The Half-Percent Promise

/in Blog, Featured, Policy, Recent Posts, Sales Tax, Taxes/by RI Center for FreedomBad Bills Of The Week: Unrestricted Abortions Not What Rhode Islanders Want

/in Blog, Featured, Progressive Bad Bills, Recent Posts/by RI Center for FreedomThe Rhode Island Center for Freedom & Prosperity today named three extreme abortion bills as the “Bad Bills of the Week,” and encourages both pro-life and pro-choice advocates who oppose unrestricted abortions to attend a statehouse rally on Tuesday afternoon.

The progressive-left legislation (H5125, H5127, S0152), which would allow abortions up until the birth of the baby, virtually without restriction, is also dishonestly being positioned as nothing more than codification of existing law.

However, the question of “choice” vs “life” is not what is central to this specific policy debate. Instead, because the legislation would dramatically expand the definition of what constitutes a legal abortion in the state, the actual question at hand is one of “restricted” vs “unrestricted abortions.”

In summary, according to a detailed legal analysis, the legislation would:

- Eliminate all legal restrictions on late-term abortions

- Eliminate all restrictions on methods of abortion

- Eliminate any penalties for experimenting on human fetuses

- Undermine the authority of the State from adopting any restrictions on the performance of abortions

- Require taxpayers to fund any abortion sought by a Medicaid enrollee

- Remove “human-ness” from an unborn baby, by making its murder no longer a crime

- Infringe on parental rights, by abrogating the “parental consent” statute from minors seeking an abortion

It is ironic and disturbing that many of the same lawmakers that have voted to systematically over-regulate legitimate businesses and industries, are the same lawmakers who want this controversial industry to be allowed to operate without any oversight or impunity.

The dishonesty arises because a recent poll clearly showed that an overwhelming majority of Rhode Islanders oppose unrestricted abortions; yet proponents of the legislation claim the public strongly supports the legislation.

This disconnect can be explained because abortion proponents believe that current law already essentially allows for anytime-anywhere abortions; and despite the legal analysis described above, that the legislation merely codifies what already exists.

But don’t tell that to Rhode Islanders who obviously believe that existing laws do impose common-sense restrictions, while banning such brutal practices as late-term and partial-birth abortions.

“Only the most extreme radicals could possibly think that a butcher like Kermit Gosnell should be able to act with impunity in our state,” said Mike Stenhouse, the Center’s CEO. In 2013 Gosnell, a Pennsylvania abortionist, was convicted of murdering three infants who were born alive during attempted abortion procedures, and was also convicted of 21 felony counts of illegal late-term abortions and 211 counts of violating the 24-hour informed consent law.

On Tuesday, February 26, opponents of the legislation are hosting a rally at the State House for a “Day of Action” from 3:00 pm to 5:00 pm. Pre-event registration is encouraged here. Further, you can contact your local state Rep or Senator here.

Governor’s Proposed Medicaid Employer Assessment Tax Will cause the Same Hardship as seen in MA.

/in Blog, Featured, Progressive Bad Bills, Recent Posts/by RI Center for FreedomStarbucks could be driven out of Rhode Island … another step down the Rhode to Serfdom!

Progressives in the Raimondo Administration are once again seeking to punish employers for not operating their private businesses the way this government wants them to. Governor Raimondo’s proposed “Medicaid Employer Assessment” is a new tax designed to force private sector businesses to pay for the state’s costly decision to expand Medicaid earlier this decade.

In a state struggling to attract business and families; a state tragically destined to lose a prized US Congressional seat because of its relative loss of population; and a state already with a bottom-5 ranked business climate … this new business tax would make matters worse.

And if Massachusetts is our guide … much worse. Ironically, because the Bay State imposed its own “MassHealth Tax” a few years ago, proponents of this blatant money grab now say the Ocean State should follow suit. What we should all know, however, is that this corporate Medicaid tax has proven to be an “absolute disaster” for Massachusetts, harming small and large businesses alike, according to the National Federation of Independent Businesses (NFIB).

