Will Rhode Islanders Purchase Insurance Under Obamacare?

June 10, 2013

Download: PDF version of this report

Read the Part-3 report, Moving Forward with Healthcare in RI

Summary

There will be a broad financial disincentive in Rhode Island for a significant number of individuals and families to obtain private health insurance coverage under the President’s Affordable Care Act. As a result, Rhode Island should be prepared to see enrollment through the Rhode Island Health Benefits Exchange that is significantly below current expectations.

Based on proposed insurance rates in the Ocean State, and given the individual mandate penalties specified in the national law, for most income and age categories earning more than 200% of the federal poverty level for individuals, and 250% for families and couples, there are often substantial pocket-book reasons not to purchase insurance, even when subsidized via the state’s pending health benefits exchange.

This perverse economic incentive runs contrary to the stated goal of Obamacare to significantly decrease the number of uninsured Americans and will likely leave tens of thousands of Ocean State residents without adequate insurance coverage. This financial disincentive could also lead some people actually to drop insurance altogether, resulting in an increased number of uninsured as well as a rise in uncompensated hospital and emergency room costs.

At Issue

On October 1, 2013, Rhode Island’s health benefits exchange will open to the public, allowing residents to purchase health insurance that becomes effective January 1, 2014. The purpose of the exchanges, and the federal Patient Protection and Affordable Care Act (PPACA) that created them, is to expand health insurance coverage and substantially decrease the number of uninsured.

For many Rhode Islanders the premiums for insurance will be capped under PPACA and the federal government will pay the premiums in excess of the capped amount. Subsidized coverage will be available to those between 100 and 400% of the federal poverty level (FPL) who do not have access to “affordable” coverage through work.

The subsidies are supposed to work in tandem with the so-called “individual mandate,” which requires most citizens to obtain health insurance or pay a tax as a penalty. By offering subsides to low- and moderate-income individuals and families while imposing a penalty for failure to buy insurance, PPACA is essentially trying a “carrot and stick” strategy to expanding coverage.

Key to the success of this strategy will be how individuals and families perceive the pocketbook tradeoffs between obtaining coverage or paying a tax. The question boils down to: Will the stick be large enough and swung hard enough to get most people to buy the carrot? This healthcare brief attempts to provide insights into the economic incentives that may serve as the basis for the answer to that question.

The Data

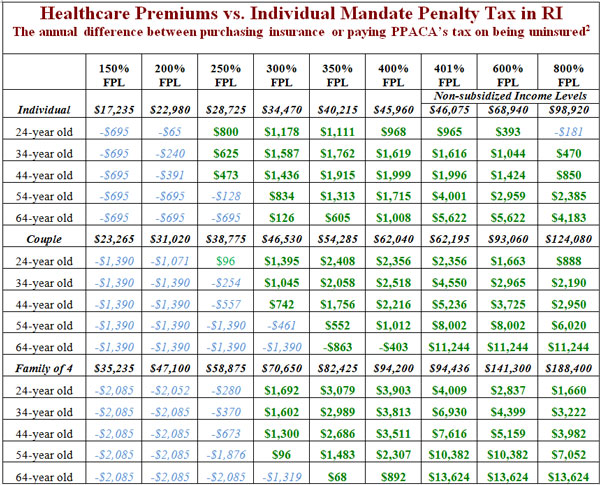

The following table depicts the financial tradeoff between the expected after-subsidy out-of-pocket cost of obtaining insurance through the exchange and the cost of not purchasing insurance and instead paying the tax. Positive numbers (in green bold) indicate that, from a strictly financial perspective, individuals and families can save money by paying the tax penalty rather than purchasing insurance. Negative numbers (in blue italics) indicate that it would be less expensive to purchase insurance than pay the tax.[1]

Proposed insurance rates in RI will generally increase by 18% over last year, with younger individuals seeing increases of up to 50% in their premiums while older persons see lower premiums as a result of the implementation of the Affordable Care Act’s requirements and the operation of the exchange.

Discussion

As the table demonstrates, at most income levels and ages the financial incentive is to avoid purchasing insurance and to instead pay the penalty. This suggests that the Rhode Island Health Benefits Exchange may have substantial difficulty in attracting a significant number of customers.

That said, the age groups and income levels for which the incentive is to purchase insurance (or at least the disincentive is not large), the young and those with low incomes, are the populations most likely to be uninsured.[3] Many of these are likely to be eligible for Medicaid, however, reducing the number that might decide to purchase insurance through the Exchange.

Additionally, the table only looks at the financial incentives and does not consider two other factors that might lead an individual or family to purchase health insurance despite these incentives. In the first instance, Rhode Islanders who tend to be risk-averse and concerned about the possible need to pay for expensive and unexpected health care needs might overlook the pure financial incentives and obtain insurance. In the second instance, Rhode Islanders who already have substantial health needs such as diabetics, heart disease sufferers, or other chronically ill persons will generally find it to their financial advantage to buy insurance because the after-tax savings for not buying insurance are still less than their out-of-pocket costs for needed care.

