Car Tax, Free Tuition Programs Could Mean Loss of Jobs and Lower Municipal Revenues

3.0% Sales Tax Adds Thousands of Jobs, Increases Local Revenues

OVERVIEW:

As taxpayers continue to be asked to fund generous corporate subsidy programs, lawmakers are now dueling over two new spending ideas – reimbursing localities to phase-out the car tax and public funding for free college tuition – each of which would likely further raise taxes and fees on Rhode Islanders.

But would these programs make Rhode Island a better state? Or would the more innovative and bold policy concept of cutting the state sales tax help families become more self-sufficient?

Neither the Speaker nor the Governor have offered research or economic projections on the impact of their respective ideas. The Center, conversely, offers well-researched projections from a credible economic modeling tool.

Rhode Islanders need a credible alternative to the status quo and its destructive progressive ideas. You can help.

Click here to find out more >>>

The RI Center for Freedom & Prosperity is the Ocean State’s leading voice against the wreckage caused by our state’s progressive agenda.

As the state’s leading research organization, advancing family and business friendly values… the mission of our Center is to make Rhode Island a better place to call home – to raise a family and to build a career.

While progressives value government-centric, taxpayer-funded dependency… our Center believes in the value of hard work and the free-enterprise system.

We understand that in order for more Rhode Island families to have a better quality of life, that more and better businesses are needed to create more and better jobs.

Your donation will help us fight the union-progressive movement and, instead, advocate for pro-family, pro-business policies and values.

Please make a generous, tax-deductible gift to support our Center today!

show less

As will be clearly demonstrated, the Center’s previously proposed 3.0% sales tax reform would help working Rhode Islanders and businesses much more than would car tax repeal or free college tuition. A cut in the state sales tax rate to 3.0% from 7% would :

- Keep significantly more money in the pockets of Rhode Island families and businesses

- Produce thousands of new jobs, as opposed to potential job losses with car tax or tuition spending

- Require lower budget cuts and/or corresponding tax increases than would car tax reform

- Create a major revenue windfall for municipalities that could go a long way toward funding local “self” phase-out of the car tax, where car tax repeal could result in lower municipal revenues

- Would allow every Rhode Island family to save for any college education

Funding? Elimination of corporate welfare subsidies and free college tuition funds could go a long way towards paying for the $82.3 million required to dynamically fund a 3.0% sales tax … vs the $229.7 required to dynamically fund car tax repeal.

Regressive? While many view the current car tax play as regressive, a revenue-neutral car tax repeal plan would be further so in that low-income individuals who do not own a car, or who own a car valued under existing exemption thresholds, would be indirectly funding property tax relief for wealthier people. A 3.0% sales tax would disproportionately help low-income families. Similarly the college tuition and corporate welfare plans require lower income families and businesses to pay for benefits that will go, in part, to the more wealthy.

Fairness? The car tax plan would inequitably distribute money to localities, and would reward those cities and towns that imposed excessively high car tax rates.

Business Climate Benefit? The sales tax is a tax on business. Collectively businesses pay almost half-of all sales taxes. A 3.0% sales tax would reduce such costs across the board and improve our state’s last place business climate ranking. Car tax repeal would only impact those businesses that have company owned vehicles.

Municipal Dependency? The car tax repeal plan would make municipalities even more dependent on state aid via its associated reimbursement mechanism. Depending how the policy is implemented, municipalities may simply increase regular property taxes to compensate for the car tax no longer collected, avoiding the state tax cap. A 3.0% sales tax would give new revenues to cities and towns to able to phase-out the car tax on their own, especially when in combination with other “tools” that could free them from state mandates and regulations.

Ease of Implementation? The car tax plan would require negotiation with low car tax municipalities, given the varying rates and exemption limits set by each municipality. Sales tax reform could be easily and uniformly implemented across the board.

BACKGROUND: Why bold reform is required

Rhode Island is losing the competition to retain and attract families who want to make our state their home-of-choice, where they can work hard, earn a respectable living, and support their families. But many Rhode Islanders feel left out. They are fed up with the status quo of ever-increased spending on special interest causes … and the perpetually high taxes and red-tape that are driving others out of town.

