NEW: Failing RI Report Card Grades Not Advancing Social Justice

/in Budget and Spending, Education, Energy, Health Care, Infrastructure, Jobs, Labor, Recent Posts, Social Services, Taxes/by RI Center for FreedomFOR IMMEDIATE RELEASE

November 17, 2015

Non-Competitive Grades Harming Work, Mobility, and Opportunity for Rhode Islanders

Preponderance of Fs and Ds Should Signal Need for Change in Policy Culture

Providence, RI — The opportunity for upward mobility for many Ocean Staters continues to be hampered by a non-competitive business climate and onerous family tax burdens, as evidenced by the poor grades the State of Rhode Island received on the 2015 Report Card on Rhode Island Competitiveness, the fourth annual such report, released today by the Rhode Island Center for Freedom & Prosperity.

Burdened with public policies that discourage work and a productive lifestyle, the state’s poor grades in 10 major categories (two F’s, seven D’s, and one C) reflect a government culture geared to benefit special interest insiders, while at the same time promoting job-crushing and soul-crushing dependency among the general populace.

Raising even further alarm, Rhode Island ranked dead-last, overall, when compared with report cards from other New England states.

“This report card clearly demonstrates the wreckage that decades of liberal policies have wrought upon our state. These unacceptable grades should be a wake-up call to lawmakers that a government-centric approach is not producing the social justice and self-sufficiency that Rhode Islanders crave,” suggested Mike Stenhouse, CEO for the Center. “If we want to provide more mobility and opportunity for our neighbors and entrepreneurs, we must completely reform our public policy approach. We must learn to trust in our people and remove the tax and regulatory boot of government off of their backs by advancing policies that empower the average family with choices, that reward work, and that grow the economy.”

The two categories with F grades are Infrastructure and Health Care; the seven D’s are Business Climate, Tax Burden, Spending & Debt, Employment & Income, Energy, Public Sector labor, and Living & Retirement in Rhode Island; while Education received a C-. Among the 52 sub-categories evaluated, Rhode Island received 19 F’s, 24 D’s, 5 Cs, 3 Bs, and just one lone A.

In a related 1-page brief, the Center also analyzes report card trends over recent years as well as comparisons to grades for other New England states.

The RI Report Card, originally developed for the Center by a national economist, compiles into a single document the state rankings among key economic and social indexes, as published by dozens of credible 3rd party national organizations.

The 2015 report card, with citations, as well as reports from prior years can be downloaded at RIFreedom.org/RIReportCard.

Media Contact:

Mike Stenhouse, CEO

401.429.6115 | info@rifreedom.org

About the Center

The nonpartisan RI Center for Freedom & Prosperity is Rhode Island’s premiere free-enterprise research and advocacy organization. The mission of the 501-C-3 nonprofit organization is to return government to the people by opposing special-interest politics and advancing proven free-market solutions that can transform lives by restoring economic competitiveness, increasing educational opportunities, and protecting individual freedoms.

2015 Report Card FAILS to Provide Equal Opportunity for Rhode Islanders

/in Budget and Spending, Regulatory Environment, Studies and Reports, Taxes/by RI Center for FreedomThe Center’s 4th annual REPORT CARD demonstrates how RI’s political class continues to cater to special insiders, while depriving other Rhode Islanders of the opportunity for upward mobility, educational opportunity, and personal prosperity.

[button url=”https://rifreedom.org/RIReportCard/” target=”_self” size=”medium” style=”royalblue” ] 2015 Report Card [/button]P3 PayGo Model for RhodeWorks

/in Blog, Budget and Spending, Recent Posts/by RI Center for FreedomBeginning this spring, Rhode Island Governor Gina Raimondo proposed a controversial RhodeWorks program to implement a toll system for commercial trucks as the foundation for a massive revenue bond that would not require voter approval. RhodeWorks is the governor’s strategy for repairing and maintaining a statewide road and bridge system that is undeniably in poor condition.

Despite a report from an insider government vendor, many are concerned that the governor’s plan would place yet another tax on Rhode Islanders — in the guise of highway tolls — putting unnecessary downward pressure on an already depressed state economy and placing taxpayers and drivers at further risk for inevitable cost overruns.

