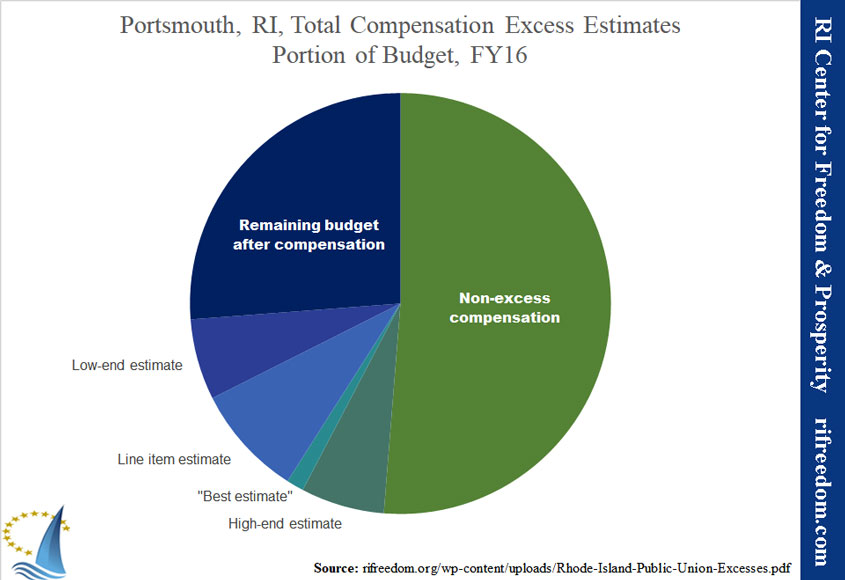

One of the most objectionable schemes of government union collective bargaining process, which excessively drives up the cost of government for taxpayers, in ways or at levels that do not exist in the private sector, is being paid for not working. This issue, along with many others defined in the Center’s report, Public Union Excesses, contribute to an $888 million per year in excessive collectively-bargained costs, responsible for driving up local property taxes by up to 25%.

After looking at examples in just a few cities and towns, municipal taxpayers across Rhode Island may collectively be paying millions of dollars per year for unionized government employees to spend their public time on work for their unions … and not to work on the public services they were hired to perform.

Adding insult to injury, the many collectively bargained provisions that specifically allow for these so-called ‘ghost workers’ may actually be in violation of state law. More on that later on.

As detailed in the Center’s landmark report, Public Union Excesses, there are multiple schemes in which government unions benefit from overly generous provisions in collective bargaining agreements, provisions that hardly, if ever, are seen in the private sector.

One such provision is called “union release time.” Under this scheme, unions across Rhode Island use taxpayers as contractual piggy banks to fund union activities. How many Rhode Islanders know that they are paying for ‘ghost workers’ who are paid by the public, but who do not actually perform a public service for some or all of their official time? Instead, a common provision — found in many government union collective bargaining agreements — mandates that taxpayers pay the salary and benefits for for certain public employees, who spend time working on their unions’ business.

Union ‘ghost workers’ impose a triple-rip-off on taxpayers.

First, there is the direct cost of paying public workers for not working on public issues. Second, compounding the cost, taxpayers are further ripped-off because, often, an extra worker must be hired (sometimes at overtime rates) to fill in for the ghost worker’s shift. Third, union workers who are paid with taxpayer dollars to work on union issues … are working directly against the very same taxpayers who pay their salaries. As the Center’s Public Union Excesses report breaks down, collectively bargained government union excesses directly raise property taxes by as much as 25% for every Rhode Island family and business.

This union release time scheme is indeed a rip-off for taxpayers, as many of the designated union ‘ghost workers’ are awarded six-figure compensation packages, paid for by the public … but without the public’s receiving a commensurate return.

In its report, Public Union Excess, the Center estimates that taxpayers in Portsmouth, Rhode Island, are wasting over $8,176 per year on ghost workers, 100% of which is considered “excessive” in the report. This figure does not include the ‘replacement’ costs to hire additional staff.

However, the ‘ghost worker’ issue is much more costly in other cities and towns. In the Rhode Island’s capital city of Providence, for example, Maribeth Calabro, a special educator, whose $83,848 salary and compensation package worth well over $100,000 per year is paid for by local taxpayers, is also president of the Providence Teachers union. Per the city’s collective bargaining agreement with her Providence Teachers Union, Calabro is allowed to spend 40% of her teaching time (with full pay and service credit) to conduct union activities, costing taxpayers over $33,000 per year. Add in the cost of substitute teachers, estimated at over $16,000 per year, and Providence taxpayers are being ripped-off to the tune of almost $50,000 per year … just for this one teacher.

In the 2016 East Providence teachers’ contract, high school teacher and local union president Nicholas Shattuck is allowed to spend 40% of his teaching time, as part of his estimated $70,000 salary, on union business. “The President of the Association shall be relieved of all his/her non-teaching duties to take care of Association business. In addition, the President shall be provided the equivalent of two (2) full days per week at no loss in salary or benefits and the Association agrees to pay one-half (1/2) of the cost. Meaning that the School Department pays for one day and the Association pays for one day.” The estimated net ‘ghost worker’ cost of $14,000 per year, plus substitute costs at around $15,000 per year, means that East Providence taxpayers are bearing costs of almost $30,000 per year for this one paid public employees to conduct union business that constantly works against the better interests of those same taxpayers.

