I attended a very interesting and thought provoking lecture at Brown University Wednesday evening (9/28/11) , featuring Dr. Yaron Brook, President of the Ayn Rand Institute. Dr. Brook, a free-market activist, provided a 30-40 minute lecture, entitled “Capitalism Without Guilt”, then took questions from the over 100 or so people in attendance, with a fair portion of them being students from Brown and other local colleges.

Here, based on my notes and personal paraphrasing, is a synopsis.

Initiating the discussion, Yaron Brook, rhetorically thanked President Obama for his plan to “fundamentally change America”. Obama’s resulting policies, he claims, have kicked off a vigorous national debate about the proper role of government, how to best create jobs, and what are free-markets and capitalism, in reality? He believes the debate will end up benefittng our country.

Brook talked about how our country is currently struggling with jobs and who creates them – the government or the private sector? He states that this issue was settled over 60 years ago; that “consumption” (as the liberals wants us to believe) is not the root of economic growth, but rather that it’s “production” and “investment”. Government stimulus programs, he says, are geared to stimulate consumption … and says this is the reason why they have never worked … anywhere, anytime for anyone. He cites the recent failed US stimulus programs that resulted in fewer jobs, and pointed to Japan, where the government re-distributed massive amounts of wealth, with the result being predictably disastrous for that once proud country.

Most stimulus created government jobs mean only in increased consumption. They are paid for by taking money away from potential investors where the money otherwise could be used to create production as well as privae sector jobs that would also result in consumption. The beaurocracy also bleeds off its share when redistributing money. Dr. Brook claims that 2-4 private may be lost for every 1 stimulus job.

Brook then spoke about the philosophy of “free” markets … that this means, barring force or fraud, that they are free to conduct business without excessive government regulation and that the matching of products and services with consumer demand is the best way to ensure a quality product at the lowest possible price, and to provide for steady economic activity and growth.

Excessive regulations and taxes, he claims, destroy free-markets and are the reason certain industry sectors can fail. He cited the 3 major sectors that collapsed in the US leading up to the 2009 recession – housing, banking, and automobiles. The common mantra was “See, capitalism failed, so government must step into to lend a helping hand”. WRONG says, Brook.

He asked: ‘What are the 3 most regulated industries and sectors in the US economy’? His answer: housing, banking, and automobiles. That it was because of over-regulation and government intervention that these industries failed. Fannie Mae (a government created, semi-private entity), he said, experienced the largest financial collapse of any entity in the history of the United States.

Each of these 3 industries, he stated, have their very own governmental Regulatory Agencies … proof positive that these sectors were not “free market” sectors; that it wasn’t the free-market (or capitalism) that failed, but rather government regulated markets that failed.

Government intervention interferes with normal market forces, by messing with the supply & demand mechanism, and more importantly, by removing the “risk” factor that is so important in regulating normal market activity. The risk of failure and loss of capital is a major incentive to behave prudently. With the current bailout/stimulus mentality, it is only natural that companies and industries would take on more risk than they normally would, knowing that the government will come to their rescue. This leads to economic bubbles, and then, economic collapse when these excessive risks begin to fail.

Brook then spoke about the creation of wealth as the primary measure of a successful economy. He asked us to think about the economic contrast of East vs West Berlin; or China (decades ago) vs Hong Kong … dramatic instances where capitalistic vs socialistic forces were at play, and the economic results were so dramatically opposite.

He then moved into the main theme of his lecture, the morality of capitalism. We have to overcome a psychological and emotional hurdle if we want to have a successful economy again.

GET OVER IT … BE SELFISH. He avers that markets exist for people to enhance their lives, meaning some people will make money – lots of it – and consumers will receive, in return, products and services that will make their lives better. He offers this as the definition of “selfishness” … a natural , self-preserving kind of attitude vs the evil connotation that we too often place on the term. That this is a human thing … a good thing. That in a true free-market, mutual selfishness and mutual profit transaction we choose to make. Even that “naked selfishness” is in everyone’s best self-interests.

Dr. Brook then stated what I felt was the crux of his provocative lecture: that our evolved and perverse sense of morality is what is destroying the American free-enterprise system. That in being politically correct, that people are viewed in positive way only when they put others first, instead of prioritizing their own rational self-interests. That philanthropists, for example, hold a much higher esteem in today’s society, than the wealthy. That the only way the wealthy, like Bill Gates for example, can obtain a positive public image is by giving away their money … not for risking their own capital, conceiving and producing a product that consumers demand, hiring lots of people, and yes, making a ton of money. That Bill Gates was initially derided publicly for being a successful businessman (the scorned capitalist), but is now more loved and accepted because of his Foundation (the beloved philanthropist). That if he gave up ALL of his fortune, and lived in a hut, we might even consider him a saint.

This standard of judgment, Brook says, is far too high a bar if we want free-markets to work effectively. That we must accept being “rationally selfish” and encourage risk and success for the greater public benefit.

What about Bernie Madoff? Wasn’t that selfishness? NO, says Brook. How could it possibly be in his long-term self interest to rip off his family, his friends, and many others, knowing all along that he would be caught someday? Brook referred to Madoff’s Ponzi-scheme as more of a delusional kind of near-term emotionally driven action vs a well thought-out plan to pursue self-happiness. It is this latter kind of selfishness that Brook promotes.

That pursuit of one’s own self-interests, or happiness, via mutually beneficial transactions, is a positive and necessary economic stimulus on its own. Conversely, what many believe as selfishness “at the expense” of others … is a very different thing.

He then asked us to consider the uniqueness and individuality of every single person. In what environment would a person with some wealth best be able to invest and prosper even more? In what environment could underprivileged people best find a way to climb out of the morass and pursue whatever might make them happy? A government controlled environment, where everyone is considered homogenous, and incentivized against acting on their own best judgment; or a free environment where people can determine their own futures based on their own unique dreams and capabilities?

Free-markets, Brook strongly contends, are the only way for each person to achieve their highest level of self-interest, or happiness. Happiness is not purely materialistic; it’s whatever rationally chosen goal we want it to be.

That this pursuit of self-interest is NOT immoral. That “sacrifice” is not the only way to be moral, as our society now seems to believe.

That our nation’s founding fathers wrote about pursuit of individual happiness: They did not write about sacrifice or being responsible to others; that charity is an individual choice, and that it should not be the role of our government to legislate economic equality, or even to have a position on whether or not that is a good thing.

That sacrifice, can actually be a bad thing, especially when government mandates it, by taking wealth or property from one person and giving it to another.

What is sacrifice, he asks? The act of sacrifice is giving something (time or money, for example) and getting something less in return; a win-lose scenario.

Alternatively, free-markets encourage win-win scenarios. People trade for something that has equal or greater value than what they give up. When we buy a car for $20,000, we get a car we believe has more than that much value. The car-dealer gives up a product that cost him less than that much to sell. Both sides win.

Why would our society value win-lose propositions over win-win propositions?

At this point, Dr. Brook ended his lecture and accepted questions from the crowd. Most of the questions, especially from the student attendees, challenged many of Brook’s premises with the expected angles: Why are the top-7 rated cities in terms of standard of living based in what Brook would call ‘socialist’ Europe, not the US? Didn’t the founding fathers allow slavery? Isn’t sacrifice a good thing, for instance, for our children? Didn’t the founders talk about equality for all? What about individual property rights, shouldn’t there be more of collective, common ownership? Doesn’t industry and pollution infringe on another person’s property and rights? What about the Christian values of loving your neighbor as yourself … vs Dr. Brooks’ selfishness philosophy? What about welfare, don’t we have an obligation to help the disadvantaged?

