New Study: higher tax burden reduces state economic growth & population

/in Blog, Budget and Spending, Commentary, Migration, Taxes/by Mike StenhouseAugust, 2014 – We consistently hear Rhode Island lawmakers claim that citizens or the wealthy can “afford” some minor, new tax to pay for some new government project. That may be true in some cases.

But what is also true, in almost all cases, is that OUR STATE’S ECONOMY CANNOT AFFORD THE TAX HIKES.

A new study by the nationally renowned Mercatus Center explains this cause and effect.

***

Read below or go to the Mercatus page here; http://mercatus.org/publication/state-economic-prosperity-and-taxation

State Economic Prosperity and Taxation

Policymakers frequently debate how different methods of taxation affect their states’ economies. While most economists agree that higher taxes result in reduced investment and innovation, previous studies have not found overwhelming evidence that higher tax rates lead to lower economic growth.

To untangle this paradox, new research by economist Pavel Yakovlev for the Mercatus Center at George Mason University examines the effects of taxation on states’ economic performance, businesses growth, and net migration rates. The study finds that higher state taxes correlate with lower economic performance, even when controlling for various factors. The magnitude and significance of this effect varies depending on the type of taxes and the type of economic activity in question. The study analyzes the relationship between states’ economic performance and tax variables including effective average tax rates, the personal income tax, and personal income tax progressivity.

To read the study in its entirety, please see “State Economic Prosperity and Taxation.”

KEY FINDINGS

- A higher average tax burden reduces state economic growth. Dividing total tax revenue by gross state product (GSP) shows that a 1 percent increase in a state’s average tax rate is associated with a decrease of 1.9 percent in the growth rate of its GSP.

- Taxes impact migration patterns. If higher state taxes lead to lower economic activity and employment, it is conceivable that people will move to states with better economic prospects. Of the nine states with no personal income tax, four—Florida, Nevada, Washington, and Tennessee—are among the states with the highest population growth rates in the country in recent decades. Also, data show that a higher personal income tax rate is associated with a higher probability of residents migrating to a state with a lower tax rates.

- Income tax progressivity affects the number of new firms. The number of new firms opening in a state is a key indicator of beneficial creative destruction and innovation that will improve living standards for the state’s residents over time. Other studies have found that new firm entry accounts for 20–50 percent of a state’s overall productivity growth. The latest economic data show that the rate of start-up creation is sensitive to personal income tax progressivity. A 1 percent increase in personal income tax progressivity is associated with a reduction of 1.2 percent in the growth rate of the number of firms.

- While the data show an important relationship between GSP growth and average tax rates, the impact of average tax rates on per capita income is less clear. A 1 percent increase in a state’s average tax rate can be expected to decrease per capita income by 0.07 percent.

- As previous studies have also noted, these findings can be sensitive to the time period, statistical methods, and variables used. Nevertheless, the results still lead to a general conclusion: not all tax variables exhibit a significant correlation with the selected measures of economic activity, but when they do, the relationship is usually negative.

CONCLUSION

Higher state taxes generally reduce state economic growth, GSP, and even population. It is clear that people produce or consume less, or even move to a different state, in response to higher taxes. Not all types of tax increases can be expected to significantly harm economic outcomes, but higher taxes are generally correlated with lower standards of living.

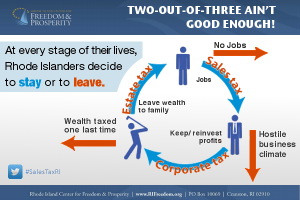

Commentary: 2-out-of-3 Ain’t Good Enough

/in Commentary, Recent Posts, Sales Tax, Taxes/by Mike StenhouseBy Mike Stenhouse, CEO

The 2015 state budget is now public. Corporate tax and estate tax cuts are in. Help for the middle class is out. In fact, the average worker is being asked to pay for reforms that benefit more well-off constituencies. Why? It’s not just a matter of fairness; it’s a question of economic stability.

Rhode Island’s poor economic performance and dismal jobs outlook can largely be attributed to high levels of taxation and regulation across all points of Rhode Island’s economic lifestyle.

An analogy can be made between a prosperous state economy and a three-legged stool, where each leg plays an equally important role in keeping balance and maintaining strength, as part of the normal economic cycle through which most individuals progress:

- First leg – workers – where individuals produce the products and services essential for a growth economy; where valuable professional experience can gained; and where individual wealth can accumulated and spent in the local economy;

- Second leg – business sector – corporations and entrepreneurs who, as managers or small business owners, guide the free-market to generate profits that further fuel the overall economy; and where, simultaneously, further personal wealth and experience can be accrued and spent;

- Third leg – investors – where wealth is put at risk via equity investment back into the business sector, further boosting the economy and creating jobs, and which provides additional opportunity to grow individual wealth; where philanthropy funds local charities; where wealth is spent on a large scale, often in retirement, and, finally; where wealth is passed down to family heirs in the hope of maintaining ongoing investment and philanthropy in the state.

