Teen Employment Sinking in the Ocean State

Quick links: to download the printable PDF of this study click here. See Media Release at end.

Related stories: Research Director Justin Katz discusses the issue on the Dan Yorke Show.

Abstract

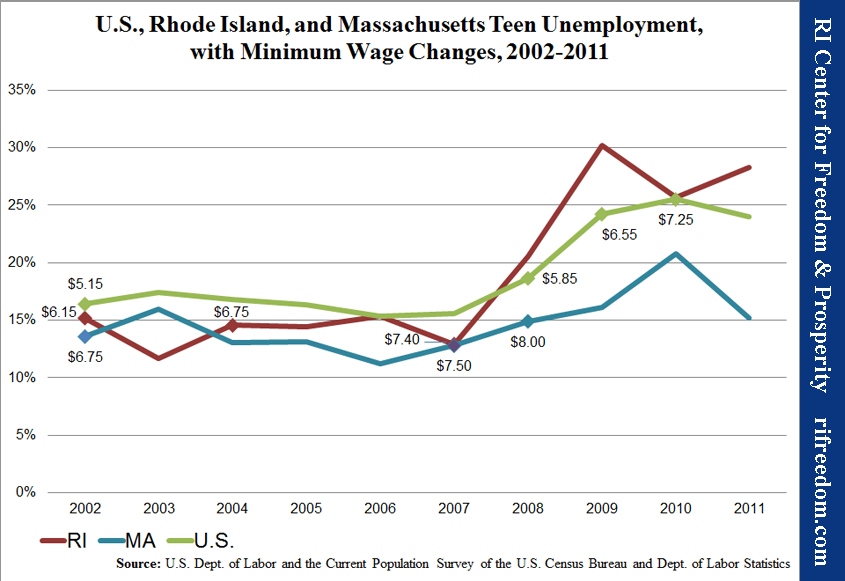

Gainful employment is disappearing from the experience of the American teenager (ages 16 to 19), and increasing minimum wages are part of the problem. In Rhode Island, teen unemployment was 28.3% in 2011, more than double its 2007 low of 12.9%, and hours worked per week had fallen from 10.0 to 6.1.

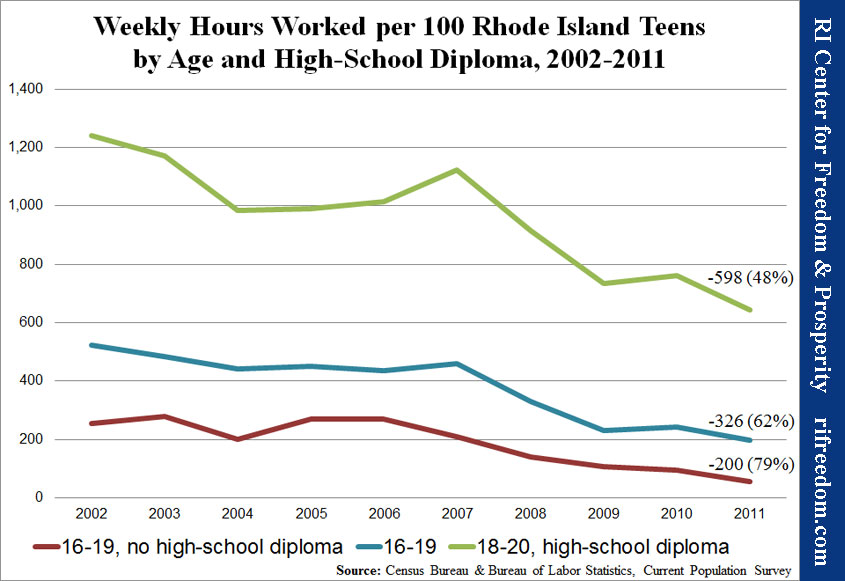

Rhode Island’s minimum wage climb from $6.75 in 2004 to $7.75 for 2013 will have cost 597 teenage jobs. As teenagers’ employment has fallen and their average hours worked per week have decreased, the weekly working hours per 100 teens in the population has dropped 62% — and 79% for those without high school diplomas. Because 70% of working teens are in the retail or leisure/hospitality industries, a bold policy change such as eliminating the state sales tax would be especially beneficial to them.