While Brook struggled for responses to only one or two very pointed questions, he provided fascinating responses to most of these queries.

Europe, he said, is a dying region. That what the economic crisis there now will only get worse as more and more of the unsustainable promises that have been made to too many workers and retirees grows in the coming years. While he questioned the standards by which those cities were rated, he also admitted that America, in his view, is no longer a true free-market economy, and that our cities and national standard of living is slowly being destroyed by the big government, anti capitalistic economy. He does not understand why many look at Europe with such admiration. It’s the past, he says, full of rich history – yes, but a doomed society. Asian economies (even China to some extent) are the future, where certain capitalistic principles have been embraced and where wealth is growing in enormous strides. America must choose which way to go.

Regarding slavery, he stated that it was the way of the world 250 years ago. That America was not alone, that the slave trade thrived in Africa, that Europe had serfs, etc

He argued THAT IS WAS INDEED THE VERY PRINCIPLES OF ‘FREEDOM’ IN OUR OWN U.S. FOUNDING DOCUMENTS THAT INVITABLY LED TO THE ABOLITION OF SLAVERY IN AMERICA! That our founders were not always perfect in practice, but they were much more so in theory.

Regarding sacrifice, Brook, said that he doesn’t sacrifice for his children. That staying home with his kids, instead of going out with his friends, is not a sacrifice, but rather, a free-market choice that enhances both him and his kids by spending time together, worth more to him (and to them) than spending time apart. Providing money or material goods to his kids is not considered a sacrifice either, any more than buying a car is a sacrifice. Why would we call something a sacrifice if we invest in our kids (with their well-being as what we receive in return), yet not consider investing in a car a sacrifice?

On the constitutional question of equality, Dr. Brook states that equality was intended only in terms of the law. That in the eyes of the law, unlike in Europe, from whence our forefathers fled, that everyone would be treated equally. That it wouldn’t matter what your race, creed, gender, status, or wealth was … that the law would treat everyone the same. This has nothing to do with equal outcomes among citizens.

Protecting individual property rights, he said is a critical component of a free-economy. That via a just court-system, that disputes and infringements of rights would be settled in a natural and moral kind of way. That contingency legal fees were created so that the poor could also have a way to bring suit if they were wronged. That the proper role of government is not to create massive amounts of new regulations in an attempt to restrict property rights so as to not potentially harm someone else or some fuzzy common good, but rather to protect property rights, and institute only those few common-sense laws that serve this purpose.

Regarding pollution of common items such as water or air, Brook gave perhaps his most provocative response: that POLLUTION SHOULD BE CELEBRATED! Pollution is a by-product of industrial progress, that it is a necessary cost to moving a society forward. He posed this scenario: think of London in the 1800’s and the huge particles of ash that most citizens inhaled from coal-powered factories. That if we applied today’s conventional solutions to that problem, we would have shut down those factories … and the INDUSTRIAL REVOLUTION WOULD NEVER HAVE OCCURRED! All of the advances in transportation and construction would never have happened.

Pollution, once industry advances and becomes wealthy enough and technologically capable of dealing with it, can be solved. Then, the next technological innovation produces a new pollution concern, which should be tolerated for a while before being solved … repeating this cycle which goes on and on. This is merely progress. And, society only improves with each cycle. He asked us, with all of our talk of pollution ruining our planet and our lives, to think about life expectancy progress: In the 1800’s, humans were expected to live not much past their forties-fifties. In the 1900’s it was sixties-seventies. Now it is seventies-eighties.

Continuing with the pollution issue, he said, people decide where to live and work, and that it’s their personal choice whether or not to put up with pollution, traffic, or any other problem in any given area. Look how many millions choose to live in LA, despite these issues. He talked about Simi Valley, right outside of LA. Before the hi-tech industry, it was nothing, just land. But because of the great job opportunities created, thousands migrated there from all over the country, putting up with LA smog and traffic, because overall, it offered them a better chance at life than where they came from. The free-market at work.

Finishing up the pollution issue, Brook asked us to think about Cambodia, for example, a country he had visited in recent years. Most of their citizens live in abject poverty, in huts in swamp areas. Brook proclaimed that the only way that Cambodia could raise itself into prosperity would be to bring on industry, and yes, the pollution that goes with it. That pollution in this case should be welcomed, if not celebrated … as a necessary transitional phase and as a sign of progress!

He dismissed the so-asked premise of Christian love for thy neighbor as thyself. He said this is unrealistic, that everyone loves themselves and their own families more than thy neighbor, and that it is nothing more than religions trying to impose “guilt” on people, as a way to have them conform with the impossible goal of ‘equal outcomes’ for everyone. He said none of us should feel guilt for loving ourselves more than our neighbors; that this kind of selfishness is natural and healthy for humans and for our economic well-being. I would personally add, that individuals freely choosing to help their neighbors, is a noble thing … but that government forcing people to help others is nothing short of tyranny.

The final session I participated in, dealt with welfare – a kind of an extension of the love thy neighbor theme. It was discussed that the way taxes and subsidies work in the real world is not a matter of debate. Laws of economics dictate that when we tax something, we get less of it (the premise behind taxing cigarettes, because society believes it is a bad thing to smoke, so therefore we should craft tax policies that discourage the activity). Conversely, when we subsidize something, we get more of it, like tax-deductions for buying a home (a good thing, society says). So, if this is the case, why do we tax work and investments when it means we will get less of each? … while at the same time we subsidize unemployment and idleness, which means we will get more of each of those?

Dr. Brook went on to claim that the biggest victims of the big government, forced responsibility for thy neighbor mentality, are the very people that the policies portend to serve. Only true freedom – to pursue their own dreams – can allow them to prosper. Welfare and other entitlement type programs condemn them to dependence and low expectations; in a way, institutionalizing them. This is not the America our founders envisioned.

In fact, Brook claims, it is IMMORAL to consider the poor as a homogeneous lot that is incapable of raising itself out of whatever morass they may be in. IT IS INSULTING! He went on to say that all people, including the underprivileged, will be more content when they achieve something based on their own merit and work …that selfishness and the resulting self-esteem is the true measure of happiness … and the only way to achieve prosperity!

***

This was a fascinating 90-minute program, which continued after I had to leave. A few of the students were appalled at some of Dr. Brook’s assertions, while many of the adults were part of the choir. No matter your views, the issues discussed are indeed at the core of the critical debate now underway throughout our nation.

I encourage every single American to take the time and effort to think through these issues, with the goal of arriving at some economic/political philosophy that rings true to you, whether or not you agree with Mr. Brook. Then remain vigilant, stay involved, speak out, support whatever cause you believe in, and adjust your views, as necessary.

“The price of freedom is eternal vigilance” … Thomas Jefferson

Citizens vigilance is the only way our uniquely American form of government can best protect the freedoms of our citizens and allow us to pursue our own idea of happiness and to achieve prosperity.

Mike Stenhouse is the CEO for the Rhode Island Center for Freedom, the leading free-enterprise think-tank in Rhode Island.

RI energy policy questioned in three national articles

/in Blog, Energy, Recent Posts/by RI Center for FreedomTwo recent articles from nationally recognized sources – the Washington Examiner and Town Hall – referenced the Deepwater project and Rhode Island’s energy landscape and strongly hinted that we are harming our citizens and businesses via our costly state energy policies and bypassing the traditional approval process.