All three economic roles, or legs of the stool, are equally important and are inter-dependent on each other. The free-enterprise system allows individuals move from role one to another as they choose, as they acquire capacity, or as other circumstances dictate.

A balanced, growth economy must have strength in each of its three legs: a partnership of sorts. If any one leg is out of balance or weak, likewise, the other legs – and the overall economy – will also suffer. It is this tri-lateral partnership that creates a vibrant free-market economy and a stable tax “base”, strong enough to support public assistance programs and foundational services such as education and infrastructure.

However, in recent decades in Rhode Island, excessive government interference has systematically weakened all three legs of our economic stool, limiting the capacity of individuals to move from one role to another; and at all three roles, driving many out of our state.

With high sales and property taxes in a high cost of living state, and with limited opportunity for upward mobility because of a weak jobs market, Rhode Island is a barely affordable home for many workers in low and middle income families, who have little chance of saving money and accumulating initial wealth. Yet no relief is planned in 2015 for the average worker.

With the highest corporate tax in New England and one of the worst business environments among all states, along with a dwindling consumer base, it has become very difficult for businesses and entrepreneurs to prosper in the Ocean state. Limited corporate tax relief is designated in the 2015 budget for the business sector.

For wealth that is accumulated despite these roadblocks, our state has further imposed a dis-incentive for many families to keep that wealth in Rhode Island, by charging one of the nation’s most punitive estate, or death, taxes … tending to drive high-income individuals out of our state. Some relief is also planned for wealthy investors in 2015.

Yet, while it is a positive sign that some reform is planned to fortify the two roles that generally involve higher income individuals, why are we ignoring relief for the middle class? To make matters even worse, the new gas taxes and fees on real estate transactions, vehicle inspections, and traffic court appearances, along with the new the ‘use tax’ on income, will be a direct hit on middle and low income families.

This puts the proposed 2015 budget completely out of balance.

There is, however, a policy idea on the table that would restore that balance by aiding those with lower incomes. Our Center’s sales tax reform idea, that cuts the rate to 3%, can also fortify the worker leg, leading to more family savings and creating thousands of vital, new job opportunities. If we also implement a major sales tax cut, strengthening this leg as well, this would spur consumer demand, increasing corporate profits and wealth creation in the other two legs. This is a balanced, win-win solution. Instead, Rhode Islanders are yet again looking at an unbalanced, win-lose approach.

Rhode Islanders want a government that works for everyone, not just for the well-off. We can do this by cutting corporate, estate, AND sales taxes.

The former rock star, Meatloaf, may have crooned that “two-out-of-three ain’t bad”. But when it comes to fortifying all three economic roles that are equally essential in turning around a struggling state like Rhode Island … two-out-of-three ain’t good enough!

Mike Stenhouse holds an economics degree from Harvard University.

Center’s Testimony Shoots Down HealthSourceRI’s Major Claims to Justify Continued State Operations

/in Blog, Commentary, Health Care, Recent Posts/by RI Center for Freedom

CEO Mike Stenhouse’s full written testimony can be viewed here.

Following a House Finance Committee hearing Wednesday on H7817 that would send the state’s health insurance exchange to the federal government, Mike Stenhouse, CEO for the RI Center for Freedom and Prosperity, commented that “virtually every major claim made by HealthSourceRI in defense of its own costly existence was shot down by well-researched testimony.”

State Funds on the Hook? HealthSourceRI officials claimed that no local funds would be required for FY2015: the Center countered that $15 million is indeed allocated in the Governor’s proposed budget for the closely related UHIP project, an expense that would be eliminated by passage of the bill.

Federal Fee Exaggeration. They previously claimed that a transfer to the federal government would cost Ocean State policyholders $17.3 million in federal fees: testimony by both the Center and by the House Fiscal Advisory Staff put the actual figure under $5 million. The Center further noted that the costs of maintaining operation of the exchange in Rhode Island would be significantly higher, and that it is disingenuous to talk about only one side of the coin.

A True Success Story? They also claimed that theirs is one of the most successful state-based exchanges in the nation: the Center questioned whether it truly should be considered a success when HealthSourceRI has met less than one-third of its original enrollment projections; has see abysmal business sector participation; has no sustainability funding plan; and will cost the state an additional $50 million per year in higher Medicaid costs.

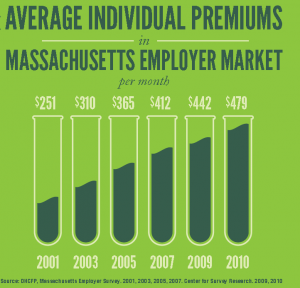

Health Insurance Premiums kept rising, even after Massachusetts passed its exchange law in 2006. Why would anyone think that RI’s exchange could do better?

