Statement on 3% Sales Tax Hearings

May 8, 2014 — OFFICIAL STATEMENT re. the May 7 House Finance Committee hearing on H8039 to lower the state sales tax to 3%.

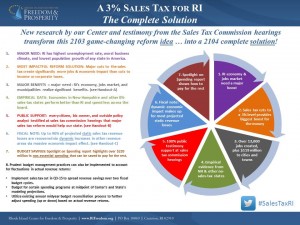

The Center’s testimony regarding a proposed sales tax cut to 3%, yesterday, appeared to generate interest from of a number of House Finance Committee members with the presentation of its “complete solution“, including a fiscal note about the anticipated dynamic revenue increases, which would lower the net impact on the state budget to as little as $47 million, in exchange for a potential increase in jobs of over 13,000. The Center then also showed how to find budget savings for this remainder (Spotlight on $pending report) without cutting any essential programs or services.

It appears that, legislatively, sales tax cuts are being considered along with corporate tax and estate tax cuts in 2014. While the Center supports all three reforms, research indicates that sales tax cuts will produce the largest economic boost and create significantly more jobs, at a lower cost per job, than any other tax reform.

The Center is puzzled by the position taken by the RI Hospitality Association, which testified against the 3% bill. It is almost certain that such reform would significantly increase consumer demand throughout the industry (diners, overnight guests, vendor services), perhaps as much as 20%, create more jobs, and lower the cost of conducting business for each of the Association’s member organizations. In 2012 RIHA actively mobilized support to stop a proposed 2% percentage-point increase in industry sales taxes, yet now is working against a sales tax cut of twice that size. The Center questions if RIHA members are aware of or support this position?

Testimony was also heard on bill to decrease the sales tax to 6% on a reduced number of industry sectors. Again, while a small step in the right direction, this reform would produce only one-sixth as many jobs, at just less than half the cost to the state budget, as compared with the 3% plan.

Leave a Reply

Want to join the discussion?Feel free to contribute!