In the article, four important points were made that RI citizens and public officials should consider:

In the Ocean State, our public policies, have raised the cost for energy for households and businesses … and we based those policies on what many now consider as false premises.

Reality is not negotiable: during these difficult economic times, should we be dealing with reality … or should we continue taking risks on politically-correct theory?

To read the first Town Hall article by Marita Noon, click here …

To read the Washington Examiner article by Ron Arnold, click here …

To read the most recent Deepwater related article by Martia Noon, click one of the links below:

http://www.globalwarming.org/2011/10/25/why-resort-to-shenanigans-to-make-green-energy-a-reality/

http://finance.townhall.com/columnists/maritanoon/2011/10/23/going_green_with_shady_deals

In the coming months, the RI Center for Freedom & Prosperity will recommend changes to our state energy policies, as part of larger, more comprehensive set of economic and educational reform items.

Student Essay Contest

/in Events, News/by RI Center for FreedomIn honor of Milton Friedman, an American icon for economic and educational freedom, the RI Center for Freedom and Prosperity invites high school students to submit an essay portraying their views about how freedom can enhance their lives.

Topic: HOW IS FREEDOM INDISPENSABLE TO YOUR FUTURE WELL-BEING AND PROSPERITY?

Successful essays will discuss generally how federal, state, or local public policy may serve to enhance or detract from your capacity to live the American dream and to pursue a free and prosperous life.

Essays should also comment on a specific public policy that restricts your freedom to prosper and should also discuss how changes to that public policy would enhance your personal freedoms in a positive way. References should also be made to the corresponding philosophies of Dr. Friedman.

Be sure to personalize your essay so that your individual aspirations or concerns are considered. Cite original sources when referring to specific legislation, reports, or political philosophies.

SUBMIT YOUR ESSAY

TO ENTER * Submit your essay before December 15, 2011 to:info@rifreedom.org . Your entire essay, citations, and personal information must be ‘pasted’ into the main body of your email for submission. Entries with file attachments will not be accepted or opened and will be automatically disqualified.

Also provide the following personal information: full name, email address, city of residence, high school and grade.

You may also enter by mailing your essay prior to December 15, 2011, with the above personal information to: RI Center for Freedom and Prosperity, PO BOX 10069, Cranston, RI 02910.

ELIGIBILITY RESTRICTIONS * The contest is open to any student enrolled in grades 9-12 in a public or private high school, or home school, in Rhode Island during the 2011-2012 academic year. Employees of the RI Center for Freedom, its PR agency, participating sponsors and promotional partners including television or radio stations, and the members of their immediate families (and/or households) are not eligible to participate or win.

CONDITIONS * By participating in the contest, winners agree to have their essay content used in any material relating to this contest. Where legal, parents will be asked to sign a publicity release permitting release of the student’s name prior to acceptance of any prize. * Prior to awarding any prize, the Center for Freedom in its sole discretion may require contest winner to sign a liability release, agreeing to hold the RI Center for Freedom and Prosperity and its directors, employees, agents and representatives of each of them harmless against any and all claims or liability arising directly or indirectly from the prize or participation in the contest. * The RI Center for Freedom reserves the right to disqualify any person tampering with the entry process. It further reserves the right to cancel, terminate or modify the contest if it is not capable of completion as planned.

PILLAR OF FREEDOM AWARD

Up to 10 essays will be selected as finalists and reviewed in greater detail. In order to be considered for one of the top 3 winning spots, all finalists will be required to submit proof of school enrollment as well as to have parents sign a release form that authorizes the RI Center for Freedom and Prosperity to utilize content from the student’s essay.

First, second, and third place winners will be announced during January of 2012. Winners will receive a “Pillar of Freedom” award and a brand new I-Pad. This prestigious award recognizes contributions by citizens who have advanced the concept of personal freedom for Rhode Islanders.

Winners will also be invited to read their essays, live on the Helen Glover radio show on WHJJ 920 AM; and will have their essays published on the RI Center for Freedom and Prosperity website.

Donated products or cash scholarship prizes may also be awarded.

Essays will be judged by a special committee of RI Center for Freedom staff and volunteers.

NOTIFICATION OF WINNERS: Winners will be announced on the RI Center for Freedom and Propserity Facebook page and on the Helen Glover radio show in January 2012. You do not have to be listening to win.

All qualified entrants who submitted their essays via email will receive an email notification upon announcement of the winners.

As with Cars, a Hybrid Pension System Will Cost More

/in Blog, Pension Reform, Recent Posts/by Justin KatzThe complexity of the pension problem comes in the multiplicity of angles from which the numbers can be presented. When it comes to the cost of current employees’ pensions, General Treasurer Gina Raimondo’s hybrid pension system will cost more than the system that’s already strangling Rhode Island.

The headline grabber — because it’s such a large figure — has been the unfunded liability. Essentially, that’s the difference between the benefits promised over the amortization period and the accumulated resources expected to be available to pay them.

It’s critical to realize that both sides of that equation are predictions. General Treasurer Gina Raimondo induced her recent shock to the pension system by leading the Pension Board in a reduction of the predicted annual market return on the system’s investments of just 0.75%, from an 8.25% expected return to a 7.5% expected return. In tweaking its assumptions, the board effectively increased the unfunded liability of state worker and teacher pensions from $5.40 billion to $6.83 billion, according to the most recent actuarial report. The overall problem, however, requires predictions about everything from a female desk clerk’s life expectancy upon retirement in twenty years to the average raise that RI school committees will give to their teachers over the next several decades.

Although interested parties like to pick and choose from among them, various factors have contributed to the existence of the liability. Given the lag time between a particular year’s pension payments and its full effects on the system, elected officials have had plenty of incentive to promise future benefits that outstripped the budget dollars that they were actually willing to put aside in the present, and union leaders have been happy to play along, expecting those promises to be fulfilled somehow, someway.

Another factor has been the market. Even responsible officials, who put aside every penny that the actuaries called for would have wound up underfunded, because the actuaries were basing their predictions on an 8.25% return, when the system has only realized 2.51% per year, considered over the past five years, 2.28% over the past 10 years, and 6.57% annually since 1995.

And then there are all those predictions. The actuaries currently expect a female teacher who retired last year to live for 24.2 more years. They predict that the same teacher retiring in 2030 will only expect an additional 1.1 years of life, or 25.3 years of retirement. With the rate of advancement in medical technology, does that really seem plausible?

The incentives and unpredictability of pension planning are what make defined-contribution option so attractive. With a defined benefit, the employer promises employees a certain amount of future income, and it is up to the employer (or, in the public sector, the taxpayer) to make sure that the money is there; with a defined contribution, the employer promises to put a certain amount of money aside, and future income will depend on the plans and investment returns of the specific employee. The dollar amounts may turn out to be exactly the same, but it isn’t a “liability” in that the employer hasn’t pledged to make up the difference for unmet expectations.

Leading up to the release of Treasurer Raimondo’s pension reform proposal, advocates for public workers and retirees have been downplaying the importance of reducing this liability by separating the theoretical cost of pensions for current employees from the amount that municipalities and the state have to put aside to catch up on the current debt. The mechanism for this argument is the “normal cost” of a current employee’s pension — that is, the percentage of payroll that must be invested in order to fully fund pensions as if the past liability did not exist.