Local Control to Reduce Costs? They further claimed that loss of local control would inhibit the likelihood of reducing healthcare costs in the state: however testimony from Josh Archambault of the Foundation for Government Accountability, a national healthcare think tank, noted that after seven years of operating its own exchange, the cost curve has not been bent-down in Massachusetts, which had similar cost-reduction hopes, and that HealthsourceRI’s claims to be able to accomplish this may be over-played. (See “They Knew in 2009” analysis)

Illegal Use of Funds? HealthSourceRI official also proclaimed that the federal government, in reaction to recent news coverage, expressed a willingness to work with HealthSourceRI to help fund its ongoing operations: the Center testified that such use of federal funds may be illegal, being specifically prohibited both by the ACA law and Governor Chafee’s executive order that established the exchange in 2011.

“HealthSourceRI officials all but admitted that they have no idea how to pay for the high expense of the exchange in future years. The fact that the federal government called local officials to try to save the exchange, shows that even its own advocates here and in DC understand the challenge of justifying its continued costly existence, and that they are willing to violate their own law,” concluded Stenhouse. “It is an obvious choice to let the federal government pay for its own federal mandate; a choice that other states are making, and a choice that will not adversely affect any current or future policyholder in Rhode Island.”

Stenhouse’s full written testimony can be viewed here.

In the past week the Center has published two reports supporting the transfer of the state’s costly health insurance exchange to the federal government; $38 million or Zero? and Moving HealthSourceRI Forward to the Feds. Each of these reports, as well as links to other related information about this issue,can be found on the Center’s home page for the health exchange issue at RIFreedom.org/Exchange.

Related News Stories:

Associated Press – http://apnews.com/ap/db_268748/contentdetail.htm?contentguid=x4SpOIdE

OPINION. The RI “left” refuses to debate: What are they afraid of?

/in Blog, Commentary, Recent Posts/by Mike StenhouseOpinion by Mike Stenhouse as appeared in the Providence Journal (May 9, 2014)

Mike Stenhouse: Left won’t defend failed R.I. policies

‘The price of freedom is eternal vigilance,” is a sentiment many have shared. Engaging in a spirited public debate is one form of such vigilance — a debate such as the Rhode Island Center for Freedom and Prosperity conducted in late April. The core question was: Would we be better off with more government in our lives, or less?

Based on the reaction we received from audience participants, our debate offered a fresh, new discussion about public policy; conversations that are not normally held by politicians or in the media. “When is the next debate? We can’t wait!” we were told, as well as, “If only our lawmakers could have heard this.”

However, the experience of organizing and running the debate ended up being as educational for me as it was for audience attendees. The audience learned about core philosophical policy differences. I learned about a revealing tactic of the left.

Ocean State “progressives” appear to have little interest in an open and honest debate about public policy. Either they don’t want to consider questions about whether their liberal agenda has been serving the well-being of our state’s residents, or they don’t want to admit that it is their big-government ideas that have, indeed, failed our families and businesses.

In seeking participants for the debate, I quickly became aware that the Rhode Island left hopes to avoid talk about connecting their policies to the wreckage we have seen across our state — either by refusing to debate in the first place, or by claiming that Rhode Island’s overall public policy culture is not liberal.

In reaching out to local groups to try to assemble a balanced slate of debaters, no fewer than four local left-leaning organizations, plus one other, refused our invitation to participate in the event: the Economic Progress Institute, the Latino Policy Institute, the Rhode Island Council of Churches, RIFuture.org and the Rhode Island Urban Debate League.

Stated reasons ranged from not wanting to be identified with or seen as supporting our center, to disingenuous questions about the debate’s funding sources, to a general sentiment that nothing would be gained from being involved in such an event. In one case, one of these groups was actually warned by another that we might be calling, and was armed with a ready excuse to turn us down.

What were they afraid of?

We are thankful that two local individuals — Tom Sgouros and Samuel Bell — agreed to participate and represent views from the left. However, their debate tactic was to run away from their own policies, by claiming that Rhode Island is much more conservative than most might think, that conservative tax cuts for the rich are partially to blame, and that there must be factors other than public policy behind our state’s failings. These assertions drew repeated chuckles from the audience.

Could these men be serious? With our heavy tax burden and poor economic rankings, how many Rhode Islanders honestly believe the state is struggling as a result of too-conservative policies?

It’s actually a very clever tactic to blame the other guy, or to avoid debate altogether. There is no doubt in my mind that a liberal-progressive agenda dominates Rhode Island — and, if I were them, I wouldn’t want to be held accountable for that agenda’s failures either. But it is a blatantly transparent tactic, with zero credibility.

Over the decades, a big-government, liberal and special-interest-oriented agenda has been systematically implemented in the Ocean State. As a result, we have seen dismal state performance in far too many important national indexes. Ranking last, or nearly last, in business climate, unemployment rate and population growth, Rhode Island simultaneously ranks near the top when it comes to redistribution of wealth, or income transfer, policies.

Yet the left refuses to even discuss whether or not there is a correlation. I believe there is a direct causation. This was the premise of our debate.

