STATEMENT: Unpopular TCI Gas Tax Remains on Legislative Back Burner

/in Featured, Recent Posts/by RI Center for FreedomRhode Island Follows Connecticut’s Lead, For now

TCI Gas Tax Scheme Stalls in the House

With gasoline prices at recent national highs, and with the Ocean State jobs market seeing the slowest recovery among all states, the Rhode Island House of Representatives wisely kept the TCI Gas Tax on the back burner, before recessing last evening from their regular 2021 legislative session.

Last month, the State of Connecticut said “no” to the TCI Gas Tax, killing the regional gas tax idea in the Nutmeg State. With the Rhode Island General Assembly also saying no for now, Massachusetts is the only state among the original 14 states still considering this costly, job-killing gas tax scheme.

“Ocean State House leaders apparently understand that as our state struggles to recover, economically, from the pandemic … now is not the time to impose new taxes at the pump. It would be cruel for lawmakers to impose this fuel tax, which will especially harm rural and low-income residents, just so the elite can receive a subsidy for their expensive electric vehicles,” stated Mike Stenhouse, the Center’s CEO. “Motorists must remain vigilant and demand that the House not follow the Senate’s lead, by considering this destructive legislation in the upcoming special fall session of the General Assembly.”

Motorists are encouraged to take action and to continue to tell lawmakers to say no to the the TCI Gas Tax here.

Such a highly highly regressive gas tax, and the projected $1200 per family cost, according to research and a poll conducted by the Center, are highly unpopular among the public. A petition opposing TCI has already generated about 15,000 emails to state lawmakers.

In March, the Center unilaterally called on McKee to withdraw from TCI, however the issue remains open in the General Assembly. A May open letter to the Governor by the Center, listing 12 coalition signatories and a range of reasons not to join the TCI compact, can be found on the Center’s website, here.

Center Calls for Suspension of “Indiscriminate” High School Vaccine Clinics

/in Blog, Featured, Recent Posts/by RI Center for FreedomLegal, Medical, and Moral Questions Surround the Apparent Indiscriminate Rush to Vaccinate Students

Providence, RI – The RI Center for Freedom & Prosperity today calls on the Governor, the RI Department Of Health (RI DOH), mayors, and town administrators to suspend high-school based vaccination clinics until six critical legal, medical, and parental-rights questions are addressed.

The RI Department of Health has declared that students ages 16 and up are medically “emancipated” from their parents or legal guardians, and thus parental consent forms are not necessary. Cranston opened its first clinic at Cranston High School East this morning, with clinics in additional cities and towns expected to come online in the following days and weeks.

Yet public details of the controversial program are shrouded in mystery and appear to violate long-time accepted medical tenets.

“This rush to indiscriminately vaccinate every eligible student, 16 years or older, and without parental consent, is certainly not moral and may not be medically safe or legally defensible,” said the Center’s CEO, Mike Stenhouse. “Families and the public need to know if vital safeguards and precautions have been put in place.”

From a legal perspective, according the Robert G Flanders, board member of the Center and former Associate Justice of the Rhode Island Supreme Court … while Chapter 23-4.6 of Rhode Island’s general laws appears to give persons the age of sixteen (16) or over the right to consent to “routine” or “emergency” medical or surgical care, many private attorneys question whether the Covid-19 shot, which is widely categorized as an experimental treatment not yet fully approved by the FDA, qualifies as either routine or as an emergency medical treatment.

Paraphrasing what one prominent civil rights attorney in the state said on a recent radio interview: the legality of applying this statute to this pandemic shot is flimsy enough, where he would not want to stand in the shoes of a government entity that might have to defend itself against an individual case that might produce some adverse health event.

The temporary EUA pandemic vaccines should not be considered as routine, nor is there any emergency situation threatening these children’s lives or health where this statute might apply and deprive their parents of the right to consent to such treatment.

-

Before these school-based clinics are allowed to continue the Center calls on the RI DOH to release its legal opinion as to why it believes these students are legally emancipated for these vaccines, so that appropriate public debate and legal scrutiny can take place.

From a medical perspective, it is unclear if the maxim of “informed consent” will be followed before students are administered the shots. Informed consent means that patients are informed of the risks and benefits of any treatment before moving forward. It is unclear if students will be afforded this widely accepted practice.