Getting Teenagers Accustomed to Working

Chores and a lemonade stand become a newspaper route and a summer job in retail, then a professional trade following high school graduation. If college is in the picture, retail transitions to on-campus service work followed by some sort of internship, which lands the young adult at the entrance of a career path, degree in hand. Such is the classic progression of young Americans’ easing into the workforce, with the adventurous and innovative breaking off to build their own companies or invent new industries.

The United States’ extended jobs recession appears to have accelerated a disruption of this pattern. The change has been acutely felt in states that have trailed the nation’s meager recovery, such as Rhode Island. From 2003 to 2011, teenagers’ share of employment in all Ocean State industries fell from 5.7% to 4.3%, despite the fact that their overall percentage of the population held steady.

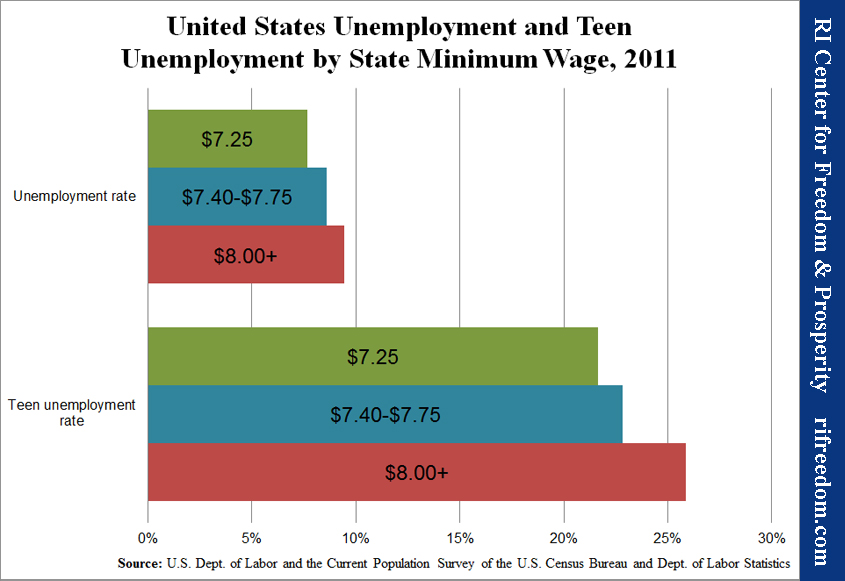

In 2011, states with minimum wages that exceeded the federal rate tended to have higher unemployment. High minimum wages disproportionately harm teenagers’ employment prospects. So, not only are young adults in such states operating in dampened economies, but the jobs that they would typically seek are even harder to come by.

Policy Recommendation

With Rhode Island in desperate need of an economic turnaround, and because dedicated and well-rounded young adults will be critical toward that end, the state must reverse the working plight of its teenagers. The RI Center for Freedom & Prosperity recommends that the General Assembly and Governor Chafee:

- Set Rhode Island’s minimum wage at the federal rate of $7.25.

- Consider a bold economic policy, such as eliminating the state sales tax, that would jolt the overall economy forward with especially beneficial effects for the teenage population.

Minimum Wage & Teen Employment

The effect of minimum wages on unemployment rates is a contentious issue among economists. Until the 1990s, they broadly understood increased minimum wages to harm employment. Since then, various studies have muddied the waters.

Given the myriad variables involved in a modern economy, small-scale policy changes can disappear in the data, and incremental minimum wage hikes may not register. Consensus is still strong, however, that low-skill, low-pay groups like teens are adversely affected by such increases.