Nor do our elected officials or local media seem to want to encourage such discussion. I noted only one lawmaker, Sen. Lou Raptakis (D-Coventry), in attendance. Further, even with national headliners such as Stephen Moore from the Heritage Foundation and Fox News, and Rich Benjamin from Demos and MSNBC, not one local news organization covered this important debate, except GoLocalProv.com, our media partner. Why not?

If people on the left truly believe that their ideas are best for our society, their advocates should proudly stand up and fight for them — not run away and blame others. Sticking our heads in the sand and refusing to engage in rigorous public debate does not serve any democracy’s best interests. What are they afraid of?

Mike Stenhouse is CEO of the Rhode Island Center for Freedom and Prosperity, a nonpartisan public policy research and advocacy organization.

Commentary: Redacted Legislator Names as IRS Protest

/in Commentary, Recent Posts/by Mike StenhouseNOTE FROM THE CEO

Our Center created its annual Freedom Index and legislator scorecard in Rhode Island as a means of informing citizens which legislators have voted to protect our freedoms and which have voted to further encroach upon our liberties. Perhaps no freedom is more sacred to Americans than the right to free speech. However, a coordinated national attack has been mounted that would limit our Constitutional right to openly and rigorously debate public policy and to hold accountable elected officials and candidates. Within the past year, the IRS proposed new regulations that would greatly restrict the ability of 501(c)(4) advocacy organizations to conduct such activity, regulations that threaten also to undercut the work of 501(c)(3) research organizations such as the RI Center for Freedom & Prosperity.

The Freedom Index is intended as a tool to educate the people of Rhode Island about the activities of their government. However, under many circumstances, the proposed IRS regulations would redefine the publishing of legislator names on any kind of scorecard — such as our Freedom Index — as “political activity.”

As a symbol of protest against these draconian proposals to restrict the freedom of grassroots advocacy groups to engage in related analysis, our Center will initially publish its Freedom Index for the 2013 RI General Assembly session with the names of legislators redacted. We had already based the index on a reading of legislation without regard to how individual legislators voted. By redacting legislators names, we are taking the additional step of associating the results only with the electoral districts in whose names the actions are taken.

If the IRS does not want grassroots groups to call out legislators by name, then our Center — as our form of protest — will not name them – at least for the moment.

“A properly functioning democracy depends on an informed electorate,” said Thomas Jefferson. We agree, and our Center decries this attempt by the IRS to limit free speech, to shut down public debate, and to inhibit the vital process of providing educational information to the citizenry.

Mike Stenhouse

PolitiFact Should Fact-Check Itself in Bogus Ruling

/in Blog, Budget and Spending, Commentary, Recent Posts, Studies and Reports/by Mike StenhouseUpdate: PolitiFact acknowledges that the major elements of my statement were indeed true, before RULING that the statement was “Mostly False”. Read their twisted logic here …

Read the full story – what the PolitiFact article did not tell you – below.

Commentary, April 4, 2014

Earlier this week our Center published its Spotlight On Spending report. That same day the Providence Journal published a related OpEd piece that I co-authored along with David Williams of the Taxpayers Protection Alliance, which partnered with the Center in creating and publishing the report.

PolitiFact, the Journal’s fact-checking unit, noticed a slight discrepancy in the description of a the same item that was referred in both my opinion piece and in the report. PolitiFact believes this semantic discrepancy is of significant enough public value to warrant an investigation; I do not. It completely misses the material reason why this item was included our report.

As it turns out, it was PolitiFact that made a significant error in mis-characterizing my original statement. See below for the explanation.

Sometime next week, PolitiFact will rule on the truth-fullness of my statement in the OpEd. Our Center believes in government transparency and applies that belief to our exchange with PolitiFact. It is important that interested readers know the whole story.

Questions and Clarifications Posed by PolitiFact’s Gene Emery

THREE SEPARATE EMAILS:

1) Hi Mike,I want to fact-check the statement in your commentary, “A grant for $5,000 went to teach an employee at a company that makes ornamental business card holders how to use Facebook and Twitter.” That seems to be referencing the part of the report that talks about “$5,000 to provide social media training for employees at Ahler’s Designs.” So it is one employee or several employees? And did the $5,000 just for teaching someone to use Facebook and Twitter, or was there more involved? If you could point me to your sources, that would useful. Thanks, — Gene Emery

Full Response by Mike Stenhouse

We agree with PolitiFact that taxpayer dollars being spent on something that millions have figured out for themselves is outrageous. We question, however, the public service value of fact-checking the semantic difference between “an employee” and “employees’ when a much larger public policy question is at the core of the issue.

There was no mistake in either statement. However there was a mistake in PolitiFact’s characterization of my commentary piece in an email that asked me to respond to the alleged statement – “‘$5,000 to teach one person how to sign up for Facebook and Twitter’, which millions have figured out for themselves, seems pretty outrageous.” In my commentary, I never made that statement; I never used the term ‘sign-up’, but instead used ‘how to use’; nor did I say ‘one person’; I said ‘an employee’. For a fact-checking organization to call a statement I never made “outrageous”, is outrageous in and of itself.

