation passes, according to Americans for Tax Reform. The Center opposes this progressive-government interference in the market. These increases will drive up energy rates for every Rhode Island family and business, and are one of the major reason’s why Ocean Staters suffer from the 50th ranked business climate and the 47th rank on the Jobs & Opportunity Index. Whether via carbon taxes, green energy mandates, or restrictions on cheaper fossil-fuel based energy production, higher energy costs are a major drag on economic growth.

show less

• Single payer healthcare - $6 billion cost paid in part by new 10% payroll tax, would leave Rhode Islanders with little or no choice in selecting the best plan for their families. Legislation promised for 2019.

• Single payer healthcare – $6 billion cost paid in part by new 10% payroll tax, would leave Rhode Islanders with little or no choice in selecting the best plan for their families. Legislation promised for 2019.

Supporters of the bill make the ‘fake’ claim that healthcare is “a fundamental human right.” Nothing can be a right if somebody else is forced to pay for it or provide it. Conversely, ‘real’ rights are based on liberty, not coercion, and do not infringe on anyone else’s rights.

Until US Congressional Republicans, however, submit a viable alternative plan, the socialist Medicare-for-All idea, and its state-based single-payer offspring will appear attractive to voters.

show less

• Governor’s proposed Corporate Medicaid tax – a failed policy in Mass that will cause similar hardship for RI businesses, the private sector should not be burdened with paying for government’s Medicaid boondoggle.

• Governor’s proposed Corporate Medicaid tax – a failed policy in Mass that will cause similar hardship for RI businesses, the private sector should not be burdened with paying for government’s Medicaid boondoggle.

Progressives in the Raimondo Administration are once again seeking to punish employers for not operating their private businesses the way this government wants them to. Governor Raimondo’s proposed “Medicaid Employer Assessment” is a new tax designed to force private sector businesses to pay for the state’s costly decision to expand Medicaid earlier this decade.

show less

• Unrestricted abortions – stop the cultural rot in our state and maintain common-sense restrictions. Rhode Islanders overwhelmingly oppose unrestricted abortions (see post with video).

• Unrestricted abortions – stop the cultural rot in our state and maintain common-sense restrictions. Rhode Islanders overwhelmingly oppose unrestricted abortions (see post with video).

In its current form, House bill H5127 could readily be interpreted to prohibit the State of Rhode Island from exercising reasonable oversight over abortion practices. The Center argues this radical approach does not represent the mainstream thinking of Rhode Islanders. The Center maintains that the public generally opposes gruesome “partial birth” and other late-term abortions; opposes state taxpayer funding of abortions to Planned Parenthood and other abortion providers; and opposes women in vulnerable circumstances from submitting to an abortion without informed consent … all of which could become rampant in Rhode Island if the proposed legislation were to become law. Further, we also call for a retraction of attacks against the Catholic Church and for a respectful public debate.

show less

• Pay Equity - unnecessary legislation as there is no documented problem, further ample legal protections already exist.

• Pay Equity – unnecessary legislation as there is no documented problem, further ample legal protections already exist.

Progressive-extremists are once again advancing a false narrative: This time suggesting that Rhode Island employers are discriminatory and bigoted in their compensatory practices. Businesses are at the tipping point – and jobs are at stake – if our state imposes more burdens and legal peril on the private sector. This progressive vision of equal outcomes for everyone could actually backfire.

show less

• Un-”Fair Housing” mandates (H5137) – backdoor RhodeMap-RI scheme would burden landlords; legal protections already exist against housing discrimination.

• Un-”Fair Housing” mandates (H5137) – backdoor RhodeMap-RI scheme would burden landlords; legal protections already exist against housing discrimination.

The deceptively named the Fair Housing Practices bill, which mirrors leftist-inspired legislation introduced in other states, is completely unfair to landlords. The legislation claims it seeks to end discriminatory housing practices because in the progressives’ land of social-equity, making a legitimate business decision should be a crime. Under the proposed law, any Section-8 lessee applicant (those whose rents are subsidized by the federal government) who are not accepted as a tenant, must have been discriminated against, and the landlord must be punished.

show less

• Minimum Wage Hike – there are many myths about this anti-jobs policy. We recommend an increase to the Earned Income Tax Credit (EITC) instead, so as to not place further burdens on employers. It is a false assumption that a hike is required to “compete” with Massachusetts.

• Minimum Wage Hike – there are many myths about this anti-jobs policy. We recommend an increase to the Earned Income Tax Credit (EITC) instead, so as to not place further burdens on employers. It is a false assumption that a hike is required to “compete” with Massachusetts.

The Center believes that every Rhode Islander who strives to work hard should be able to earn enough income to support themselves and their families. However, decreasing our state’s overall business competitiveness and risking loss of jobs via minimum wage mandates is not the right approach. There are many myths about who minimum wage earners are, and there may be ulterior motives by unions that the Center has discussed in its prior research. In fact, a minimum wage hike will likely harm many of the same low-income or minority primary family breadwinners it is intended to help, as most of the raises would go to white, middle-income secondary earners. Also, certain union wages for middle- and high-income rank and file may be pegged to the minimum wage. The Center recommends increases to the Earned Income Tax Credit (EITC) as a superior alternative to aid working families, and avoids all above risks.

show less

• More 2nd Amendment restrictions, sales taxes on membership clubs – restricting the rights of law-abiding citizens, or implementing a back-door scheme to identify legal firearms owners, will not reduce crime.

• More 2nd Amendment restrictions, sales taxes on membership clubs – restricting the rights of law-abiding citizens, or implementing a back-door scheme to identify legal firearms owners, will not reduce crime.

As the Center wrote after the State of the State address, the assault on individual and 2A constitutional rights under this administration is worse than expected. This “crystal ball” approach of justifying government infringement because something “might” happen must end!

show less

• Slowdown to car tax phase-out – the one significant policy for tax relief must not be slowed down.

• Slowdown to car tax phase-out – the one significant policy for tax relief must not be slowed down.

As taxpayers continue to be asked to fund generous corporate subsidy programs, lawmakers are now dueling over two new spending ideas – reimbursing localities to phase-out the car tax and public funding for free college tuition – each of which would likely further raise taxes and fees on Rhode Islanders. A more innovative and bold policy concept of cutting the state sales tax to 3.0% to help families become more self-sufficient is being called for by the Center. A 3.0% sales tax reform would help working Rhode Islanders and businesses much more than other proposals by having more money directly in the pockets of Rhode Island families.

show less