Of the 24 states with unemployment over 8.0% for 2011, 11 had set their minimum wages above the federal $7.25 per hour. Of the 26 states with 8.0% unemployment or lower, only six had elevated minimums. The average unemployment rate for former was 9.0%, compared with 7.7% for those in which the federal rate applied.

That gap doubles for teenagers (16-19 years old). In states where the $7.25 minimum applied, teens’ unemployment rate was 21.7%. In the elevated-rate states, it was 24.3%. Chart 1 illustrates the point, narrowing the focus to the eight states with minimum wages over $8.00 per hour.

Rhode Island

In 2011, the Ocean State’s teen unemployment was 28.3%, the worst in New England, and more than double its 2007 low of 12.9%. Meanwhile, the weekly hours of the average employed RI teen dropped from 10.0 to 6.1.

Putting Rhode Island in context requires an acknowledgment that it simultaneously has the most-sickly economy in New England and the second lowest minimum wage, in 2011. The $7.40 per hour the state mandated for the lowest-paid employees within its borders was higher than only New Hampshire’s rate, regionally. Increasing the rate to $7.75 this past legislative session pushed the Ocean State past Maine, as well.

At first glance, these comparisons would seem to contradict the notion that high minimum wages are associated with higher unemployment. As suggested above, however, minimum wage is a secondary factor and is not sufficient to save a state economy that is already failing.

In an update for the RI Center for Freedom & Prosperity of their 2010 study, “The Teen Unemployment Crisis,” economists David Macpherson (Trinity University) and William Even (Miami University) found that Rhode Island’s increase from $6.75 in 2005 to $7.40 cost the state’s teens 397 jobs in 2011. Of that total, 306 were lost to those without high school diplomas. As the Center reported in June, Macpherson and Even estimate that the additional hike, to $7.75 per hour, will cost Rhode Island’s teenagers another 200 job opportunities.

In total, that $1 raise will have cost about 2.7% of employed teens valuable work experience, increasing to about a 7.1% loss among those without high school diplomas.

Table 1 shows the dramatic drop in teen employment from 2002 to 2011. For perspective, the 2010 Census found 66,423 Rhode Islanders 16-19 years old — about 32,663 without high school diplomas.

| Table 1 | |||

| RI Teen Employment Trends by Age and High School Diploma | |||

| 16-19, no diploma | 16-19 | 18-20, diploma | |

| Employment | |||

| 2002 (%) | 38 | 49 | 64.3 |

| 2011 (%) | 19 | 32.4 | 49.2 |

| Change (%) | -50 | -33.9 | -23.5 |

| Ave. hours/week | |||

| 2002 | 6.7 | 10.7 | 19.3 |

| 2011 | 2.8 | 6.1 | 13.1 |

| Change (%) | -57.6 | -43.1 | -32.3 |

| Hours/100 teens | |||

| 2002 | 254.4 | 522.2 | 1,240.20 |

| 2011 | 54 | 196.5 | 642.2 |

| Change (%) | -78.8 | -62.4 | -48.2 |

| Note:“Change” percentages may differ due to rounding.Source: Census Bureau & Bureau of Labor Statistics, Current Population Surve | |||

Not only are fewer teens working, but those who have jobs are spending less time on them. The weekly hours worked per 100 teens in the total population captures the combined effects of these trends. Employment is evaporating from teens’ experience in Rhode Island.

Massachusetts shows that a high minimum wage doesn’t always correspond with high teen unemployment (see Chart 2). But if Rhode Island insists on imposing a high rate, it must take even more dramatic steps to improve its economy to counter-balance the downward pressure on employment.

One Solution: Eliminate Sales Tax

In early June, the RI Center for Freedom & Prosperity proposed its Zero.Zero plan to eliminate the state sales tax in Rhode Island. Such a policy would be especially beneficial for teens.

The Center found that immediate elimination of Rhode Island’s sales tax would create 23,873 jobs. The data did not differentiate between industries or the demographic qualities of the newly hired workers, but it would be reasonable to predict that teenagers and other low-wage workers would benefit disproportionately and more immediately.

