2014 Campaign: Six BIG Issues No One is Talking About

6 Big Questions Not Being Asked of the Gubernatorial Candidates

With the 2014 Rhode Island gubernatorial campaign now shifting into high gear, the Rhode Island Center for Freedom and Prosperity encourages the media, advocacy groups, and citizens to ensure that certain major policy issues are publicly addressed by the full slate of gubernatorial and other statewide and General Assembly candidates.

Each of the issues below has the potential to significantly alter the future of our state, and to date, little, if any debate has taken place, with most candidates talking vaguely about their own plans for broadly related issues. The specific positions of each candidate on these issues and questions would provide clearer insight into each of their individual governing philosophies.

Each of the issues below has the potential to significantly alter the future of our state, and to date, little, if any debate has taken place, with most candidates talking vaguely about their own plans for broadly related issues. The specific positions of each candidate on these issues and questions would provide clearer insight into each of their individual governing philosophies.

The Center believes that candidates should be forced out of their comfort zones and inform voters of their specific positions on each of these important statewide issues:

1. Constitutional Convention: on the ballot this year will be a referendum for voters to decide if the State should convene a constitutional convention. Advocates believe that a convention is necessary due to the lack of action by the General Assembly in addressing Rhode Island’s most pressing issues and its continued favoritism to special-interest groups.

- Are you in support of a Constitutional Convention for Rhode Island?

- What specific issues would you like to see addressed if a convention were to be approved by voters?

- As governor, if the convention is approved, how would you help ensure that the Convention is conducted a non “politics as usual” manner?

- Would you encourage the election of delegates in a nonpartisan manner?

- How do you feel about sitting lawmakers’ being eligible to run as delegates?

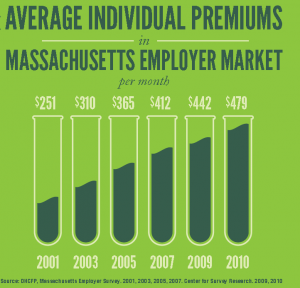

2. HealthSource RI: once federal funding runs out in FY2016, what position will the candidates take regarding use of state funds or assessments to Ocean State taxpayers or policyholders?

- Do you support paying $23 million per year for ongoing operations? Or should we transfer the exchange to the federal government?

- Major insurance premium increases were again approved for 2015, despite HealthSourceRI claims that it would decrease costs. Is this a concern to you?

- Do you support consolidating all public and private healthcare in the state under HealthSource RI? (Per H7819, which was heard in House Finance in June 2014)

- Are you aware of and do you support paying $10-15 million per year for the related Unified Health Infrastructure Project (UHIP)?

- Do you support using financial information collected from individuals applying for health insurance via HealthSource RI to automatically enroll them in other statewide public assistance programs?

- Given the projected $50 million per year increase in the state share of Medicaid costs, can the state afford similar additional increases in other public assistance programs?

- Do you support using financial information collected from individuals applying for health insurance via HealthSource RI to automatically enroll them in other statewide public assistance programs?

3. Educational Choice: While each candidate has put forth some general thoughts on education, no significant reforms have been suggested. A movement is underway in Rhode Island to empower parents with expanded choices for their children’s education, choices that may include some form of scholarship voucher so that no child is condemned to remain in a failed government school.

- Do you support providing expanded educational choice for families? Why or why not?

- Do you specifically support some form of educational voucher?

- Do you support expansion of charter schools? Or expansion of the state’s existing Corporate Tax Credit Scholarship program?