Under this proposed new tax in Rhode Island, employers would receive a bill from the government, up to $1500 for each employee who chose to opt-in to the government’s own push to increase enrollment in Medicaid. The Governor’s misguided theory is that if employees are not covered by their employer’s insurance plan, full or part time, and instead have chosen to enroll in Medicaid, then the business should be punished. Unfortunately, in many such instances, it is out of the employer’s control.

Keep in mind that an employer cannot force an employee to accept their business-offered health insurance, because in America, people (for the time being) still have some choice to choose. In many cases, the employer likely does not know which of their employees may be enrolled in Medicaid

Further, it is not the responsibility of job-producers to pay for government’s bad decisions of the past. Regardless, the government is looking for money, and once again it is blaming job-producers … the lifeblood of our economy. Even more outrageous, some members of the RI business community, who are insider cronies of the Governor, have apparently endorsed this anti-jobs tax.

As our Center predicted six years ago, when Rhode Island opted to expand Medicaid under Obamacare provisions, the massive increased costs to our state would be unaffordable, without contriving some new scheme to extract more money from taxpayers or businesses. And now, here we are.

The negative impact has been so severe for some Massachusetts’ businesses, that:

- State lawmakers had to scramble to implement a “hardship waiver” to save them from closing their doors or moving out of state.

- For certain high-turnover industries, with a high-proportion of part-time workers, the MassHealth Tax has been devastating. Temp agencies and large company-owned restaurant and grocery chains (like Starbucks, Chipoltle, Cracker Barrel, Dave’s, and Stop & Shop) would be especially hard hit.

- Several MA lawmakers have filed bills to immediately repeal the MassHealth Tax even before the December 31, 2019 sunset date, because its negative impacts have been so severe for some.

- Seasonal job-providers in MA were less likely to hire workers during the summer months and holiday season in fear of triggering the new tax

Does RI really want to risk large employers not hiring lower income individuals in search of work because they may trigger this new tax?

The proposed Rhode Island Medicaid tax is different from the Massachusetts version in two important ways:

- Rhode Island’s Medicaid tax would initially apply only to businesses with 300 or more employees, while the MassHealth Tax would apply to large and small businesses.

- Unlike the temporary MassHealth Tax which had a two-year sunset period, Rhode Island’s Medicaid tax would presumably go on forever … with no sunset provision. This is especially dangerous because over time, and as is the case with virtually all taxes, it is likely that this unfair tax would be extended to include more and more businesses with lower numbers of employees

In summary, this Medicaid tax has been a nightmare for employers in Massachusetts.

But in following down this same failed path, Rhode Island would put more and more Ocean Staters on the Rhode to Serfdom.

***

Related excerpts from the Governors proposed 2020 budget:

Pg. 4. Medicaid Employer Assessment: Too many Rhode Islanders are working multiple jobs without the benefit of health insurance through an employer. Medicaid is their only path to health care, placing the cost burden on taxpayers alone. The Medicaid Employer Assessment Fee charges large, for-profit employers with at least 300 employees an assessment for each employee they have on Medicaid, creating a shared investment in the health of Rhode Islanders. This is projected to generate about $14.5 million in general revenue.

Pg 15. Medicaid Employer Assessment: Too many Rhode Islanders are working multiple jobs without the benefit of health insurance through an employer. Medicaid is their only path to health care, placing the cost burden on taxpayers alone. The Governor recommends that for-profit employers of 300 employees or greater be assessed for each non-fully-disabled employee receiving Medicaid, so that these employers share the costs of Medicaid with Rhode Island taxpayers. The quarterly assessment would be 10% of those employees’ wages, capped at $1,500. This assessment, effective October 1, 2019, is expected to increase revenues by $15.6 million.

Unnecessary “Fair Housing” Bill is Unfair to Landlords!

/in Blog, Featured, Progressive Bad Bills, Recent Posts/by RI Center for FreedomPhoto by Russ Hendricks

House bill 5137, deceptively named the Fair Housing Practices bill, which mirrors leftist-inspired legislation introduced in other states, is completely unfair to landlords. The legislation claims it seeks to end discriminatory housing practices because in the progressives’ land of social-equity, making a legitimate business decision should be a crime. Under the proposed law, any Section-8 lessee applicant (those whose rents are subsidized by the federal government) who are not accepted as a tenant, must have been discriminated against, and the landlord must be punished.

