Jobs & Opportunity Index (JOI), December 2019: Signs of Growth Foretell a Revision

The final report for 2019 of the RI Center for Freedom & Prosperity’s Jobs & Opportunity Index (JOI) found Rhode Island still with its overall ranking of 47th in the country. Data for all 12 datapoints of the index except federal taxes were updated for this iteration, and the only negatives, compared with September, were a slight increase in marginally attached workers and a more-significant increase in state and local taxes.

Employment and labor force were up about 0.7% and 0.6%, respectively, since the first-reported numbers for September, and RI-based jobs increased 0.5%. With the national economy continuing to improve, Medicaid enrollment fell 3.2%, while TANF (cash welfare) rolls shrank by 24.0%. SNAP enrollment was down 0.3%. The Ocean State had 16.5% fewer residents who counted as long-term unemployed and 7.8% fewer who were working only part time because more work was not available. However, the number counting as marginally attached increased 2.1%.

When it comes to money, personal income was up a modest 0.3% on an annualized basis, which amounted to $161 million more income. However, state and local taxation increased 1.4%, or $50 million, resulting not only from the increased income, but also increases in taxation after recent legislative sessions.

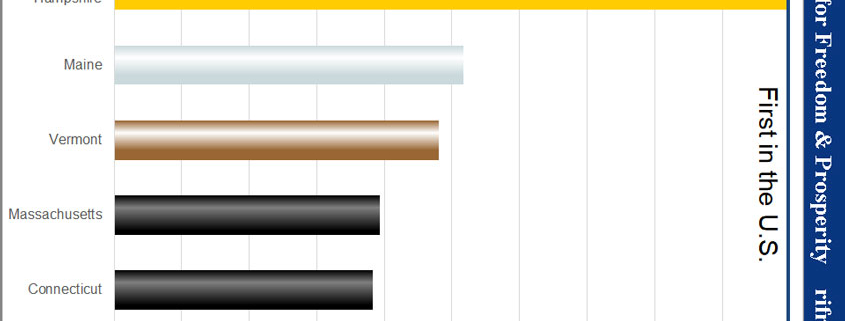

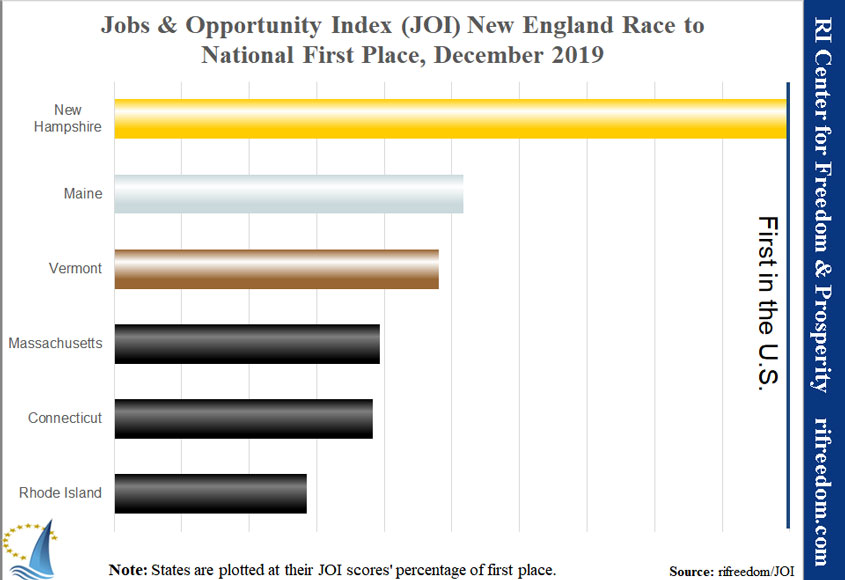

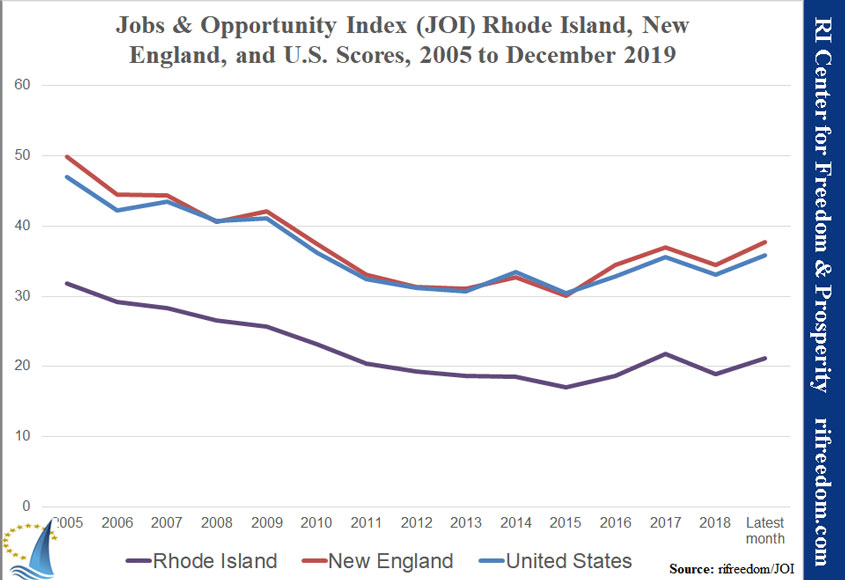

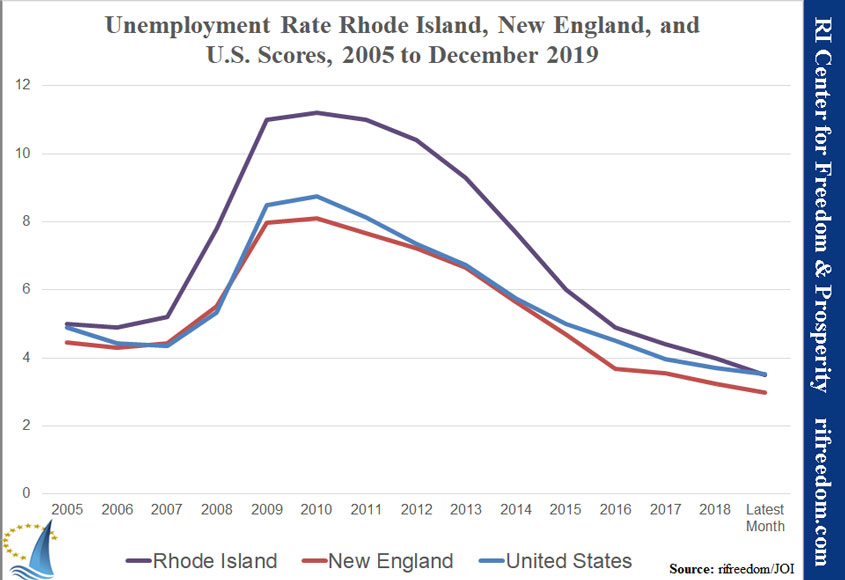

The first chart shows RI remaining last in New England on JOI, at 47th. New Hampshire held the 1st spot, nationally. Maine improved its standing two spots, to 17th, while Vermont continued to slip, to 21st. Massachusetts moved up a step to 36th, and Connecticut advanced to 37th. The second chart shows the gaps between RI and New England and the United States on JOI, and the third chart shows the gaps in the official unemployment rate.

Results for the three underlying JOI factors were:

- Job Outlook Factor (optimism that adequate work is available): RI advanced five spots, to 27th.

- Freedom Factor (the level of work against reliance on welfare programs): RI remained 41st.

- Prosperity Factor (the financial motivation of income versus taxes): RI remained 47th.

Click here for the corresponding employment post on the Ocean State Current.