-

The state and each school district should make their respective ‘informed consent’ policies publicly clear so that appropriate review and discussion can occur.

According to research by Dr. Andrew Bostom, adjunct scholar to the Center and Brown University credentialed epidemiologist, there are multiple reasons why young adults should not indiscriminately rush to receive the vaccine and why informed consent is so critical:

-

Healthy teenagers 16-19 have an extraordinarily low risk of severe adverse medical consequences if they contract the coronavirus.

-

The risk of an adverse Covid-19 vaccine medical reaction is significantly higher than that of the annual flu shot, according to data on the CDC’s own website, potentially leading to hospitalizations or fatalities.

-

The potential long-term risks of these vaccine treatments are not yet known

-

Teenagers who have recovered from a coronavirus infection also need to be informed that their naturally-developed immunity is at least as protective as any immunity that might be conferred by a vaccine.

-

Anyone who may have contracted the virus, could be at increased short-term risk of adverse reaction to the vaccine.

-

There may exist instances, rare as they may be, where a specific vaccination may pose increased risks for certain individuals with certain medical conditions. The maxim of first “consulting with your physician” also appears to be purposefully ignored.

-

What data and studies, and what medical rationale does the DOH cite in justifying this rush to vaccinations of young adults?

From a moral perspective, there are two important considerations.

Parental-rights. Even if legal, based on private discussions and public interviews conducted on the popular video blog show, In The Dugout with Mike Stenhouse, parents are outraged and believe it is immoral that their children are being subjected to experimental medical treatments without their consent.

Not only do parents believe that they have the right to authorize care for their children, but families are concerned that students may be bullied … via peer pressure from fellow students, teachers, or administrators … into making rash medical decisions.

The opposite of informed consent, it anathema to the medical community, and of significant concern to parents, that any student or patient be coerced or forced into receiving any medical treatment.

-

How will school districts ensure not only that “informed consent” appropriately happens, but also that no “coercion” or “bullying” occurs in pressuring students into signing up for the treatment.

Vaccine Passports: As Governor McKee all but admitted in a recent press conference, and as the letter from Cranston Public Schools stated in its clinic announcement letter, it appears that schools may soon require vaccinations from students if they are to be allowed to participate in “spring end-of-year events such as the junior and senior proms and graduation-related events.”

In mandating experimental health care treatments for any reason, this assault on medical freedom, personal choice, and parental rights is immoral. Such tyrannical acts by government and government schools in Rhode Island, not only runs counter to the concept of individual liberty, but runs counter to policies that more enlightened states are implementing. For example, Florida Governor Ron DeSantis is expected to soon sign legislation that passed its state legislature that would impose a $5,000 fine on any school or business for each time it requires a “vaccine passport” or proof of vaccination in order to be a participant or patron.

-

Legal or not, what is the state government’s official position on the justification for this infringement on parental rights?

-

Will the State commit to banning ‘vaccine passports’ for any and all high school events?

Governor McKee Mis-informed About Mask Mandates

/in Blog, Featured, Recent Posts/by RI Center for FreedomDr. Andrew Bostom, Adjunct Scholar to the Center and Epidemiologist, Invokes Objective Evidence in Requesting That Governor McKee End The Mask Mandate and Fully Re-Open Rhode Island

Rhode Island Governor Daniel McKee has been misinformed by his Covid-response team and has not adequately considered data and views that demonstrate that mask mandates are not effective in stopping the spread of the corona-virus. This according to Dr. Andrew G. Bostom, epidemiologist and adjunct scholar to the RI Center for Freedom & Prosperity, who today called on McKee to end the mask mandate.