We all agree that if such discrimination were to be practiced … it would be wrong. However, this legislation is not necessary, as there already exists multiple state and federal laws that protect against discrimination. Additionally, there are multiple legitimate reasons for making certain business decisions.

The legislation would make it illegal for a landlord to inquire about a potential tenant’s source of income, or even whether they are an adult over the age of 18.

According to federal guidelines, acceptance of Section-8 vouchers is supposed be voluntary. Yet this Fair Housing Practices bill would unfairly impose a defacto state mandate on landlords to accept any Section-8 application they receive. Even if the landlord makes a legitimate and nondiscriminatory business decision otherwise, they would be at legal risk of being prosecuted for discriminatory racial actions.

Further, this legislation is a back-door RhodeMap RI type scheme to advance a social equity agenda that will only tear at the fabric of our society … by making innocent private property owners appear to be bigots.

Yes, once again, after failing in 2018, the social equity extremists are back; those who believe that their views of society should prohibit the free-choice and rights of property owners to make business decisions that are in their own best interests. Once again, RhodeMap Rhode Island and HUD (the federal department of Housing and Urban Development), and its local surrogate, the RI Housing authority, are at it again..

According to progressive logic, since people receiving Section-8 vouchers are typically low-income; and because many low-income individuals and families are minorities, then saying ‘no’ to a Section-8 applicant must be because of racism, and therefore must be discriminatory. The actual effect of this legislation, which seeks to extend government control into even more aspects of our personal and business lives, would be to subject landlords to lawsuits or other penalties by automatically assuming that discrimination was the motivating factor.

Based on conversations with landlords I know, there is a major, legitimate, and non-racial reason why some business prefer not to accept clients subsidized by public money and all the red-tape they would have to go through. In this case, once a landlord accepts a federally subsidized Section-8 tenant, that business is now subject to a whole new array of mandates, red tape, and risks that otherwise, it would not have to worry about.

Under this legislative mandate, landlords would be subject to unfair rules by HUD, which we know from the RhodeMap RI debate years ago, does not care about private property rights. HUD has corrupted its mission of putting low-income people into appropriate housing to the point where it routinely tramples on the rights of other private property owners.

Landlords would be forced to endure annual state inspections, they otherwise would not be subject to, and could even be at potential criminal risk if they did not appropriately “police” their own tenants and report to the state any potential violations Section-8 eligibility guidelines.

This legislation, avidly supported by Rhode Island Housing is a clear extension of the HUD and RhodeMap RI anti property-owner agenda.

Consider that this legislation automatically presumes that our neighborhood brothers and sisters are guilty of discrimination. Last year, our Center hosted a luncheon where the nationally acclaimed Arthur Brooks, President of the American Enterprise Institute, spoke of the “solidarity of brotherhood”, where we should work together to help “start up” the lives of those in our community. But how can it possibly be “solidarity” to automatically and divisively claim that legitimate business decisions by business owners in our community are based on bigotry?

Private business owners should be free to make the business decisions that they feel are best for them – and none should be forced to comply with onerous federal regulations, if they are allowed to choose not to. Just because the progressive-left see inequities in every aspect of our society, does not mean that government should be stepping-in to tell people how to run their businesses.

Already suffering from one of the most hostile business and legal climates in the country, Rhode Island would become an even more dangerous place to operate as a landlord. Small ‘rental property’ business owners could be forced to spend money unnecessarily to become lawyered-up like a major corporation if they were to be sued … an expense and time most cannot possibly afford. In other states where similar legislation has already been enacted, property owners are indeed being sued, and they are routinely losing in court battles, even though they may have committed no wrong.

Our state would suffer greatly if the unintended consequences of this legislation might drive some landlords out of business, or out of state, and lead to fewer available housing units.