Both statements accurately identify the same material finding: that $5000 in taxpayer money went to a private company for social media training.[http://www.gwb.ri.gov/pdfs/FY13ExpressGrantAwards.pdf]

The more superfluous descriptions of how that funding was used vary only in that the statement from the OpEd describes a subset of the broader and more inclusive statement from the report.

-

It is true that “an employee” received training, even if others received training as well

-

It is true that the Ahler’s Designs makes business card holders

-

It is presumably true that Facebook and Twitter were part of the larger social media training

The reason we included this item in our report, is not because of the amount of money spent per employee, as PolitiFact appears to be concerned with, but rather that any taxpayer dollars were spent in this regard in the first place. This spending was outrageous, regardless of whether or not the business owner feels that it was important for her business.

Either way, this scenario where many companies pay into a fund that gets re-distributed to just a few, is itself unfair, while also creating potential for cronyism and insider politics. In fact, an additional GWB post notes that in 2013, this same company, “Ahlers Design received $8,150 to train three employees; it also received $8,150 in youth bonus funding.” [http://www.rihric.com/news/news062013.htm] .

The lack of transparency and specificity in the GWB’s reporting apparently also has confused someone at Ahler’s or at GWB. The referenced source in our report indicates that four employees received training; yet Ahler’s stated to PolitiFact that five employees received training. Will this discrepancy be PolitiFact checked? Is this even an important distinction? Like the original premise of this PolitiFact investigation … I think not.

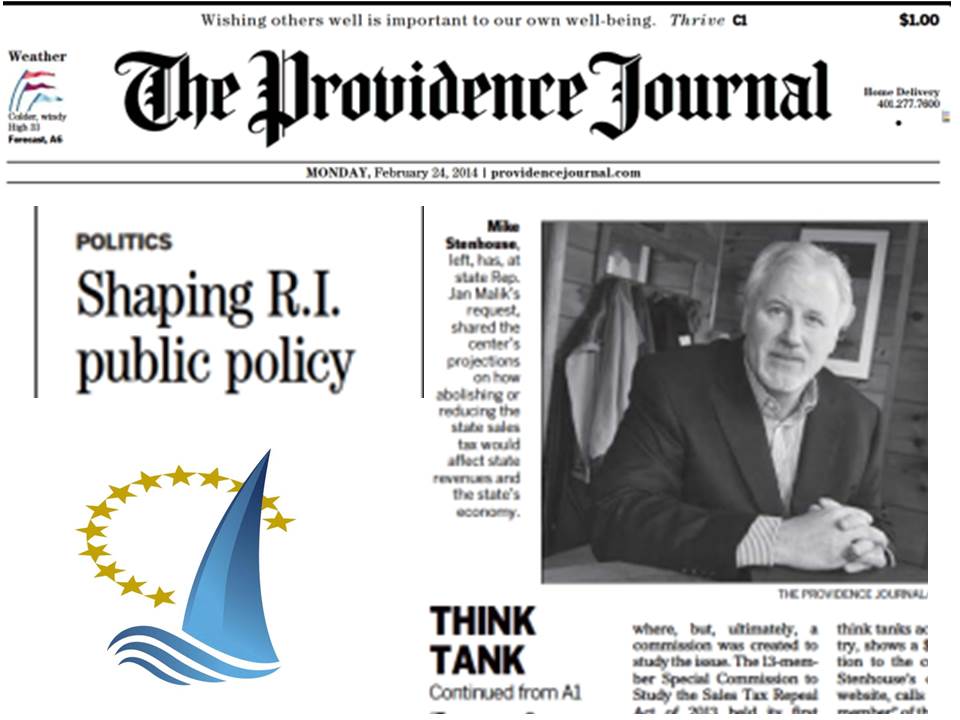

The “full” story about our Center

/in Blog, Commentary, News, Organizational/by Mike StenhouseThe recent front-page Providence Journal story about our Center did not tell the whole story. You deserve to know. Click on …

[button url=”http://www.rifreedom.org/?p=10326″ target=”_self” size=”medium” style=”royalblue” ] See the full story here [/button]Commentary: The Full Story, What the ProJo Did Not Tell You About Our Center

/in Blog, Commentary, Political Philosophy, Recent Posts/by Mike StenhouseRead the subsequent OpEd in the Providence Journal here …

.

“Is it so unimaginable to our critics that there are indeed many people who volunteer their support to our Center, and who also believe that a limited, transparent government is the best interests of the average Rhode Islander?” … Mike Stenhouse, CEO.

THE FULL STORY

In recent months, a national smear campaign was launched by left-leaning groups such as Progress Now and the Center for Media and Democracy to attempt to call into question the increasingly effective work of state-based think tanks like our RI Center for Freedom & Prosperity.

