.

“Is it so unimaginable to our critics that there are indeed many people who volunteer their support to our Center, and who also believe that a limited, transparent government is the best interests of the average Rhode Islander?” … Mike Stenhouse, CEO.

THE FULL STORY

In recent months, a national smear campaign was launched by left-leaning groups such as Progress Now and the Center for Media and Democracy to attempt to call into question the increasingly effective work of state-based think tanks like our RI Center for Freedom & Prosperity.

There have been dozens of unfounded allegations from the left, including our own U.S. Senator Sheldon Whitehouse, falsely claiming that the groups like ours are “phony” and engaged in “dirty business” and “dirty tricks” in advancing the agenda of out-of-state rich people who supposedly fund our operations and determine the issues we promote. Since then our Center has occasionally been asked about these baseless accusations.

Providence Journal article confirms that Center operates in a nonpartisan manner, and in full-compliance with federal law.

The Providence Journal published a related front-page story this week, after recently requesting that our Center to respond to a number of questions regarding the funding sources of our Center, and whether or not our agenda is influenced by out of state interests. As a Cranston native, and founder and CEO for the Center, I welcome this opportunity to discuss the mission and operation of our organization, and to set the record straight.

As the ProJo article confirms, our Center works in a nonpartisan manner and maintains the privacy of our donors as provided by the IRS and federal law, and as affirmed by the U.S. Supreme Court. Other clarification points from the article:

- Our Center never accepts public funds or taxpayer dollars. Unlike the Economic Progress Institute, one of the local groups compared to us, which has accepted funds from the state and is housed at RI College.

- Senator Whitehouse’s spokesman was INCORRECT in asserting that our Center makes ‘efforts to influence elections …”. This against IRS rules and our Center has never engaged in such activity.

While our work is often viewed as disruptive to the ‘establishment’, it is an unfounded accusation and a typical ploy of those we challenge to aver that the work of our Center is influenced by any out-of-state interest. Our Center’s staff and Board are comprised of Rhode Island residents, who all believe in the power of free markets and the capacity of free people to create a healthy, prosperous Ocean State.

As supporters and friends of our Center, you deserve to know the full story, not just a portion of it. The ProJo article does not tell the whole story. All of the questions submitted to us by the Journal and all of the responses our Center provided to them are shown below. You can decide for yourself if they purposely omitted certain information.

We are not surprised that just as our Center is establishing itself as an alternative strong and consistent voice in the Ocean State, that our opponents predictably trot out such intellectually dishonest questions, in an attempt to discredit our work, and that certain members of the media oblige them.

Even a recent New York Times article confirms that such smear attacks stem from a national, partisan effort. In fact, in parroting the same false talking points across the nation, the left is once again creating myths: http://m.washingtonexaminer.com/it-turns-out-the-evil-koch-bros-are-only-the-59th-biggest-donors-in-american-politics.-can-you-guess-who-is-number-one/article/2544025?

Also note that our Center operates in stark contrast to groups like Progress Now and the Center for Media and Democracy who receive hefty gifts from unions, who in turn use coercive tactics to force their members to donate to political causes with which they may not agree.

PROJO QUESTIONS, RESPONSES by the Center

Below are the questions submitted to us by the Providence Journal, along with our complete replies. As you will see, the published story in the Providence Journal omitted most of our comments.

* (ProJo) Can you say how much the center received during 2013 in contributions and grants?

(Center) In accordance with IRS rules, our Center will make this information available when we file our annual 990 report in the coming months. Now in our third year of operation, our 2011 and 2012 reports are also publicly available.

* With regard to your donors, your stance is that you cannot reveal them?

The Center – like almost all IRS designated 501-C-3 nonprofit organizations, including the Red Cross, the liberal Tides Foundation, and Rhode Island’s Economic Progress Institute, and as affirmed by the U.S. Supreme Court – respects the privacy wishes of its donors, who give freely and voluntarily to support our mission to enhance the lives of all Rhode Islanders. Should individuals choose to make known their gifts to our Center, our Center also respects their right to do so.

* What do you say about the center being an affiliate of the Franklin Center for Government and Public Integrity, which according to the Center for Public Integrity gets most of its money from Donors Trust. The Center for Public Integrity calls Donors Trust “a vehicle for tax-exempt giving from wealthy conservatives such as billionaire industrialist Charles Koch.” In light of this, is the center largely funded by the Koch brothers and other very wealthy individuals?