For teachers, the “normal cost” is now pegged at 11.82% of payroll, and since the teachers contribute 9.5% from their own paychecks, the city and state combined only have to put in another 2.32%. That’s what NEA-RI Executive Director Robert Walsh meant when he wrote in the Providence Journal that “for the vast majority of existing employees, the facts support no further changes” to the pension system. Get over the liability hump, in other words, and it’ll be clear sailing for public-sector retirees.

The question that hasn’t been asked, yet, is what Raimondo’s hybrid defined-contribution/defined-benefit plan will do to public costs when calculated in these terms. The answer is that it will actually increase them, as the following table shows.

Employer Contribution Rates (% of Payroll)

1) Prior and current data from Employees’ Retirement System of Rhode

Island Actuarial Valuation Report as of June 30, 2010

2) Proposal data from “Actuarial Analysis of the Rhode Island Retirement

Security Act of 2011”

3) Amortization is currently scheduled for 2029; 2035 represents reamortization.

4) The proposed system continues the assumptions that will be in effect

as of July 2012.

5) Liability amortization includes current retirees’ pensions and the portion of current employees’ pensions not covered under normal costs.

Reformers should be wary of two facts that emerge from these eye-glazing numbers:

This means that the savings of the overall pension reform rely entirely on changes to the existing system (e.g., COLAs and retirement age), because the hybrid will cost tens of millions of dollars more every year… even when the “pension crisis” is completely resolved and even if the assumptions prove accurate. And changes to the existing system are precisely the controversial elements that have battle lines being drawn.

With all the lines on the field and the questionable allegiances, taxpayers should be sure that somebody is defending their interests.

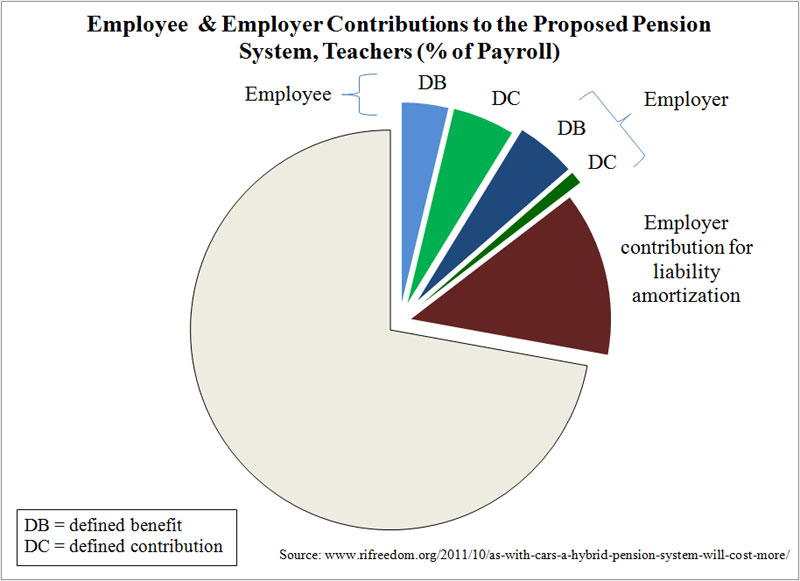

Hybrid Pies

/in Blog, Pension Reform, Recent Posts/by Justin KatzAs much as I love text and tables, they do require quite a bit of background consideration before their more interesting revelations are truly visible. So, herewith, some pie charts to illustrate my core point on the matter of General Treasurer Gina Raimondo’s hybrid pension proposal.

The first chart shows state workers’ arrangement currently in place for fiscal year 2012. Of total state worker payroll, each employee will contribute 8.75% of his or her salary to the defined benefit plan (the light-blue wedge), and the state will add in another 2.64% of payroll (the dark blue wedge). The larger part of the state’s pension expenditure, accounting for 33.7% of payroll, is the brown wedge, which will go toward amortization of the unfunded liability. In total, 45.09% of state worker payroll goes toward pensions.

Under the new pension system that General Treasurer Gina Raimondo and Governor Lincoln Chafee have proposed, state workers will put 3.75% of their salaries into the defined benefit plan (light blue) and 5% toward a defined contribution plan (leaving their total contribution the same). These amounts will be supplemented with 5.44% of payroll from the state toward the defined benefit program (dark blue) and 1% toward the defined contribution program (dark green). The amount to be put toward the unfunded liability (brown) is 14.91%, bringing the overall cost of pensions to 30.1% of payroll.

The current arrangement in place for fiscal year 2012 for teachers calls for each employee will contribute 9.5% of his or her salary to the defined benefit plan (the light-blue wedge), to which the state and local governments combined add another 2.32% of payroll (the dark blue wedge). Again, the larger part of the state’s pension expenditure, accounting for 32.93% of payroll, is the brown wedge, which will go toward amortization of the unfunded liability. In total, 44.75% of teacher payroll goes toward pensions.

Under the proposed pension system, teachers, will put 3.75% of their salaries into the defined benefit plan (light blue) and 5% toward a defined contribution plan (reducing their total contribution by 0.75% of salary). These amounts will be supplemented with 4.84% of payroll from the state toward the defined benefit program (dark blue) and 1% toward the defined contribution program (dark green). The amount to be put toward the unfunded liability (brown) is 13.27%, bringing the overall cost of pensions to 27.86% of payroll.

Justin Katz joins the RI Center for Freedom

/in News/by Mike StenhouseThe Task Force members, who will provide commentary and analysis and who may also offer to testify at upcoming committee hearings in the General Assembly, include Bob Williams (President of State Budget Solutions), Jonathan Williams (Director Tax & Fiscal Policy for ALEC), Jagadeesh Gokhale (senior fellow at the CATO institute), and Eileen Norcross (senior research fellow at the Mercatus Center).

Additional bio information for Task Force members can be found by visiting our Pension Reform page.

The RI Center for Freedom also announced that it played a central role in securing a panelist position for Josh Barro, a state budget expert from the Manhattan Institute, at the special pension forum to be conducted this October 21, 2011 by RIPEC.

Negotiating Points in the Pension Proposal

/in Blog, Pension Reform, Recent Posts/by Justin KatzUnderlying the policy complexities of the pension issue is the background give and take of financial interests and political careers. General Treasurer Gina Raimondo, for example, is free to propose pretty much anything and let the General Assembly take the heat for actual changes. As long as she stays off the unions’ “not with a 10-foot pole” list, she can run for higher office as the stern-chinned pragmatist.

Similarly, Governor Lincoln Chafee can seek to burnish his “fiscal conservative” bona fides by publicly endorsing a plan more generally seen as Raimondo’s handiwork. For their part, legislative leaders can play off the treasurer’s supposedly objective calculations and the governor’s veto power. What the public is seeing and what elected officials are planning can be two very different policies.

An October 10 Providence Journal op-ed by National Education Association Rhode Island Executive Director Robert Walsh fits neatly into that interpretation:

Obviously, Treasurer Raimondo’s proposal (onto which the union-backed Governor Lincoln Chafee has signed) goes a bit farther than that, mainly in that it completely suspends COLAs pending the pension system’s healthy recovery, it introduces a hybrid defined-benefit/defined-contribution plan, and it adjusts the retirement age upwards to Social Security standards. (Keep in mind, by the way, that various categories of employees — teachers, public safety, and so on — receive differing treatment.)