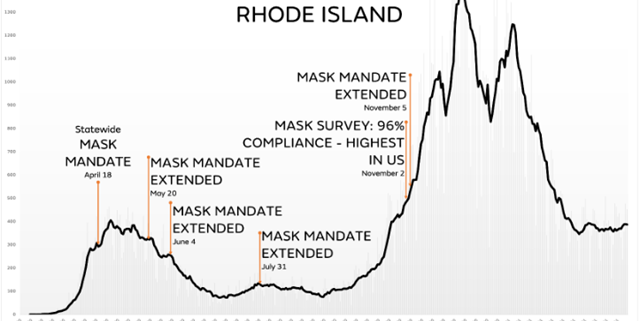

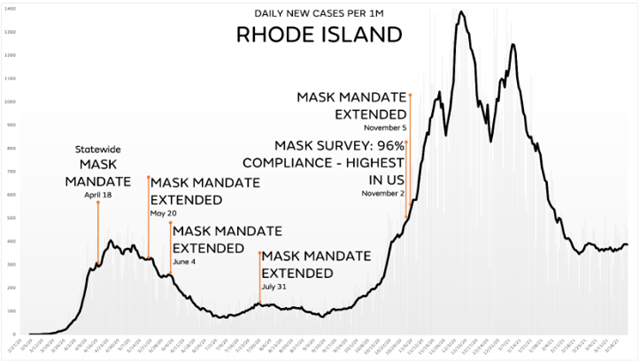

Bostom, also a Brown University Academic Internist, rejects the Governor’s contention that he has considered alternative views and data regarding the effectiveness of masks. Dr. Bostom notes that despite the state’s mask mandate, with multiple extensions and a 96% compliance rate (the highest in America), Rhode Island one month later would suffered a twin-peak infection spike from mid-December 2020 to mid January 2021, per the chart below:

Additionally, from 2008 through the end of 2020, 12 randomized, controlled trials—the gold standard for judging medical intervention effectiveness—involving some 18,000 persons, including a 6,000 person study with covid-19 infections as the outcome, have EACH FAILED to show community masking reduces the rate of respiratory viral infections. Twenty-four (24) states have lifted, or never had an indoor mask mandate, and ALL have lower per capita covid-19 mortality rates than Rhode Island.

“Please end Rhode Island’s indoor mask mandate, and fully re-open the state, immediately, based upon this wealth of objective, irrefutable evidence,” advised Bostom, whose views that challenge the status quo Covid narrative gained increased prominence when he began regularly appearing on the Center’s popular video blog series, In The Dugout with Mike Stenhouse.

Further supporting Dr. Bostom’s call to end the mask mandate, is the fact that Rhode Island’s covid-19 percent positive test rate for 11 straight weeks has been 2.5%, or below; the week ending April 24th it was 1.9%. Hospitalizations are flat/declining at low levels, and deaths even flatter: between April 22nd and 26th there were 3-days with zero deaths per day.

CDC tracking data shows that 91% of Rhode Islanders 65+ years old have been at least partially vaccinated, and that group accounts for almost 90% of the state’s covid-19 mortality. Another large swath of people under 65 years old— some 100,000—have been infected with covid-19 clinically (and more sub-clinically), and recovered, and are now contributing robust, natural herd immunity to the state’s population, in addition to those ~300,000 under 65 who have been partially vaccinated.

References:

- RIDOH Covid Data Tracker https://ri-department-of-health-covid-19-data-rihealth.hub.arcgis.com/

- “Protection of previous SARS-CoV-2 infection is similar to that of BNT162b2 vaccine

protection: A three-month nationwide experience from Israel” https://doi.org/10.1101/2021.04.20.21255670

- May 2020: “Nonpharmaceutical Measures for Pandemic Influenza in Nonhealthcare Settings—Personal Protective and Environmental Measures” https://wwwnc.cdc.gov/eid/article/26/5/19-0994_article (10 individual studies from 2008-2016 were pooled and “meta-analyzed” and the pooled results remained negative)

- October, 2020: “Facemask against viral respiratory infections among Hajj pilgrims: A challenging cluster randomized trial” https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7553311/pdf/pone.0240287.pdf

- November 2020: “Effectiveness of Adding a Mask Recommendation to Other Public Health Measures to Prevent SARS-CoV-2 Infection in Danish Mask Wearers” https://www.acpjournals.org/doi/full/10.7326/M20-6817

- Death rates from coronavirus (COVID-19) in the United States as of April 26, 2021, by state https://www.statista.com/statistics/1109011/coronavirus-covid19-death-rates-us-by-state/

- List of coronavirus restrictions in every state https://www.aarp.org/politics-society/government-elections/info-2020/coronavirus-state-restrictions.html

For Earth Day, “No TCI Gas Tax” Letter Sent to Governor McKee by 12 Advocacy Organizations and Citizens Groups

/in Blog, Featured, Recent Posts, TCI Tax/by RI Center for FreedomMassive Burdens on Businesses & Families with No Environmental Benefit

Providence, RI – On Earth Day 2021 (April 20-22), a coalition of 12 advocacy and citizens groups joined the Center’s prior call on Governor Daniel McKee to withdraw Rhode Island from the controversial TCI Gas Tax regional compact, ostensibly designed to reduce carbon emissions, but, which in reality, is nothing more than a pure money grab.