The Center worked with the Franklin Center in identifying and securing a journalist for our online blog and journalism website, The Ocean State Current, in 2012. That employee relationship lasted for six months, ending in December of 2012. Our Center is not aware of the funding sources of the Franklin Center. The Ocean State Current remains in operation because of the voluntary work of a team of in-state bloggers.

The concept of donor directed granting organizations such as Donors Trust are not endemic to conservatives or liberals, or billionaires or millionaires. They are numerous and diverse in nature, throughout the country, accepting charitable donations from individuals at virtually all income levels to support thousands of charitable causes and nonprofit groups. Organizations such as the United Way and the Rhode Island Foundation serve the same function for a diverse array of donors who wish to maintain their anonymity for any number of reasons.

I can categorically answer “no” to the question about whether or not our Center is largely funded by Charles Koch, or any out-of-state wealthy individuals. Depending on how you define wealthy individuals, I can confirm that our Center does solicit and accept funding from individuals in Rhode Island who agree with our free-market principles and who have the means to support our mission to enhance the well-being and prosperity of the average Rhode Islander through responsible public policy reform.

* Some people and groups say organizations such as the RI Center for Freedom and Prosperity are simply fronts for the very wealthy who want to avoid paying their share of taxes. What is your response to this?

I can also categorically state that 100% of the policy decisions our Center makes are determined by our own Board and staff, based on Rhode Island’s unique circumstances, without any influence from any outside group or individual.

Regarding our policy advocacy, consider the top three issues in which our Center is engaged:

Our Sales Tax Repeal idea would eliminate a highly regressive tax that will most benefit low-income families, by keeping more of their hard-earned money in their own pockets and providing new job opportunities to enhance chances for upward mobility.

Similarly, our School Choice campaign will benefit inner-city families most, especially those who have children who are condemned to attend failed schools simply because of their zip code

Finally, the ideas in our Healthcare Freedom Act provide solutions to many Rhode Islanders who are concerned about access to affordable, quality care. As it is now obvious that tens of thousands of Rhode Islanders will remain uninsured, even after full implementation of the President’s healthcare law and our state’s exchange, our Center recommended multiple solutions that will make access to healthcare a more viable option for the average Rhode Islander.

Clearly, this is not a tax-break-for-the-rich agenda, but rather, an agenda that will provide renewed opportunities for most Rhode Island families and also provide a boost to our state’s broken economy.

* Is it appropriate for an advocacy group that won’t disclose its donors to be preparing testimony and research reports to a legislative commission that is considering major changes in state tax policy?

It is entirely appropriate for our Center, and all similar state-based organizations, to advocate for policies that will help our state, as we best determine ourselves. Virtually all IRS approved C3 and C4 groups also choose to respect the privacy of their donors; there is nothing new or suspicious about this.

Like virtually all nonprofits, our Center conducts multiple fundraising activities to support our activities, including direct mail solicitations, personal networking with citizens in our state, and competitive grant applications to national and local foundations. Our Center employs a full-time Development Director to manage these efforts. Currently, the Center has almost 300 distinct donors, almost all of whom are Rhode Island citizens who share our belief in economic and educational freedom.

Is it so unimaginable to our critics that there are indeed many people who volunteer their support to our Center, and who also believe in a limited, transparent government?

* Any other comments welcome.

It is obvious that those who defend the status quo are not at ease with the work of our Center, which challenges the policy culture that has created the unacceptable economic and educational conditions from which far too many Rhode Islanders are currently suffering. It is important for Rhode Islanders to know that any implication that our Center’s work is influenced by outside sources is completely unfounded.

Has the Providence Journal asked the same questions of those groups who have raised questions about our Center?

* Is it fair/accurate to say that the center wanted to provide a different voice/perspective than people might have been hearing state policy debates? If yes, can you elaborate?

Yes. In fact, it is the primary mission of our Center is to attempt to balance and stimulate public policy debates. Through research, analysis, and advocacy our Center provides new and alternative views on important issues for our state. In some cases our views challenge the entrenched status quo mindset, while at other times our ideas are in direct opposition to the highly restrictive progressive/union agenda, which has dominated our state – virtually unopposed – for recent decades.