Several components of the proposal are subject to basic mathematical negotiation, meaning that the sides will trade dollar amounts in order to secure principles that they want to protect. It’s useful, therefore, to consider COLAs, retirement age, and amortization in this context.

The “Plan B” COLA calculation to which Walsh refers follows the Consumer Price Index and is capped at 3%; it also applies only to $35,000 of the pension benefit (although that number adjusts upwards every year by CPI-to-3%, as well). Raimondo’s proposal replaces the CPI with the pension’s annual net return (over a five-year average), with the cap at a 4% increase. In terms of the actuarial calculations, the upshot is that this move reduces the predicted annual COLA from 2.35% to 2%. The sticking point is that the new proposal would withhold COLAs in any year that the system is less than 80% funded, which could mean a decade or more of no increases.

That aspect of the proposal, along with the increase in retirement age, are likely to be hotly contested. And since Raimondo has crossed the Rubicon of reamortization (thus extending the number of annual state budgets until the plan is fully funded, reducing the hit each year, but also reducing investment returns), it will appear more reasonable to extend the amortization period even farther in order to “buy back” reduced benefits. So, for example, advocates for retirees might accept the later retirement age but insist that the COLA pinch be eased, with the difference in costs made up with a few more years of amortization.

But this is all a numbers game. The interesting wild card is the hybrid plan, which reformers rightfully like as a means of shifting market risk away from taxpayers and toward retirees, but which contains details that ought to make them wary. Given the complexity of that topic, I’ll take it up in a separate post.

Bank of America Debit Card Tax: a Result of Bad Legislation?

/in Blog, Liberty Bytes, Recent Posts/by RI Center for FreedomThe consequences are apparently over-whelmingly negative for Bank of America after they announced a new $5 debit card monthly usage fee. In trying to login to their website, it was down, citing slower than usual operations. Whether this is because the Bank is trying to stop protesting customers from withdrawing their funds online … or whether it’s the work of angry hackers … the real question is:

Should Bank of America take all the blame for this highly unpopular, anti-consumer new fee?

The Heritage Foundation says “No”. That this is is simply another example of federal government regulations interfering with (as opposed to regulating) normal free-market activity.

It is a gross mis-understanding of our US Constitution for the federal government to believe it has the duty to intervene in commerce via the levy of unnecessary restrictions and costly regulations.

Article I, Section 8 of the Constitution gives Congress the power to regulate commerce, so as to ensure that commerce among the states would take place under clear and predictable rules. According to Georgetown law professor Randy Barnett, our framers granted Congress the power to regulate domestic commerce in order “to make commerce regular.” Today, far too many public officials mistake the term “regulate” to mean “intervene”. And the results are predicatably bad for consumer freedom.

In the Bank of America debit card case, the Bank is imposing the new fee in anticipation of a $2 billion annual loss brought about by the “Durbin Amendment” — a provision of last year’s Dodd-Frank Wall Street financial reform bill. The measure was intended to protect America from another financial meltdown, but in reality it placed a boatload of new burdens on financial institutions and their customers. The results? Increased risks to the financial system, increased regulations, and in this case, increased costs to anyone who uses a debit card.

This fee would not likely have occured if Congress had not interevned where it does not belong.

Read the full Heritage post here …

Selfishness as the means to Restore Prosperity?

/in Blog, Political Philosophy, Recent Posts/by Mike StenhouseI attended a very interesting and thought provoking lecture at Brown University Wednesday evening (9/28/11) , featuring Dr. Yaron Brook, President of the Ayn Rand Institute. Dr. Brook, a free-market activist, provided a 30-40 minute lecture, entitled “Capitalism Without Guilt”, then took questions from the over 100 or so people in attendance, with a fair portion of them being students from Brown and other local colleges.

Here, based on my notes and personal paraphrasing, is a synopsis.

Initiating the discussion, Yaron Brook, rhetorically thanked President Obama for his plan to “fundamentally change America”. Obama’s resulting policies, he claims, have kicked off a vigorous national debate about the proper role of government, how to best create jobs, and what are free-markets and capitalism, in reality? He believes the debate will end up benefittng our country.

Brook talked about how our country is currently struggling with jobs and who creates them – the government or the private sector? He states that this issue was settled over 60 years ago; that “consumption” (as the liberals wants us to believe) is not the root of economic growth, but rather that it’s “production” and “investment”. Government stimulus programs, he says, are geared to stimulate consumption … and says this is the reason why they have never worked … anywhere, anytime for anyone. He cites the recent failed US stimulus programs that resulted in fewer jobs, and pointed to Japan, where the government re-distributed massive amounts of wealth, with the result being predictably disastrous for that once proud country.

Most stimulus created government jobs mean only in increased consumption. They are paid for by taking money away from potential investors where the money otherwise could be used to create production as well as privae sector jobs that would also result in consumption. The beaurocracy also bleeds off its share when redistributing money. Dr. Brook claims that 2-4 private may be lost for every 1 stimulus job.

Brook then spoke about the philosophy of “free” markets … that this means, barring force or fraud, that they are free to conduct business without excessive government regulation and that the matching of products and services with consumer demand is the best way to ensure a quality product at the lowest possible price, and to provide for steady economic activity and growth.

Excessive regulations and taxes, he claims, destroy free-markets and are the reason certain industry sectors can fail. He cited the 3 major sectors that collapsed in the US leading up to the 2009 recession – housing, banking, and automobiles. The common mantra was “See, capitalism failed, so government must step into to lend a helping hand”. WRONG says, Brook.

He asked: ‘What are the 3 most regulated industries and sectors in the US economy’? His answer: housing, banking, and automobiles. That it was because of over-regulation and government intervention that these industries failed. Fannie Mae (a government created, semi-private entity), he said, experienced the largest financial collapse of any entity in the history of the United States.

Each of these 3 industries, he stated, have their very own governmental Regulatory Agencies … proof positive that these sectors were not “free market” sectors; that it wasn’t the free-market (or capitalism) that failed, but rather government regulated markets that failed.

Government intervention interferes with normal market forces, by messing with the supply & demand mechanism, and more importantly, by removing the “risk” factor that is so important in regulating normal market activity. The risk of failure and loss of capital is a major incentive to behave prudently. With the current bailout/stimulus mentality, it is only natural that companies and industries would take on more risk than they normally would, knowing that the government will come to their rescue. This leads to economic bubbles, and then, economic collapse when these excessive risks begin to fail.

Brook then spoke about the creation of wealth as the primary measure of a successful economy. He asked us to think about the economic contrast of East vs West Berlin; or China (decades ago) vs Hong Kong … dramatic instances where capitalistic vs socialistic forces were at play, and the economic results were so dramatically opposite.

He then moved into the main theme of his lecture, the morality of capitalism. We have to overcome a psychological and emotional hurdle if we want to have a successful economy again.

GET OVER IT … BE SELFISH. He avers that markets exist for people to enhance their lives, meaning some people will make money – lots of it – and consumers will receive, in return, products and services that will make their lives better. He offers this as the definition of “selfishness” … a natural , self-preserving kind of attitude vs the evil connotation that we too often place on the term. That this is a human thing … a good thing. That in a true free-market, mutual selfishness and mutual profit transaction we choose to make. Even that “naked selfishness” is in everyone’s best self-interests.