The National Federation of Independent Businesses (NFIB) and the RI Center for Freedom & Prosperity, authors of the open letter, thanked McKee for his prior voiced support for the small business community. The coalition’s letter went on to point out how artificial new fuel taxes, the goal of the Transportation & Climate Initiative (TCI), would create large and unnecessary costs on the private sector – for no environmental benefit.

With a TCI Gas Tax bill expected to be submitted soon, after former Governor Raimondo signed-on to the TCI scheme in 2020, the 12 group coalition also called on the current Governor to pledge to veto any related legislation.

“The dishonesty of TCI proponents is alarming,” claimed the Center’s CEO, Mike Stenhouse. “They falsely claim they can achieve major emissions reductions with a minor gas tax. In reality, the multi-year plan would raise fuel taxes by 40 to 50 cents per gallon … and would do virtually nothing to reduce global carbon emissions.”

The letter cited studies and public polls demonstrating that the highly regressive gas tax, and the projected $1200 per family cost, are highly unpopular among the public. A petition opposing TCI has already generated over 10,000 emails to state lawmakers.

The coalition letter also discusses the competitive advantage the Ocean State would enjoy regionally by not joining the TCI compact and keeping fuel taxes where they are.

The letter concludes it appeal to McKee by stating: “Withdrawing our state from TCI would be a terrific first-step and would send a strong signal that you are serious about improving our state’s dismal business climate.”

In March, the Center unilaterally called on McKee to withdraw from TCI. After receiving strong support, this larger coalition effort was put together.

The entire letter and a listing of all 12 coalition signatories can be found here.

Flanders, Stenhouse Provide Testimony Calling for an End to Unchecked Executive Branch Emergency Powers

/in Blog, Featured, Litigation, Recent Posts/by RI Center for Freedom“Appalled” that a state Senator is a “big fan” of unconstitutional EOs

Providence, RI – Former state Supreme Court Justice and board member Robert Flanders, as well as CEO Mike Stenhouse, provided testimony on behalf the Rhode Island Center for Freedom and Prosperity at yesterday’s Senate Oversight Committee hearing on the emergency Executive Orders issued during the current pandemic.

“I’d like to thank Chairman DiPalma for holding this important hearing,” commented Stenhouse. “However, I was very disappointed in the lack of interest in providing balanced government by most of the other committee members.”

Former judge Flanders submitted written testimony which, in part, stated: “Rhode Island’s Emergency Powers Act should be legislatively reformed to provide for more democratic emergency governance, along with a re-examination of the statutory parameters of the Governor’s emergency powers and the related roles of the legislative and judicial branches of state government.”

Flanders, whose testimony listed many areas of concern regarding executive over-reach and potentially unconstitutional executive orders, has also publicly stated that “there is no pandemic exception to the Constitution.”

Stenhouse, in his verbal testimony (beginning at the 50:35 mark), firmly stated that he was “appalled” that a sitting Senator (Stephen Archambault) openly averred (40:45) at the hearing that he was a “big fan” of an unconstitutional executive order described by an attorney from the executive branch. The Senator would later double-down on his absurd assertion (58:45).

Stenhouse decried the legislative branch’s lack of oversight of the executive branch – especially the publicly transparent and vigorous debate that would accompany such oversight – during the still-ongoing declared state of emergency. He called for reforms that would require General Assembly approval to extend emergency Executive Orders beyond their initial 30-day period.

