Property Taxes on Families & Businesses Driven Up By 25%

“Firefighter Overtime” and “Evergreen” Bills Would Give Unions a More Unfair Negotiating Advantage

Providence, RI– With two-thirds of the statewide burden heaped on local taxpayers, Rhode Island property taxes would be 25% lower were it not for the ‘excessive’ costs imposed on families and businesses for collectively bargained government services, according to a major report released today by the Rhode Island Center for Freedom & Prosperity.

Public Union Excesses, the largest research report ever produced by the Center, details how Ocean State taxpayers are dishing out an extra $888 million per year in providing up to a 27% total compensation premium for government workers as compared with their private sector counterparts; findings that are consistent with previous national studies, including a report by the Center in 2012.

“Our state cannot survive morally or economically with this obvious imbalance. At $888 for each Rhode Islander, a family of four is paying over $3500 annually for these excessive compensation deals,” emphasized the Center’s CEO, Mike Stenhouse. “We must find a better balance between how much union members are paid and how much taxpayers can afford.”

The 48-page report, which utilized regression analysis calculations that controlled for experience and educational levels, was researched and co-authored by adjunct scholar to the Center, Dennis P. Sheehan, who is Professor Emeritus at the Penn State University Smeal College of Business, and who taught Finance at Penn State, Purdue University, the University of Chicago, and the University of Rochester. The report was co-authored by the Center’s research director, Justin Katz, who is one of the state’s leading analyst of the state’s jobs market and overall economy.

Among the primary drivers of excessive public union employee total compensation, up to 27% higher than for comparable services in the private sector, are:

- The 9th most favorable pro-union laws in the nation

- A 4-6% base “wage premium”

- Overly generous pension and healthcare benefits

- Systematic overtime abuse

- Numerous collectively-bargained cash-back schemes

The “firefighter overtime” mandate bill that passed the House in April and the “evergreen contract” legislation that passed the House in May would each create new state laws granting additional unfair leverage to local union negotiators.

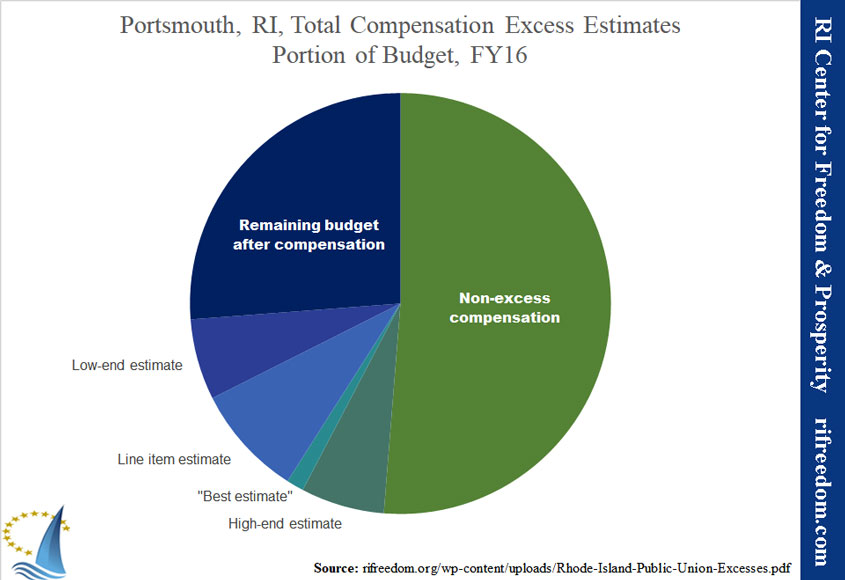

The Public Union Excesses report discusses in some detail how its findings are supported by prior national studies and also includes a line-by-line budget analysis of the median Rhode Island town of Portsmouth.

One chart in particular from Portsmouth demonstrates the lost opportunity cost, whereby excessive total compensation payments mean less money to spend on other important projects. For example, the $590 million aggregate annual municipal savings could easily pay for all necessary school building repairs and upgrades in just three to four years, estimated to be at over $2 billion, statewide.

“Treating the 10% of unionized government employees more like the 90% of the rest of us are treated … is not only more fair but also builds trust that government is looking-out after everyone the same,” concluded Stenhouse.

The full report also includes tables with town-by-town estimates of the excessive total compensation costs of government workers at the municipal level, in school districts, and in independent fire districts.

Many state and municipal leaders also provided statements that say the reports’ statistically-determined findings match up well with their actual local budget analysis:

Mike Riley, municipal pension expert on Providence’s $110 million annual total compensation excess: “This massive over-payment in the budget directly hinders the City’s capacity to properly fund its critically under-funded pension plan.”

Ken Block, WatchdogRI.com, regarding the nation’s highest-cost for firefighter services in RI: “It is time to bring local municipal labor contracting into the light. A lack of transparency helps labor and elected officials hide the true cost of municipal labor contracts.”

Rob Cote, Warwick watchdog on his city’s estimated $54 million annual excessive overpyament: “… the actual numbers taken from official Warwick budget documents substantiate the analysis in the Center’s report …”

Stuart Peterson, former School District Finance Committee Chair, on East Greenwich’s $9.5 million excess: “The report’s findings are certainly in line with what we have seen in East Greenwich for the last 30 years. Our residents have seen (property) tax increases three times that of inflation, and up to four times that of median household income wage growth.”

Larry Fitzmorris, East Bay Taxpayers Association, on Portsmouth’s $10.2 millionexcess: “The millions of dollars of excessive costs identified in the report represents institutionalized spending borne by the taxpayers that is completely unnecessary.”

Rob Coulter, President Tiverton Town Council on its $7.4 million over-payment: “This high-quality study is incredibly insightful, and is sure to help us as we keep striving for the right balance of having a first-rate municipal workforce at a cost that is fair and affordable to our residents.”