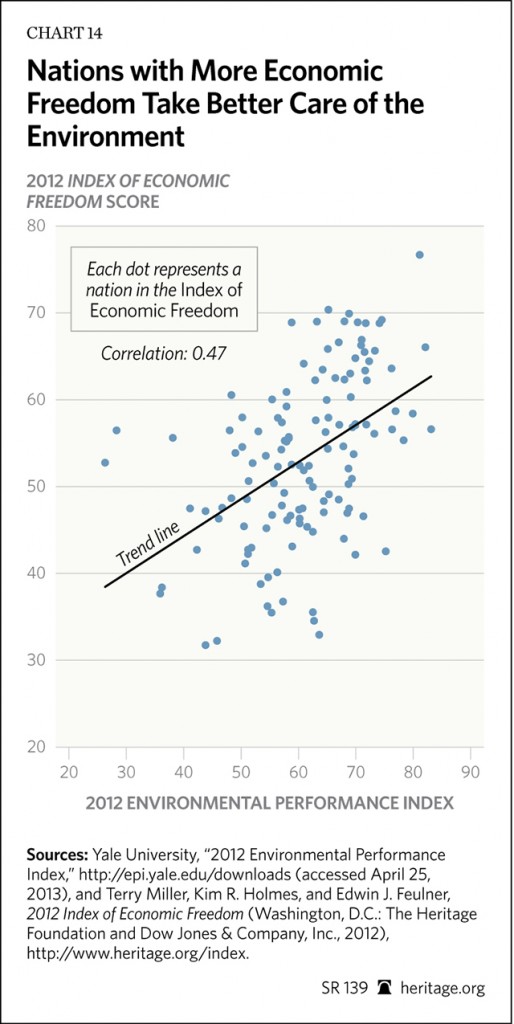

It is our opinion that “free market” policies are indeed in the best interest of all Rhode Islanders. Clearly, the big government, special interest approach has failed this state. Our recommended policies offer a fresh, new path forward, based on principles that have a proven record of prosperity and that served as the basis for the founding of our nation.

* Did the center contact Rep. Malik about sponsoring the no sales tax bill last year, or did he contact the center?

Representative Malik first approached the Center following testimony we provided at a 2012 House Finance Committee hearing: Around that time we had published our first sales tax report, and he expressed general interest in the issue to me. In November 2012, House Minority Leader Newberry publicly stated that sales tax reform would be one of his caucus’ platforms for 2013. I approached the Leader to offer access to our research, and he suggested that I contact Representative Malik who, as a retailer himself, had been interested in sales tax issues for years. It was following the Massachusetts’ State of the State address in January of 2013, when Governor Patrick proposed to lower his state’s sales tax, that I re-established contact with Representative Malik. He indicated that he was interested in submitting a bill to repeal the Rhode Island sales tax and inquired if our Center would further educate him on the issue, based on our prior reports, and if there was additional research that could be conducted to advance the public debate.

This is precisely the role our Center is designed play: Injecting new ideas and research into the market and then aggressively supporting debate when related legislative or other advocacy efforts are initiated. We are happy to work with any interested lawmaker from any party.

Our Center is not a lobbying entity, and had no part in securing any sponsors for the bill. I’m sure that Representative Malik would confirm these details, if you choose to contact him.

* You mentioned that school choice will be the center’s next big issue. Can you say why the center chose that one?

Economic and educational reforms are the two issues our board determined should be our Center’s top priorities. Without economic growth that brings new job and career opportunities, and without a properly educated citizenry to fill those positions, Rhode Island will not be able to break out of its stagnancy.

In selecting major issues to advance, we look beyond policies that nibble around the edges of the massive problems facing our state, and seek to inject well-researched, game-changing ideas into the public policy debate; ideas that can provide immediate and broad benefits to Rhode Islanders. Also, we seek policy ideas that are not only needed, but which have a legitimate chance to advance, given our state’s unique and current political orientation.

School choice reforms, whether through expanded charter school or tax credit programs, or through a voucher system, would provide immediate relief for families with children condemned to attend a failed school simply because of their zip code. Further, the competition created between public and private schools will likely lead to a higher educational achievement across our entire state. We are working in cooperation with Speaker Pro Tem Elaine Coderre and her son’s new organization, RI Families for School Choice. This organization approached our Center in late 2012 to ask if our Center was interested in helping to raise awareness on school choice. As this issue fit our mission, we have not only engaged, but have since decided to make it a priority for this year.

Similarly, significant sales tax reform would immediately put money back in the pocket of every family and business in the state, create economic growth, and provide new job opportunities for tens of thousands of Rhode Islanders.

There are dozens of additional reforms that our state must consider in the years ahead, many of which our Center will also attempt to advance. However, we believe that sales tax and school choice reforms are an important first step in putting our state on a new policy path.