STATEMENT: General Assembly Budget – More of the Same

STATEMENT

FOR IMMEDIATE RELEASE

June 10, 2015

2016 Budget Has No Broad-based Reforms

No Game Changing Economic Ideas

Continued Special-Interest Spending

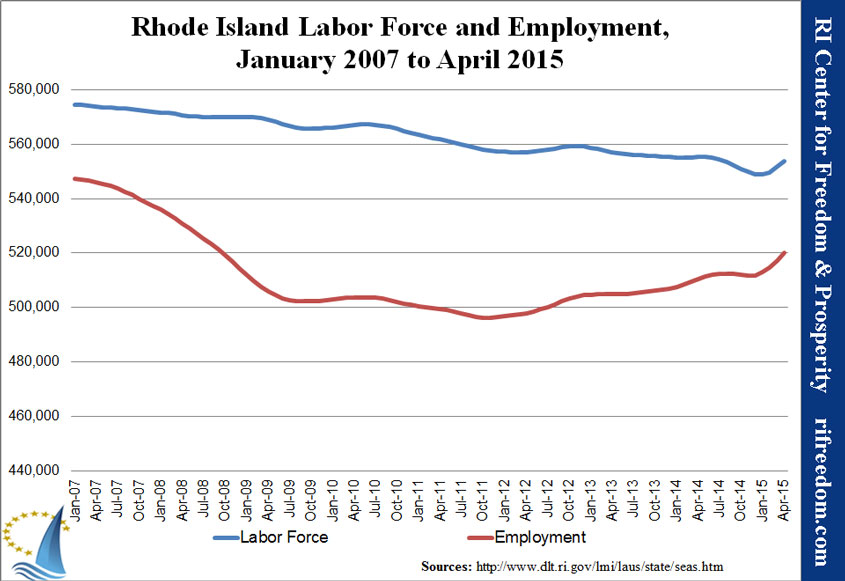

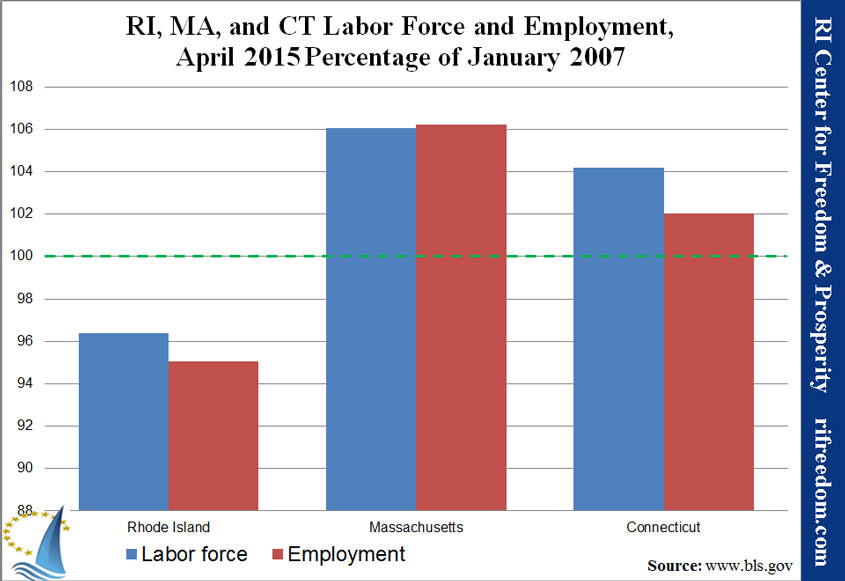

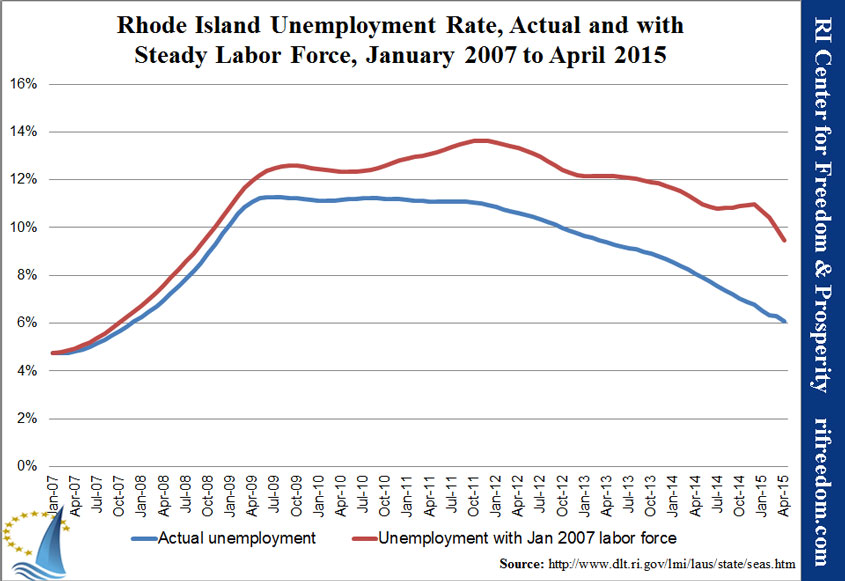

Providence, RI — The General Assembly’s proposed FY-2016 budget plan, consistent with recent annual budgets, and despite the positive spin from lawmakers, includes no broad-based plan to boost Rhode Island’s stagnant jobs market, according to the nonpartisan Rhode Island Center for Freedom & Prosperity. The Center maintains that the budget gives government more power in attempting to orchestrate economic development and represents a further departure from proven free-market principles

While the budget does include a number of positive elements, there are off-setting negative elements that will largely serve to maintain the Ocean State’s stagnant status quo. In fact, in its initial ratings of 151 bills on its annual Legislative Scorecard, the Center scored 92 bills as having a negative impact, with only 59 bills rated as positive.

“Our state levies high taxes, spends at high levels, and has amassed high debt … yet when you look at our business climate, infrastructure and education, it is obvious that taxpayers are receiving low value for their hard-earned tax dollars,” said Mike Stenhouse, CEO for the Center. “Once again special-interest insiders will benefit at the expense of average Rhode Islanders.”

