Why RI Should Opt Out of Exchanges and Medicaid Expansion

Quick Links: download a printable PDF of this brief here; go to our Healthcare home page here ; read our policy brief about a Healthcare Freedom Act here;

News Coverage: GoLocalProv article – good discussion in the comments section

High Cost of State Implementation

The federal government’s healthcare law — the Patient Protection and Affordable Care Act (PPACA) — if fully implemented in Rhode Island, will impose a high cost for the Ocean State in terms of budgets, jobs, dependency, and privacy. In upholding the law as constitutional, the Supreme Court alleviated one very narrow area of uncertainty but did nothing to repair problems with the policy.

Rhode Island will experience multiple negative ramifications if a state-based exchange and the Medicaid expansion options are put into practice, including:

- Unfunded budget costs that Rhode Island does not have the capacity to absorb

- Job-killing employer mandates and penalties that would otherwise be avoided

- Increased dependency on government for health care and other services

- Government intrusion on privacy in the highly personal areas of healthcare and family finances

Despite its lofty claims, PPACA will not lower health care and insurance costs and will do nothing to increase the supply of quality healthcare services in our state. The law will also lead to new federal and state taxes and cost the economy even more jobs.

State officials are already envisioning the exchange as what might be termed a dependency portal. Using information that residents enter for the purpose of determining health program eligibility, the exchange will alert users to a menu of other benefits for which they qualify, expanding Rhode Island’s public welfare system to an unknowable degree.

Policy Recommendation

The RI Center for Freedom & Prosperity recommends that the state of Rhode Island halt its headlong lunge into expensive and intrusive policy changes concocted in Washington, D.C., and join with other states that have taken a more skeptical view of the promises of the poorly vetted health care reform.

- Repeal the executive order creating RI’s health benefit exchange and replace it with patient-centered, market-based reforms, as described in the Center’s Healthcare Freedom Act policy brief.

- Opt out of the Medicaid expansion program, declining partial federal funding that would increase dependency on publicly financed health care and lead to increased budget deficits.

The Health Care End Game

Within two hours of the Supreme Court’s determination that the Patient Protection and Affordable Care Act (PPACA) is constitutional, three Rhode Island public officials held a related press conference. Lieutenant Governor Elizabeth Roberts has made health care a focus of her time in office; Secretary Steven Costantino heads the Executive Office of Health & Human Services; and Christine Ferguson is the newly appointed director of the Rhode Island Health Benefits Exchange.

During the conference, the trio promoted the inchoate exchange as more than a Web site for comparing products. Rather, they described what small-government advocates might see as a dependency portal. Based on information that users provide in order to determine eligibility for health premium subsidies, the site would also offer other forms of public assistance and subsidies that they could claim.

The prudence of government’s promoting its services as if they were private-sector products is a matter of legitimate debate. But the idea of a dependency portal does highlight one critical fact: The exchange, and PPACA generally, will expand the size, cost, and scope of state government.

Compounding Government Costs

Much has been made of the federal government’s 100% coverage of direct expenses for expanding Medicaid under PPACA. All childless, able-bodied residents with household income below 133% of the federal poverty level (i.e., individuals below $14,856 in 2012) will for the first time be eligible for health care through Medicaid.

Under the assumption that the state and federal governments will be somewhat aggressive in promoting enrollment, the Kaiser Family Foundation estimates that these new Medicaid recipients in Rhode Island will cost an additional $1.8 billion from 2014 to 2019, or about $301 million per year. However, costs will not be evenly distributed across those years, with increasing participation as time goes on. In 2019, the total cost for these newly eligible Medicaid recipients will be approximately $414.0 million.

The federal aid covering the Medicaid expansion will have phased down from 100% in 2014 to 90% in 2020. Therefore, in the unlikely event that total Medicaid spending does not increase from 2019 to 2020, the annual cost to Rhode Island taxpayers that year will be about $41.4 million. (The RI Center for Freedom & Prosperity inferred this annual total using the ratio of total state and federal spending in 2019 to total state and federal spending for 2014-2019, as provided in Table 4 on page 38 of the Kaiser report.)

