Opinion by Mike Stenhouse as appeared in the Providence Journal (May 9, 2014)

Mike Stenhouse: Left won’t defend failed R.I. policies

‘The price of freedom is eternal vigilance,” is a sentiment many have shared. Engaging in a spirited public debate is one form of such vigilance — a debate such as the Rhode Island Center for Freedom and Prosperity conducted in late April. The core question was: Would we be better off with more government in our lives, or less?

Based on the reaction we received from audience participants, our debate offered a fresh, new discussion about public policy; conversations that are not normally held by politicians or in the media. “When is the next debate? We can’t wait!” we were told, as well as, “If only our lawmakers could have heard this.”

However, the experience of organizing and running the debate ended up being as educational for me as it was for audience attendees. The audience learned about core philosophical policy differences. I learned about a revealing tactic of the left.

Ocean State “progressives” appear to have little interest in an open and honest debate about public policy. Either they don’t want to consider questions about whether their liberal agenda has been serving the well-being of our state’s residents, or they don’t want to admit that it is their big-government ideas that have, indeed, failed our families and businesses.

In seeking participants for the debate, I quickly became aware that the Rhode Island left hopes to avoid talk about connecting their policies to the wreckage we have seen across our state — either by refusing to debate in the first place, or by claiming that Rhode Island’s overall public policy culture is not liberal.

In reaching out to local groups to try to assemble a balanced slate of debaters, no fewer than four local left-leaning organizations, plus one other, refused our invitation to participate in the event: the Economic Progress Institute, the Latino Policy Institute, the Rhode Island Council of Churches, RIFuture.org and the Rhode Island Urban Debate League.

Stated reasons ranged from not wanting to be identified with or seen as supporting our center, to disingenuous questions about the debate’s funding sources, to a general sentiment that nothing would be gained from being involved in such an event. In one case, one of these groups was actually warned by another that we might be calling, and was armed with a ready excuse to turn us down.

What were they afraid of?

We are thankful that two local individuals — Tom Sgouros and Samuel Bell — agreed to participate and represent views from the left. However, their debate tactic was to run away from their own policies, by claiming that Rhode Island is much more conservative than most might think, that conservative tax cuts for the rich are partially to blame, and that there must be factors other than public policy behind our state’s failings. These assertions drew repeated chuckles from the audience.

Could these men be serious? With our heavy tax burden and poor economic rankings, how many Rhode Islanders honestly believe the state is struggling as a result of too-conservative policies?

It’s actually a very clever tactic to blame the other guy, or to avoid debate altogether. There is no doubt in my mind that a liberal-progressive agenda dominates Rhode Island — and, if I were them, I wouldn’t want to be held accountable for that agenda’s failures either. But it is a blatantly transparent tactic, with zero credibility.