Stenhouse also listed 10 states that have already passed or were moving similar legislation, after it became clear that existing law in many states provided too much unchecked power to the executive branch during states of emergency:

Kentucky, Utah, and Ohio have already passed related laws; while West Virginia, Arizona, Pennsylvania, North Dakota, Texas, North Carolina, and Indiana are expected to pass laws or constitutional amendments. These legislative actions, generally and among other items, would place time limits on executive emergency powers and would require the legislature to extend emergency orders by joint resolution.

Only one committee-member, Senator Jessica De La Cruz, expressed support for limiting emergency executive powers by requiring legislative approval.

How the Ocean State Should Spend Its Federal COVID Relief Funds

/in Blog, Featured, Recent Posts/by RI Center for Freedom

Overview: The Opportunity and American Rescue Plan Allocations

The $1.9 trillion American Rescue Plan (ARP) Act enacted in March 2021 included $122 billion for the ARP Elementary and Secondary School Emergency Relief (ARP ESSER) Fund.

Background

The old saying goes, “there’s no such thing as a free lunch,” but advocates of the left-wing’s modern monetary theory (MMT) want you to think there is.

Under traditional economic theory, every government dollar spent or borrowed must be eventually paid back, leading to upward pressure on taxes imposed on the citizenry. But according to this more-recent socialist monetary theory, federal governments that control their own currencies, as does America, should be free to print (without backing) and spend as much money as they desire to fulfill their political and societal goals, without regard to debt levels or offsetting funding via tax and other revenue receipts. According to today’s Left, there can be as many free lunches as they can possibly imagine.

In reality, the MMT economic approach is a myth, albeit a popular one. As has resulted in virtually every socialist country, most recently Venezuela, this approach to wanton government spending will necessarily lead to disaster over the mid-to-long term: hyper-inflation and massive devaluation of the core currency … and inevitable economic despair.

But most politicians are concerned only with the short-term time-period of their political careers.

Since states cannot print their own money out of thin air and must operate under a balanced budget, leftist MMT advocates have devised a scheme whereby the federal government will print trillions in “fake money,” spend some on what it desires, and then distribute the rest to states and localities to spend as they wish.

While anyone with an economic background knows that this irresponsible approach will eventually backfire, the illusion of a free lunch will become widely promulgated… and will be highly popular among an unsuspecting citizenry.

Localities and states across America will soon be receiving a significant windfall in millions and billions of dollars of perceived free money from the federal government under the guise of COVID relief funds. How to productively spend that money is a public policy question that every governor, mayor, town or county manager, and legislative council will soon have to consider.

The Federal Rules

According to the relevant language in the actual federal legislation, there are generally authorized “uses” for the funds, along with a few specifically barred uses. State and local government will have approximately two-and-one-half years to spend the money, with all funds to be spent by December 31, 2024.

The American Rescue Plan Act provides $350 billion to state and local governments, with $219.8 billion distributed to states, territories and tribal governments and $130.2 billion for local governments.

In general, the money is authorized to be used for:

- Costs incurred to respond to the pandemic emergency or its negative economic effects, including assistance to households, small businesses, nonprofits, and affected industries (such as tourism, travel, and hospitality)

- Premium pay for eligible workers who do essential work

- Replacing lost tax revenue relative to revenue collected in the most recent fiscal year

- Investments in water, sewer, and broadband infrastructure

States are expressly prohibited from using the funds to directly or indirectly offset a reduction in net tax revenue during the covered period (March 1, 2021, through December 31, 2024) or to delay the imposition of any tax or tax increase. States are also prohibited from using the funds to make deposits into pension funds. Notably, local governments are also prohibited from using the funds to make deposits into pension funds. However, local governments are not prohibited from using the funds for tax relief.

Most of the data and analysis in this report was originally developed in partnership with Marc Joffe, Senior Policy Analyst at Reason Foundation, and Michael Lucci, Senior Policy Advisor at State Policy Network.

National Highlights

- State and local governments are expected to experience $140 billion in revenue losses from 1Q20 through 2Q21.

- Congress has already allocated approximately $400 billion in state and local aid.

- State and local governments started the pandemic recession with over $200 billion in rainy day and other fund balances.

- States are incurring additional expenditures due to increased Medicaid enrollment. The costs are more than offset by temporarily increased federal Medicaid support, but states are prohibited from removing ineligible individuals from the program.