Once again, we ask lawmakers to consider the moral and real-world impacts of such presumptive and intrusive legislation, and to understand that the issue is not a real major problem – at least not for the stated discriminatory reasons.

Governor’s 2019-20 Budget: The Rhode to Serfdom

/in Blog, Budget and Spending, Featured, Sales Tax/by RI Center for FreedomProvidence, RI — Instead of seeking to shape Rhode Island’s future with the proven ideals of a free-society, Governor Raimondo’s proposed 2019-2020 budget is a stunning departure from America’s core values and, instead, would put our state on a “Rhode to Serfdom,” according to the RI Center for Freedom & Prosperity.

With the Ocean State doomed to lose a US Congressional seat because of its hostile tax, educational, and business environment, which chases away wealth, families, and businesses, the policies presented in the Governor’s budget would make matters far worse.

“Just yesterday, I attended a thoughtful lecture by the chief economist for JP Morgan Chase at an event hosted by the RI Society of CPAs. His message was that economic growth is the best path to achieve prosperity and to manage deficits … not raising taxes and not necessarily cutting spending,” commented Mike Stenhouse, the Center’s CEO. “However, this Governor’s regressive budget points us 180 degrees in the opposite direction and would stifle any opportunity for growth. Ocean Staters are clearly being forced down a Rhode to serfdom.”

With new government-imposed health insurance mandates that will further burden already distressed families as well as employers who are already suffering from one of the worst business climates in the nation, and along with a bevy of new taxes and fees that will further restrain economic growth, the proposed budget takes a giant step backwards towards a centrally-planned society, where government controls more and more aspects of our lives. The entire country is thriving, economically, from reduced government intrusion into our lives, but these progressive-left policies would increase dependency on government.

The proposed Medicaid tax on businesses and the individual mandate are particularly egregious. Each would serve as yet another reason for large employers and families to stay away from Rhode Island. It is oppressive that the government would seek to punish employers for not compensating their workers how the government wants them to; or to punish individuals not being able to afford the high-cost insurance resulting from the government created Obamacare mandates.

“For the better part of a decade, the State has encouraged and bragged about the number of people enrolled in Medicaid with taxpayer funded ads, and now she wants to make businesses pay for it,” cynically question the Center’s research director, Justin Katz.

Equally disturbing, the budget contains no meaningful remedies to the many problems that plague our state, such as high taxes across the board, high energy and healthcare costs, and onerous regulatory burdens on job-producers.

“On top of her irresponsible new spending proposals, clearly designed to benefit special-interest unions, the reliance on SIN taxes to pay for these schemes will tear at the cultural fabric of our society,” continued Stenhouse. “The continued attacks against legal firearms owners and smokers, along with the unsustainable increase in overall government spending, with its immoral budget scoops, also points Rhode Island back towards a totalitarian form of government that I thought we were done with in America.”

For these reasons and more, Rhode Island suffers from an epidemic of people and businesses fleeing our state. “Maybe it’s time to build our own wall to keep people in,” joked Stenhouse earlier in the week.

The Center again calls on General Assembly leaders to reduce the state’s sales tax, citing existing law that requires such a rate-reduction if certain “internet” taxes are enacted. With the multitude of new sales taxes imposed in recent budgets, the Center maintains that we have essentially reached that legal threshold.

State of the State Analysis: Making RI Worse … Again

/in Featured, Recent Posts/by RI Center for FreedomGovernor’s Policy Ideas Will Make Matters Worse

More of the same progressive-left policies that are hampering our state today

Providence, RI — With the Ocean State doomed to lose a US Congressional seat because of its hostile tax, educational, and business environment, which chases away wealth, families and potential investors, the policies presented in the Governor’s 2019 State of the State address would only make matters worse, according to the Rhode Island Center for Freedom & Prosperity.

“The Governor offered nothing but more of the same, failed progressive-left policies,” commented Mike Stenhouse, CEO for the Center. “Instead of seeking to make our state a more free and welcoming place to live and work by easing governmental intrusion in our lives, the Governor is proposing even further attacks on our individual and economic rights. This misguided vision should be alarming to all Rhode Islanders.”