There have been dozens of unfounded allegations from the left, including our own U.S. Senator Sheldon Whitehouse, falsely claiming that the groups like ours are “phony” and engaged in “dirty business” and “dirty tricks” in advancing the agenda of out-of-state rich people who supposedly fund our operations and determine the issues we promote. Since then our Center has occasionally been asked about these baseless accusations.

Providence Journal article confirms that Center operates in a nonpartisan manner, and in full-compliance with federal law.

The Providence Journal published a related front-page story this week, after recently requesting that our Center to respond to a number of questions regarding the funding sources of our Center, and whether or not our agenda is influenced by out of state interests. As a Cranston native, and founder and CEO for the Center, I welcome this opportunity to discuss the mission and operation of our organization, and to set the record straight.

As the ProJo article confirms, our Center works in a nonpartisan manner and maintains the privacy of our donors as provided by the IRS and federal law, and as affirmed by the U.S. Supreme Court. Other clarification points from the article:

- Our Center never accepts public funds or taxpayer dollars. Unlike the Economic Progress Institute, one of the local groups compared to us, which has accepted funds from the state and is housed at RI College.

- Senator Whitehouse’s spokesman was INCORRECT in asserting that our Center makes ‘efforts to influence elections …”. This against IRS rules and our Center has never engaged in such activity.

While our work is often viewed as disruptive to the ‘establishment’, it is an unfounded accusation and a typical ploy of those we challenge to aver that the work of our Center is influenced by any out-of-state interest. Our Center’s staff and Board are comprised of Rhode Island residents, who all believe in the power of free markets and the capacity of free people to create a healthy, prosperous Ocean State.

As supporters and friends of our Center, you deserve to know the full story, not just a portion of it. The ProJo article does not tell the whole story. All of the questions submitted to us by the Journal and all of the responses our Center provided to them are shown below. You can decide for yourself if they purposely omitted certain information.

We are not surprised that just as our Center is establishing itself as an alternative strong and consistent voice in the Ocean State, that our opponents predictably trot out such intellectually dishonest questions, in an attempt to discredit our work, and that certain members of the media oblige them.

Even a recent New York Times article confirms that such smear attacks stem from a national, partisan effort. In fact, in parroting the same false talking points across the nation, the left is once again creating myths: http://m.washingtonexaminer.com/it-turns-out-the-evil-koch-bros-are-only-the-59th-biggest-donors-in-american-politics.-can-you-guess-who-is-number-one/article/2544025?

Also note that our Center operates in stark contrast to groups like Progress Now and the Center for Media and Democracy who receive hefty gifts from unions, who in turn use coercive tactics to force their members to donate to political causes with which they may not agree.

PROJO QUESTIONS, RESPONSES by the Center

Below are the questions submitted to us by the Providence Journal, along with our complete replies. As you will see, the published story in the Providence Journal omitted most of our comments.

* (ProJo) Can you say how much the center received during 2013 in contributions and grants?

(Center) In accordance with IRS rules, our Center will make this information available when we file our annual 990 report in the coming months. Now in our third year of operation, our 2011 and 2012 reports are also publicly available.

* With regard to your donors, your stance is that you cannot reveal them?

The Center – like almost all IRS designated 501-C-3 nonprofit organizations, including the Red Cross, the liberal Tides Foundation, and Rhode Island’s Economic Progress Institute, and as affirmed by the U.S. Supreme Court – respects the privacy wishes of its donors, who give freely and voluntarily to support our mission to enhance the lives of all Rhode Islanders. Should individuals choose to make known their gifts to our Center, our Center also respects their right to do so.

* What do you say about the center being an affiliate of the Franklin Center for Government and Public Integrity, which according to the Center for Public Integrity gets most of its money from Donors Trust. The Center for Public Integrity calls Donors Trust “a vehicle for tax-exempt giving from wealthy conservatives such as billionaire industrialist Charles Koch.” In light of this, is the center largely funded by the Koch brothers and other very wealthy individuals?

The Center worked with the Franklin Center in identifying and securing a journalist for our online blog and journalism website, The Ocean State Current, in 2012. That employee relationship lasted for six months, ending in December of 2012. Our Center is not aware of the funding sources of the Franklin Center. The Ocean State Current remains in operation because of the voluntary work of a team of in-state bloggers.

The concept of donor directed granting organizations such as Donors Trust are not endemic to conservatives or liberals, or billionaires or millionaires. They are numerous and diverse in nature, throughout the country, accepting charitable donations from individuals at virtually all income levels to support thousands of charitable causes and nonprofit groups. Organizations such as the United Way and the Rhode Island Foundation serve the same function for a diverse array of donors who wish to maintain their anonymity for any number of reasons.

I can categorically answer “no” to the question about whether or not our Center is largely funded by Charles Koch, or any out-of-state wealthy individuals. Depending on how you define wealthy individuals, I can confirm that our Center does solicit and accept funding from individuals in Rhode Island who agree with our free-market principles and who have the means to support our mission to enhance the well-being and prosperity of the average Rhode Islander through responsible public policy reform.