- Additional funds to state and local governments are not needed. Instead, Congress should focus on policies that will spur economic recovery.

General Risks to State and Local Governments

Additional federal aid could harm the long-term financial health of states by:

Overwhelming state and local governments with more money than they can effectively spend.

- Making it more difficult for states to maintain balanced budgets in the future.

- Incentivizing states to rely on the federal government for financial support in future crises instead of developing their own fiscal responsibility.

- Making spending decisions based on directives from DC instead of the local needs of constituents and communities.

- Funding new and expanded programs that require future tax increases to sustain.

- Enlarging state and local governments to a point where they cannot adjust accordingly and become a larger portion of the economy while the private sector contracts.

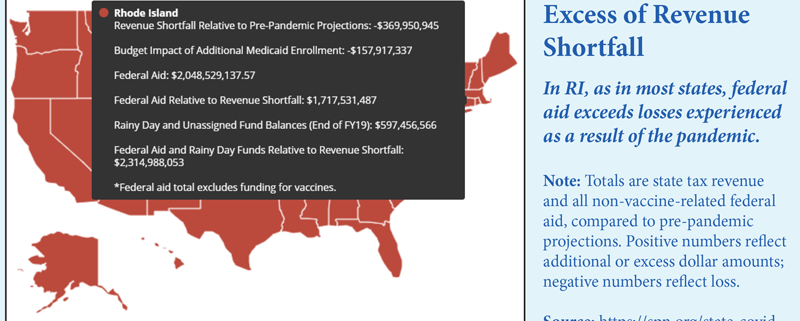

Rhode Island Federal Aid

The latest revenue projections show that states are not experiencing as much of a shock from lost revenue as anticipated. The projected $140 billion in lower revenue is more than made up for with approximately $400 billion in various forms of federal aid to state and local governments. In fact, 48 out 50 states received more federal aid than anticipated revenue lost, and Rhode Island falls into this category.

State and local governments will now need to adjust their finances for a different economic reality than existed pre-pandemic.

Estimated Aid to Rhode Island and Its Municipalities

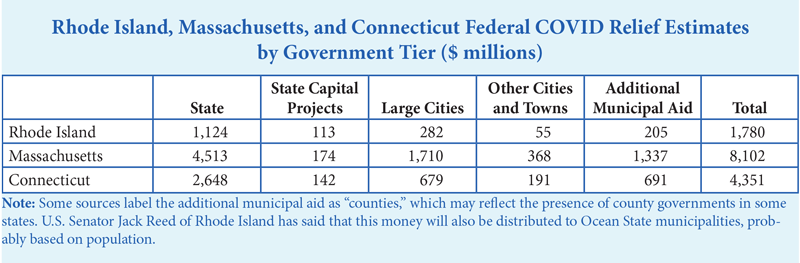

Rhode Island will receive a total of approximately $1.78 billion in federal COVID relief aid:

- $1.12 billion for the state government

- $0.11 billion for capital projects

- $0.54 billion to be distributed to its 39 local governments

City and Town Aid

Rhode Island’s six largest cities will receive the lion’s share of allocated municipal funds, with significantly less for the smaller cities of Newport and Central Falls and the other 31 towns.

The Center’s Recommendations

In general, the COVID relief funds to states and localities should not be spent on any project or initiative that permanently expands the scope or size of government. Spending projects should be temporary, with defined end dates and should have no risk of incurring associated maintenance costs in future years.

Furthermore, all spending plans should be 100% transparent, with full and detailed reporting on the status of all projects and all vendor disbursements. If the function is not adequately staffed within the governmental unit, an auditor or inspector-general-type oversight capacity should be established, temporarily, with the relief funds.

While the federal government has provided general guidelines for authorized spending uses, plenty of grey areas that will be clarified in the coming months and years, as inquiries to the U.S. Treasury are responded to or as inevitable future court cases set precedent.

Based on calls with our national partners and our collective best efforts to interpret these federal guidelines and navigate the grey areas, our Center puts forth the following specific project ideas. For Rhode Island, some of these ideas are applicable only at the state level and some only at the local level, while some others may be applicable at both levels.