As prior Governors and General Assembly leaders have erred in the recent past, many items from the Governor’s speech would again make Rhode Island an even worse place to raise a family or build a career:

- With no coherent plan to address our long-time K-12 public-schools problem other than throwing more money at it; and instead of lessening government and union influence over our recently exposed dismal student test scores, the Governor is proposing even more government control over students via her “universal pre-K” and expanded “free college tuition” programs.

- Instead of easing regulatory burdens on employers in a state with one of the worst business climates in the country, the Governor proposed placing job-producers in further economic peril via more onerous wage mandates. Instead of combating the deadly use of opioids, the Governor’s unspoken tonight push for legalization of marijuana will only create a stepping stone for further drug abuse and will lead to a further fraying of our state’s societal fabric.

- Instead of protecting and preserving our individual freedoms, the Governor is expanding the attacks and infringements on the rights of the unborn and those seeking to exercise their constitutional right to defend themselves.

- Instead of seeking to provide more affordable and higher-quality health insurance for state residents, the Governor continues to push for sub-standard and unaffordable government-mandated insurance.

- With corporation after corporation pulling out of RI and reneging on their corporate welfare deals, the Governor continues to promote more special-interest incentives that end up producing little more than empty headlines … all paid for by the hard-working taxpayers of our state.

For these reasons and more, Rhode Island suffers from an epidemic of people fleeing our state. “Maybe it’s time to build our own wall to keep people in,” quipped Stenhouse.

Center Co-signs Amicus Brief in Public Employee Union Supreme Court Case

/in Blog, Featured, MyPayMySayRI, Recent Posts/by RI Center for FreedomCENTER JOINS LOCAL AND NATIONAL ORGS IN SUPPORT OF FURTHER WORKPLACE FREEDOM FOR PUBLIC EMPLOYEES