Unfortunately, if individuals with greater health needs than average are more inclined to purchase insurance, it will lead to adverse selection in the health insurance market and set off a “death spiral” causing premiums for non-subsidized (and some subsidized) individuals to rise, leading even more individuals and families to drop coverage, until only those with extremely high medical bills are left paying extremely high premiums.[4]

Another factor not included in the financial analysis is the impact that social expectations might have. It is possible that even though it may not be seen to make financial sense to purchase insurance through the exchange, the fact that there is a penalty for not doing so will lead some to decide that purchasing insurance is the responsible thing to do, and that not purchasing insurance is an act of poor citizenship.

On the negative side, the disincentive to purchase insurance may be even greater in many people’s view because of the nature of the insurance. The Blue Solutions for HSA Direct 5000 plan, which is the plan used here for most of the analysis, features a $5,000 deductible for an individual and $10,000 for a family.

The least expensive Silver plan, Blue Solutions for HSA 2600, features a $2,600 deductible for an individual and $5,200 for a family, and costs nearly 30 percent more than the Blue Solutions for HSA Direct 5000 policy.

This means individuals and families considering whether to purchase insurance or pay the tax will also be looking at the benefits they might get from being insured. In the case of a family of four with two adults age 34 earning $82,425 (350% of FPL), they would not only consider whether it’s worthwhile to spend about $3,000 more on insurance than they would pay in taxes for being uninsured but also recognize that they would still need to pay $10,000 out of their own pockets before getting benefits from their policy in the event of a catastrophic illness or injury.

Because very few individuals and families will see medical expenses approaching $13,000 (adding the $3,000 difference between the tax and out-of-pocket premiums to the $10,000 deductible),[5] it is highly likely that many individuals and families will see little value in insurance that is expensive while still exposing them to substantial financial risk, and will choose to remain uninsured, paying for their relatively few medical expenses out-of-pocket and saving a substantial amount of money.

An additional factor to consider is the “moral hazard” created by requiring that insurers accept all applicants at standard rates, with no exclusions or limits on care for pre-existing medical conditions. This effectively tells Rhode Islanders weighing whether to buy costly insurance or pay a relatively modest tax if they choose to remain uninsured that they can delay purchasing insurance and still be able to obtain coverage at a later date to pay future medical expenses in the unlikely event of a catastrophic injury or illness.

This has the potential to further tip the decision towards remaining uninsured, although the limited open-enrollment period may mitigate this impact somewhat (the rate filings by Blue Cross/Blue Shield of Rhode Island indicates an annual open enrollment period between October 15 and December 7).

This “moral hazard” could also manifest itself if many of the currently insured in the individual market as well as some receiving insurance through their employer respond to the incentives embedded in PPACA and the exchange and elect to drop coverage.

Finally, the analysis here uses the tax amounts for 2016, and assumes the tax will be collectable by the IRS. In 2014, the tax for remaining uninsured will be the larger of $95 per person or 1% of taxable income, rising in 2015 to $395 or 2%, making the incentive to remain uninsured for at least these two years substantially more than the table above indicates.

There is also some doubt about the ability of the IRS to actually collect the tax, given that they are prohibited from pursuing civil or criminal charges for nonpayment, and are not able to garnish wages, seize assets, or levy additional penalties or interest for nonpayment. The only mechanism available to the IRS for collecting the tax for being uninsured is to take it out of tax refunds, which can be easily avoided by adjusting how much tax is withheld.

Methodology & Sources

The financial incentives to obtain health insurance coverage (subsidized or unsubsidized) or be uninsured and pay the tax depend on several factors: age and how much an individual or family earns as a percentage of the federal poverty level (FPL) in adjusted gross income; what the Bronze and Silver level premium for their age/family composition would be; what their premium subsidy would be; and what their tax for being uninsured would be. Once this information is known, it is fairly easy to calculate how much any particular individual or family would have to pay to obtain health insurance as well as what their tax would be for being uninsured.

Age levels for the purposes of this analysis were set at 24, 34, 44, 54, and 64 years old. Income levels for this analysis were selected to be 150, 200, 250, 300, 350, 400, 401, 600, and 800 percent of FPL, using 2013 poverty guidelines.[6]

Bronze level premiums were assumed to be the lowest-cost Bronze plan submitted to the Rhode Island Office of Health Insurance Commissioner on April 15, 2013, in this case the Blue Solutions for HSA Direct 5000.[7] The Silver premium cost used was VantageBlue Direct 3000. Premiums for a couple of the same age are calculated to be two times the individual premium, and the family premium assumes two adults of the same age and two children under age 21.

The premium subsidy was determined by subtracting the maximum out-of-pocket amount (as determined by PPACA’s guidelines)[8] from the Silver premium. This amount was then subtracted from the Bronze level premium, with the remainder being what individuals, couples, and families are expected to pay for coverage through the exchange. In some cases, the result was negative, in which case “zero” was substituted for the subsidy.

The premium for the Catastrophic plan was used where it was less than the subsidized Bronze premium for those eligible to purchase it, defined in PPACA as those age 30 and under and those for whom out-of-pocket premium costs would exceed 8% of income.