The state of Rhode Island is expected to receive approximately $1.8 billion in COVID Relief Funds. All but a few hundred million, which will be spent to plug anticipated budget gaps due to lost tax receipts resulting from the pandemic shutdowns, may be available for special projects or purposes.

The Center’s recommendations are conceptual only. We do not attempt to calculate the cost of each program.

State Government

Educational Uses

- “Catch Up ESAs” — up to a $750 scholarship “match” for every public and private school K–12 student who was forced into distance learning, to fund complementary educational activities or items, such as tutors, online classes, or other learning aids, where that locality has itself enacted a similar Catch Up ESA scholarship program.

Small Business Uses. The most important component in achieving a full economic recovery is to ensure that a strong foundation exists in the small business community. Without more and better companies, there cannot be more and better–paying jobs for Rhode Islanders.

- Eliminate fees in specified occupational licensing industries.

- Allow for immediate and full “expensing” of capital expenditures on RI tax returns through 2024.

- Fund an increase the Earned Income Tax Credit (EITC) to support low-income working families that were hit hardest by the pandemic lockdowns. NOTE: this EITC increase is only recommended if the state’s minimum wage mandate on employers is not increased.

- Temporary tax credits for businesses in industries hardest hit by the pandemic lockdowns. Since the government created the lockdown problem, it should play a role in a solution.

- Temporary waiver of the annual corporate tax, to encourage small business creation.

- Partially fund cities and towns to phase-out or create/increase the exemption level for the unpopular “tangible assets” tax.

Infrastructure Uses

- Upgrade Rhode Island’s power grid by moving underground major electric lines on state roads to help avoid future mass power outages.

- Expanded broadband wireless coverage in remote and low-income areas to allow for increased educational or telehealth options.

General Budget and Public Uses

- Pay out of Unemployment Insurance benefits.

- Eliminate “beach fees” through 2024.

- Pay off some our state’s bonded debt.

- Build up “Rainy Day Fund.”

- Fund a temporary Office of the Inspector General with full authority to oversee expenditures and publicly report on inappropriate use of funds.

Civics Uses

- Provide a print copy of the United States Constitution and the Rhode Island Constitution to every elected official and government employee at the state and local level.

Municipal Governments

Larger municipalities will receive tens of millions of dollars in windfall funding.

Unlike the restrictions on state governments, the federal guidelines for the COVID Relief Funds do not ban municipalities from using these funds to reduce taxes.

Educational Uses

- “Catch Up ESAs” — a $500 scholarship for every public and private school K–12 student who was forced into distance learning, to fund complementary educational activities or items, such as tutors, online classes, or other learning aids.

- Property tax refund in recognition that full in-person learning was not made available to students in 2020 or 2021 and other government services were curtailed.

Small Business Uses

- Property tax credits for businesses in the hardest hit industries or for all businesses.

- Phase-out or create/increase the exemption level for the unpopular “tangible assets” tax (potentially funded via state use of COVID Relief Funds)

Senior Citizens Uses

- Upgrade senior centers with a one-time purchase of recreational aids (audio/visual, for example) or transportation (shuttle buses).

Infrastructure Uses

- One-time upgrades to parks, sports facilities, and other recreational areas.

General Budget and Public Uses

- Pay off some the locality’s bonded debt.

- Build up “rainy day funds.”

- Fund a temporary Office of the Inspector General with full authority to oversee expenditures, and publicly report on inappropriate use of funds.

MEDIA RELEASE: Center Urges Motorists to Join in Call to Stop the TCI Gas Tax

/in Blog, Featured, Recent Posts, TCI Tax/by RI Center for FreedomCenter Launches Campaign for Ocean State Motorists to “SAY NO” to TCI Gas Taxes

Providence, RI – The Rhode Island Center for Freedom and Prosperity announced today that it has launched its “Say NO to the TCI Gas Tax” campaign, including an online form, whereby Ocean State motorists can petition the state lawmakers to reject the regional gasoline cap-and-trade scheme, known as the Transportation & Climate Initiative (TCI).

The simple form, once completed at www.RIFreedom.org/TCI-action, will automatically send an email to the Governor and to legislative leaders. Social media advertising, to raise awareness of how state residents can take action, has already begun.

A January report by the Center estimated that the TCI Gas Tax would cost the average family an extra $1200 per year in increased fuel, food, and retail product prices.