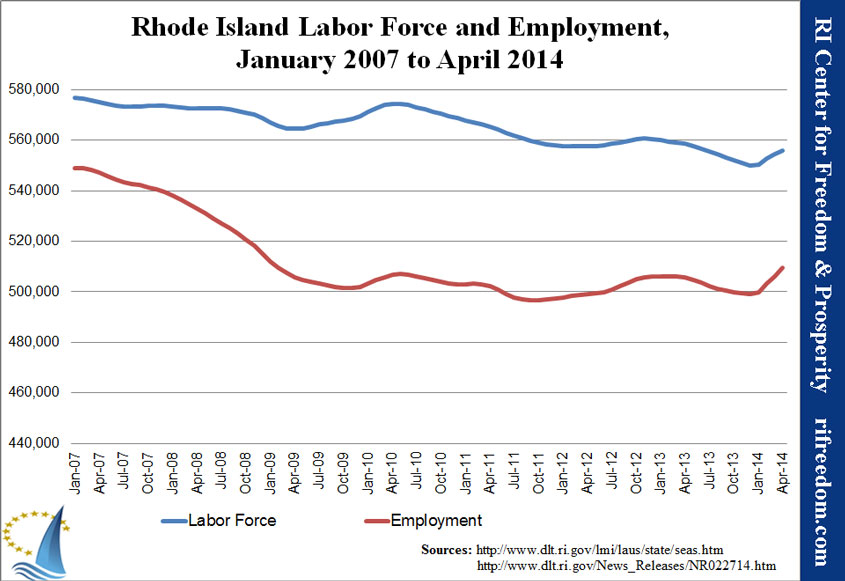

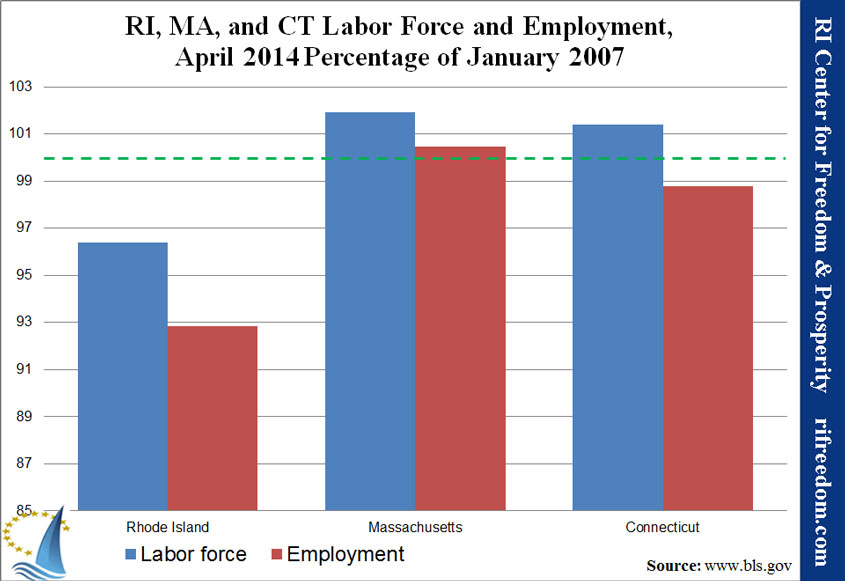

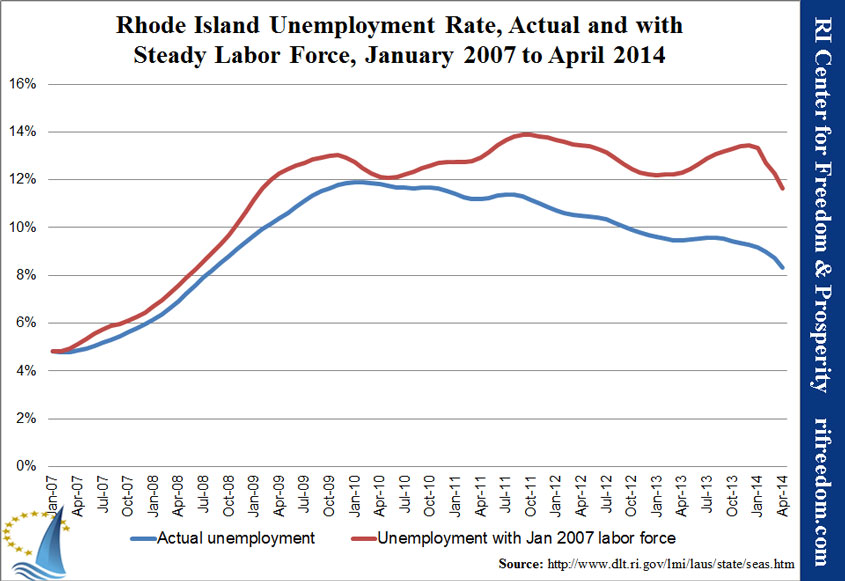

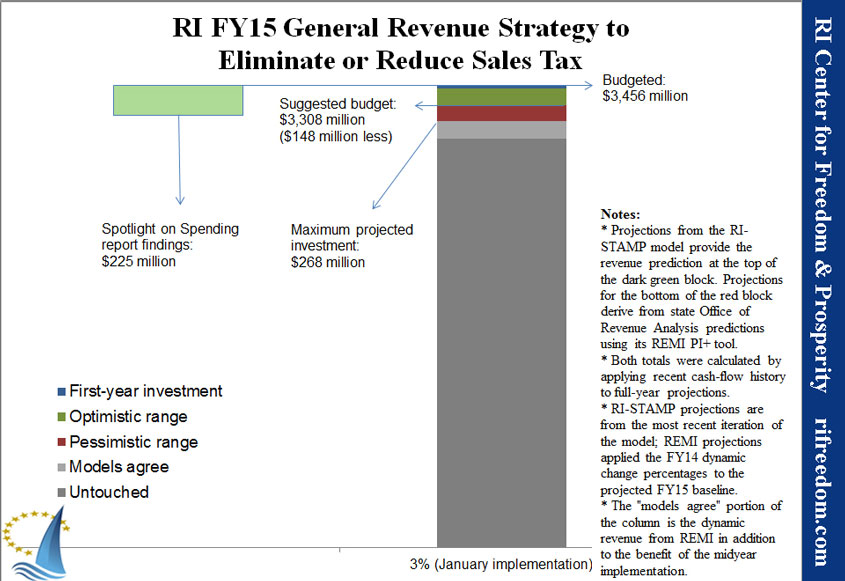

Over the decades, a big-government, liberal and special-interest-oriented agenda has been systematically implemented in the Ocean State. As a result, we have seen dismal state performance in far too many important national indexes. Ranking last, or nearly last, in business climate, unemployment rate and population growth, Rhode Island simultaneously ranks near the top when it comes to redistribution of wealth, or income transfer, policies.

Yet the left refuses to even discuss whether or not there is a correlation. I believe there is a direct causation. This was the premise of our debate.

Nor do our elected officials or local media seem to want to encourage such discussion. I noted only one lawmaker, Sen. Lou Raptakis (D-Coventry), in attendance. Further, even with national headliners such as Stephen Moore from the Heritage Foundation and Fox News, and Rich Benjamin from Demos and MSNBC, not one local news organization covered this important debate, except GoLocalProv.com, our media partner. Why not?

If people on the left truly believe that their ideas are best for our society, their advocates should proudly stand up and fight for them — not run away and blame others. Sticking our heads in the sand and refusing to engage in rigorous public debate does not serve any democracy’s best interests. What are they afraid of?

Mike Stenhouse is CEO of the Rhode Island Center for Freedom and Prosperity, a nonpartisan public policy research and advocacy organization.