REJECT QUESTIONS #4–7 AND $321,000,000 IN WASTE

Time for Rhode Island to Exercise Fiscal Restraint… Like Families Do

Rhode Island cannot afford to sink any deeper into debt by passing unnecessary, wasteful, and costly new bond measures. Voters should keep in mind that ballot bonds are not a popularity contest, but rather, by approving any of the five state bond offerings in 2016 (questions # 3–7), voters will be putting the State of Rhode Island into even greater debt.

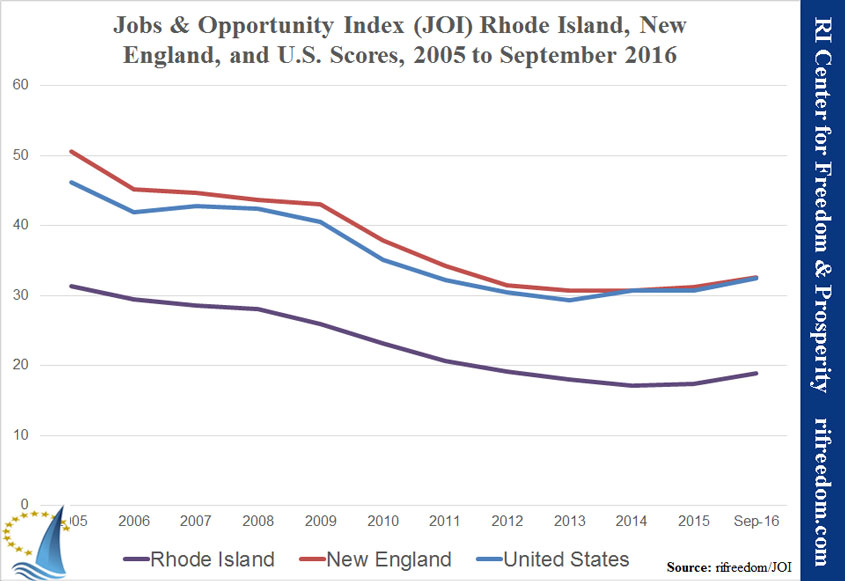

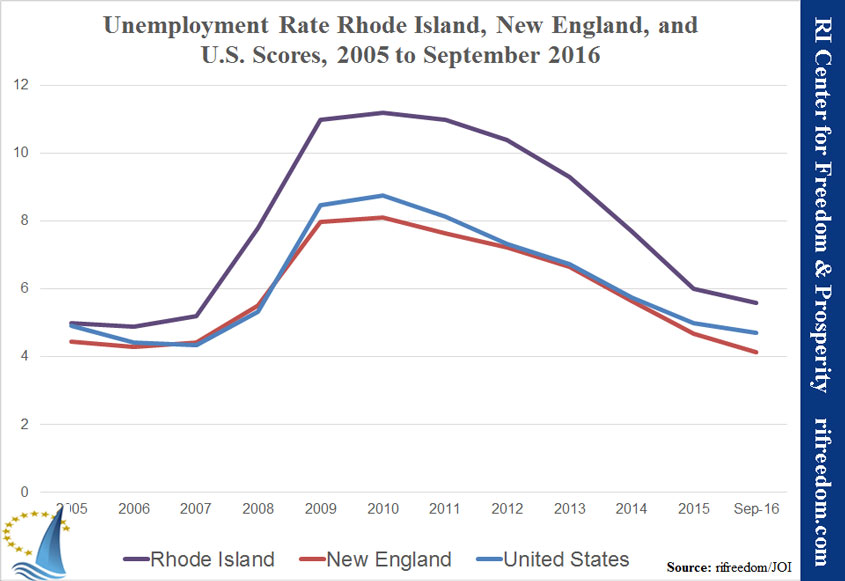

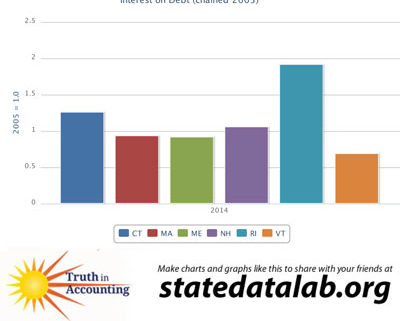

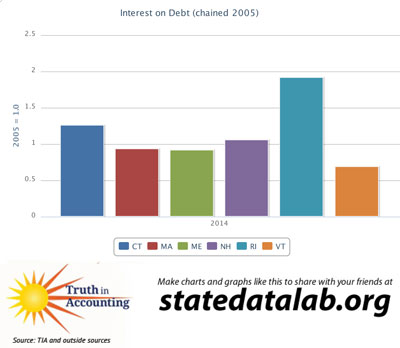

Ocean State taxpayers already are suffering from the largest “interest on debt” burden of any state in New England, with interest around $550 per year for every man, woman, and child in the state, compared with a $300 average for all states. Since 2005, related interest payments have increased by 90% in Rhode Island, with Connecticut at 25%, and New Hampshire at 10%. The three other New England states actually saw decreases.

Nationally, the average increase is just 25%, while Illinois, considered by many to be the most fiscally troubled state in the nation, saw a 45% increase.

By these measures, Rhode Island’s 90% increase in debt-interest payments dwarfs other states. This level of fiscal irresponsibility by our state’s political class should not be worsened by voters in 2016.

Rhode Island families, who rank just 48th on the national Family Prosperity Index, have long had to tighten their belts when it comes to spending and debt. Approving any of these bond measures would place a future debt burden on our own children!