The plan’s government-centric approach toward economic development that favors unions and targeted industries is merely an extension of the same, failed public policy approach that is responsible for sinking Rhode Island into its current economic rut. The Center, instead, recommends broad based tax and spending reductions as the primary means to boost the economy, as have been highly successful in North Carolina.

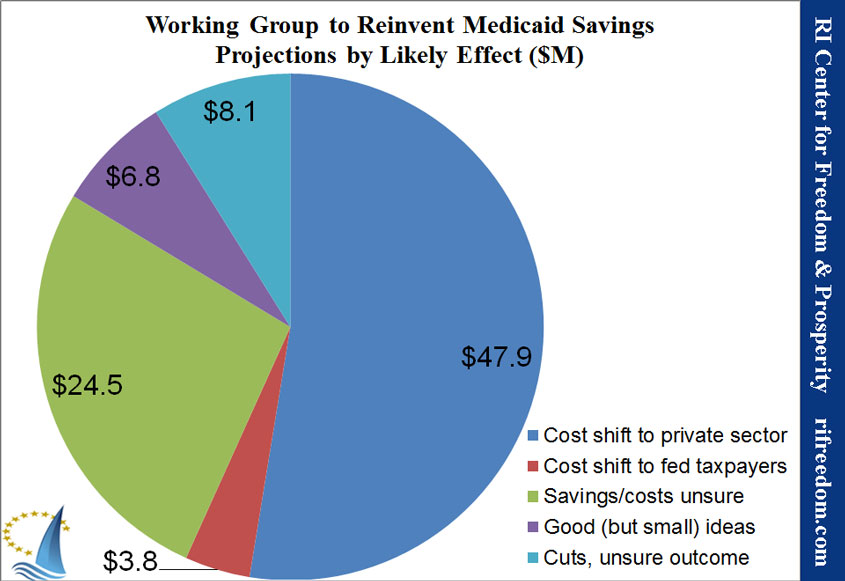

Among the minor, positive elements in the budget are the elimination of income tax on social security and the sales tax on commercial energy; the reduction of the corporate tax; the minimal Medicaid reforms; and the exclusion of the Taylor Swift tax and the trucker tolls.

On the negative side, are new taxes on health insurance premiums and on vacation home rentals, and higher taxes on cigarettes; union hand-outs such as spending for all day kindergarten and construction jobs; and multiple corporate welfare programs such as the real estate development tax credit, the vendor relocation tax credit, and the I-195 redevelopment fund.

Other major issues are still outstanding, some that will impact municipal budgets and local governmental sovereignty:

- A realistic plan to address the state’s crumbling roads and bridges

- The pro firefighter and municipal employee collective bargaining bills

- Bills to reduce the negative impacts of RhodeMap RI

- The Pawtucket Red Sox stadium deal

Media Contact:

Mike Stenhouse, CEO

401.429.6115 | info@rifreedom.org

About the Center

The nonpartisan RI Center for Freedom & Prosperity is Rhode Island’s premiere free-enterprise think tank. The mission of the 501c3 nonprofit organization is to return government to the people by opposing special-interest politics and advancing proven free-market solutions that can transform lives by restoring economic competitiveness, increasing educational opportunities, and protecting individual freedoms.