Removing Pension Dollars from the RI Economy

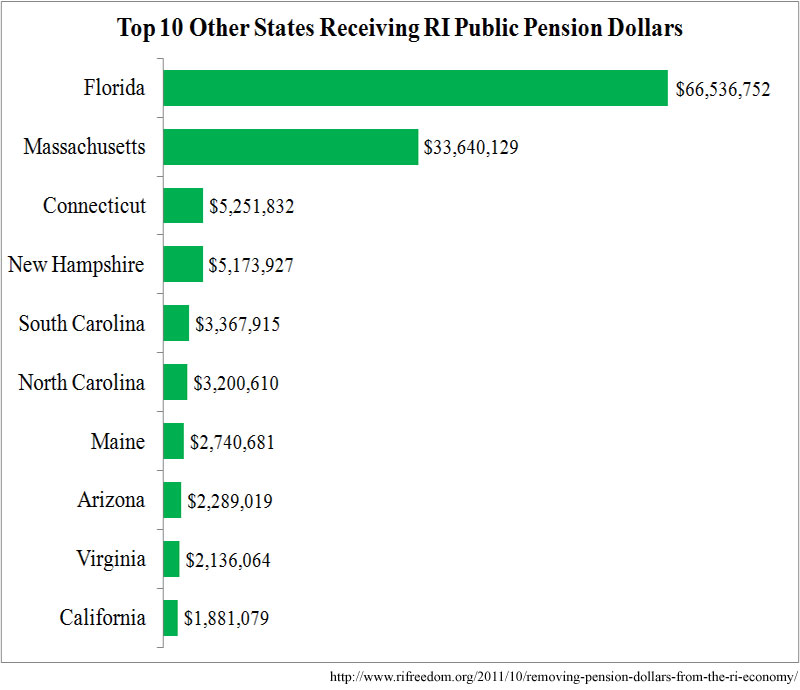

Rhode Island’s pension system sent $142,159,475 directly out of state, in 2010, to the 4,575 public-sector retirees who live elsewhere. That’s according to the RI Center for Freedom & Prosperity’s new RIOpenGov.org section on pensions. Overall, government pension payouts amount to approximately 1.7% of Rhode Island’s gross state product (GSP), and 17.2% of them support the economies of other states, with the following top 10:

The pension dollars lost to Rhode Island’s economy are of particular concern during this era of high unemployment and sluggish economic activity, when it seems as if political actors feel they must couch every argument about public policy in terms of economic stimulus. In the debate over pension reform in Rhode Island, National Education Association Government Relations Director Pat Crowley got ahead of the pack by telling GoLocalProv on October 21 that freezing cost of living adjustments (COLAs) would “be a major drain on the Rhode Island economy.” The following week, the Brown Daily Herald noted the point being made in the wave of Finance Committee testimony. The assertion, in brief, is that if retirees’ pensions do not match or exceed inflation, they will have less cash to spend, which means that less money will cycle through the local economy.