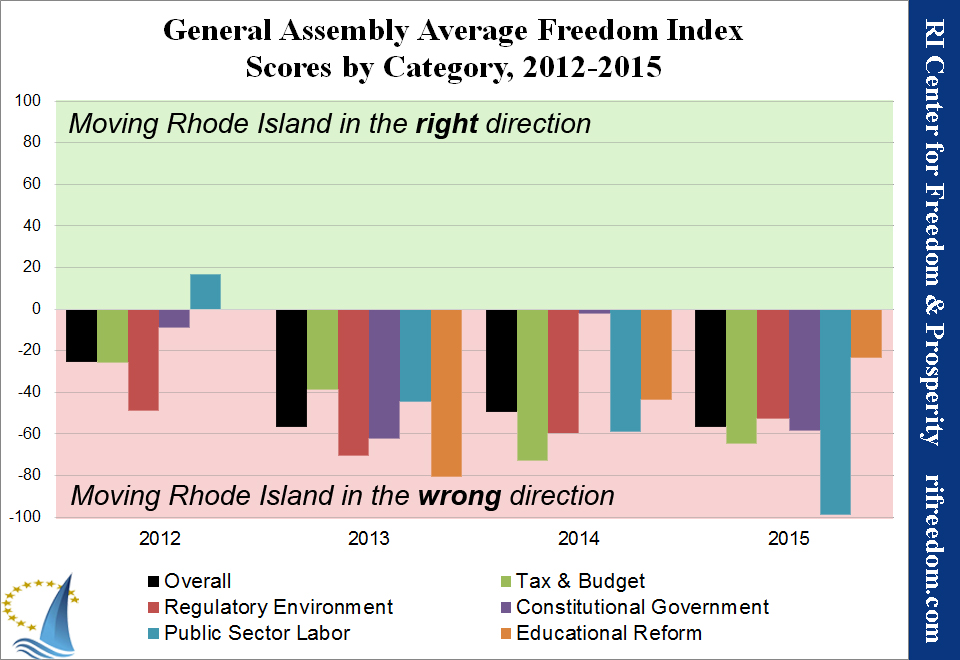

Our state’s stagnant population growth will likely result in the loss of one of our two precious U.S. Congressional seats after the 2020 census. This net-migration problem can be attributed to concerns about present and future financial security. Factors that contribute to this problem are obvious: In 2016 Rhode Island ranked as the worst state business climate in America and ranked just 48th on the national Family Prosperity Index (FPI) and on the Jobs & Opportunity Index (JOI)

People want restored hope that government is working for them and to feel that they have not been forgotten. To accomplish this, a bold reform idea is clearly required.

The RI Center for Freedom & Prosperity agrees with the Speaker of the House and with the Governor that Rhode Island families should keep more of their hard-earned income via tax reductions and that a college education should be more affordable. Car and property taxes, as well as college tuitions, are indeed high; they are an irritating or unbearable cost for most families. However, directly confronting those issues, may not be the most prosperous path forward.

The Center also believes that the state needs to relieve burdens on employers, increase our state’s consumer and tax base, and create more opportunities for meaningful work for those who want to improve their quality of life.

As such, not all tax and spending programs are created equally, as adjustments to certain taxes and fees will have greater impact on job creation and can be more of an economic stimulus than others. Given our state’s dismal national status, it is vital that Rhode Island takes bold and well-researched reforms to maximize the impact of every budget dollar.

Years ago the Center researched and proposed major cuts to – even repeal of – the state’s nationally high, job-killing sales tax. A complex economic modeling tool that has been used by dozens of states and major municipalities, STAMP (State Tax Analysis Modeling Program), showed that for the Ocean State, sales tax reform, among all taxes and fees considered, would produce the greatest and most beneficial dynamic* economic impact.

However, neither the House leadership at that time, nor the special commission that was created to study sales tax cuts, were interested in re-configuring the state’s budget to accommodate for the major economic growth projected by STAMP.

But now today, with House leadership and the Governor apparently appreciating that tax and fee cuts would keep more money in the pockets of Ocean Staters, the Center suggests, once again, that reform to the sales tax would produce more benefit to families and businesses than would the Speaker’s or the Governor’s plan.

Not only would sales tax reform keep more money in the pockets of every Rhode Island family, it would reduce costs for every Rhode Island business. It would also spur increased consumerism by both in-state and out-of-state shoppers, and; most importantly … it would create thousands of good, new job opportunities.

