Task Force OpEd in ProJo: All RI Communities in Deep Trouble

by MIKE STENHOUSE and RICK DANKER

Rhode Island has become ground zero for the public-employee pension crisis owing to the size of the unfunded pension liabilities the state and its cities face along with the sad story of the Central Falls bankruptcy.

But, unlike other states stuck in similar situations, the Ocean State has been proactive in making solid reforms to reduce this debt load. This month, Governor Chafee introduced a municipal pension reform plan that will enable localities to make cuts similar to what the state made with its reform late last year.

The centerpiece of the governor’s proposal is legislation to let the state’s independent pension plans suspend annual cost-of-living adjustments (COLAs). Eileen Norcross, senior research fellow with the Mercatus Center at George Mason University, and a member of the Rhode Island Center for Freedom and Prosperity’s national pension task force, finds that a 1 percent reduction in the COLA reduces the overall pension plan liability by 10 percent.

The magnitude of this cost savings is clear in the data on the task force’s transparency website, RIOpenGov.org? , which shows the difference in a 3 percent COLA and no COLA on projected future pension payouts to the top-earning retirees to be around $1.5 million. Cranston, for one, would cut its total projected future pension costs associated with its 421 public police and fire retirees from $579 million to $410 million with this change.

To qualify for the COLA suspension — which the state already enacted with its own reform legislation — local pension plans must be in a “critical status” of a funded level below 60 percent. As the governor’s plan notes, the most recent average reported funded level for the plans is just 40 percent.

But this reporting doesn’t tell the whole story of local pension debt. When these liabilities are calculated using private-sector valuation rather than assumed investment returns, the picture gets even worse.

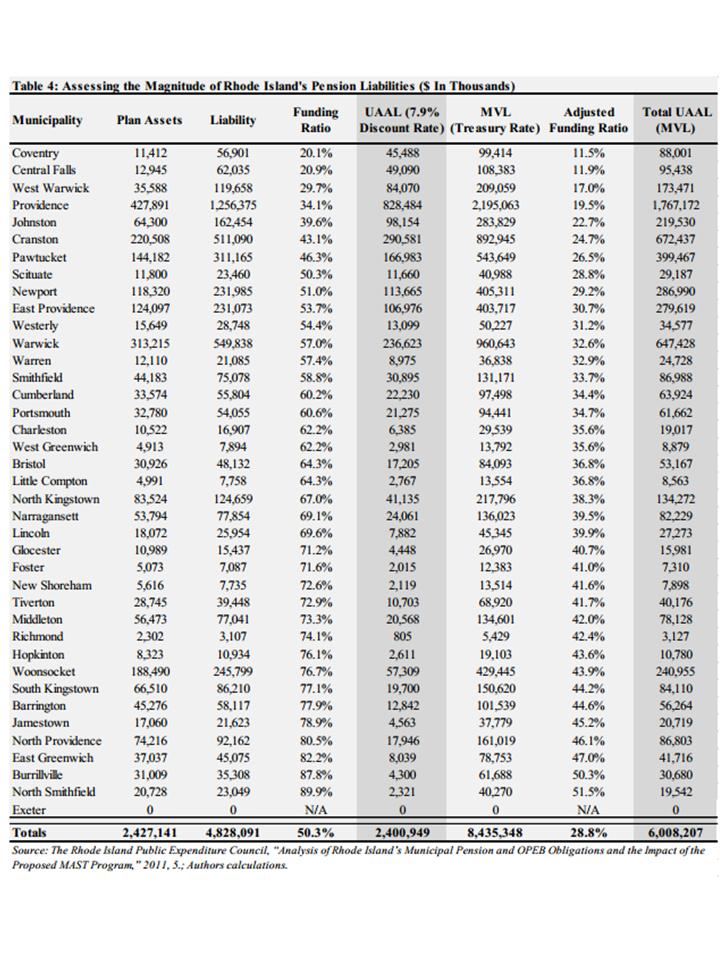

Norcross and her Mercatus Center colleague Benjamin VanMetre in November 2011 calculated the average funded level to be 29 percent using Treasury bond yields. The unfunded liabilities belonging to the 36 Rhode Island cities with their own pension plans was therefore $6 billion rather than the reported $2.4 billion.

Utilizing private-sector valuation, every locality in Rhode Island would be funded below 60 percent, according to this same Mercatus report. We question, then, why there should even be a “critical status” test in the legislation.

This truth about local pension debt means that many of these municipalities will ultimately need to do more than suspend COLAs. They will need to consider adjusting benefit formulas, capping pension payments, or offering buyouts to pare down this debt. The alternative is to let the burden remain on taxpayers, either in the form of higher taxes, cuts in public services, or both. Those are particularly bad options in Rhode Island, where emigration to other states and towns is just a short trip away.

Governor Chafee should be commended for acting decisively on the public-pension crisis and introducing a plan to give the municipalities a head start on reform. It is now up to the legislature to quickly pass this into law. But the hard work will remain for those cities and towns deemed to be in “critical status.”

They should now calculate and disclosure their pension debt using market valuation so their citizens know full extent of the unfunded liabilities. Then they should come up with reform plans that use every legal option available to spare those citizens from having to prop up uncontrollable pension plans. Rhode Island will benefit when the state’s enablement of the COLA suspension is combined with the opportunity for its fiscally-distressed cities and town to design their own reform plans.

When adding the often-overlooked burden of other post employment benefits (OPEB), the public retirement crisis — decades in the making as benefits outstripped contributions through government overpromising — is the state and local finance issue of our time. It threatens foundations crucial to making government work, such as truthfulness about finances and fairness in allocating public services and benefits. When they get the state’s go-ahead to start reducing their pension obligations, Rhode Island’s cities and towns will have no excuse not to take it on.

Mike Stenhouse is CEO of the conservative Rhode Island Center for Freedom and Prosperity. Rich Danker is director of economics at American Principles in Action, a conservative Washington policy organization. Bot individuals are part of the RI Center for Freedom’s national task force on Pension Reform in the Ocean State.