In Tiverton, there is a minimum trifecta of ‘ghost worker’ union release time provisions. Elementary school teacher and local union president Amy Mullen is allowed one teaching period per day (20%) for “union business.” At a salary of over $75,000 per year, the total rip-off to taxpayers, including the cost of substitute teachers, is likely over $30,000 per year. Provisions in Tiverton’s firefighter and police union contracts are less costly, having mainly to do with periodic conventions and meetings, but still may add over $10,000 per year in ‘ghost worker’ costs to taxpayers.

The above examples do not take into account common provisions that relieve union officers of “non-teaching duties” (for example). We did not attempt to value these activities, but exempting union officers likely has a cost of thousands of dollars, either in lost benefit to taxpayers and constituents or in the increased burden on other employees.

Unauthorized release time. But the rip-off to taxpayers does not end here. While it’s one thing for taxpayers to bear the burden for “authorized” release time as collectively-bargained for ghost-workers, it’s quite another thing for these same ghost-workers to cause “unauthorized” release time for co-workers. For instance, our Center has anecdotally been told by numerous former educators that it is common practice for local union NEA officials, who themselves were on release time to conduct ‘union business’ at the expense of the taxpayers, to simply walk into classrooms and pull other teachers (and fellow union members) out of their classes for meeting on various topics … often leaving entire classrooms unattended. In one instance, the so-called ‘union business’ that the authorized and unauthorized ghost-worker teachers were discussing … was to scheme how to get rid of a school administrator that the union did not like.

On the legal side, state law appears to prohibit these collectively bargained schemes. Under the state Labor Relations Act, Rhode Island General Law 28-7-13 states that “it shall be an unfair labor practice for an employer to” give preference to “any employee organization”:

By compensating any employee or individual for services performed in behalf of any employee organization or association, agency or plan, or by donating free services, equipment, materials, office or meeting space, or any thing else of value for the use of any employee organization or association, agency, or plan; provided that an employer shall not be prohibited from permitting employees to confer with him or her during working hours without loss of time or pay.

Rhode Islanders expect their hard-earned money to be spent to educate our children, protect our homes and businesses, or to provide other vital services. We do not expect that our money will be spent to advance the work of overly politicized unions.

According to our Center’s report and this follow-up post, not only are taxpayers grossly overpaying for government services, but they’re also regularly paying out their hard-earned money to government workers who are not even working! Whether it’s paying for release time where union members are paid by taxpayer for doing union work, overly generous vacation and personal days, paying for public employees on sabbatical, paying for suspended workers, paying for years and years for people out of work on dubious injury claims … or paying unsustainable levels of post-employment benefits … taxpayers are being ripped off.

If public workers want to assist their unions, the should do so on their own time or be paid out of the dues of union members … not on public time and certainly not on the public nickel. If we can bring these and other public union excesses into line with the private sector, your property taxes could be reduced by 25%.

Ghost Workers – Government Workers who are Union Officials Paid for Not Working – Drive-up Property Taxes

And it may even be illegal …

Providence, RI— One of the most objectionable schemes of collective bargaining contracts with government unions are provisions not found in the private sector that pay workers for not working, that increase the cost of government, and that unfairly drive up property taxes. Even more egregiously, in this case, public employees are being paid by taxpayers to work for someone else.

According to a post today as follow-up to to the RI Center for Freedom & Prosperity’s landmark Public Union Excesses report on the excessive costs of collectively bargained government services, ‘union release time’ provisions that allow for “ghost workers” – public employees paid by the public NOT to conduct work for the public; but rather paid by the public to conduct union work – are a major taxpayer rip-off.

In the post, Paid For Not Working; a Taxpayer RipOff; Ghost Workers and the Triple-Whammy of Union Release Time, multiple examples of contract language, as well identification and cost-calculation of actual ‘ghost workers’are provided.

“Worse, this unfair and unjustifiable practice appears to be in direct conflict with state law,” exclaimed Mike Stenhouse, CEO for the Center.

For example, in the city of Providence’s collective bargaining agreement with the Providence Teachers Union, publicly paid special educator, Maribeth Calabro, also the local union president, is contractually allowed to spend 40% of her school schedule (with an estimated $100,000+ compensation package) on union business. Add in the cost of substitute teachers and the total annual cost to taxpayers likely exceeds $60,000 per year.

The full ghost worker post provides other individual examples and also discusses:

- The ‘triple-whammy’ on taxpayers, once substitute worker costs are added-in

- State law on what constitutes and “unfair labor practice”

- Further abuses of unauthorized release time

“If public workers want to assist their unions, they should do so on their own time and on the union’s nickel,” suggested Stenhouse, “and certainly not at the taxpayers’ expense.”

According the Center’s May 2019 Public Union Excesses report, Rhode Island taxpayers dish-out $888 million per year (or $3500 for a family of four) for excessive compensation provisions in collective bargaining agreements with government employee unions, which may drive up local property taxes by as much as 25%.