* Some people and groups say organizations such as the RI Center for Freedom and Prosperity are simply fronts for the very wealthy who want to avoid paying their share of taxes. What is your response to this?

I can also categorically state that 100% of the policy decisions our Center makes are determined by our own Board and staff, based on Rhode Island’s unique circumstances, without any influence from any outside group or individual.

Regarding our policy advocacy, consider the top three issues in which our Center is engaged:

Our Sales Tax Repeal idea would eliminate a highly regressive tax that will most benefit low-income families, by keeping more of their hard-earned money in their own pockets and providing new job opportunities to enhance chances for upward mobility.

Similarly, our School Choice campaign will benefit inner-city families most, especially those who have children who are condemned to attend failed schools simply because of their zip code

Finally, the ideas in our Healthcare Freedom Act provide solutions to many Rhode Islanders who are concerned about access to affordable, quality care. As it is now obvious that tens of thousands of Rhode Islanders will remain uninsured, even after full implementation of the President’s healthcare law and our state’s exchange, our Center recommended multiple solutions that will make access to healthcare a more viable option for the average Rhode Islander.

Clearly, this is not a tax-break-for-the-rich agenda, but rather, an agenda that will provide renewed opportunities for most Rhode Island families and also provide a boost to our state’s broken economy.

* Is it appropriate for an advocacy group that won’t disclose its donors to be preparing testimony and research reports to a legislative commission that is considering major changes in state tax policy?

It is entirely appropriate for our Center, and all similar state-based organizations, to advocate for policies that will help our state, as we best determine ourselves. Virtually all IRS approved C3 and C4 groups also choose to respect the privacy of their donors; there is nothing new or suspicious about this.

Like virtually all nonprofits, our Center conducts multiple fundraising activities to support our activities, including direct mail solicitations, personal networking with citizens in our state, and competitive grant applications to national and local foundations. Our Center employs a full-time Development Director to manage these efforts. Currently, the Center has almost 300 distinct donors, almost all of whom are Rhode Island citizens who share our belief in economic and educational freedom.

Is it so unimaginable to our critics that there are indeed many people who volunteer their support to our Center, and who also believe in a limited, transparent government?

* Any other comments welcome.

It is obvious that those who defend the status quo are not at ease with the work of our Center, which challenges the policy culture that has created the unacceptable economic and educational conditions from which far too many Rhode Islanders are currently suffering. It is important for Rhode Islanders to know that any implication that our Center’s work is influenced by outside sources is completely unfounded.

Has the Providence Journal asked the same questions of those groups who have raised questions about our Center?

* Is it fair/accurate to say that the center wanted to provide a different voice/perspective than people might have been hearing state policy debates? If yes, can you elaborate?

Yes. In fact, it is the primary mission of our Center is to attempt to balance and stimulate public policy debates. Through research, analysis, and advocacy our Center provides new and alternative views on important issues for our state. In some cases our views challenge the entrenched status quo mindset, while at other times our ideas are in direct opposition to the highly restrictive progressive/union agenda, which has dominated our state – virtually unopposed – for recent decades.

It is our opinion that “free market” policies are indeed in the best interest of all Rhode Islanders. Clearly, the big government, special interest approach has failed this state. Our recommended policies offer a fresh, new path forward, based on principles that have a proven record of prosperity and that served as the basis for the founding of our nation.

* Did the center contact Rep. Malik about sponsoring the no sales tax bill last year, or did he contact the center?

Representative Malik first approached the Center following testimony we provided at a 2012 House Finance Committee hearing: Around that time we had published our first sales tax report, and he expressed general interest in the issue to me. In November 2012, House Minority Leader Newberry publicly stated that sales tax reform would be one of his caucus’ platforms for 2013. I approached the Leader to offer access to our research, and he suggested that I contact Representative Malik who, as a retailer himself, had been interested in sales tax issues for years. It was following the Massachusetts’ State of the State address in January of 2013, when Governor Patrick proposed to lower his state’s sales tax, that I re-established contact with Representative Malik. He indicated that he was interested in submitting a bill to repeal the Rhode Island sales tax and inquired if our Center would further educate him on the issue, based on our prior reports, and if there was additional research that could be conducted to advance the public debate.

This is precisely the role our Center is designed play: Injecting new ideas and research into the market and then aggressively supporting debate when related legislative or other advocacy efforts are initiated. We are happy to work with any interested lawmaker from any party.

Our Center is not a lobbying entity, and had no part in securing any sponsors for the bill. I’m sure that Representative Malik would confirm these details, if you choose to contact him.

* You mentioned that school choice will be the center’s next big issue. Can you say why the center chose that one?

Economic and educational reforms are the two issues our board determined should be our Center’s top priorities. Without economic growth that brings new job and career opportunities, and without a properly educated citizenry to fill those positions, Rhode Island will not be able to break out of its stagnancy.

