Progressive Land of Make Believe Bad Bill of the Week: $10K Pays The Way (H8018)

Progressive lawmakers are once again seeking to hand out “free stuff”, this time to wealthy-out of staters, in a misguided attempt to bribe them to move to Rhode Island. The legislation, House bill H8018, has been named the “Progressive Land of Make Believe Bad Bill of the Week” by the RI Center for Freedom & Prosperity, and is an individual-level extension of the state’s failed corporate welfare strategy.

“If we have to pay families, students, and businesses to move to or remain in Rhode Island, to survive our state’s oppressive tax and regulatory climate, then something is very wrong,” said Mike Stenhouse, the Center’s CEO. “Worse than the obvious face-value inanity of the bill, the ignorant belief of how an economy and family dynamics actually work is what is most troubling. The legislation openly acknowledges the negative economy in our state, yet, as with other progressive policies, it tries to band-aid the symptom rather than cure the core illness. ”

Dubbed by the Center as the #10kPaysTheWay Act, the legislation, sponsored by Representative Carlos Tobon, a progressive-Democrat from Pawtucket, pretends that taxpayer funded government hand-outs would be incentive-enough for upper-middle income people to relocate their lives to the Ocean State. It is the false premise of the progressive ideology that more government dependency is what people want; in this case, in desperate hope of increasing our state’s population so as to avoid losing one of its two U.S House of Representative seats after the 2020 national census is tabulated.

While it is unclear how much of a population increase Rhode Island might need to preclude losing a Congressional seat, the legislation seeks to pay up to 30,000 new families. The cost to state taxpayers for this program, estimated at $300 Million, at the proposed handout rate of $10,000 per family … but only to wealthier families that make over $100,000 per year.

There are so many make-believe assumptions underlying this bill that do not exist in the real world, that it is difficult to know where to begin to enumerate them:

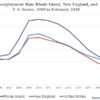

- Families have left Rhode Island not because of deficient government programs, but because of sub-standard job and educational opportunities. Until we can break away from the self-imposed budgetary constraints and special interest influences that impede reforms in our state, Rhode Island’s bottom-10 business climate and family prosperity rankings, will continue to make Rhode Island a relatively inhospitable place to build a career and raise a family.

- This regressive ‘wealthy-welfare’ scheme is unfair. Not only would all current Rhode Island residents, including low-income families, be taxed more so that wealthy out-of-state families can be given our money, but those in-state families that have worked hard to become successful will receive nothing. This is similar to how existing Ocean State businesses have to pay for corporate tax credit handouts to other companies, often their own competitors.

- People not want to be dependent on government. Current and would-be Rhode Islanders want to live productive, soul-fulfilling, self-sufficient, and prosperous lives … even though progressives like to pretend this that more government programs define success.

- A government hand-out is not enough to overcome the “long-term and short-term negative economic trends” that the legislation itself admits are currently plaguing our state. Already damaged by too many current job-killing progressive policies, more progressive policies cannot possibly make our state more attractive to families and entrepreneurs.

- Rhode Island’s population would not likely increase. As with most tax schemes, progressives pretend that there will be no adverse economic impact or other unintended consequence to their simple-minded and purely emotional-based policies. In the real world, tax policy drives behavior. In this case, the increased taxes that will be heaped on every family and business will cause even more people to flee our state.

- Most importantly, progressives pretend that the obvious solution to Rhode Island’s economic and population stagnation is not staring them directly in the face. Proving that the theoretical benefits of the tax and regulatory reductions that our Center have espoused since its inception in 2011, and which is the foundation of conservative economic policy, the recently implemented federal tax and regulatory reductions have led to unprecedented economic optimism and renewed economic growth across America.

Similarly, if Rhode Island were to abandon its government-centric corporate-welfare and wealthy-welfare agenda, and instead start working on creating a reality-based and improved economic climate, where businesses and families can thrive on their own and without costly government assistance, the Ocean State might soon be able to regain the Congressional seat that progressive policies have likely already doomed us to lose.

Leave a Reply

Want to join the discussion?Feel free to contribute!