Dr. Brook then stated what I felt was the crux of his provocative lecture: that our evolved and perverse sense of morality is what is destroying the American free-enterprise system. That in being politically correct, that people are viewed in positive way only when they put others first, instead of prioritizing their own rational self-interests. That philanthropists, for example, hold a much higher esteem in today’s society, than the wealthy. That the only way the wealthy, like Bill Gates for example, can obtain a positive public image is by giving away their money … not for risking their own capital, conceiving and producing a product that consumers demand, hiring lots of people, and yes, making a ton of money. That Bill Gates was initially derided publicly for being a successful businessman (the scorned capitalist), but is now more loved and accepted because of his Foundation (the beloved philanthropist). That if he gave up ALL of his fortune, and lived in a hut, we might even consider him a saint.

This standard of judgment, Brook says, is far too high a bar if we want free-markets to work effectively. That we must accept being “rationally selfish” and encourage risk and success for the greater public benefit.

What about Bernie Madoff? Wasn’t that selfishness? NO, says Brook. How could it possibly be in his long-term self interest to rip off his family, his friends, and many others, knowing all along that he would be caught someday? Brook referred to Madoff’s Ponzi-scheme as more of a delusional kind of near-term emotionally driven action vs a well thought-out plan to pursue self-happiness. It is this latter kind of selfishness that Brook promotes.

That pursuit of one’s own self-interests, or happiness, via mutually beneficial transactions, is a positive and necessary economic stimulus on its own. Conversely, what many believe as selfishness “at the expense” of others … is a very different thing.

He then asked us to consider the uniqueness and individuality of every single person. In what environment would a person with some wealth best be able to invest and prosper even more? In what environment could underprivileged people best find a way to climb out of the morass and pursue whatever might make them happy? A government controlled environment, where everyone is considered homogenous, and incentivized against acting on their own best judgment; or a free environment where people can determine their own futures based on their own unique dreams and capabilities?

Free-markets, Brook strongly contends, are the only way for each person to achieve their highest level of self-interest, or happiness. Happiness is not purely materialistic; it’s whatever rationally chosen goal we want it to be.

That this pursuit of self-interest is NOT immoral. That “sacrifice” is not the only way to be moral, as our society now seems to believe.

That our nation’s founding fathers wrote about pursuit of individual happiness: They did not write about sacrifice or being responsible to others; that charity is an individual choice, and that it should not be the role of our government to legislate economic equality, or even to have a position on whether or not that is a good thing.

That sacrifice, can actually be a bad thing, especially when government mandates it, by taking wealth or property from one person and giving it to another.

What is sacrifice, he asks? The act of sacrifice is giving something (time or money, for example) and getting something less in return; a win-lose scenario.

Alternatively, free-markets encourage win-win scenarios. People trade for something that has equal or greater value than what they give up. When we buy a car for $20,000, we get a car we believe has more than that much value. The car-dealer gives up a product that cost him less than that much to sell. Both sides win.

Why would our society value win-lose propositions over win-win propositions?

At this point, Dr. Brook ended his lecture and accepted questions from the crowd. Most of the questions, especially from the student attendees, challenged many of Brook’s premises with the expected angles: Why are the top-7 rated cities in terms of standard of living based in what Brook would call ‘socialist’ Europe, not the US? Didn’t the founding fathers allow slavery? Isn’t sacrifice a good thing, for instance, for our children? Didn’t the founders talk about equality for all? What about individual property rights, shouldn’t there be more of collective, common ownership? Doesn’t industry and pollution infringe on another person’s property and rights? What about the Christian values of loving your neighbor as yourself … vs Dr. Brooks’ selfishness philosophy? What about welfare, don’t we have an obligation to help the disadvantaged?

While Brook struggled for responses to only one or two very pointed questions, he provided fascinating responses to most of these queries.

Europe, he said, is a dying region. That what the economic crisis there now will only get worse as more and more of the unsustainable promises that have been made to too many workers and retirees grows in the coming years. While he questioned the standards by which those cities were rated, he also admitted that America, in his view, is no longer a true free-market economy, and that our cities and national standard of living is slowly being destroyed by the big government, anti capitalistic economy. He does not understand why many look at Europe with such admiration. It’s the past, he says, full of rich history – yes, but a doomed society. Asian economies (even China to some extent) are the future, where certain capitalistic principles have been embraced and where wealth is growing in enormous strides. America must choose which way to go.

Regarding slavery, he stated that it was the way of the world 250 years ago. That America was not alone, that the slave trade thrived in Africa, that Europe had serfs, etc

He argued THAT IS WAS INDEED THE VERY PRINCIPLES OF ‘FREEDOM’ IN OUR OWN U.S. FOUNDING DOCUMENTS THAT INVITABLY LED TO THE ABOLITION OF SLAVERY IN AMERICA! That our founders were not always perfect in practice, but they were much more so in theory.

Regarding sacrifice, Brook, said that he doesn’t sacrifice for his children. That staying home with his kids, instead of going out with his friends, is not a sacrifice, but rather, a free-market choice that enhances both him and his kids by spending time together, worth more to him (and to them) than spending time apart. Providing money or material goods to his kids is not considered a sacrifice either, any more than buying a car is a sacrifice. Why would we call something a sacrifice if we invest in our kids (with their well-being as what we receive in return), yet not consider investing in a car a sacrifice?

On the constitutional question of equality, Dr. Brook states that equality was intended only in terms of the law. That in the eyes of the law, unlike in Europe, from whence our forefathers fled, that everyone would be treated equally. That it wouldn’t matter what your race, creed, gender, status, or wealth was … that the law would treat everyone the same. This has nothing to do with equal outcomes among citizens.

Protecting individual property rights, he said is a critical component of a free-economy. That via a just court-system, that disputes and infringements of rights would be settled in a natural and moral kind of way. That contingency legal fees were created so that the poor could also have a way to bring suit if they were wronged. That the proper role of government is not to create massive amounts of new regulations in an attempt to restrict property rights so as to not potentially harm someone else or some fuzzy common good, but rather to protect property rights, and institute only those few common-sense laws that serve this purpose.

Regarding pollution of common items such as water or air, Brook gave perhaps his most provocative response: that POLLUTION SHOULD BE CELEBRATED! Pollution is a by-product of industrial progress, that it is a necessary cost to moving a society forward. He posed this scenario: think of London in the 1800’s and the huge particles of ash that most citizens inhaled from coal-powered factories. That if we applied today’s conventional solutions to that problem, we would have shut down those factories … and the INDUSTRIAL REVOLUTION WOULD NEVER HAVE OCCURRED! All of the advances in transportation and construction would never have happened.

Pollution, once industry advances and becomes wealthy enough and technologically capable of dealing with it, can be solved. Then, the next technological innovation produces a new pollution concern, which should be tolerated for a while before being solved … repeating this cycle which goes on and on. This is merely progress. And, society only improves with each cycle. He asked us, with all of our talk of pollution ruining our planet and our lives, to think about life expectancy progress: In the 1800’s, humans were expected to live not much past their forties-fifties. In the 1900’s it was sixties-seventies. Now it is seventies-eighties.

Continuing with the pollution issue, he said, people decide where to live and work, and that it’s their personal choice whether or not to put up with pollution, traffic, or any other problem in any given area. Look how many millions choose to live in LA, despite these issues. He talked about Simi Valley, right outside of LA. Before the hi-tech industry, it was nothing, just land. But because of the great job opportunities created, thousands migrated there from all over the country, putting up with LA smog and traffic, because overall, it offered them a better chance at life than where they came from. The free-market at work.