It is time for the State of Rhode Island to show similar restraint. On November 8, it is up to voters actually to do the tightening by voting to reject state questions #4–7. These bonds, totaling $200,500,000 in new debt — over $321,000,000 including interest payments — will also advance the controversial RhodeMap RI agenda as well as more 38 Studios–style corporate-welfare programs as recommended by the discredited Brookings Institution report.

It is a myth that advancing smart growth and sustainable development boondoggles such as campus innovation centers, subsidized affordable housing, green infrastructure, and government land acquisition programs can produce a positive return on investment. The reality is these programs merely increase the level of government intervention in our lives, while costing millions to taxpayers.

Summary: Voters should decide their own priorities, of course, but for the reasons described below, the Center can clearly recommend to approve only one ballot measure: #2, asking for “ethics reform” approval. Of the five spending bonds, as discussed below, only #3, $27 million for veterans homes, should be given any serious consideration by voters.

FIRST THE REJECTIONS (QUESTIONS #4–7)

#4: Higher Education Bonds

Principal: $45,500,000

Total estimated cost: $72,937,126

Discussion: Not only does this bond increase Rhode Islanders’ debt burden, but it also puts taxpayers, the state government, and college students in bed with private, for-profit companies. The money wouldn’t just invest in new buildings, but it would also fund a new program that helps private corporations use public resources to develop “products, services, and businesses.”

#5: Port Infrastructure Bonds

Principal: $70,000,000

Total estimated cost: $112,210,962

Discussion: This new debt would not only move business costs off of the private businesses that use the ports in Quonset and Providence, but it would also hand 25 acres of Providence real estate over to the government and a non-profit company acting in its behalf.

#6: Property Takeover and Development Bonds

Principal: $35,000,000

Total estimated cost: $56,105,481

Discussion: Of all the bonds on the ballot, this one teaches most clearly the lesson that bonds are not just borrowing for infrastructure, but are policy decisions. Of the total, $8,000,000 will go toward the direct government purchase of land or property rights, some of it for resale or lease at heavy discounts to preferred individuals and businesses. When the Center began investigating the new practice of the state’s purchasing farmland, officials pointed to a bond on the 2014 ballot that had authorized such action. These bonds allow the state government to buy up even more open space, recreation land, and farmland while also creating a windfall for private construction companies and non-profits.

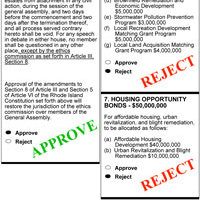

#7: Affordable Housing Bonds

Principal: $50,000,000

Total estimated cost: $80,150,687

Discussion: These bonds would feed what has become an affordable housing industry in Rhode Island, with overlapping interests of construction companies, non-profits, politicians, and government agents. Burdening Rhode Islanders with yet more unaffordable debt is not the way to help us pay our housing bills.

MAYBE, APPROVE, MAYBE (QUESTIONS #1–3)

#1: Tiverton Casino

Maybe

Discussion: The first question on the ballot will essentially allow the state government, acting through the private Twin River Management Group, to construct and operate a casino in Tiverton, on the border of Fall River, Massachusetts. (Tiverton residents will also have to pass their own local ballot question.)

The Center’s emphasis on freedom would generally lead us to support the right of individuals to engage in activities such as gambling if that is what they want to do. On the other hand, our preference for a very limited scope for government leaves us wary of creating a monopoly market for government to enter as if it were some sort of organized crime syndicate. The case for gambling on principles of freedom weakens to the extent that Americans are only able to gamble under the watchful eye — and for the direct profit — of the government.

However, this ballot question does not create that dynamic. Indeed, one could characterize the Tiverton casino not so much as a new operation, but as a new location for Newport Grand, which would be closed if Tiverton opens. Granted, a Tiverton casino will be an expanded casino, but voters may reasonably see the difference as minimal and balance it against an expected relief of pressure to increase Rhode Island’s already-high taxes.

#2: Ethics Commission Authority over the General Assembly

Approve

Discussion: A member of our staff recently received the intriguing question of whether giving the unelected Ethics Commission authority over the elected General Assembly contradicts the Center’s preference for smaller, less-intrusive government. To the contrary, our state and our nation are constructed so as to ensure a balance of powers, and in the case of legislators’ immunity to Ethics Commission investigation, the legislature is dramatically unbalanced.

In offering this assessment, we would stress our skepticism of the Ethics Commission’s execution of its role. With members’ terms extending into decades, even though state law is supposed to limit them to five years, and with the commission’s decisions sometimes seeming to float between arbitrary and abstruse, we aren’t confident that this renewed oversight power will make a great deal of practical difference.

But these are pragmatic considerations, whereas the ballot question would be procedural. A future governor and legislature appointing a different sort of commissioner, with greater turnover, will do the state government more good if those commissioners can address corruption among legislators.

#3: Veterans Home Bonds

Maybe

Principal: $27,000,000

Total estimated cost: $43,281,371

Discussion: As a baseline judgment, we oppose any and all new debt for the state government of Rhode Island at this time. Too often, it seems, voters see bonds as a way to access free money for projects that the profligate spending of the government precludes.

Nonetheless, we cannot ignore the sacrifice and dedication of America’s veterans or the unacceptable treatment that they have received so visibly from our government in recent years. Voters should therefore weigh the practice of borrowing and the implicit boon to labor unions that it represents with the value of developing infrastructure for the benefit of those to whom we owe our freedom.