The Center further researched which level of cut to the sales tax would produce the most benefit. It was clearly demonstrated that a cut in the sales tax to 3.0% would produce the best value for taxpayers and for the budget by creating a high number of jobs at the lowest budget-cost per job created.

*Based on 2014 figures from STAMP (State Tax Analysis & Modeling Program) developed by the Beacon Hill Institute. Dynamic scoring impact takes into account the “ripple” impact of tax reforms by projecting increases or decreases to other tax revenues and fees.

BUDGET RECONCILIATION METHODS

There are two primary methods to accommodate the budget to account for the impact of any tax cut or new spending program:

- “Revenue Neutral” approach by raising other taxes to make up for the anticipated lost revenues or higher spending

- “Spending Cuts” to other budget items

Or, some combination of the two.

To date, neither the Speaker nor the Governor have identified how they will reconcile, or pay, for their respectively proposed programs.

Revenue Neutrality?

The Center maintains that Rhode Island spends too much taxpayer money for the state to quickly break-out of its economic stagnation. No matter how lawmakers slice and dice the many taxes and fees that are imposed on our citizenry, our high level of spending – and corresponding need for high taxation – creates a permanent negative drag on our state economy.

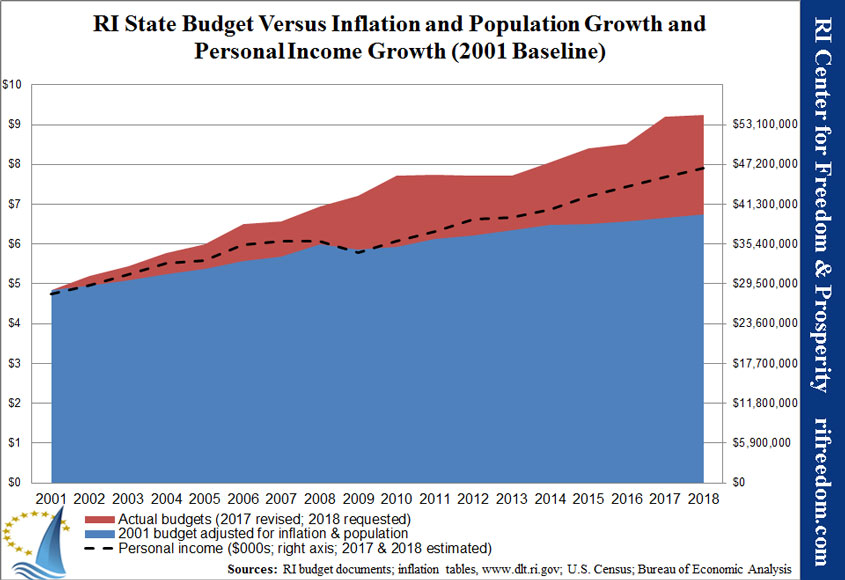

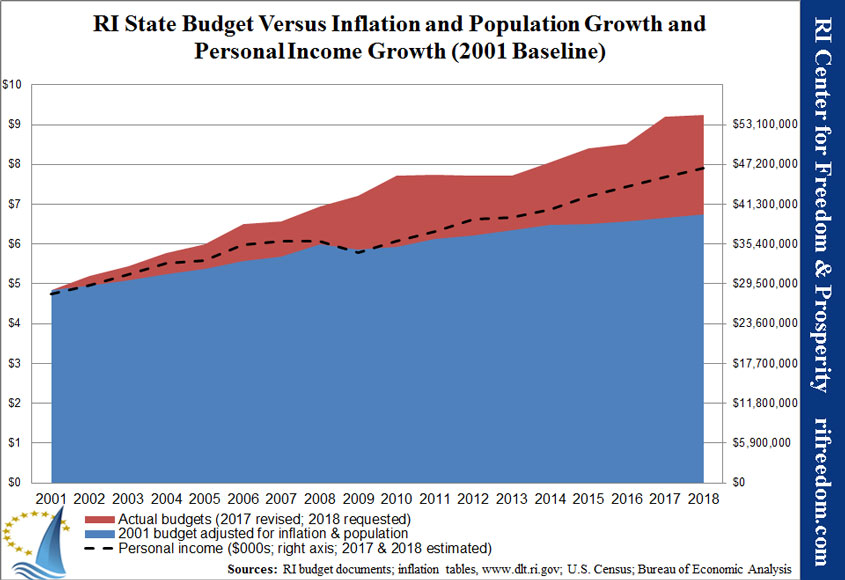

In the past two decades, Rhode Island’s spending trajectory has risen far faster than inflation, population growth, or personal income would otherwise dictate.