Finishing up the pollution issue, Brook asked us to think about Cambodia, for example, a country he had visited in recent years. Most of their citizens live in abject poverty, in huts in swamp areas. Brook proclaimed that the only way that Cambodia could raise itself into prosperity would be to bring on industry, and yes, the pollution that goes with it. That pollution in this case should be welcomed, if not celebrated … as a necessary transitional phase and as a sign of progress!

He dismissed the so-asked premise of Christian love for thy neighbor as thyself. He said this is unrealistic, that everyone loves themselves and their own families more than thy neighbor, and that it is nothing more than religions trying to impose “guilt” on people, as a way to have them conform with the impossible goal of ‘equal outcomes’ for everyone. He said none of us should feel guilt for loving ourselves more than our neighbors; that this kind of selfishness is natural and healthy for humans and for our economic well-being. I would personally add, that individuals freely choosing to help their neighbors, is a noble thing … but that government forcing people to help others is nothing short of tyranny.

The final session I participated in, dealt with welfare – a kind of an extension of the love thy neighbor theme. It was discussed that the way taxes and subsidies work in the real world is not a matter of debate. Laws of economics dictate that when we tax something, we get less of it (the premise behind taxing cigarettes, because society believes it is a bad thing to smoke, so therefore we should craft tax policies that discourage the activity). Conversely, when we subsidize something, we get more of it, like tax-deductions for buying a home (a good thing, society says). So, if this is the case, why do we tax work and investments when it means we will get less of each? … while at the same time we subsidize unemployment and idleness, which means we will get more of each of those?

Dr. Brook went on to claim that the biggest victims of the big government, forced responsibility for thy neighbor mentality, are the very people that the policies portend to serve. Only true freedom – to pursue their own dreams – can allow them to prosper. Welfare and other entitlement type programs condemn them to dependence and low expectations; in a way, institutionalizing them. This is not the America our founders envisioned.

In fact, Brook claims, it is IMMORAL to consider the poor as a homogeneous lot that is incapable of raising itself out of whatever morass they may be in. IT IS INSULTING! He went on to say that all people, including the underprivileged, will be more content when they achieve something based on their own merit and work …that selfishness and the resulting self-esteem is the true measure of happiness … and the only way to achieve prosperity!

***

This was a fascinating 90-minute program, which continued after I had to leave. A few of the students were appalled at some of Dr. Brook’s assertions, while many of the adults were part of the choir. No matter your views, the issues discussed are indeed at the core of the critical debate now underway throughout our nation.

I encourage every single American to take the time and effort to think through these issues, with the goal of arriving at some economic/political philosophy that rings true to you, whether or not you agree with Mr. Brook. Then remain vigilant, stay involved, speak out, support whatever cause you believe in, and adjust your views, as necessary.

“The price of freedom is eternal vigilance” … Thomas Jefferson

Citizens vigilance is the only way our uniquely American form of government can best protect the freedoms of our citizens and allow us to pursue our own idea of happiness and to achieve prosperity.

Mike Stenhouse is the CEO for the Rhode Island Center for Freedom, the leading free-enterprise think-tank in Rhode Island.

Gio Cicione on Newsmakers (Ch-12 & Ch-11) this past Sunday

/in Blog, News, Pension Reform/by RI Center for FreedomOur senior policy advisor, Gio Cicione, appeared this past Sunday, 9/25, on Channel-12. Tim White and co. reviewed our Center’r recent Policy Brief on the legal authority to adjust state pensions as well as our recommendation that the General Assembly clarify the law with legislation that states this intent due to a critical “public purpose”. Check back soon for a link to the video.

Legal Authority to Adjust State Pension Plans

/in Pension Reform, Policy, Recent Posts/by RI Center for FreedomTo read the full version, with citations, click here for PDF …

Exorbitant retirement benefits are threatening the ability of Rhode Island and its municipalities to deliver essential government services and, in one of the most extreme cases in the nation, one of Rhode Island’s municipalities has been driven into bankruptcy because of an inability to resolve pension debt issues through negotiation.

A recent decision by Rhode Island Superior Court Justice Taft-Carter has called into question whether the state and its municipalities have the flexibility to unilaterally adjust pension benefits. Our Center believes that Rhode Island does have broad legal flexibility to adjust existing pension benefits in order to stave off bankruptcy or avoid dramatic reductions in essential services. This policy brief considers the legal background of that question and suggests proactive steps which the legislature can take in order to guide future courts as they consider the constitutionality of proposed reforms.

Most estimates place Rhode Island’s state level unfunded liability at approximately $6,800,000,000 ; a figure on scale with the state annual budget and roughly twice what the state collects in revenues in a year. Of great concern is that such estimates assume investment returns in the pension funds of 7.5 percent while many states are considering using estimates pegged to the money they pay for bond issues – potentially closer to 5 percent. If Rhode Island was to follow that more prudent approach, the unfunded liability would likely exceed twice the current estimates.

More importantly, a practical discount rate would more accurately reflect the expectations of beneficiaries as to the risk of their retirement plans. State and municipal retirees have long been led to believe that pensions were guaranteed by the government. In fact, pensions have always been some combination of promise and ‘gratuity,’ with payouts left to the discretion of politicians and future taxpayers.

And while a lower discount rate would expand the unfunded liability on paper, perhaps it is better to recognize that, for retirees, a conservative estimate of returns is more properly in line with their tolerance for risk.

Unfortunately, for current pensioners, those less conservative estimates of 7.5% returns or higher have been used for decades in Rhode Island and, while we can take the more prudent approach going forward, we must accept that for current participants in our retirement system, the money they were promised is simply not there.

Like the state, municipalities suffer under the burdens of their own liabilities and, with well over one-hundred separate plans, Rhode Island fails to realize savings related to economies of scale and more experienced oversight: Already some of our pensioners are suffering the consequences.

With the City of Central Falls in bankruptcy, its retirees are facing potential cuts to their pension checks of more than half what they had been receiving; a dramatic reduction to a fixed income that many cannot reasonably expect to afford. Poor planning, non-existent oversight, and bad political choices will, in a very real sense, be driving some of these pensioners into poverty.

As the Wall Street Journal’s David Wessel says, “Bankruptcy is a last resort. To avoid it, state and local governments need an alternative that is less unappealing. They don’t have one yet.” With 38 other cities and towns in Rhode Island facing the impacts of the same crisis, Governor Chafee recently called for alternate suggestions to the futility of trying to tax our way out of this deep hole.

There is growing bi-partisan recognition that exorbitant retirement benefits granted to civil service unions are threatening the ability of states and cities to provide essential services without implementing job-destroying tax increases. Indeed, even former San Francisco Mayor and California State Assembly Speaker Willie Brown (D), a staunch public union supporter, recognizes that lucrative defined benefit pension plans are unsustainable. John Fund of the Wall Street Journal writes about a column Willie Brown authored for the San Francisco Chronicle in which Brown lamented that civil service was out of control.

“The deal used to be that civil servants were paid less than private sector workers in exchange for an understanding that they had job security for life. But we politicians – pushed by our friends in labor – gradually expanded pay and benefits … while keeping the job protections and layering on incredibly generous retirement packages.”

Brown later told Fund, “When I was Speaker I was in charge of passing spending. When I became mayor I was in charge of paying for that spending. It was a wake-up call.”