“As our state struggles to recover from the pandemic, and while Biden administration policies are already driving up the price of gasoline, it should be unthinkable that state lawmakers would choose this time to plan an additional 30-40 cents per gallon gas tax increase ,” warned Mike Stenhouse, the Center’s CEO. “People who drive their cars are not ‘bad guys’ as some government officials believe.”

A leaked video caught a Massachusetts government climate official overtly stating that people who drive cars, like “seniors on fixed incomes” are “bad guys” who need to have “the screws turned on them” so as to “break their will.”

The petition email in part states; Along with the 7 in 10 Ocean Staters, per a January public poll, who oppose TCI once they learn of its high cost:

- I oppose the TCI gas tax scheme, designed to make gasoline prices so high that I will be forced to drive less, and so that “gasoline will go away.”

- I am not willing to pay major new gas taxes at the pump and for increased prices of vehicle delivered goods, especially when there is virtually no environmental benefit.

- I believe Rhode Islanders should be free to choose the energy options that best fit our lives.

Earlier this week, the Center formally called on Governor McKee to withdraw Rhode Island from the regional TCI compact that former Governor Raimondo signed the state up for.

In December, former Governor Gina Raimondo signed-on Rhode Island, just one of three states to do so, to the TCI Memorandum Of Understanding (MOU). Implementation of TCI would lead to a significant increase in automobile and diesel gasoline prices for motorists, while also systematically limiting regional supplies of vehicle fuel.

More information about the proposed TCI gas tax can be found on the Center’s TCI webpage: RIFreedom.org/NoTCItax. The Center is one of over two-dozen organizations in the northeast working cooperatively to defeat TCI in their respective states.

Vote to “Reject” all 7 bond Questions

/in Blog, Featured, Recent Posts/by RI Center for FreedomRhode Islanders can’t afford $642 million – We’ve Spent Enough Money!

Doc Skoly Does It Again! #RejectThe7RI

Center Releases Counter-video to Cooler/Warmer II

Providence, RI – In response to a union-funded advertising video in support of new bonded debt that will cost taxpayers $642 million, the RI Center for Freedom & Prosperity today released its own video ad, urging voters to “REJECT” each of the 7 special-interest oriented spending questions on the ballot for the special election, now underway through March 2.

Citing the Ocean State’s existing level of crushing debt, the video’s theme is ‘We’ve spent enough money’. The Center’s video was produced by JawDoc Productions, the same outfit that in just few hours in 2016, at virtually no cost, produced a superior and more popular counter-video to the massively expensive and geographically-incorrect Cooler/Warmer video ad embarrassingly published by Governor Gina Raimondo at significant taxpayer expense.

“This year, special interest unions conspired to fund yet another advertising debacle, again paying exorbitant fees to an out of state firm, which made the same mistake in using geographically-incorrect images,” commented Mike Stenhouse, the Center’s CEO. “Just take a look at the money behind this ad campaign promoting massive government spending; it is clear that such spending will only enrich insider cronies at the expense of the hard-working people of our state.” This year’s union video has been dubbed by many as Cooler/Warmer II.

The Center argues that debt is a delayed tax. And that as Ocean Staters struggle to recover from the devastating impact of the pandemic, forced to cut back on their family and business budgets … that likewise, the State of Rhode Island should trim its big-spending habits. “It would be completely tone-deaf and yet another self-inflicted wound for government to impose such future burdens on taxpayers during these trying times,” concluded Stenhouse.

Dr. Stephen Skoly, founder of JawDoc Productions and a maxillo-facial surgeon, is also Chairman of the RI Center for Freedom & Prosperity.

More Reasons for Voters To Reject All 7 Bond Questions

- Debt is $14,700 per taxpayer, giving RI a D for fiscal health.

- Per capita bonded debt of $10,215, 3rd highest

- In general, RI’s interest costs of 25% (17th highest)

- Estimated interest of 5% on 3/2/21 bond questions produces interest cost estimate of 60% ($242m on $400m).

- Story of recent migration in RI is young, early-career people moving out and older people moving in. Inevitable tax increase to pay for debt will push more younger folks out while squeezing the older folks, especially those on fixed incomes.