By comparison, New Hampshire, which consistently ranks near the top of most national rankings, spends almost 50% less per person than does Rhode Island.

In order for any public policy reform to achieve maximum economic impact, it is necessary that budget cuts – without offsetting tax increases – are used to pay for the reform. However, the reality and history of public policy in the Ocean State tells us that lawmakers will likely consider only “revenue-neutral” scenarios, where revenue losses due to cuts in one tax are offset by increased fees or taxes elsewhere. While this practice would minimize or – as we will show – potentially eliminate any economic benefits in some cases, a revenue-neutral policy is seen as the likely political solution … as economically-unsound as it may be.

To be clear, the Center contends, for a state struggling as much as is Rhode Island, that revenue neutrality should not be the goal of bold tax reform … and that both tax and budget cuts are required if we want to generate maximum stimulus to our state’s stagnant economy.

Found Revenues? It has also been suggested by both the Speaker and the Governor, that “newly found” revenues from debt restructuring, casinos, or other sources, might be used to fund their new proposed spending. It is the Center’s contention that such new revenues should be applied to help pay for sales tax cuts.

In order to set the outside parameters for economic impact, the Center created two tables? Each compares the long-term dynamic* scoring of the two tax reform concepts for Rhode Island: 1) phasing-out the car tax; and 2) phasing-down the sales tax to 3.0%:

- TABLE-1 assumes “revenue neutrality,” with offsetting tax increases, to pay for each policy option

- TABLE-2 assumes “spending cuts” to pay for each policy option

Any actual implementation of either of these programs would likely fall within these parameters.

Because the governor’s free college tuition plan and the state’s current corporate welfare strategy technically do not qualify as tax reforms, we are not able to effectively run them through the STAMP model. Their economic impact, based on the findings and theory of the model, is assumed and referred to separately.

FINDINGS

Taxpayer Savings and Increased Purchasing Power: The Speaker’s car tax plan would directly save taxpayers $215 million in property taxes, while a 3.0% sales tax would put $585 million back into the pockets of Rhode Island families and businesses, and eventually back into the economy. However, the net dynamic impact would be far less – or even entirely eliminated – if other taxes and fees are hiked under a revenue-neutral approach.

A 3.0% Sales Tax is is the most beneficial reform in terms of jobs, economic stimulus, business climate, and budget value … regardless of whether a revenue-neutral approach is adopted or not.

Car Tax Phase-Out Could Lead to LOSS of Jobs. Car tax reform, on its own, is a minor economic stimulus at best, as it does little to improve the state’s dismal business climate.

A revenue-neutral car tax phase-out would necessarily increase statewide taxes and fees (relatively) – even while most car owners would pay lower local property taxes – and would lead to a net loss of jobs. This is because the negative economic impact of increased state-level taxes is significantly greater than the positive impact of lowered local taxes.

If a “spending cut” approach is taken, car tax repeal could spur the creation of a limited number of new statewide jobs, but at a significantly lower level, and with far more required budget cuts, than a 3.0% sales tax with spending cuts.

Free-College Tuition Could Also Lead to a LOSS of Jobs. Similarly, using the same STAMP theory, providing free-tuition would also increase statewide taxes and fees (relatively) – even while some in-state families would have more disposable income due to lowered fees – and would lead to a net loss of jobs. Again, this is because the negative economic impact of broadly increased state-level taxes is greater than the positive impact of more disposable income for a more narrow base.

Under a ‘spending cut’ approach, free college tuition, as car tax repeal, might produce a limited number of new statewide jobs, but at a significantly higher cost per job, than a 3.0% sales tax with spending cuts.

Rhode Island’s Current Corporate Tax-Credit Economic Development Strategy is highly inefficient as it creates relatively few jobs at an extremely high cost per job to taxpayers. Using the same STAMP theory, the negative impact of requiring increased statewide taxes to pay for the credits is presumed to be greater than the positive impact of a few hundred more people working.

Further, this targeted ‘advanced industry’ approach does little if anything to improve the overall business climate, which is necessary if organic entrepreneurial growth is to occur on its own.