Fortunately, despite the concerns raised by a recent Rhode Island Superior Court decision in the matter of Council 94 v. Carcieri , a more appealing remedy than bankruptcy exists. It is contained in two U.S. Supreme Court cases, Energy Reserves Group v. Kansas Power & Light and United States Trust Company of New York v. New Jersey .

States and (with state authority) municipalities, can unilaterally reduce excess retirement benefits under circumstances now widely prevailing. There is a widespread misunderstanding in many states that the U.S. Constitution prohibits these adjustments but there is no such prohibition. The Council 94 v. Carcieri decision has been misinterpreted as suggesting that Rhode Island has some unique version of that prohibition but that is not what the decision says.

In short, the Council 94 v. Carcieri decision simply states that some Rhode Island pensioners have certain contract rights. That is far from saying that those contract rights cannot be revoked when the state faces a pressing need.

A report published earlier this year by The Pew Center on the States confirmed that legislators’ belief that retirement benefits cannot be modified is only an assumption. “It is uncertain in many states what the constitutional protections are because they haven’t been tested or at least thoroughly tested in the courts,” says Ron Snell, director of state services at the National Conference of State Legislatures. “But state legislators have assumed the protections to be quite strong.”

This assumption that there is constitutional prohibition against benefit modification is a misunderstanding. Case precedent is clear that, under circumstances currently prevailing in many places, retirement benefits may be reduced. The U.S. Supreme Court’s interpretation of the U.S. Constitution lays out the rules by which states may modify their contractual obligations.

The facts required by the clear language of the governing cases are directly applicable to the situation in RI. These cases give us clear guidance.

There are scores of state and lower federal court cases holding against attempts to modify vested pension benefits. Upon examination, few, if any, of these cases were brought on the grounds set forth as applicable by the U.S. Supreme Court. Accordingly, these state and lower court cases are irrelevant to the current circumstances. They were special, very narrow cases that did not spring from legislative action to remedy a broad and general social or economic problem. The governing law may be summarized as follows:

• A state may impair a contractual right if it has a significant and legitimate public purpose such as remedying a broad and general social or economic problem, such as elimination of unforeseen windfall profits.

• A state may do so as an exercise of its police power.

• A contractual impairment may be constitutional if it is reasonable and necessary to serve an important public purpose.

When a state reduces an obligation, the courts will inquire as to whether the adjustment of “the rights and responsibilities of contracting parties is based upon reasonable conditions and is of a character appropriate to the public purpose justifying the legislation’s adoption. Courts properly defer to legislative judgment as to the necessity and reasonableness of a particular measure.”

When a state impairs its own contractual obligations (as is the case with retirement benefits promises) the courts and certain other material factors come into play. The courts will hold the state to a somewhat higher standard of scrutiny as to the policy’s necessity and reasonableness. Therefore, a prospering state with a well-funded retirement plan could not arbitrarily cut promised benefits. But a state struggling to the point of eliminating essential services or a municipality facing insolvency certainly may, under the law, modify existing retirement benefits. Furthermore, it is entirely settled law that one legislature may not abridge the powers of a succeeding legislature and cannot bargain away the police power of a state.

So, in addition to the realistic reading of the contracts clause itself, and as recognized by the Supreme Court, an independent doctrine holds that the Constitution’s contract clause does not require a state to adhere to a contract that surrenders an essential attribute of sovereignty. The classic doctrine that one legislature can neither abridge the powers of a succeeding legislature nor bargain away its police power permits states to reduce their public employee pension obligations under the circumstances now besetting many states.

The law does not permit a state to impair its contractual obligations arbitrarily or with impunity. The courts will look into whether a proposed impairment is reasonable and necessary to “serve an important public purpose”. Modifying existing pension benefits because the cost of providing them threatens a state or municipality’s ability to provide essential services or precipitating insolvency certainly rises to the standard of “remedying a broad and general social or economic problem.”

According to several well accepted doctrines and the clear holdings of the United States Supreme Court, if a state or, with a state’s authority, a municipality finds itself confronting a severe fiscal challenge based on exorbitant retirement pension obligations it is well within its inherent police powers to reduce its obligations to a reasonable level.

The courts will not rubber-stamp an arbitrary decision. Yet it is difficult to imagine a court finding that a reduction of such benefits to private sector levels for retirees of comparable circumstances to be ‘unreasonable,’ especially when the cost of providing those benefits threatens the ability to provide essential services.

Current evidence of reasonableness and necessity of such reductions includes:

1. extensive studies by respected nonpartisan institutes;

2. reports from respected media sources from across the political spectrum;

3. critiques by elected officials nationwide, both liberal and conservative, Democrat and Republican, of unjustifiably extravagant retirement benefits;

4. the documented growing inability of states and municipalities burdened by the cost of these retirement benefits to provide essential government services or maintain solvency.

Taken together, these factors are highly persuasive that it is reasonable and necessary to adjust certain states’ and municipalities’ pension obligations to the median level of private sector comparable positions. The power to unilaterally, though reasonably, reduce benefits provides a great deal more latitude for officials than many knew they had.

By taking this power into account, the Governor, the Treasurer, and the Rhode Island legislators who are considering solutions for addressing our pension crisis will find themselves positioned with many new options that they may not have realized were available.

Recognizing that, public officials simply may choose to reduce benefits of public workers to demonstrably reasonable levels. A good faith demonstration is all a state needs to reduce retirement benefits. This is simply done by showing they are implementing a remedy to a general economic problem and that such reductions are necessary and reasonable.

One approach, and one that has the added benefit of giving future courts a well-defined outline of legislative intent, would be to introduce and pass legislation laying out clearly and without hesitation the dramatic economic crisis now faced by the state. Such an Act would describe the need to assess the liabilities of the state and municipal pension funds with reference to rates of return reasonably in line with pensioners’ expectations of risk, would describe the limitation on additional sources of revenue to find the massive deficit, and would reference the dramatic reductions in essential services that are unavoidable if we fail to address the unfunded pension liability.

Therefore, the Rhode Island Center for Freedom and Prosperity recommends that the Rhode Island legislature acknowledge, through amendments to the laws governing Rhode Island’s state and local pension systems, that:

a. Pension benefits are promises limited by the ability of the system to pay, and are not binding contracts with pensioners;

b. A reasonable rate of return for pension investments should be equivalent to that of high-quality corporate bonds, as this is more in line with pensioner’s expectations as to the security of their retirement funds;

c. The unfunded liability of the state should be calculated using these more conservative rates and should be reduced to zero over a clearly defined period of time by modifications to existing pension plans that fairly reflect the economic circumstances we face as a state today and the detrimental impact on essential state services that this liability creates.

We further recommend that an extensive public record of such findings be established and preserved in order to leave no questions as to legislative intent and the factual basis for any proposed reforms. By taking this added step the executive branch and the general assembly will have made the job of the courts in ratifying such reforms all the easier, hopefully avoiding further costly legal battles, and providing pensioners with the clarity and predictability that they deserve.

***

About The Author

Giovanni D. Cicione Esq. is the Senor Policy Advisor to the Rhode Island Center for Freedom and Prosperity, a non-partisan and non-profit public policy group that advocates for free enterprise solutions to societal problems and for the protection of personal freedom. He received his Juris Doctor from Boston University Law School, a bachelors degree in Philosophy from George Mason University, and is a member of the Bar of the State of Rhode Island and of the Commonwealth of Massachusetts.

***

To read the full version, with citations, click here for PDF …