The tax levied on being uninsured was calculated using the 2016 tax rate, the time at which penalties under PPACA for being uninsured will first be in full force. Income subject to the tax equals income minus the tax filing threshold ($9,750 for an individual in 2012, $19,500 for a married couple) multiplied by 0.025 in 2016, or $695 per uninsured adult and half that amount for each uninsured child, whichever is larger.[9] Individuals and families for whom purchasing insurance would cost more than 8% of income are exempt from the tax if they elect not to purchase insurance.

Once this information was obtained and calculated, a simple analysis was performed subtracting the tax for being uninsured from the out-of-pocket premium. The difference represents the financial incentive or disincentive for purchasing insurance under PPACA.

Conclusion

While advocates of the Rhode Island Health Benefits Exchange are optimistic about its ability to substantially reduce the unacceptably high number of uninsured in the state (along with the Medicaid expansion), there is substantial reason to be concerned that it will not attract large numbers of individuals and families.

As demonstrated here, for many age and income levels, the clear financial incentive is to not buy insurance and instead pay (or possibly avoid altogether) the tax. In some instances this incentive is relatively weak, only several hundred dollars. But for many more the incentive is thousands of dollars in difference between buying insurance or remaining uninsured, and more than $10,000 for many who are older, have children, and are in higher income brackets.

This strongly suggests that public officials and community leaders in Rhode Island should be prepared to see enrollment through the Rhode Island Health Benefits Exchange that is significantly below current expectations, leaving a substantial number of Ocean State residents uninsured.

Future Related Papers

The Rhode Island Center for Freedom & Prosperity will continue to contribute to this important and highly personal public discussion by publishing two related papers in the coming months.

First, identifying and quantifying the groups of people who are likely to remain uninsured after the PPACA takes effect.

Second, to propose free-market public policy solutions, as well as private strategies, that can be pursued to address this shortcoming, without requiring any additional taxpayer funding.

About the Author

Sean Parnell, an adjunct scholar to the RI Center for Freedom & Prosperity, is president of Impact Policy Management (IPM), a Washington, D.C., area full-service public policy firm, and manages political advocacy projects for free market and limited government causes. Before founding IPM he was president of the Center for Competitive Politics (CCP), a nonprofit advocacy organization focused on defending the First Amendment. Prior to joining IPM Parnell was Vice President of External Affairs at the Heartland Institute.

[1] Technically the penalty for being uninsured cannot exceed the cost of the national average for a Bronze plan, meaning that in cases where the tax is greater than the Bronze premium (a negative number), the actual difference between the maximum out-of-pocket premium and the tax is close to zero. In order to demonstrate how close or far each income level is from this point, we have kept the originally calculated number.

[2] The table here presents only final findings, based on the data and calculations described in the Methodology and Sources section. The full spreadsheet including all data and formulas used is available to anyone who requests it, please contact info@rifreedom.org[3] For a more complete discussion of the composition and characteristics of the uninsured in Rhode Island, see Karen Bogen’s Who Are The Uninsured in Rhode Island: Demographic Trends 1990 – 2004, Access to Care, and Health Status for the Under 65 Population prepared for the Rhode Island Department of Human Services in 2006, available at: http://www.dhs.ri.gov/Portals/0/Uploads/Documents/Public/Who%20are%20the%20uninsured.pdf

[4] For a full discussion of the ‘death spiral’ phenomenon, see: Destroying Insurance Markets by Conrad Meier, published by the Council for Affordable Health Insurance and The Heartland Institute, 2005. Full text available at: http://www.cahi.org/cahi_contents/resources/pdf/destroyinginsmrkts05.pdf.

[5] A review of data available from the results of the Medical Expenditure Panel Survey (MEPS) conducted by the Agency for Healthcare Research & Quality shows that in 2010 the median healthcare expense was $875 for persons age 18 – 44 and $2,124 for those age 45 – 64. Mean expenditure for these age groups were $3,230 and $6,429, respectively. MEPS has repeatedly found that medical expenditures are highly concentrated among a small percentage of the population, typically older and Medicare-enrolled. See reports available at: http://www.ahrq.gov/research/data/meps/index.html

[6] 2013 Poverty Guidelines, U.S Department of Health & Human Services, available at: http://aspe.hhs.gov/poverty/13poverty.cfm

[7] BCBSRI Individual Market Submission to Rhode Island Office of Health Insurance Commissioner, p. 93 4/15/2013, available at: http://www.ohic.ri.gov/documents/2013%20Rate%20Review%20Process/2013%20Rate%20Review%20Submissions/1_2013%20BCBSRI%20Individual%20Market%20Submission%2041513%20Final.pdf

[8] Health Reform Subsidy Calculator, Henry J. Kaiser Family Foundation, available at: http://healthreform.kff.org/subsidycalculator.aspx

[9] “Payments of Penalties for Being Uninsured Under the Affordable Care Act,” Congressional Budget Office, September 2012, available at: http://www.cbo.gov/sites/default/files/cbofiles/attachments/09-19-12-Indiv_Mandate_Penalty.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!