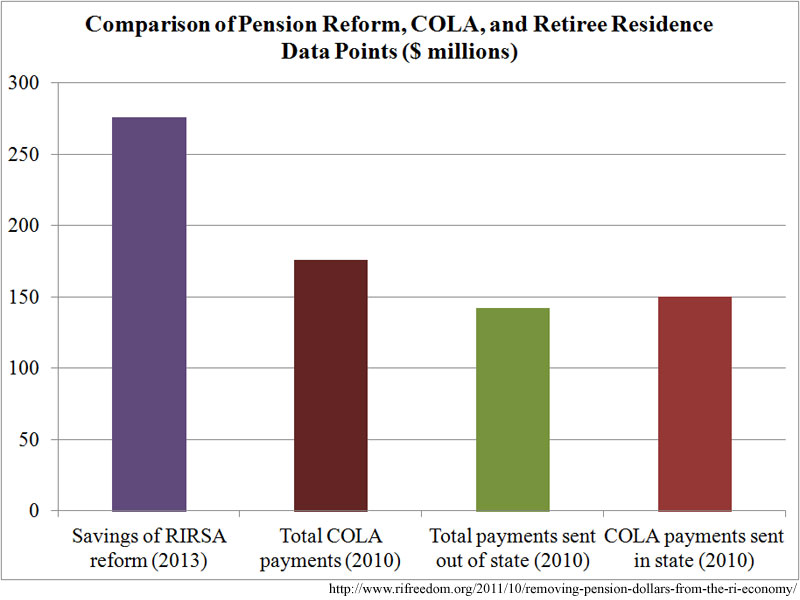

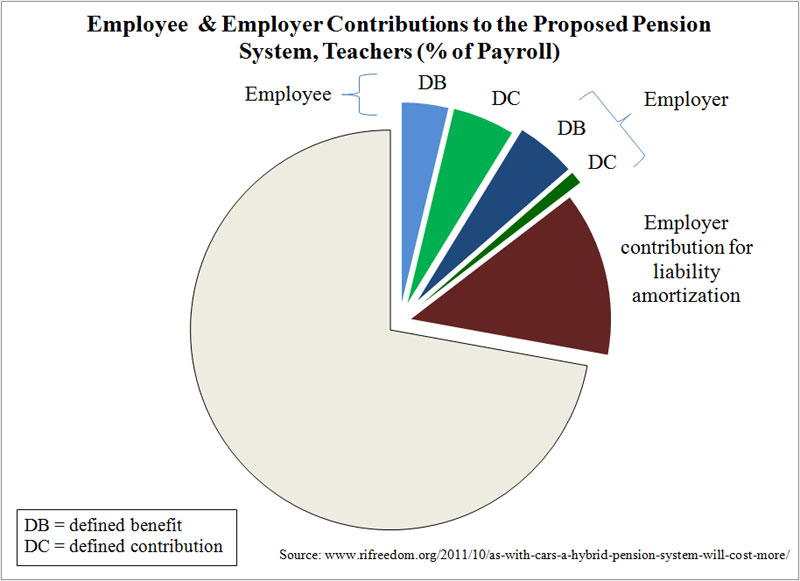

The broadest response to such claims is that every dollar paid into the public sector pension system has to come out of the economy in the first place, most of it reducing local buying power in order to fund national and international investments. In that light, General Treasurer Gina Raimondo’s proposed reform — any reform — would count as stimulus. The state’s pension actuaries, Gabriel Roeder Smith & Company, estimate that the retirement system will require state and local governments to contribute $659 million in fiscal year 2013 without reforms, but only $383 million with the proposed reforms. That’s a difference of $276 million that taxpayers could use to pay bills, purchase goods and services, and make investments.

Meanwhile, additional data from RIOpenGov.org shows that the pensions paid out in 2010 were augmented by $176.0 million for total COLAs already applied to base pensions. In other words, while special interests are arguing that freezing COLAs at their current level would harm Rhode Island’s economy, the state could erase COLAs from the pension system entirely and the economic harm still wouldn’t amount to two-thirds of the economic benefit that the current (arguably too restrained) reform would represent for local economic activity. (All of this leaves aside, of course, the additional benefit of proving that the state is interested in securing its future.)

And as the total pension dollars sent out of state show, that’s not the whole picture. If COLAs are distributed equally among retirees in state and out of state, $149.6 million of the money paid to retirees who live in Rhode Island is attributable to the adjustments. That means that completely eliminating every penny of current COLA payments would have about the same economic impact, in Rhode Island, as paying for the retirements of people who don’t live here.

Whether these amounts are significant in a $47.6 billion state economy is a matter of opinion. So, too, is the legitimacy of various changes and restrictions that the state could consider imposing on pensions. When assessing the impact of reform, however, it is critical to consider the many ways in which Rhode Island’s public-sector pension system interacts with the economy.