Government Unions Should Welcome a pro-Uradnik Decision

Jobs & Opportunity Index (JOI), November 2018: Employment and Income Diverging

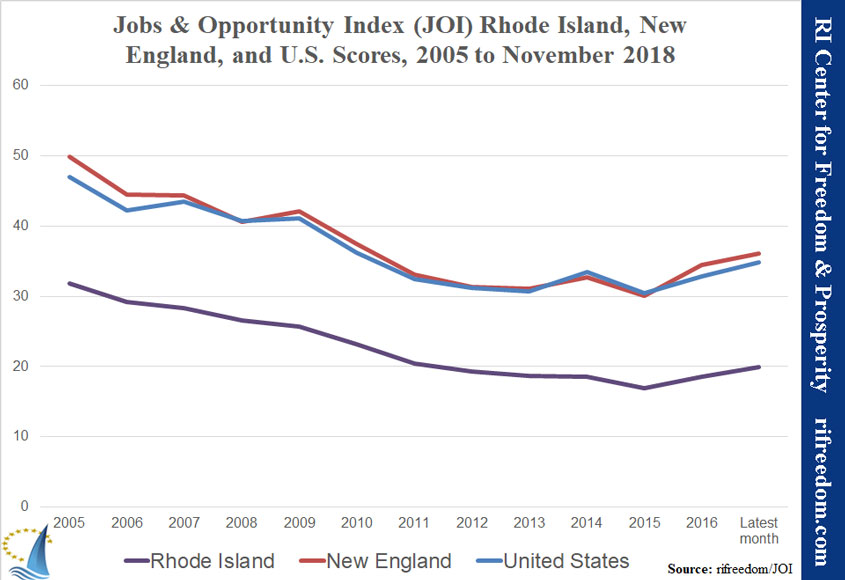

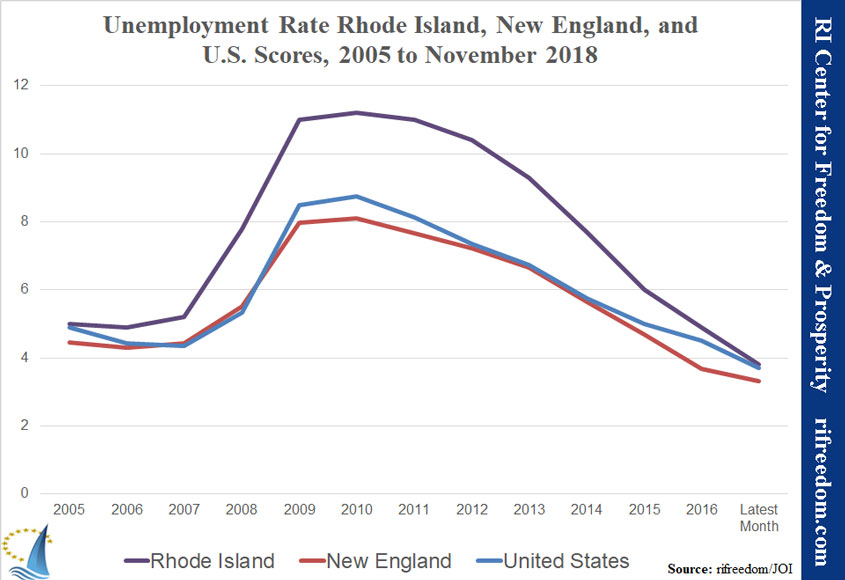

/in Blog, Featured, Jobs & Opportunity Index, JOI, Recent Posts/by RI Center for FreedomNovember’s data for the RI Center for Freedom & Prosperity’s Jobs & Opportunity Index (JOI) paints a bit of a mixed picture. The Ocean State is still 47th in the country, with seven of the 12 datapoints in the index updated. (Rhode Island remains the only state not updating its SNAP [food stamp] data, thanks to UHIP, although positive news suggest this may soon change.)

Employment was down 190 people from the first-reported number for October, and the labor force dropped 208. The number of jobs in the state also dropped, by 400. Turning to the financial results that make up JOI’s Prosperity Factor, total personal income in Rhode Island increased by an annualized $359 million from the prior number, while state and local tax collections increased $71 million. On the hopeful side, the number of Rhode Islanders relying on Medicaid decreased by 1,490 enrollees.