EXPLANATION OF S.T.A.M.P. PROJECTIONS (see Tables 1 & 2)

ECONOMIC EFFECTS

Private Employment (or Jobs). Both the Speaker and Governor claim that “jobs” is their top economic priority. Sales tax reform produces significantly more job-growth, regardless of revenue-neutrality, while car tax reform and, as explained above, free-college tuition could lead to a loss of jobs under a revenue-neutral approach.

Investment. The increase/decrease in capital invested in the state due to tax reforms. As with employment, sales tax reform always produces a positive investment, while revenue-neutral car tax and free-tuition programs could produce a negative impact and a reduced investment.

STATE REVENUES:

Sales Tax Revenue: Under a ‘revenue neutral car tax repeal scenario, to partially fund the state’s $215 million in “Transfer” (reimbursements) to municipalities, and in order set the worst-case economic impact parameter, we assume an increase in “Sales tax” revenues. However, because a sales tax hike will negatively impact commerce and the economy, it will dynamically result in less sales tax revenue than the straight-line (or static) calculation, therefore the “Policy target” for sales tax increases must be higher than the needed revenues.

Conversely, under either budget reconciliation method for a 3.0% sales tax phase-down plan, the straight-line (static) calculated sales tax “Policy target” revenue losses are greater than the actual (dynamic) “Sales tax” revenue loss, because the sales tax cuts will spur more sales tax transactions.

Under a ‘spending cut’ approach, car tax reform would produce a very limited increase in “Sales tax” revenues, because of greater disposable income across the state.

The difference between the static and dynamic sales tax revenue projections is portrayed as the “Dynamic difference”

Personal Income Tax Revenue: Similarly, increased “Personal income tax” revenues are also assumed to fund the rest of revenue-neutral car tax plan. However, because negative dynamic impact will lessen such revenues, a higher income tax “Policy target” is required.

Under the 3.0% sales tax plan, because of the thousands of new jobs created, “Personal income tax” revenues are projected to dynamically rise by between $304 million to $468 million, regardless of which budget reconciliation process is utilized.

Corporate/Business Tax . As with sales and income taxes, the negative statewide impact of a revenue-neutral car tax plan that includes other tax hikes, may produce lower “Corporate/business taxes”. Under all scenarios, a 3.0% sales tax will always produce positive and significantly higher “Corporate/business tax” revenues.

Cigarette Tax, Other Taxes & Other Sources. As with the personal and income taxes, the negative statewide impact of a revenue-neutral car tax plan, may reduce revenues from “Cigarette taxes”, “Other taxes” and “Other sources”. Under all scenarios, a 3.0% sales tax will produce positive and significantly more revenues in these areas.

MUNICIPAL REVENUES: Additional municipal benefits from sales tax cuts will result from the increased retail and overall economic activity .

Business Property Tax. The stimulus of sales tax cuts would see many existing businesses expand and many other new business established. Cities and towns will likely see an expansion of its local commercial property tax base and will result in increased “Business property tax” revenues. While municipalities must comply with a 4% annual tax-levy cap, this larger tax-base will allow localities to reduce property taxes in other areas, potentially including the car tax.

Conversely, under a revenue-neutral car tax repeal plan, municipalities could actually see reduced municipal “Business property tax” revenues, due to the more potent impact of statewide sales and income tax hikes as compared with local property tax cuts.

In fact, the potential new municipal revenues from a 3.0% sales tax – on their own – could fund over half of the cost of statewide car tax repeal.

Municipal Sales Tax, Other taxes and Other sources of revenues: Similarly, under a car tax repeal plan, municipal revenues in other areas could increase or decrease in limited amounts. Conversely, under any 3.0% sales tax scenario, these revenue areas would increase, potentially in a significant way.

The RI Center for Freedom & Prosperity is the Ocean State’s leading voice against the wreckage caused by our state’s progressive agenda.

As the state’s leading research organization, advancing family and business friendly values… the mission of our Center is to make Rhode Island a better place to call home – to raise a family and to build a career.

While progressives value government-centric, taxpayer-funded dependency… our Center believes in the value of hard work and the free-enterprise system.

We understand that in order for more Rhode Island families to have a better quality of life, that more and better businesses are needed to create more and better jobs.

Your donation will help us fight the union-progressive movement and, instead, advocate for pro-family, pro-business policies and values.

Please make a generous, tax-deductible gift to support our Center today!