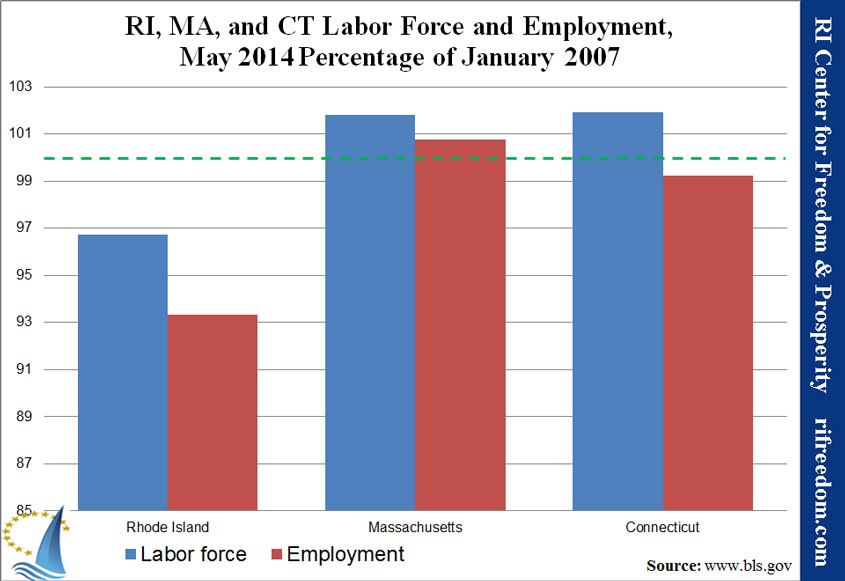

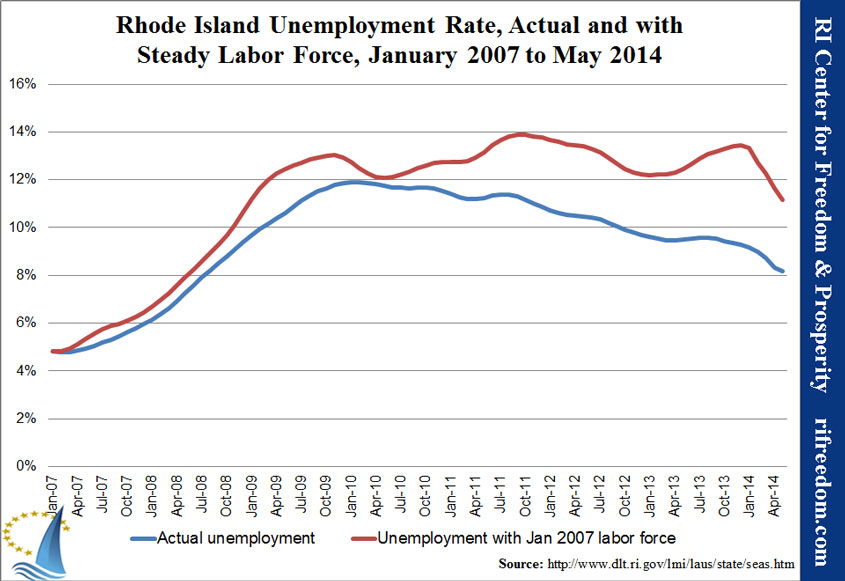

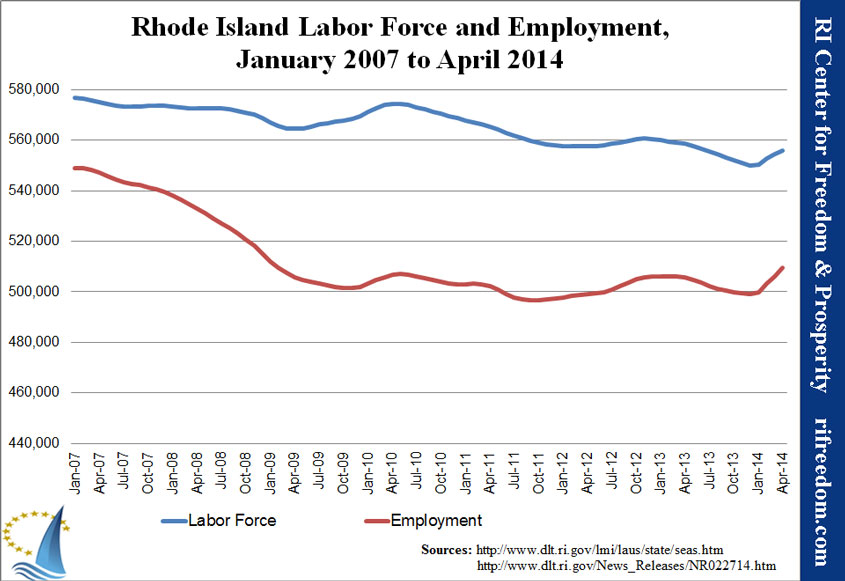

4. Sales Tax Reform: Speaker Mattiello has publicly stated that he will take a look at sales tax reform in 2015. The RI Center for Freedom & Prosperity claims that major reforms in this area would produce a game-changing, massive jobs boost for the state’s economy, much more than any other tax reform idea. Given the chronic unemployment problems we face in Rhode Island …

- As Governor, will you support significant sales tax reform?

- Do you believe any major jobs creation policy idea would be worth pursuing if it was not revenue-neutral?

5. RhodeMapRI: is a major economic development plan for the state, quietly advanced by the Chafee administration and signed-on to by multiple municipalities and other organizations, that has largely flown under public and media scrutiny. This self-described “sustainable living” plan is funded by the federal department of Housing and Urban Development (HUD) and is largely based on an environmentalist and economic justice agenda, that may even include future racial quotas for communities.

- Are you aware of and do you generally support the RhodeMapRI plan?

- Do you believe that unelected federal bureaucrats should be dictating the future economic development of our state?

- Or should any plan for Rhode Island be developed by our own elected officials?

In other cities and counties across the nation where similar plans have been implemented, such as Westchester County, NY, residents have complained about a loss of individual property rights, loss of sovereignty of locally elected government, and unequal property taxes levies.

- Do you share these concerns or do you believe they justify the larger goals of the plan?

6. Unionization of Independent Business Owners: in June of this year, the U.S. Supreme Court’s ruling on the Harris v Quinn case led most legal experts to believe that the ruling has a direct impact on last year’s successful effort to unionize home childcare workers in Rhode Island. The 2013 law and subsequent election that would force the payment of union dues or fair-share fees is now likely unconstitutional for such non full-time state employees.

- As governor, what will you do regarding ongoing negotiations with the SEIU?

- What will you do to return workplace freedom to this group of childcare workers?

- What is your position on the unions’ stated intention to unionize other private workers — as quasi public employees — in other industries?