More recently, to address this concern, a Republican Policy Group (RPG) of state lawmakers has proposed a pay-as-you-go (PayGo) alternative that would find an annual sum of money derived from cuts and reform to existing state expenditures in order to fund the annual cost.

The mission of the Rhode Island Center for Freedom and Prosperity is to advance market-based solutions for the Ocean State through a rigorous exchange of ideas, as well as to provide alternative perspectives in the debate about important public policy issues. We agree with the priority on infrastructure established by the governor and the RPG’s directive to fund and build a sustainable repair and maintenance program within the state’s already high tax and fee regime. However, with Rhode Island’s infrastructure in such bad condition, a large up-front investment of money may be unavoidable.

The Center proposes an out-of-the-box concept for “delivery” of this massive public works project utilizing a proven model utilized in many other states for similar projects. Lawmakers should conduct the detailed due diligence necessary to properly consider a public-private-partnership (P3) delivery model, with a pay-as-you-go (PayGo) funding foundation.

All combined this approach would fund much needed infrastructure upgrades largely from existing general revenue, yet would offload the debt, risk, and delivery of the project to a private sector partner.

The P3 PayGo model would preclude the need for tolling and would provide substantial benefits for Rhode Island taxpayers and drivers by:

- Removing the risk of taxpayers’ or ratepayers’ bearing the burden of likely cost overruns

- Requiring no major new revenue streams, such as tolls, taxes, or fees

- Removing project management from the RI Department of Transportation (RIDOT), which has recently come under intense public criticism for ongoing internal inefficiencies

- Delivering bridge and road repairs in a more timely manner

- Potentially saving hundreds of millions of dollars in overall project costs

Compiling this paper, the Center found the potential cost savings of a P3 PayGo project to be massive, reducing project costs by nearly half and potentially reducing annual costs to nearly one-third of the proposed spending. However, the primary goals of this proposal are to allow an upfront infusion of money without the need for tolls or other new revenue or long-term general obligation debt and to mitigate the risk associated with a project of this size. We therefore consider cost savings to be a secondary benefit, with the expectation that the numbers will become clearer as the public debate proceeds. At the very least, it is clear that, like the state’s bloated budget, P3 PayGo has plenty of slack to make the proposal feasible.

Important note: The term “public private partnership” is often used to describe government subsidies arbitrarily handed out to private ventures, such as 38 Studios. The P3 described in this paper is very different, with delivery of a vital public works project farmed out to a private sector partner in order to achieve market-based efficiencies and risk management not usually available to the government.

[button url=”https://rifreedom.org/wp-content/uploads/RICFP-P3-PayGo-101515.pdf” target=”https://rifreedom.org/wp-content/uploads/RICFP-P3-PayGo-101515.pdf” size=”medium” style=”royalblue” ]Click for full “P3 PayGo Model” report[/button]P3: a Compelling Delivery Model for Governor’s Proposed Infrastructure Upgrades

/in Budget and Spending, Infrastructure, Labor, Studies and Reports/by Mike StenhouseA P3 Model would bypass the troubled RI DOT and enable a private sector partner to deliver vital bridge and road repairs in a timelier, safer, and less costly manner. WOULD REMOVE ALL RISK OF COST OVER-RUNS FROM RHODE ISLANDERS!

[button url=”http://www.rifreedom.org/p3/” target=”_self” size=”small” style=”royalblue” ] Read the Policy Report [/button]Gary Sasse on RhodeWorks: Leaving No Stone Left Unturned

/in Budget and Spending, Infrastructure/by RI Center for FreedomState Leaders Should Remember that Rhode Island’s Transportation Funding Crisis Evolved Primarily From Debt- Driven Financing Practices

Statement from Gary Sasse:

A recent Hassenfeld Institute public opinion survey found that 76% of Rhode Islanders felt the State was spending too little on road and bridge maintenance. This finding is consistent with the bipartisan agreement that Rhode Island’s bridges urgently need to be improved.

The key question that the General Assembly will need to address is what would represent the most efficient, economically neutral and fairest way to finance and deliver a bridge safety and improvement initiative. To answer this question the General Assembly has four optional approaches it may choose to consider.

