NEW: Failing RI Report Card Grades Not Advancing Social Justice

FOR IMMEDIATE RELEASE

November 17, 2015

Non-Competitive Grades Harming Work, Mobility, and Opportunity for Rhode Islanders

Preponderance of Fs and Ds Should Signal Need for Change in Policy Culture

Providence, RI — The opportunity for upward mobility for many Ocean Staters continues to be hampered by a non-competitive business climate and onerous family tax burdens, as evidenced by the poor grades the State of Rhode Island received on the 2015 Report Card on Rhode Island Competitiveness, the fourth annual such report, released today by the Rhode Island Center for Freedom & Prosperity.

Burdened with public policies that discourage work and a productive lifestyle, the state’s poor grades in 10 major categories (two F’s, seven D’s, and one C) reflect a government culture geared to benefit special interest insiders, while at the same time promoting job-crushing and soul-crushing dependency among the general populace.

Raising even further alarm, Rhode Island ranked dead-last, overall, when compared with report cards from other New England states.

“This report card clearly demonstrates the wreckage that decades of liberal policies have wrought upon our state. These unacceptable grades should be a wake-up call to lawmakers that a government-centric approach is not producing the social justice and self-sufficiency that Rhode Islanders crave,” suggested Mike Stenhouse, CEO for the Center. “If we want to provide more mobility and opportunity for our neighbors and entrepreneurs, we must completely reform our public policy approach. We must learn to trust in our people and remove the tax and regulatory boot of government off of their backs by advancing policies that empower the average family with choices, that reward work, and that grow the economy.”

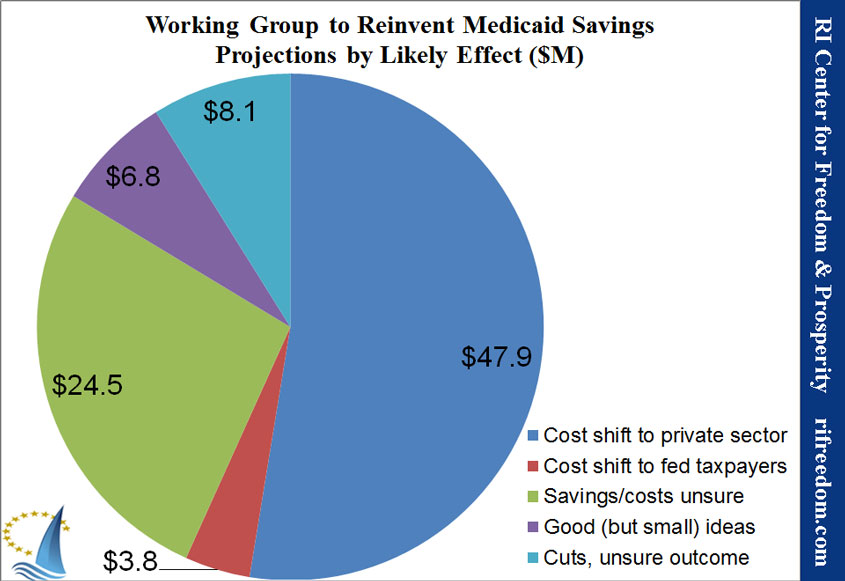

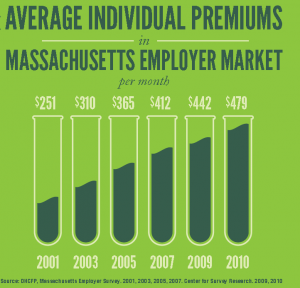

The two categories with F grades are Infrastructure and Health Care; the seven D’s are Business Climate, Tax Burden, Spending & Debt, Employment & Income, Energy, Public Sector labor, and Living & Retirement in Rhode Island; while Education received a C-. Among the 52 sub-categories evaluated, Rhode Island received 19 F’s, 24 D’s, 5 Cs, 3 Bs, and just one lone A.

In a related 1-page brief, the Center also analyzes report card trends over recent years as well as comparisons to grades for other New England states.

The RI Report Card, originally developed for the Center by a national economist, compiles into a single document the state rankings among key economic and social indexes, as published by dozens of credible 3rd party national organizations.

The 2015 report card, with citations, as well as reports from prior years can be downloaded at RIFreedom.org/RIReportCard.

Media Contact:

Mike Stenhouse, CEO

401.429.6115 | info@rifreedom.org

About the Center

The nonpartisan RI Center for Freedom & Prosperity is Rhode Island’s premiere free-enterprise research and advocacy organization. The mission of the 501-C-3 nonprofit organization is to return government to the people by opposing special-interest politics and advancing proven free-market solutions that can transform lives by restoring economic competitiveness, increasing educational opportunities, and protecting individual freedoms.