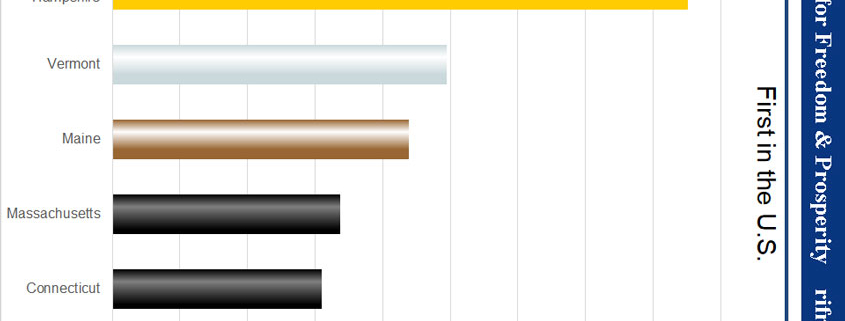

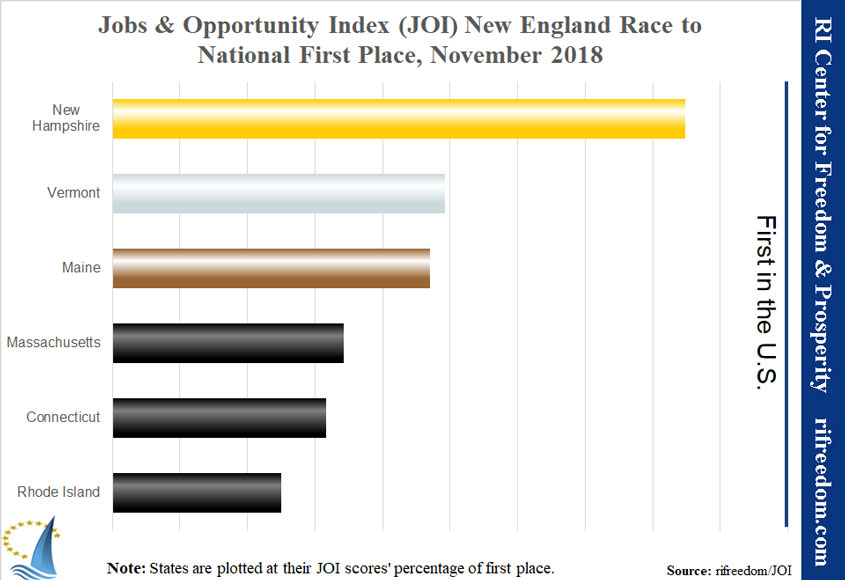

The first chart shows RI remaining last in New England. New Hampshire leads the region, in 3rd place, nationally. Vermont held 13th place, but Maine lost the step it had taken last month and fell back to 16th. Massachusetts and Connecticut both remained in place at 36th and 40th, respectively.

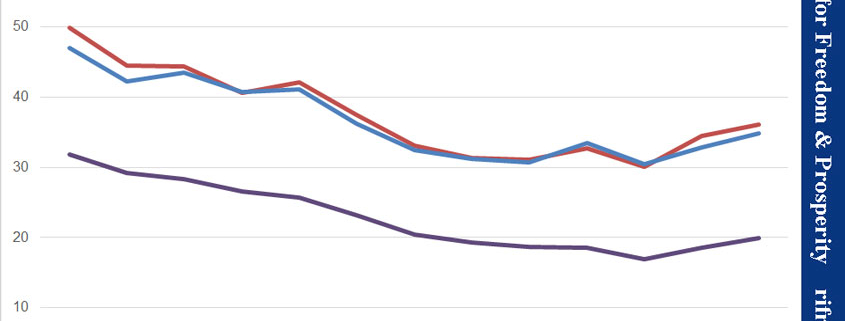

The second chart shows the gaps between RI and both New England and the United States on JOI, which both increased in November. The third chart shows the gaps in the official unemployment rate, which both decreased slightly.

Results for the three underlying JOI factors were:

- Job Outlook Factor (optimism that adequate work is available): RI remained 26th.

- Freedom Factor (the level of work against reliance on welfare programs): RI remained 41st.

- Prosperity Factor (the financial motivation of income versus taxes): RI remained 47th.

Center Calls for Empowered Teachers and ESA’s as Part of the Solution to RI’s Education Failures

/in Blog, Featured, MyPayMySayRI, Recent Posts/by RI Center for FreedomTeachers Should Leverage Their Newly Restored Rights

ESA Outlet for Concerned Families?

Providence, RI — The Rhode Island Center for Freedom & Prosperity for years has been warning about the poor value state and local taxpayers have been receiving for their high public investment in public education. Throwing more money at the severe education failures highlighted in this week’s RICAS student assessment scores is not the answer, as our state already ranks among the highest spending states per student in the nation. The solution must come from fundamental reforms.

First, the Center has previously suggested that public education can be the greatest beneficiary of the last summer’s landmark US Supreme Court Janus decision. By boldly taking advantage of their recently restored first-amendment Janus rights, and because unions can no longer force teachers who disagree with them to fund bargaining positions that tie the hands of educators, teachers have been empowered with a stronger voice to fight against ineffective policies. Teachers must be un-handcuffed by ending union-negotiated restrictions on how they are allowed to educate our children. Teachers must also demand a greater say about potential reforms that may improve educational outcomes. If teachers believe their unions are not helping to positively reform education, they now have the full-freedom and leverage to opt-out of paying any money to their union without fear of negative repercussions. Teachers, and all public employees can learn more at MyPayMySayRI.com.

Second, an outlet must be provided for families that want a brighter future for their children, which begins with a better education today. The Center’s “Bright Today” Educational Scholarship Account program (ESA), which was blocked by teachers unions in the General Assembly years ago, would empower parents to choose a better school for their children, by allowing limited dollars to follow the student to a private school of their choice. National studies have shown that such private school choice policies can improve educational results for participating students, without harming existing public educational outcomes. More information about the Bright Today ESA scholarship program can be found at BrightToday.org.