The first is the Governor’s plan that is financed by borrowing backed by truck toll revenues. The second is a PAYGO plan that has been recommended by House Republicans. This plan would be financed by reallocating existing resources, and would not contain new tolls, fees or taxes. The third option, put forward by the Rhode Island Center for Freedom and Prosperity, constitutes a P3 public-private partnership between the State and private partner. The private partner, in exchange for pre-determined revenue guarantees, would finance, repair and maintain bridges for an agreed upon time. The final option is a hybrid PAYGO- debt plan would be based on some additional public debt, but also the use of current general revenues.

In studying these options state leaders should remember that Rhode Island’s transportation funding crisis evolved primarily from debt -driven financing practices. These practices have served to inhibit the state’s ability to properly maintain its roads and bridges. Therefore, in considering the best way to finance and deliver a bridge improvement program, the General Assembly should remember that borrowing is expensive. The most costly public debt may occur when there is a limited history with a new revenue source and any debt financing should be designed to avoid the carrying charges of issuing a large bond upfront.

While the REMI study provided additional information about the economics of the Governor’s truck toll proposal, questions remain regarding the impact of this proposal on sectors of the Rhode Island economy and operationalizing the tolling system.

In order to serve the best interests of the Rhode Island taxpayer, the General Assembly should take the time to fully evaluate all four options, leaving no stone left unturned.

About the Author:

Gary Sasse is the director of Bryant University’s Institute for Public Leadership. He is a former executive director of the Rhode Island Public Expenditure Council, and for several years directed the state’s Department of Revenue and Department of Administration during the Carcieri administration.

STATEMENT: REMI Toll & Bond Report Overstates Benefits; New Model Next Week

/in Budget and Spending, Infrastructure, Recent Posts/by RI Center for FreedomFOR IMMEDIATE RELEASE

September 3, 2015

Economic Drawbacks Under-Stated, Benefits Overstated

Pro Government Spending Analysis is Not Balanced with Free Market Analysis

Providence, RI – As projected months ago, the economic development analysis released yesterday by the Raimondo administration, conducted by Regional Economic Models, Inc. (REMI), is based on pro government spending theory that under-states the negative impact of extracting new funds out of the private sector economy, and does not take into account the more traditional free market economic theory, according to the RI Center for Freedom & Prosperity.

“On the one hand, and obviously, when hundreds of millions of dollars are spent on a project like this there will be a near-term boost in jobs and economic activity, as the REMI report suggests,” commented Mike Stenhouse, CEO for the Center. “However, on the other hand, there is also a negative ongoing impact on the economy through the imposition of new tolls, taxes, or fees. The REMI model minimizes this effect, while free market models normally project a greater long-term negative impact to economic growth.”

The Center plans to release a policy concept paper next week that will put forth an alternative funding and delivery model, that would complete the vital bridge and road repair project at a lower cost and in a more timely manner, while also removing risk of likely cost overruns from taxpayers or ratepayers.

Media Contact:

Mike Stenhouse, CEO

401.429.6115 | info@rifreedom.org

About the Center

The nonpartisan RI Center for Freedom & Prosperity is Rhode Island’s premiere free-enterprise research and advocacy organization. The mission of the 501-C-3 nonprofit organization is to return government to the people by opposing special-interest politics and advancing proven free-market solutions that can transform lives by restoring economic competitiveness, increasing educational opportunities, and protecting individual freedoms.

Governor’s BOND & TOLL plan will waste over $650 million

/in Blog, Budget and Spending, Labor, Studies and Reports, Transparency/by Mike StenhousePAY-AS-YOU-GO a Superior Approach.

The plan under consideration would more than double the cost of the project and would enrich special-interests without any added benefit for Rhode Islanders. The Center’s new report shows how to make RhodeWorks “work” for Rhode Island.

[button url=”https://rifreedom.org/2015/07/making-rhodeworks-work-for-rhode-islanders/” target=”_self” size=”medium” style=”royalblue” ] Read the PayGo Report here [/button]2015 Legislator Scorecard – Now Live!

