ZERO.ZERO % Sale Tax Too Much for the Imagination of the Political Class

Imagine tens of thousands more people employed in Rhode Island.

Imagine new retail and construction jobs to support an economic growth spurt.

Based on a 2012 policy recommendation by our Center, some members in our General Assembly actually think we can make these things happen in our state.

Yet, as we close out the year with reports of even more dismal national rankings for our Ocean State, the Political Class is looking to kill this policy idea from our Center that some believe could make those imaginations happen in 2013; an idea that is clearly ‘out of the box’; but sadly, an idea that those who defend the status quo cannot even begin to comprehend.

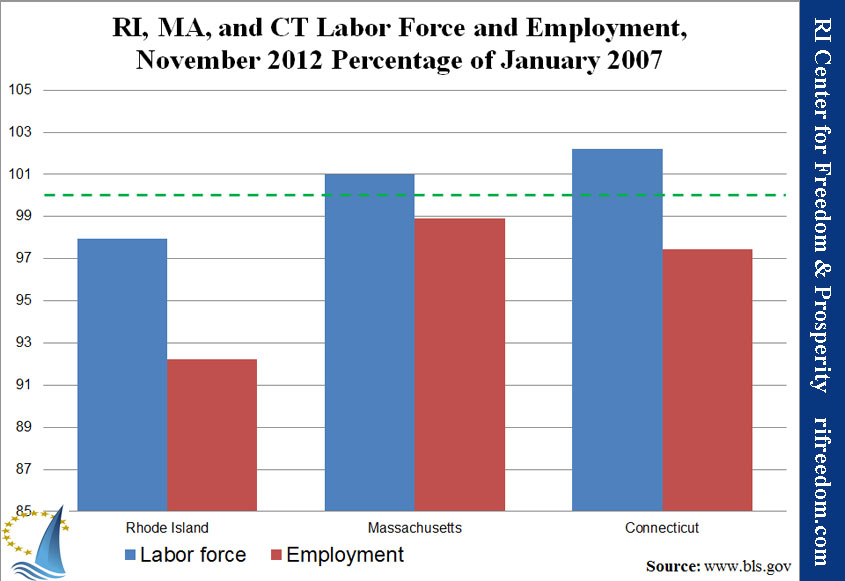

Rhode Island desperately needs a number of game-changing policy reforms to gain a competitive advantage over our neighboring states and to provide much needed economic opportunities for workers; the elimination or phase-out of the state sales tax is a policy reform idea that offers the most immediate jobs dividend.

In June our Center published a report detailing the positive jobs and economic benefits Rhode Island would realize if we were to reduce or eliminate the state sales tax. Just this week, a front-page story in the Providence Journal discussed how some members in the House are considering this strategy, making reference to our Center’s report.

But – per a recent ProJo article about related legislation – to hear members of the Political Class reject this notion out-of-hand is an indictment of their lack of leadership and imagination. How can we afford not to have this important debate?

Our Center produces credible information and it’s unfortunate that we have to find a way around so many with closed minds. Our Center is an idea factory … and one such idea was put forth in our Zero.Zero report; a well-researched study that projected the benefits of sales tax reductions: A report that reviewed how this policy has been successful in other states; a policy that is consistent with a free-market economic philosophy. Yet the Political Class still cannot comprehend … and they choose to stick their collective heads in the sand and say “it isn’t so”.

The problem is that they are fixated on “balancing the budget” … a budget that has clearly failed our state. Balancing the budget – especially this budget – is not an economic policy and it should not be the Holy Grail for our public officials … making our state more competitive and creating jobs should be the goal!

The budget, then, should be crafted to support that more worthy goal; a budget that will likely be significantly smaller so that we can reduce taxes on citizens and businesses in order to create a positive business climate … scandalous!

But those without imagination; those who are not prepared to lead; and those who are afraid of upsetting the apple-cart find it all too easy to hide behind the limitations of our existing job-killing budget, to impose a few new taxes on someone else to raise a few more dollars, and then wash their hands and say “we did good”.

This failure of leadership and this culture of failure is what we voters have continually put in place over the recent decades … so that now, any bold, new idea is systematically rejected by the establishment.

This will happen with our innovative sales tax idea unless you, and thousands of citizens like you, are willing to stand-up, speak-out and demand that our state rigorously debate the pros and cons of a policy concept that could reduce our state’s chronically high unemployment rate by about one-third!

Forward this email, make your calls, talk to your family and friends … but do not complain about our state if you are not willing to stand up to the Political Class. They will listen if you and I speak loud and often enough!

In 2013, I look forward to working with anyone with an open mind to advance the bold policy reforms that our state so badly needs.

by Mike Stenhouse, CEO