By far, Rhode Island teenagers are more active in the very industries that most feel the effects of the sales tax: retail and leisure and hospitality. Of teens who were working in 2011, 23.5% were in the retail industry, where they accounted for 8.8% of the workforce. Another 46.4% worked in the leisure and hospitality industry, accounting for 17.8% of all employees.

Altogether, 69.9% of working teens were in these two industries. Clearly, the healthier retail and leisure market in a zero percent sales tax environment would benefit the lowest-paid workers first, including Rhode Island’s young adults.

Conclusion

As with all of the challenges that it faces, Rhode Island has a choice between paths: the one we’ve been following and one that shifts decision-making back toward individuals working together in a less-regulated private economy. The first shifts resources under the control of government planners, and the second would allow Rhode Islanders to keep their money and make decisions in accordance with their own interests.

For all of the emphasis that the state has been placing on developing a “knowledge economy,” it has paid precious little attention to the need to foster work ethic and experience in its youth. Meanwhile, lavish public-school funding and special deals toward government-approved economic development have been requiring increasingly high tax burdens — in the form of the incrementally broadening sales tax, of ballooning property taxes, and of expanding licensing requirements and fees.

Instead, Rhode Island’s emphasis should be on getting people, especially young people, back to work, regardless of their field or pay scale.

***

MEDIA RELEASE: July 24, 2012

A 28.3% teen unemployment rate is sinking career building opportunities for Ocean State youth according to a report released today by the Rhode Island Center for Freedom and Prosperity. This unemployment rate has more than doubled in recent years to become the worst in New England, and demonstrating even further weakness in the teen sector, the report also highlights that the number of hours worked has dropped by over 40%.

“If our state is to rebound in the long term, we need our working-age youth to learn to become productive. As part of their transition into a career that fosters self-reliance, teens are looking for valuable workplace experience and resume building, in addition to a little pocket change”, said Mike Stenhouse, CEO for the Center. “Unfortunately our overly burdensome regulatory and tax structure, along with statewide minimum wage increases, are resulting in fewer opportunities for everyone and disproportionately harm our teens. This category would grade-out at yet another F for our state,” continued Stenhouse, referring to the Competitiveness Report Card published earlier this year by the Center.

According to the report, high minimum wage states had a 24.3% teen unemployment rate, compared with 21.7% for states at the federally mandated rate. Further, Rhode Island’s recent minimum wage hikes will cost almost 600 area teenagers a chance at an entry level job. Even for those young adults who were fortunate enough to find work, the average hours worked plummeted to 6.1 per week from 10.7.

As about 70% of working teens are hired in the retail or leisure/hospitality industries, the Center recommends two policy changes: lowering the state minimum wage rate to federal levels; and a phase-out the the state sales tax, which would not only reinvigorate the state’s economy, but would be especially favorable for the retail industry, creating new job opportunities for younger Rhode Islanders.

Today, July 24, is the National Day of Action to Raise the Minimum Wage. “The RI Center for Freedom & Prosperity categorically rejects this ill-informed policy push. A minimum wage hike is yet another regulation that strangles businesses; our report provides clear evidence of the negative, unintended consequences that meddling in complex economic issues can often bring about,” concluded Stenhouse.

The complete teen unemployment report can be downloaded from the Center’s website at www.RIFreedom.org .

Earlier this year, the Center published a policy brief detailing the negative effects of the state’s occupational licensing policies on opportunities for low income and entry level workers. Another report – Zero.Zero – detailed the positive economic effects of eliminating the state sales tax.

The Rhode Island Center for Freedom and Prosperity, a non-partisan public policy think tank, is the state’s leading free-enterprise advocacy organization. With a credo that freedom is indispensable to citizens’ well-being and prosperity, the Center’s mission is to stimulate a rigorous exchange of ideas with the goal of restoring competitiveness to Rhode Island through the advancement of market-based reform solutions.