But that total doesn’t account for the “woodwork” effect, which suggests that people who are currently eligible for Medicaid but have not applied will do so as implementation of the reform draws attention to the program. In Rhode Island, this population includes:

- All children under 19 and pregnant women in house-holds at 250% of the poverty level, as well as all parents with children under 18 and household income below 175% of the poverty level.

- Seniors (over 65) and disabled adults who qualify for Supplemental Security Income (SSI) or have income below the federal poverty level and have limited resources.

The federal government will assist with this new spending at its standard rate, which Kaiser estimates at 53-1/8% for Rhode Island over the six years, leaving the state to cover $30 million of the $64 million tab. (Note that the latest RI Executive Office of Health and Human Services Annual Medicaid Expenditure Report puts the federal contribution “typically” at 52.47%.)

Again, this spending will not be evenly distributed by year. With the same assumptions for 2020 as above, the annual cost to the state at the end of the examined period will be $6.9 million. In total, therefore, the Medicaid expansion portion of PPACA will represent new annual service costs to the Rhode Island taxpayer in the neighborhood of $48.3 million.

A third cost component that must be added to the total is administration. A 2010 Heritage Foundation study found that “administrative expenses add an average of 5.5 percent in addition to total (federal and state) benefit costs, and that, on average, the federal government pays 55 percent of total administrative costs.”

Taking all of these factors into account, the push for expanded enrollment will result in around $452.3 million in annual Medicaid spending. Of that, the State of Rhode Island will be responsible for $58.9 million in 2020. At that time, about one in four Rhode Islanders will be directly dependent on the Medi-caid program for health care.

The good news, from the Supreme Court’s ruling, is that states cannot be forced to participate in the expansion through the threatened loss of all federal Medicaid assistance.

Exchanges: More Costs

Where Medicaid leaves off, at 133% of the federal poverty level, subsidized premiums through the health care exchange will pick up, providing public money to families up to 400% of the poverty level. That’s $92,200 for a family of four, in 2012. The subsidies will come via advance federal tax credits, but there are five major cost factors of concern at the state level.

First, federal assistance toward start-up and operation expenditures for exchanges will end after 2014. Stan Dorn, of the Urban Institute, notes that states will thereafter have to come up with some reliable funding source — perhaps “surcharging insurance premiums; assessing health plans, employers, or individuals; appropriating state General Fund dollars; or otherwise.”

In Massachusetts, as part of its recent state-based health care reform, the exchange charges participating insurers a fee equivalent to 3% of premiums. Writes Dorn, “The insurers then pass on this cost to purchasers of coverage.”

Second, Rhode Island taxpayers will have to subsidize costs, through the exchange, associated with benefits that the state requires plans to offer beyond federally designated “essential benefits.” According to the RI Center for Freedom & Prosperity, Rhode Island leads the nation in health care mandates.

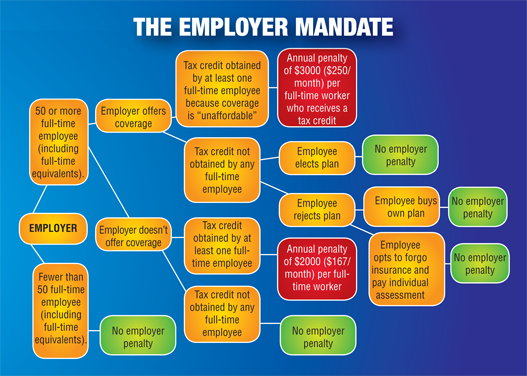

Third, state-based exchanges will be the mechanism for imposing penalties against “large” businesses (those with 50 or more employees) that either do not offer health benefits or that require employees to share more than a federally designated maximum amount of their cost.

Consider a business with 50 employees who work at least 30 hours per week, but that is unable to provide health care benefits beyond its other compensation. If a single employee acquires a subsidy through a state-based health benefit exchange, the employer will be responsible for $40,000 in annual penalties. For many, that will be substantially higher than the costs of hiring an additional employee.