In selecting major issues to advance, we look beyond policies that nibble around the edges of the massive problems facing our state, and seek to inject well-researched, game-changing ideas into the public policy debate; ideas that can provide immediate and broad benefits to Rhode Islanders. Also, we seek policy ideas that are not only needed, but which have a legitimate chance to advance, given our state’s unique and current political orientation.

School choice reforms, whether through expanded charter school or tax credit programs, or through a voucher system, would provide immediate relief for families with children condemned to attend a failed school simply because of their zip code. Further, the competition created between public and private schools will likely lead to a higher educational achievement across our entire state. We are working in cooperation with Speaker Pro Tem Elaine Coderre and her son’s new organization, RI Families for School Choice. This organization approached our Center in late 2012 to ask if our Center was interested in helping to raise awareness on school choice. As this issue fit our mission, we have not only engaged, but have since decided to make it a priority for this year.

Similarly, significant sales tax reform would immediately put money back in the pocket of every family and business in the state, create economic growth, and provide new job opportunities for tens of thousands of Rhode Islanders.

There are dozens of additional reforms that our state must consider in the years ahead, many of which our Center will also attempt to advance. However, we believe that sales tax and school choice reforms are an important first step in putting our state on a new policy path.

OpEd: Repeal or Roll-back Anti-growth Laws

/in Blog, Commentary, Policy, Prosperity Agenda, Recent Posts, Taxes/by Mike StenhouseOpEd by Mike Stenhouse, CEO, as it was published in the Providence Journal, 1/12/14

As the 2014 legislative session begins, the leaders of Rhode Island’s political class have signaled that they will not let themselves consider any big ideas to boost our state’s stagnant economy or to improve our dismal jobs outlook.

There has been much speculation about what issues the General Assembly will take up. Unfortunately, if recent history is our guide, legislators will do more harm than good, as they see it as the government’s duty to help those who they perceive are in need — those who are harmed by the very policies their predecessors have implemented over the years.

Click here for ProJo link, to view/post public comments

Indeed, public policy in the Ocean State is tearing families apart. We all know of a recent graduate, often one of our own children, who has left town to look for work in a more fertile state; one of our parents who has retired to a lower cost-of-living state; a prominent business or community leader who has fled to avoid taxes on his or her heirs; or a business owner or entire family that has simply uprooted and moved to regions that offer more opportunity.

The government of Rhode Island has implemented dozens of taxes and regulations that have proven harmful to economic growth and job creation. In far too many categories, Rhode Island ranks at or near the bottom — a last-place team.

Yet political leaders act as if they’re not allowed to do anything about it, rather than seeing the status quo as the enemy of our future.

Instead of creating new Band-Aid fix bills, maybe lawmakers should eliminate some of the statutes that have harmed our chances for prosperity in the first place. The most productive path for legislators in 2014 may be to wipe out destructive policies.

Perhaps the General Assembly should be judged this year not by how many new policies it creates, but by how many existing, anti-growth policies it repeals or rolls back.

For starters, we could repeal or roll back the state’s regressive sales tax; or the requirement that families have no choice on what schools best educate their children; or punitive estate taxes that drive wealthy people to other states; or restrictions on out-of-state companies to sell health insurance in Rhode Island; or the minimum franchise tax, which stifles entrepreneurship; or corporate welfare, to level the playing field; or even renewable energy mandates that drive up costs for every family and business. All of these policies have created a drag on our economy, reducing opportunities for those who wish to succeed.

We continue to inflict legislative wounds on ourselves. We are suffering death by a thousand cuts. Isn’t it time we reversed course and healed some of these wounds?

To do this, we would also have to roll back spending levels, the holy grail of the political class; spending levels that fabricated the very same onerous taxes and fees that are the root cause of our economic woes. This seems beyond the imagination of the political class. Yet, this is allowed. Other states are doing it. We are allowed to change course and create a brighter future for ourselves.

Rhode Island is not defined by its government or a budget number at the bottom of a spreadsheet. Rather, Rhode Island is about the hopes and dreams of real people and real families. We should no longer be held hostage by a failed budget. Should our lives and chances for prosperity be restricted by a number? Or, rather, should the budget be crafted to serve our needs? Which should be the higher priority: the well-being of real people or an arbitrary revenue figure? In Rhode Island, we have it precisely backwards.

If we can roll back certain taxes and spending levels, and if the political class can prioritize the well-being of its residents over its fixation on revenues, tens of thousands of new jobs could soon be created, along with a lower cost of living and renewed opportunities for all Ocean State families and businesses.

We must free ourselves from burdensome taxes and a culture of dependency, and be unleashed to improve our own lives and prosperity.

As an analogy, we don’t have to look any further than the 2012 Boston Red Sox, which, as a last-place team, fired its manager, traded away expensive, non-productive players, and brought in fresh talent. The Sox reinvented themselves, and became World Champions just one season later.

Rhode Island faces a similar situation: We must demand new leadership, repeal non-productive policies, and right-size spending. We can do this. It is allowed!