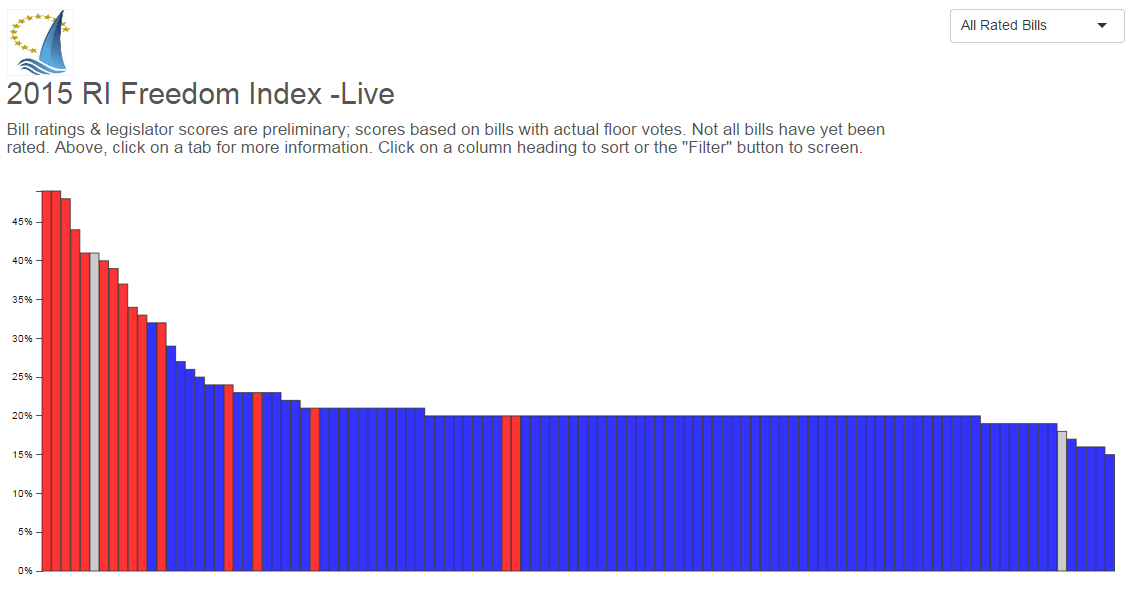

/in Budget and Spending, Citizen Vigilance, Transparency/by RI Center for FreedomHOW DOES YOUR REPRESENTATIVE OR SENATOR RANK?

Preliminary ratings show RI General Assembly turns state in the wrong direction once again!

[button url=”https://rifreedom.org/rifreedomindex/” target=”_self” size=”medium” style=”royalblue” ] Interactive Scorecard Here [/button]Statement: Open And Contentious Debate Being Stifled By The Status Quo

/in Budget and Spending, Recent Posts/by RI Center for FreedomSTATEMENT

June 17, 2015

Open And Contentious Debate Being Stifled By the Status Quo

Budget The Culmination Of Months Of Back-Room Negotiations And Special Deals

The floor session addressing the state’s budget in the Rhode Island House of Representatives was short, pervasively unanimous, and light on opposition action. The momentum of the evening – the culmination of months of back-room negotiations and special deals – was so strong that Republicans did not even put forward a plan that their caucus had developed as an alternative for funding infrastructure without debt.

The Rhode Island Center for Freedom & Prosperity has already released a statement on the budget, itself, and the details are largely unchanged. On the day after the vote, however, Rhode Islanders should find it shocking that insiders and special interests have our government so locked up that neither conservatives nor progressives can muster sustained political opposition to a budget that claims so much authority for the government and spends so much of the people’s money.

Providing an alternative to the status quo thinking about government is core to the Center’s mission. Now more than ever, the people of Rhode Island must work independently of their government to change minds, to change the debate, and to change the direction in which the Ocean State is headed.

Only a well-informed, passionate electorate can put Rhode Islanders back at the center of their state’s decision-making process and foster freedom and prosperity. If there is no open and contentious debate inside the State House, then it is only more critical for there to be open and contentious debate outside of it.

Media Contact:

Mike Stenhouse, CEO

401.429.6115 | info@rifreedom.org

About the Center

The nonpartisan RI Center for Freedom & Prosperity is Rhode Island’s premiere free-enterprise think tank. The mission of the 501c3 nonprofit organization is to return government to the people by opposing special-interest politics and advancing proven free-market solutions that can transform lives by restoring economic competitiveness, increasing educational opportunities, and protecting individual freedoms.