Fourth, PPACA imposes tighter “community rating” standards on the individual and small group markets, within and outside of exchanges. Broadly speaking, in the “small group” market (employers with 100 or fewer employees), Rhode Island’s already-restrictive statutes forbid insurers from varying their premium costs by more than four times. That is, one family plan covering a spouse and children cannot differ by more than four times another such plan. PPACA reduces the differential to three times and limits family types to “individual” and “family.”

Plainly put, community rating lowers prices for plan members who actuarially should pay higher premiums by increasing them on those who should pay lower premiums.

This relates to the exchanges because, if Rhode Island decides to open its exchange to large groups, then the community rating scheme will apply to all such plans in the state for the first time ever. This rule apparently applies even if no insurers utilize the exchange for this purpose.

Finally, state officials’ vision of an expanded dependency portal will produce an unknowable increase in recipients of food stamps, cash payments, and other forms of public welfare whom the exchanges rope in as a bonus feature. These costs will span multiple layers of government and will be compounded to the extent that they require additional expenses to administer and maintain.

None of these five cost drivers applies if the state does not initiate and maintain a health benefit exchange.*

Danger Cubed: More Regulation, Less Freedom, Lost Privacy

Arguably more substantial than the direct financial costs of the Medicaid expansion and health benefits exchange is the danger created through the new authority that PPACA grants to the state and federal governments.

That danger comes first through dependency. Under the Medicaid expansion, 25% of Rhode Islanders will be direct wards of the state, when it comes to health care. Under the state exchange, up to 57% of Rhode Islanders will be eligible for health care handouts. And the expanded menu of the dependency portal will deepen families’ reliance on the state.

The danger comes second through a new ease of regulation. As health benefit exchanges absorb a greater percentage of the industry, local and national bureaucrats will be able to introduce new mandates and requirements not as legislation passed by duly elected members of the General Assembly or Congress, but simply as new requirements in order for plans to qualify for the exchange. Alternatives will be increasingly diffi-cult to procure, and costs will be forced upwards.

The danger comes third through the loss of privacy and financial intrusion. In order to qualify for Medicaid coverage and health care subsidies, Rhode Islanders will regularly have to inform the state about minute details of their lives. Indeed, it is likely that even families that receive no assistance at all will be faced with the same standardized application process.

In this way, two of the most intimate aspects of a person’s life — finances and health — will be collected through a single agency in a single location for the great majority of Rhode Islanders.

Conclusion

For all of this expense and intrusion, the state will not likely experience any reduction in the overall cost of health care, and Rhode Islanders will likely see the quality and availability of the care that they receive worsening. A Beacon Hill Institute study of Massachusetts’ health care reform, after which much of PPACA was modeled, found cost increases across the board — in and out of government, in an out of public assistance programs, and across tiers of government.

The reason, according to the researchers, was that the reform increased the demand for health care services without increasing the supply. The most alarming manifestation of this dynamic appeared in the state’s emergency rooms.

Across the country, there has been a noticeable decline in enthusiasm for exchanges among states that had begun work on them shortly after PPACA passed Congress. North Dakota, New Hampshire, Idaho, and South Carolina are among the states resisting the federal timetable to implement these insurance “marketplaces.” Kaiser Health News reports that, by the end of June, “only 14 states and the District of Columbia have so far passed legislation authorizing the exchanges.”

At Rhode Island Lt. Governor Roberts’s June 28 press conference, the three public officials made the familiar point that the availability of preventative, regular care might reduce the utilization of more-expensive emergency services. To the contrary, with wait times likely to increase for family physicians, and with greater portions of the population accessing subsidies for premiums and other expenses, the savings for which Rhode Islanders are being asked to sacrifice privacy and self-reliance may never materialize.

* Whether employer penalties ultimately depend on state-initiated exchanges is likely to be the subject of political dispute and litigation. However, the penalties are triggered by employees’ receipt of premium assistance, and PPACA Sec. 1401, which creates those subsidies, refers to “an Exchange established by the State under 1311.” Sec. 1311 describes state-initiated exchanges, but not federally initiated exchanges. It is Sec. 1321 that empowers the Secretary of Health and Human Services to create a federal exchange for use in a state.

Leave a Reply

Want to join the discussion?Feel free to contribute!